Bitcoin short-term holder sales near $5B as profit-taking mimics 2021

Bitcoin makes Christmas come early for its more speculative investors, with BTC price still facing “early bull market” resistance.

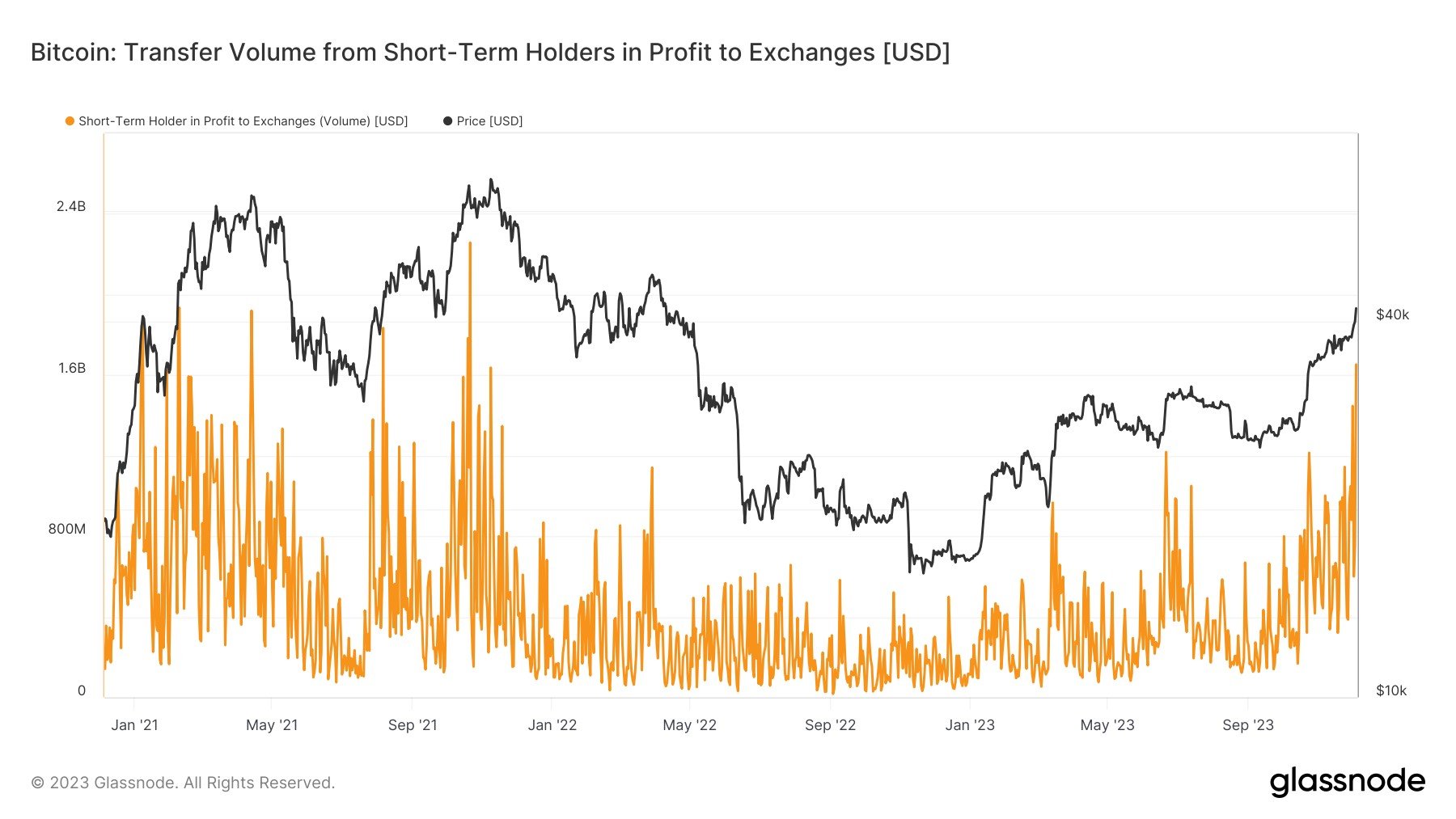

Bitcoin (BTC) has seen a mass profit-taking event which rivals its $69,000 all-time highs, new analysis reveals.

In a post on Dec.

Bitcoin speculators sell as if all-time highs are back

BTC price gains have delivered a welcome reward to hodlers across the board in recent days as 19-month highs appear.

While old hands are retaining their share of the BTC supply, at the other end of the spectrum, so-called short-term holders (STHs) have been busy locking in profits on their investments.

STHs refer to entities holding a given part of the supply for 155 days or less. They correspond to the more speculative class of Bitcoin investor, and their cost basis has formed a key BTC price support this year.

Now, with BTC/USD up almost 15% in a week, the time has come to reassess their exposure, data shows.

According to Van Straten, the total volume transfer between STHs and exchanges — coins being prepared for sale — has come close to $5 billion in the four days to Dec.

“Bitcoin recorded a 7% gain, culminating in a year-to-date peak of $38,800 by Dec.

“This milestone ignited the most considerable profit realization from short-term holders seen in recent times since November 2021.”

Go to Source

Author: William Suberg

Related posts:

- Short-Term Bitcoin Holders Taking the Brunt of BTC Capitulation: Analytics Firm Glassnode

- Crypto token supplies explained: Circulating, maximum and total supply

- BTC Wraps up 13 Consecutive Years of Recorded Market Value, With No Santa Rally in 2022

- Whale Watch: A Deep Dive Into the Concentrations of Large Crypto Holders