Many have already pronounced the death of NFTs, and in part, they are correct. Amidst the fervor of the NFT hype cycle, we saw huge valuations and sales such as Beeple’s ‘The 5000 Days’ collection selling for a staggering $69.3 million. However, not substantiated by anything beyond the hype, the market came crashing down with […]

Many have already pronounced the death of NFTs, and in part, they are correct. Amidst the fervor of the NFT hype cycle, we saw huge valuations and sales such as Beeple’s ‘The 5000 Days’ collection selling for a staggering $69.3 million. However, not substantiated by anything beyond the hype, the market came crashing down with […]

Former FTX CEO Sam Bankman-Fried dreamed of being the President of the United States, but his lawlessness eventually caught up with him.

Sam Bankman-Fried was found guilty of all seven counts of fraud and conspiracy to commit fraud in the late hours of Nov. 2. The jury delivered its verdict in less than 10 minutes after nearly 4 hours of deliberation, leaving his parents to fall silent in the crowded courtroom at the Southern District Court of New York.

Over the course of his lengthy trial, my thoughts kept returning to: How did you come to be here? Could all of this harm have been prevented? What can we do to avoid the next FTX?

Some say that existing financial regulations could have prevented the collapse of FTX. Having to comply with regulatory requirements, Bankman-Fried would never have been able to commingle and embezzle customer funds.

FTX used Alameda Research as a “payment processor,” as described by Bankman-Fried’s defense. One of Alameda’s subsidiaries, Northern Dimension, received deposits from FTX customers since the exchange was founded. Without any corporate control, the companies commingled funds.

Commingling of funds may not necessarily involve fraudulent intent, but can still be problematic due to the lack of transparency and accountability. In fact, it’s a “dirty word” in securities law, an attorney observing Bankman-Fried’s trial explained.

Embezzlement, on the other hand, typically involves intentional and fraudulent actions and occurs when one in control of funds uses the capital for personal gain or unauthorized purposes. Bankman-Fried, according to prosecutors, used billions of dollars in venture capital investments, real estate acquisitions, and political donations for personal gain. None of these funds belonged to him.

Without corporate controls, his defense couldn’t prove that the $8 billion missing from clients was not the result of the market downturn instead of misappropriation of funds.

Bankman-Fried had high ambitions. He dreamed of being the President of the United States. He thought growing FTX would be the only way to cover the billion-dollar hole on its balance sheet, but it was too late for FTX. As Warren Buffett wisely said: “You only find out who is swimming naked when the tide goes out.”

In the end, Bankman-Fried was caught not for crypto fraud but for traditional fraud. Theoretically, regulatory guardrails could have prevented him from commingling and embezzling funds, but the law won’t prevent someone who believes they're uncatchable from doing wrong.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

The former FTX CEO will take the stand in his own defense. Will it be enough to counter the narrative introduced by former employees and expert witnesses?

Sam Bankman-Fried (SBF) had a lot going against him well before the start of his criminal trial: the ire of many in the crypto space, suspicion from United States policymakers, and negative attention from some in the media looking for clickbait angles to associate with the former FTX CEO.

None of that may have had any impact on the case his attorneys planned to present at trial, which so far doesn’t seem to have given jurors much of anything to counter the bulk of the narrative put forth by prosecutors. With few exceptions, the testimonies from witnesses for the Justice Department have been straightforward even for those unfamiliar with the intricacies of crypto trading and investments.

Former Alameda Research CEO Caroline Ellison provided statements admitting to providing fudged numbers while former FTX Chief Technology Officer Gary Wang claimed SBF directed efforts to allow Alameda to “withdraw unlimited funds.” Former FTX engineering director Nishad Singh also testified regarding the “excessive” purchases Alameda made in endorsements from celebrities.

Related: Michael Lewis' new book puts a positive spin on Sam Bankman-Fried

"[Sam] said he was willing to take large coin flips," Ellison told jurors on Oct. 10, regarding investment risks. "He talked about being willing to flip a coin and destroy the world, as long as a win would make it twice as good.”

