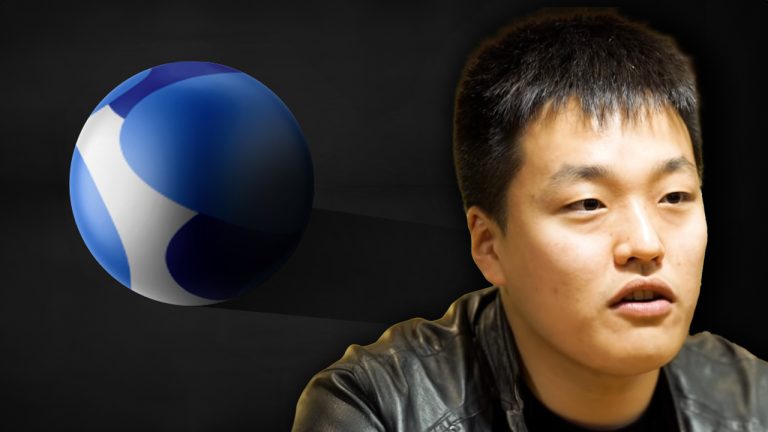

In a pivotal legal reversal, Montenegro’s Court of Appeals has annulled the extradition of Terraform Labs co-founder Do Kwon to the United States, siding with his defense’s appeal and invalidating a prior High Court ruling from Feb. 20. Montenegro’s Appeal Court Blocks Do Kwon’s U.S. Extradition, Cites Legal Flaws This latest court decision underscores the […]

In a pivotal legal reversal, Montenegro’s Court of Appeals has annulled the extradition of Terraform Labs co-founder Do Kwon to the United States, siding with his defense’s appeal and invalidating a prior High Court ruling from Feb. 20. Montenegro’s Appeal Court Blocks Do Kwon’s U.S. Extradition, Cites Legal Flaws This latest court decision underscores the […] Do Kwon, the embattled former CEO of Terraform Labs, is currently stranded in Montenegro due to extradition delays, following accusations by the U.S. Securities and Exchange Commission (SEC) of conducting a massive fraudulent crypto scheme. Last year, the SEC charged that from April 2018 to May 2022, Terraform and Kwon’s operations resulted in at least […]

Do Kwon, the embattled former CEO of Terraform Labs, is currently stranded in Montenegro due to extradition delays, following accusations by the U.S. Securities and Exchange Commission (SEC) of conducting a massive fraudulent crypto scheme. Last year, the SEC charged that from April 2018 to May 2022, Terraform and Kwon’s operations resulted in at least […] In a landmark decision, the High Court in Podgorica has ruled that the former Terraform Labs CEO, Do Kwon, will be extradited to the United States, sidelining South Korea’s request for his extradition. The court’s ruling comes after extensive deliberations on the legal and political implications of the extradition. Report Details Do Kwon’s U.S. Extradition […]

In a landmark decision, the High Court in Podgorica has ruled that the former Terraform Labs CEO, Do Kwon, will be extradited to the United States, sidelining South Korea’s request for his extradition. The court’s ruling comes after extensive deliberations on the legal and political implications of the extradition. Report Details Do Kwon’s U.S. Extradition […] Platforms authorized by the Russian government issued digital assets worth around a billion rubles in April, the local press reported. The spike in the volume has been attributed to Russian companies experimenting with new financial instruments amid limited access to traditional capital. Russia’s Digital Assets Market Livens Up as Capital Markets Dry Up for Russian […]

Platforms authorized by the Russian government issued digital assets worth around a billion rubles in April, the local press reported. The spike in the volume has been attributed to Russian companies experimenting with new financial instruments amid limited access to traditional capital. Russia’s Digital Assets Market Livens Up as Capital Markets Dry Up for Russian […] The development bank established by the BRICS group of nations has issued its first “green” bonds in U.S. dollars (USD). Proceeds from the placement will be used to fund “green” projects supported under the banking institution’s sustainable financing policy. BRICS Development Bank Launches 3-year ‘Green’ Bonds The New Development Bank (NDB), founded by the BRICS […]

The development bank established by the BRICS group of nations has issued its first “green” bonds in U.S. dollars (USD). Proceeds from the placement will be used to fund “green” projects supported under the banking institution’s sustainable financing policy. BRICS Development Bank Launches 3-year ‘Green’ Bonds The New Development Bank (NDB), founded by the BRICS […] The Oman Capital Market Authority (CMA) has said it plans to establish a regulatory regime to govern as well as develop the country’s virtual assets market. The regulator said the envisaged regulatory regime enables it to avail an “alternative financing and investment platform for issuers and investors while mitigating the risks associated with this asset […]

The Oman Capital Market Authority (CMA) has said it plans to establish a regulatory regime to govern as well as develop the country’s virtual assets market. The regulator said the envisaged regulatory regime enables it to avail an “alternative financing and investment platform for issuers and investors while mitigating the risks associated with this asset […] An Israeli capital markets regulator, the Insurance and Savings Capital Market Authority, recently granted a “crypto financial services provider license” to Bits of Gold, the first such license for an active company in the country. This license allows Bits of Gold to offer crypto custodian services and to enable the safekeeping of funds belonging to […]

