Federal Reserve Chair Jay Powell says his agency is paying close attention to financial institutions that are heavily exposed to the commercial real estate sector. In a new appearance at the ECB Forum on Central Banking, Powell addressed concerns about commercial real estate loans and whether they pose a serious threat to the already embattled […]

The post Regional US Banks Have ‘Surprisingly Large’ Exposure to Troubled $2,900,000,000,000 Office Loan Sector: Jerome Powell appeared first on The Daily Hodl.

While the U.S. dollar has been extremely robust in recent times, compared to a myriad of fiat currencies worldwide, a number of analysts and economists think the greenback will eventually falter in an inconceivable manner. The owner of aheadoftheherd.com, Richard Mills, published a comprehensive research post on Wednesday called “Walking Dead U.S. Dollar,” warning that […]

While the U.S. dollar has been extremely robust in recent times, compared to a myriad of fiat currencies worldwide, a number of analysts and economists think the greenback will eventually falter in an inconceivable manner. The owner of aheadoftheherd.com, Richard Mills, published a comprehensive research post on Wednesday called “Walking Dead U.S. Dollar,” warning that […] Federal Reserve Chairman Jerome Powell says the central bank is “not really seeing significant macroeconomic implications” from crypto’s volatility. The Fed chair stressed that there is a need for a better crypto regulatory framework. Fed Chair Powell Says Crypto Needs Better Regulation Federal Reserve Chairman Jerome Powell testified before the Senate Committee on Banking, Housing, […]

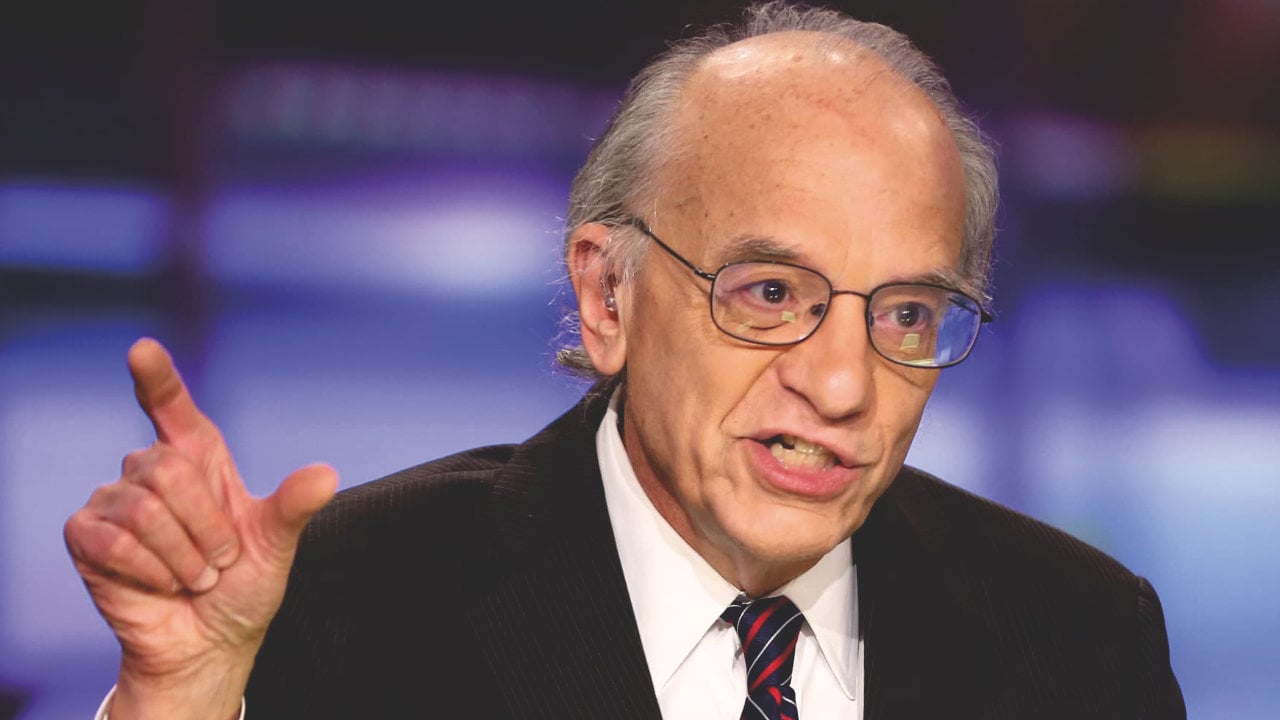

Federal Reserve Chairman Jerome Powell says the central bank is “not really seeing significant macroeconomic implications” from crypto’s volatility. The Fed chair stressed that there is a need for a better crypto regulatory framework. Fed Chair Powell Says Crypto Needs Better Regulation Federal Reserve Chairman Jerome Powell testified before the Senate Committee on Banking, Housing, […] A finance professor at the Wharton School of the University of Pennsylvania has warned of “bitcoin taking over.” He added that the Fed “has been terribly wrong over the last year” about inflation and must now act to defend the U.S. dollar. Finance Professor Urges the Fed to Take Action to Defend the U.S. Dollar […]

A finance professor at the Wharton School of the University of Pennsylvania has warned of “bitcoin taking over.” He added that the Fed “has been terribly wrong over the last year” about inflation and must now act to defend the U.S. dollar. Finance Professor Urges the Fed to Take Action to Defend the U.S. Dollar […]

Rising jobless claims in the U.S. sparked selloffs in the dollar market. On the other hand, Bitcoin held onto its intraday gains.