Subscribe to our ‘1 Minute Letter’ NOW for daily deep-dives straight to your inbox! ⚖️ Be the first to know every twist and turn in the Sam Bankman-Fried case! Subscribe now: https://t.co/jQOIYUv6IW #SBF pic.twitter.com/gp7zJu5sgy

— Cointelegraph (@Cointelegraph) October 5, 2023

Through the court proceedings, defense lawyers Mark Cohen and Christian Everdell frequently called for objections and sidebars — a time when counsel can address the judge without the jury hearing — but rarely seemed to pose questions to witnesses that would significantly help SBF’s case or sway the jury. Jurors have already heard testimony painting SBF as the instigator behind efforts for Alameda to use FTX customer funds without users’ knowledge.

Related: Sam Bankman-Fried trial moves to final stages

One of the few holes defense lawyers were able to poke in Singh’s testimony was him admitting to being a little fuzzy on details in 2022 ahead of FTX’s bankruptcy and taking his own loan to purchase a vacation home. After laying out their case in opening arguments on Oct. 4, Cohen and Everdell suggested they would present evidence pointing the finger at Ellison for much of the criminal acts. However, as Ellison, Wang, and Singh all accepted plea deals and told parallel versions of the same story, SBF lawyers’ cross-examination came across as milquetoast.

SAM BANKMAN-FRIED MIGHT RISK TESTIFYING IN CRIMINAL TRIAL

— zerohedge (@zerohedge) October 25, 2023

Risk? Dude went on the shoeshine boy's podcast last year to explain that he was very "sorry"

Soon SBF’s legal team will be the one calling witnesses, which we learned on Oct. 25 will include the former FTX CEO himself. The only reason to call Bankman-Fried to the stand in his defense would be to bolster his case, and that means having jurors believe SBF, a socially awkward “math nerd” according to his own lawyers, over his colleagues. While potentially testifying that he “did what [he] thought was right” might be personally satisfying to SBF, it doesn’t seem to help defend his actions, let alone inure jurors to his plight.

There's been an astonishing contrast between the pre-arrest and mid-trial personas of Bankman-Fried. The former CEO used to have regular interviews with major media outlets, wasn't shy about tweeting his thoughts on the crypto market, and was considered by many to one of the most popular figures in the space.

Now, following his path to jail, SBF has gone from freedom in The Bahamas to home confinement with limited internet, to the point where few people have actually heard his voice or seen a photo of him in months — cameras generally aren't allowed in the courtroom, and getting a snapshot of him from jail is unlikely. The former CEO has trimmed his hair and regularly wears a suit and tie to court, something many would have found unthinkable a year ago.

SBF’s attorneys and New York prosecutors are on hiatus until Oct. 26, when court proceedings will resume. The defense team has suggested it could call up to three witnesses — four, including Bankman-Fried — compared to the roughly 20 people called by prosecutors. This strategy, according to Cohen, will only take a few days to present to the jury, after which time closing arguments will begin.

Defense attorneys have their work cut out for them.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

The public perception surrounding AI’s abilities is no match for the laws of physics.

Almost nothing is known about Elon Musk’s latest endeavor, an artificial intelligence startup named xAI. But “almost nothing” is still something. And we can glean a lot from what little we do know.

As Cointelegraph recently reported, Musk announced xAI on July 12 in a statement comprising three sentences, “Today we announce the formation of xAI. The goal of xAI is to understand the true nature of the universe. You can meet the team and ask us questions during a Twitter Spaces chat on Friday, July 14th.”

Based on this information we can deduce that xAI exists, it is doomed, and more information about how it will fail will be revealed on Twitter. The reason it is doomed is simple: The laws of physics prevent it.

According to a report from Reuters, Musk’s motivation for xAI is based on a desire to develop safe artificial intelligence (AI). In a recent Twitter Spaces event, he said:

“If it tried to understand the true nature of the universe, that’s actually the best thing that I can come up with from an AI safety standpoint.”

This is a laudable goal, but any attempts to understand the “true” nature of the universe are doomed because there isn’t a ground-truth knowledge center somewhere where we can verify our theories against.

It’s not that humans aren’t smart enough to understand the nature of the universe — the problem is that the universe is really, really big, and we’re stuck inside of it.

Heisenberg’s Uncertainty Principle tells us unequivocally that certain aspects of reality cannot be confirmed simultaneously through observation or measurement. This is the reason why we can’t just measure the distance between Earth and Uranus, wait a year, measure it again, and determine the exact rate of the universe’s expansion.

The scientific method requires observation, and, as the anthropic principle teaches us, all observers are limited.

