Bitcoin breaks $65,000 level as US economy grows 3%

Key Takeaways

- Bitcoin’s value surged past $65,000 following a 3% US GDP growth report.

- Improvements in the US job market correlate with increases in Bitcoin prices.

Share this article

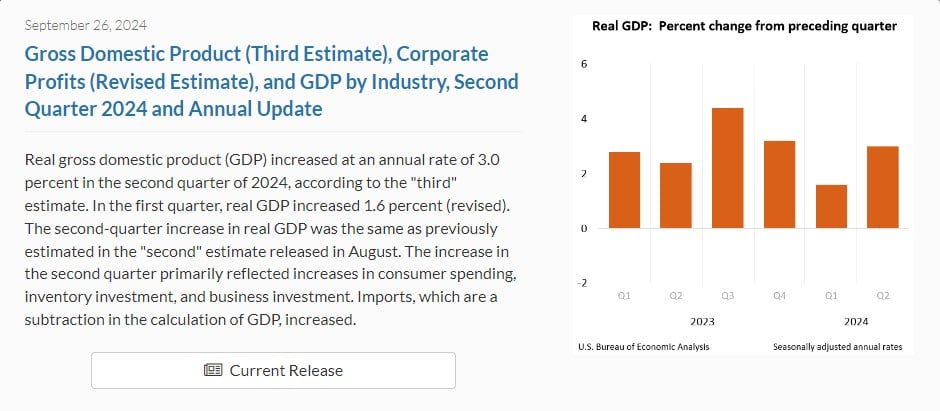

Bitcoin broke the $65,000 level, hitting a monthly high, after the US GDP growth rose to 3% from 1.6% last quarter, according to the BEA.

In addition, the US Department of Labor reported a decrease in initial jobless claims, which fell by 4,000 to a seasonally adjusted 218,000 for the week ending September 21. The figures came in slightly below expectations, suggesting some improvement in labor market conditions.

The four-week moving average of weekly jobless claims, which smooths out weekly volatility, also fell by 3,500 to 224,750, which suggests an overall trend of decreasing claims.

The latest GDP figures, coupled with the falling weekly unemployment claims, reinforce the notion that the US economy is on solid footing. This positive outlook has likely contributed to the bullish sentiment surrounding Bitcoin, pushing its price to new highs.

Bitcoin’s price now edges close to $65,500, marking a 3% increase in the last 24 hours, according to TradingView. The flagship crypto has gained over 1000 points in market value since GDP numbers were released.

Monetary policy adjustments in the US and China

Bitcoin’s price rally began last week following the Fed’s decision to cut interest rates by 50 basis points, a move not seen since the Covid pandemic.

Earlier this week, Bitcoin surged past $64,000 due to expectations of relaxed global monetary policies, influenced significantly by stimulus measures in China and the US Fed’s rate cut decision.

China is considering injecting 1 trillion yuan ($142 billion) into major banks to stimulate lending and economic growth. This potential move, China’s largest capital injection since 2008, aims to counteract slowing economic performance.

The funding, sourced from new sovereign bonds, could benefit risk-on assets like Bitcoin due to increased liquidity and reduced borrowing costs.

Share this article

Go to Source

Author: Vivian Nguyen