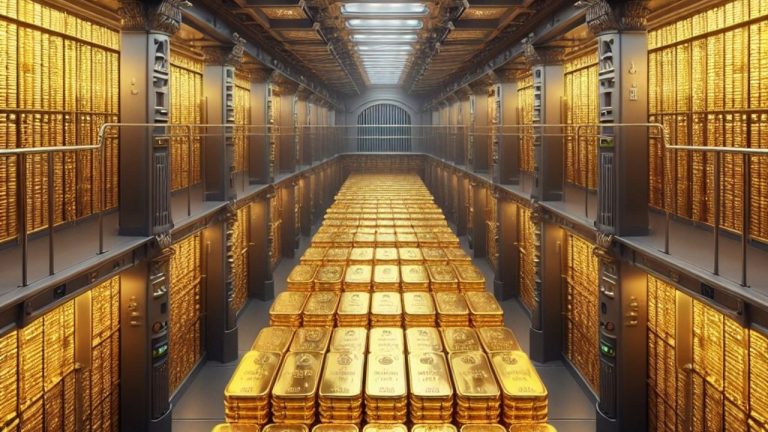

Central banks kept up demand for gold in February, registering net purchases of 19 tonnes. Albeit the purchasing trend continued, purchases fell 58% compared to January’s demand, according to IMF and World Gold Council numbers. China reported the largest gold accumulation, acquiring 12 tonnes to maintain a 16-month gold purchasing streak. Gold Demand Still High […]

Central banks kept up demand for gold in February, registering net purchases of 19 tonnes. Albeit the purchasing trend continued, purchases fell 58% compared to January’s demand, according to IMF and World Gold Council numbers. China reported the largest gold accumulation, acquiring 12 tonnes to maintain a 16-month gold purchasing streak. Gold Demand Still High […] The Chinese government is reportedly launching an “ultra-large-scale blockchain infrastructure platform for the Belt and Road Initiative.” The platform will support the implementation of cross-border cooperation projects along the Belt and Road Initiative and provide the base for developing applications that showcase collaboration across borders. ‘Ultra-Large Scale Blockchain Infrastructure Platform’ The Chinese government has reportedly […]

The Chinese government is reportedly launching an “ultra-large-scale blockchain infrastructure platform for the Belt and Road Initiative.” The platform will support the implementation of cross-border cooperation projects along the Belt and Road Initiative and provide the base for developing applications that showcase collaboration across borders. ‘Ultra-Large Scale Blockchain Infrastructure Platform’ The Chinese government has reportedly […] A London woman has been convicted for money laundering, having been found with over $4.3 billion in bitcoin, which she converted into physical assets. The SEC is seeking a nearly $2 billion fine from Ripple Labs in a landmark XRP lawsuit, a move Ripple’s CEO deems unprecedented. The activation of a dormant bitcoin wallet, known […]

A London woman has been convicted for money laundering, having been found with over $4.3 billion in bitcoin, which she converted into physical assets. The SEC is seeking a nearly $2 billion fine from Ripple Labs in a landmark XRP lawsuit, a move Ripple’s CEO deems unprecedented. The activation of a dormant bitcoin wallet, known […] A recent report from Jan Nieuwenhuijs, an expert in the Chinese gold market, has found that the actual gold reserves held by the People’s Bank of China might comprise over 5,300 tonnes, dwarfing official numbers. Nieuwenhuijs explains China might be a driving force behind increasing gold prices, as the country moves to hoarding gold to […]

A recent report from Jan Nieuwenhuijs, an expert in the Chinese gold market, has found that the actual gold reserves held by the People’s Bank of China might comprise over 5,300 tonnes, dwarfing official numbers. Nieuwenhuijs explains China might be a driving force behind increasing gold prices, as the country moves to hoarding gold to […]

New data from market intelligence firm Chainalysis reveals that global cryptocurrency gains topped $37.6 billion in 2023 as asset prices and market sentiment continue to improve after a challenging 2022. In a new report, the crypto analytics platform says that the United States accounted for the lion’s share of realized profits in 2023, hauling in […]

The post United States Leads All Countries With a Staggering $9,360,000,000 Worth of Crypto Gains in 2023: Chainalysis appeared first on The Daily Hodl.

Russia has proposed the development and implementation of a BRICS-wide payment system that would use central bank digital currencies (CBDCs) to manage trade settlements. The BRICS bridge, as referred to by Russian Finance Minister Anton Siluanov, would address the fragmentation of the current payment system outside the West’s “unfriendly infrastructure.” Russia Hints at Using CBDC […]

Russia has proposed the development and implementation of a BRICS-wide payment system that would use central bank digital currencies (CBDCs) to manage trade settlements. The BRICS bridge, as referred to by Russian Finance Minister Anton Siluanov, would address the fragmentation of the current payment system outside the West’s “unfriendly infrastructure.” Russia Hints at Using CBDC […] The digital yuan, China’s central bank digital currency (CBDC), is being used as a security element in car prepurchase payment settlements. According to local media reports, a pilot test that allows customers to pay for their cars with digital yuan was established in early February in Shenzhen, and several customers are already purchasing their vehicles […]

The digital yuan, China’s central bank digital currency (CBDC), is being used as a security element in car prepurchase payment settlements. According to local media reports, a pilot test that allows customers to pay for their cars with digital yuan was established in early February in Shenzhen, and several customers are already purchasing their vehicles […]

Florida Senator Marco Rubio just issued a warning about the growing global economic alliance known as BRICS. In a new article on RealClearWorld, the Republican senator says the recent expansion of BRICS poses a threat to the SWIFT payment system and America’s ability to weaponize the dollar to sanction people and nations. “As of New […]

The post US Senator Issues BRICS Warning, Says Economic Alliance May Damage America’s Ability to Weaponize Dollar appeared first on The Daily Hodl.

A Chinese state-owned newspaper has warned that corrupt officials could be funneling crypto into cold storage to avoid investigations. Legal Daily, a media outlet directly under the control of the Chinese Communist Party (CCP), notes in a new report that experts at the China Integrity and Legal Research Association’s 2023 annual meeting drew attention to […]

The post Chinese State Media Warns Corrupt Officials May Be Using Cold Storage Crypto To Avoid Investigation: Report appeared first on The Daily Hodl.