“The claim that Bitcoin miners jeopardize the electricity network is completely misinformed,” says EU-based fund manager Melanion Capital.

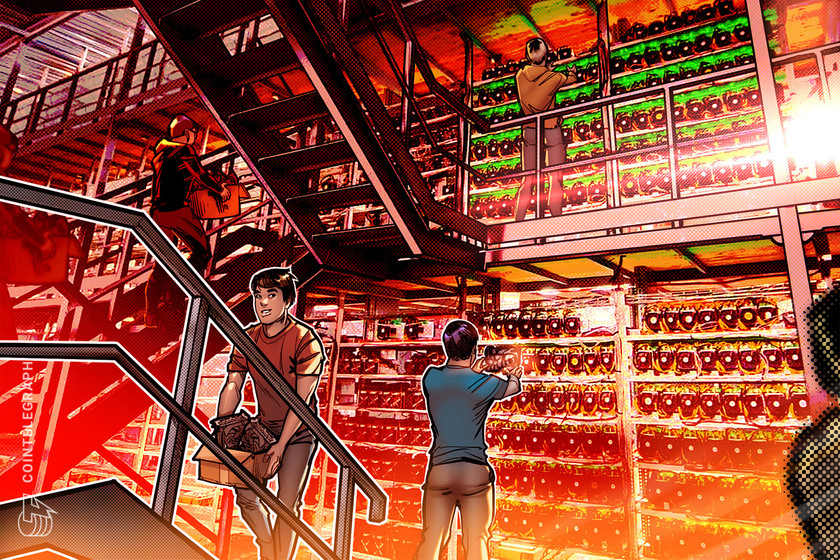

A Swedish financial watchdog’s call for a European Union-wide ban on proof-of-work (PoW) crypto mining, mainly known as the method of minting new Bitcoin (BTC), has received backlash from crypto-related fund managers.

Melanion Capital, a Paris-based alternative investment firm known for its Bitcoin ETF, addressed the Swedish Financial Supervisory Authority and Swedish Environmental Protection Agency’s call to ban PoW mining across Europe.

“The claim that Bitcoin miners jeopardize the electricity network is completely misinformed,” noted Melanion, reminding that Bitcoin miners’ business model is prone to collapse when the electricity demand increases as it would also increase energy prices.

The statement points to the authorities that have chosen to welcome miners instead of banning them, such as Texas, adding that Bitcoin miners are complementary for renewable energy power generation, “as they capture wasted energy and provide a baseload for a volatile resource like wind or hydropower.”

Due to its decentralized nature, the Bitcoin mining industry has no lobby to defend its interests and negotiate with governments, Melanion Capital reminded, adding:

“The absence of such a political counterbalance [for Bitcoin miners] should not be taken as an opportunity to implement measures rendering illegal an industry for its lack of defensive powers.”

The environmental footprint of Bitcoin mining was a major conversation at the United Nations Climate Change Conference. Speaking at a panel, Cointelegraph editor-in-chief Kristina Cornèr said it’s more important to have people in the blockchain space who are ready to think with a new mindset and search for solutions.

Related: Climate Chain Coalition advocates for the creation of a green economy at COP26

After surveying one-third of the global Bitcoin network, the Bitcoin Mining Council estimated that the global mining industry’s sustainable electricity mix grew to 56% in the second quarter of 2021.

Bitcoin miners are also looking for other energy resources, and nuclear is not off the table. Panelists at the Bitcoin & Beyond Virtual Summit reminded the potential of nuclear energy to introduce “enormous amounts of clean, carbon-free” power to the baseload.