An Israeli capital markets regulator, the Insurance and Savings Capital Market Authority, recently granted a “crypto financial services provider license” to Bits of Gold, the first such license for an active company in the country. This license allows Bits of Gold to offer crypto custodian services and to enable the safekeeping of funds belonging to […] The Moroccan Capital Market Authority (AMMC), the capital markets regulatory body in Morocco, announced recently that it has launched a fintech portal on its website. The new portal has been created in order to facilitate exchanges between the regulator and “companies involved in the innovative financial technology sector.” Portal to Help Promote Development of New […]

The Moroccan Capital Market Authority (AMMC), the capital markets regulatory body in Morocco, announced recently that it has launched a fintech portal on its website. The new portal has been created in order to facilitate exchanges between the regulator and “companies involved in the innovative financial technology sector.” Portal to Help Promote Development of New […]

Sang Lee believes blockchain technology developments have already left traditional banks in the dust, but adoption remains relatively low due to several factors.

If crypto capital markets have a chance of becoming an institutional reality, decentralization will be one of the key aspects according to one industry insider.

Capital markets bring suppliers and those in need of capital together to initiate supposedly efficient transactions. Investments or savings are often funneled between suppliers of funds like banks and those who need capital like businesses, governments and individuals.

Co-founder of crypto financial service provider VegaX Holdings Sang Lee told Cointelegraph today that incumbent financial institutions have simply been left behind by the rapid pace of developments in the crypto industry.

VegaX Holdings is building a suite of crypto-based financial services. Its VegaX decentralized finance (DeFi) platform allows staking while its Konstellation ecosystem is a DeFi ecosystem based on Cosmos (ATOM).

Lee believes decentralization is likely the most important thing that will help crypto enter capital markets. Decentralization involves removing costly intermediaries in decision making and in executing transactions.

Lee decried the current state of centralized payments platforms in saying “You can’t send a wire on the weekend which is atrocious. And the amount of times a stock changes hands when you buy it is atrocious.” He added:

“We have evolved far enough to say we don’t need people as intermediaries. It was necessary before but not anymore.”

Intermediaries tend to increase the amount of fees spent and the amount of time required to make an investment, thereby potentially reducing potential returns. Removing them through decentralization may be a viable way to make markets more efficient and help investors earn higher returns.

Lee also believes stablecoins will play an essential role in expanding capital markets in crypto. To him, stablecoins have the strongest potential to leapfrog other digital assets and even fiat currency because most stablecoins, such as Tether (USDT) and Dai (DAI) are still denominated in US dollars.

He emphasized that stablecoins allow investors to have a universal unit of account with which to transact. More importantly, stablecoins are things that everyone will be using since they add a sense of constancy, especially if markets become frothy. Lee said:

“In an economy where things become murkier and harder to track, a stablecoin helps even things out.”

The world’s second largest stablecoin by market cap Circle’s USD Coin (USDC) has already begun making a bid to enter capital markets with new partner BlackRock’s backing.

Ultimately, Lee believes the flow of money, people, and things will go from the traditional financial world into blockchain, not the other way around. As he put it,

“Crypto will probably refuse to be brought into the incumbent fold. Things off-chain will move on-chain, but it won’t go in reverse.”

However, he believes “DeFi and crypto markets need to have a lot more efficiency” to help the rate of adoption increase as the technology improves. In his view, a good deal of inefficiency comes from the “unusable” platforms designed to help inexperienced users bring funds into crypto. He added:

“People are avoiding the best performing asset class in history because there’s no way to get there. If platforms were more usable for the layperson adoption would be a lot higher than it is now.”

This opinion echoes an analysis made by Cointelegraph on April 12 that sees traditional financial resistance to using crypto as an increasingly obvious exercise in futility.

Bringing things on to the blockchain and into crypto requires token bridges, which Vitalik Buterin raised concerns about in early Jan. They have also been the target of several security breaches already in 2022 amounting to nearly $1 billion in losses.

Related: Blockchain.com names custody partner for its institutional offering

Regardless, Lee sees them as an essential part of the capital markets infrastructure. He said “We need bridges to build out the capital markets, but the problem is most bridges are pseudo-centralized.”

People familiar with the matter claimed Brett Redfearn's departure was due to Coinbase shifting its priorities away from digital asset securities.

Brett Redfearn, the former director of the division of trading and markets at the United States Securities and Exchange Commission (SEC), has reportedly left his position at Coinbase after less than five months.

According to a Wall Street Journal report, Redfearn resigned as the head of Coinbase’s capital-markets group at the end of July. People familiar with the matter claimed his departure was due to the crypto exchange shifting its priorities away from digital asset securities.

During his time at Coinbase, Redfearn was responsible for the crypto exchange’s strategy for crypto capital markets, including digital asset securities. The U.S.-based crypto exchange has hired a number of individuals formerly involved with the government prior to and following its initial public offering in April.

Related: Coinbase CEO Brian Armstrong says proposed crypto tax rule makes no sense

Earlier this year, Coinbase announced that a former member of the White House National Security Council, Faryar Shirzad, would become the company’s chief policy officer. The firm also continued to expand its operations in India with the hiring of former Google Pay engineering lead Pankaj Gupta.

Cointelegraph reached out to Coinbase, but did not receive a response at the time of publication.