Gaming companies Zebedee and Thndr are taking advantage of the Lighting Network, atop Bitcoin, to entertain and onboard gamers into Bitcoin.

You can now play Solitaire, Snake and even Counter-Strike to earn Satoshis, tiny fractions of Bitcoin (BTC). Cointelegraph spoke to executives at Thndr Games, a play-to-earn (P2E) company built around Bitcoin and Zebedee, a gaming platform that will “Transform gaming with the power of Bitcoin.”

Thanks to the Lightning Network (LN), a layer-2 payment solution built on top of Bitcoin, instant microtransactions of Sats can pay out to gamers across the globe quickly. “This genuinely fixes a need in gaming,” Ben Cousens, chief strategy officer at Zebedee, told Cointelegraph.

Zebedee offers Bitcoin and LN support for popular games such as Counter-Strike: Go. They promote casual gaming and the creation of inviting environments that could “Bring people into Bitcoin in a way that surprises them,” Cousens explained.

For THNDR, which released a Solitaire-style mobile game on Monday, the rollout of popular, casual gaming types is also about onboarding people into Bitcoin. They actively target gamers in emerging markets as well as female audiences.

Desiree Dickerson, CEO & co-founder of Thndr Games, shared some statistics with Cointelegraph during a call: “Sixty percent of all women worldwide play games, and 60% of these women play mobile games every day.”

On top of that, the gaming industry is bigger than the movie industry; “2.6 billion people worldwide play games,” and within that segment, mobile gaming is the most popular. “It makes up 60% of the entire gaming market, and it’s only increasing,” Dickerson explained.

The release of Club Bitcoin: Solitaire specifically taps into the growing female audience segment:

“The mission is to onboard people into Bitcoin, but we are never going to make a game that is not a good game. We don’t want just to target Bitcoiners non-stop. It’s about making an excellent game that has Bitcoin in it.”

Around 60% of Thndr Game's users are located in the global south, a popular touchpoint for Bitcoiner companies. Emerging markets suffer from unstable regimes, volatile currencies and weaker socio-economic development.

In this environment, Bitcoin the asset can provide an economic lifeline to many and thanks to near-instant payment rails and Bitcoin-centric games, Bitcoin the protocol now offers a means of escapism as well as small economic rewards. At Zebedee, for example, the average transaction size is tiny, just $0.02.

Cousens told Cointelegraph, “Gaming and Bitcoin and Lighting is a huge onramp for Bitcoin [adoption],” sharing that Brazil is an important territory of their userbase, followed by the Philippines–both emerging countries with thriving crypto adoption.

Furthermore, both Dickerson and Cousens illustrated that gaming is a way of onboarding people into Bitcoin without “ideology.” The Bitcoin and crypto spaces are rife with infighting, dunking and told-you-so's, whereas gaming, in particular idle gaming, is a laidback environment in which users can start stacking sats.

Related: Bandai Namco, SEGA among gaming giants eyeing blockchain gaming

Thndr has successfully sent over 1.5 million rewards over the LN and has garnered a growing audience of devoted fans. All of its games on the Apple App Store boast a 4.5-star or more rating. “We are almost first and foremost thinking about the pure joy of play,” Dickerson explained.

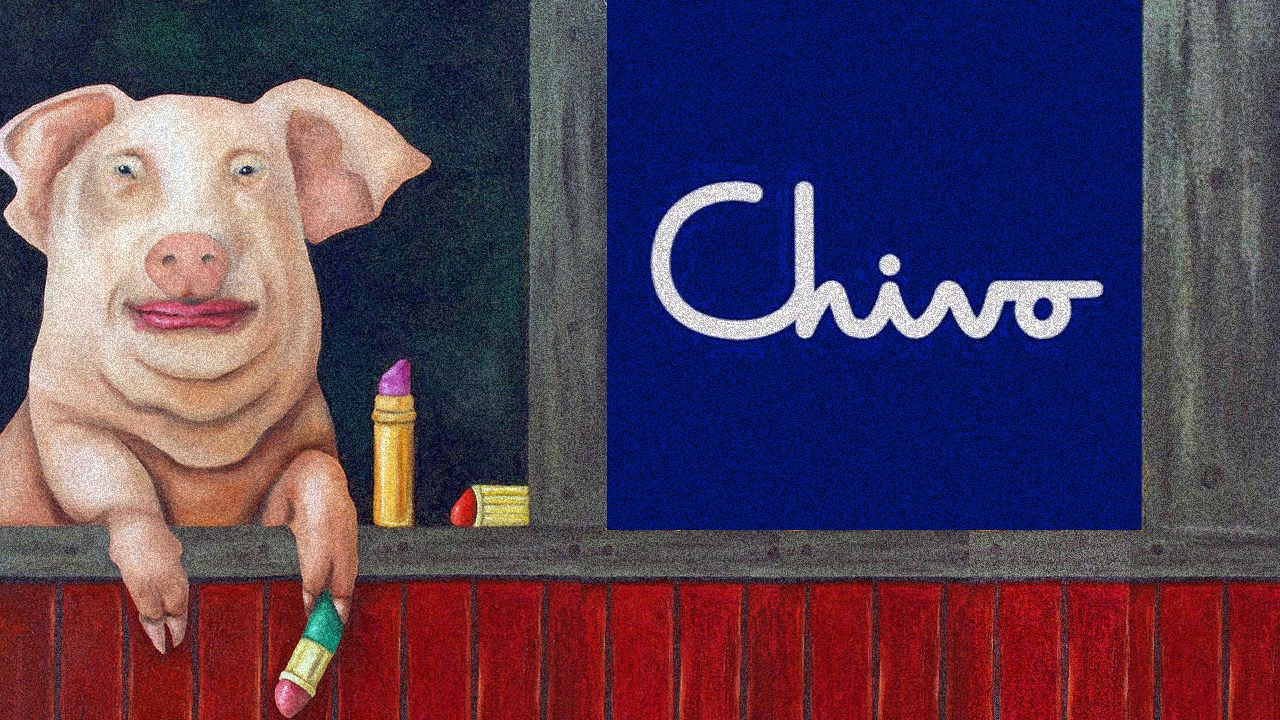

For Cousens, who is well aware of the risk of “Hyperfinancialisation” of gaming products, he explains it’s hard to underestimate the role that casual gaming could play in Bitcoin adoption .“A bad casual mobile game has like 10 million downloads [...] You get one or two games, you dwarf El Salvador.”

El Salvador could onboard a total population of 6.4 million people into earning, saving, and spending Bitcoin thanks to The Bitcoin Law. Solitaire, by comparison, has 35 million monthly users, according to Microsoft. And that’s just one game.