Bitcoin (BTC) looks to reclaim $45,000 on Oct. 1 as the U.S dollar retreated lower after hitting its one-year high. Bitcoin's tight inverse correlation with the greenback over the past month suggests that a weakening dollar could push BTC price even higher in the coming sessions.

In detail, the U.S. Dollar Index (DXY), which measures the greenback's strength against a basket of six foreign currencies, including euro and sterling, hit $94.50 Thursday for the first time since Sept. 28, 2020. But it retreated on news of rising U.S. jobless claims against the forecasts of a decline.

The labor data released Thursday showed that the number of jobless claims rose to 362,000 last week against 351,000 a week earlier and against the economists' projection of 333,000. As a result, the number of reapplications got stuck around 2.8 million for five weeks in a row.

For the markets, this could be the news that the Federal Reserve might delay tapering its $120 billion asset purchasing program from November to a later month, thus keeping interest rates lower and the dollar's renewed strength temporary.

The index was trading at 94.263 at the time of this writing.

Technicals also showed the greenback facing the prospect of a correction ahead. For example, independent market analyst TradingShot spotted the dollar index inside a Megaphone pattern, about to get topped out to pursue a correction in the coming sessions, as shown in the chart below.

"Based on the 1D relative strength index (RSI), it appears that DXY is right at the top of the formation as [it was] on Aug 15, 2018," TradingShot wrote.

"DXY is building up a strong pull-back to the bottom of the Megaphone."

Meanwhile, a recent bout of selling in the Bitcoin market lately had it paint a Falling Wedge pattern. In detail, Falling Wedges appear when the price trends lower inside a channel comprising of two diverging, descending trendlines.

Traditional analysts see the Falling Wedge pattern as a bullish reversal indicator, noting that a break above its upper trendline moves the price higher by as much as the maximum distance between the Wedge's trendlines.

The structure's maximum height is roughly $10,000. As a result, the Bitcoin price can at least retest $50,000 should the Wedge breakout play out as intended.

On the other hand, the underwhelming jobs report could boost investors' interim appetite for Bitcoin.

Related: Bitcoin’s sharp fall from $50K linked to stronger US dollar, gold — Correlation shows

Vasja Zupan, president of Matrix Exchange, told Cointelegraph that the dollar's weakness and devaluation against rising inflation would continue to make investors put their excess cash in crypto markets. He said:

"Bitcoin in its core proposition has an integrated hedge against inflation and therefore persistently higher inflation in the U.S. can only push it upwards. Therefore, in the long term, the dollar's worth will continue to be lesser than Bitcoin.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Unnamed sources familiar with the matter indicate the Biden administration may allow Federal Reserve chairman Jerome Powell to continue as the central bank’s lead. The news follows three U.S. representatives asking Biden to replace Powell with a central bank leader that addresses equality and climate change. Jerome Powell to Stay for Second Term, Sources Say […]

Unnamed sources familiar with the matter indicate the Biden administration may allow Federal Reserve chairman Jerome Powell to continue as the central bank’s lead. The news follows three U.S. representatives asking Biden to replace Powell with a central bank leader that addresses equality and climate change. Jerome Powell to Stay for Second Term, Sources Say […] Federal Reserve Chairman Jerome Powell believes that there is no need for cryptocurrencies if there is a digital dollar. “I think that’s one of the stronger arguments in its favor,” he said. The Fed chair also insists that the U.S. is not in danger of losing its reserve currency status. Fed Chair Powell Thinks Cryptocurrencies […]

Federal Reserve Chairman Jerome Powell believes that there is no need for cryptocurrencies if there is a digital dollar. “I think that’s one of the stronger arguments in its favor,” he said. The Fed chair also insists that the U.S. is not in danger of losing its reserve currency status. Fed Chair Powell Thinks Cryptocurrencies […] Federal Reserve Chairman Jerome Powell sees cryptocurrency as a substitute for gold, rather than the dollar. However, he cautioned that crypto assets, including bitcoin, are highly volatile and not useful as a store of value. Fed Chair Sees Bitcoin as a Gold Substitute During a webinar sponsored by the Bank of International Settlements (BIS) on […]

Federal Reserve Chairman Jerome Powell sees cryptocurrency as a substitute for gold, rather than the dollar. However, he cautioned that crypto assets, including bitcoin, are highly volatile and not useful as a store of value. Fed Chair Sees Bitcoin as a Gold Substitute During a webinar sponsored by the Bank of International Settlements (BIS) on […]