In the case of the observable universe, we’re further limited by the nature of physics. The universe is expanding at such a rapid pace that it prohibits us from measuring anything beyond a certain point, no matter what tools we use.

The universe’s expansion doesn’t just make it bigger. It gives it a distinct, definable “cosmological horizon” that the laws of physics prevent us from measuring beyond. If we were to send a probe out at the maximum allowable speed under the laws of physics, the speed of light, then every bit of the universe that’s beyond the exact point the probe could travel in X amount of time is forever inaccessible.

This means even a hypothetical superintelligence capable of processing all of the data that’s ever been generated still could not determine any ground truths about the universe.

A slight twist on Schrödinger’s Cat thought experiment, called Wigner’s Friend, demonstrates why this is the case. In the original, Erwin Schrödinger imagined a cat trapped in a box with a vial of radioactive liquid and a hammer that would strike the vial, and thus kill the cat, upon the completion of a quantum process.

One of the fundamental differences between quantum and classical processes is that quantum processes can be affected by observation. In quantum mechanics, this means that the hypothetical cat is both alive and dead until someone observes it.

Physicist Eugene Wigner was reportedly “irked” by this and decided to throw his own spin on the thought experiment to challenge Schrödinger’s assertions. His version added two scientists, one inside the lab who opens the box to observe whether the cat was alive or dead and another outside who opens the door to the lab to see whether the scientist inside knows whether the cat is alive or dead.

What xAI appears to be proposing is a reversal of Wigner’s thought experiment. They seemingly want to remove the cat from the box and replace it with a general pre-trained transformer (GPT) AI system — i.e., a chatbot like ChatGPT, Bard or Claude 2.

Related: Elon Musk to launch truth-seeking artificial intelligence platform TruthGPT

Instead of asking an observer to determine whether the AI is alive or dead, their plan is to ask the AI to discern ground truths about the lab outside of the box, the world outside of the lab and the universe beyond the cosmological horizon without making any observations.

The reality of what xAI seems to be proposing would mean the development of an oracle: a machine capable of knowing things it doesn’t have evidence for.

There is no scientific basis for the idea of an oracle; its origins are rooted in mythology and religion. Scientifically speaking, the best we can hope for is that xAI develops a machine capable of parsing all of the data that’s ever been generated.

There’s no conceivable reason to believe this would turn the machine into an oracle, but maybe it’ll allow it to help scientists see something they missed and lead to further insight. Perhaps the secret to cold fusion is lying around in a Reddit data set somewhere that nobody’s managed to use to train a GPT model yet.

But, unless the AI system can defy the laws of physics, any answers it gives us regarding the “true” nature of the universe will have to be taken on faith until confirmed by observations made from beyond the box — and the cosmological horizon.

For these reasons, and many others related to how GPT systems actually interpret queries, there’s no scientifically viable method by which xAI, or any other AI company, can develop a binary machine running classical algorithms capable of observing the truth about our quantum universe.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

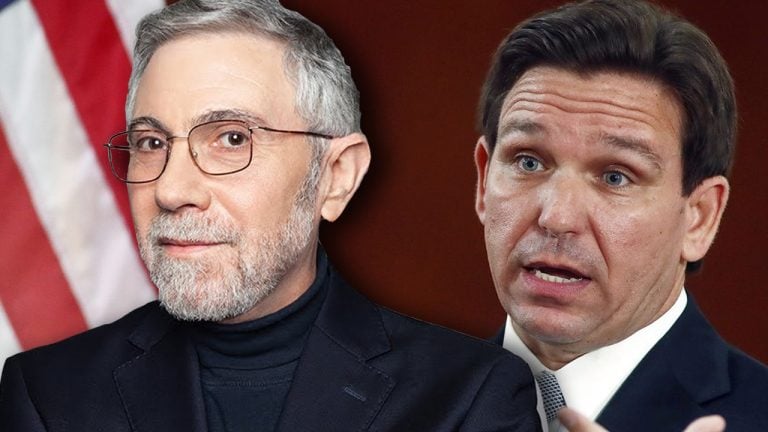

Economist Paul Krugman questioned why Republican Florida governor Ron DeSantis opposes a central bank digital currency (CBDC) in a recent opinion editorial. Krugman suggested that DeSantis may be motivated by “general paranoia.” He speculated that DeSantis may be influenced by individuals who fear a digital currency could hinder “un-woke activities such as tax evasion and […]

Economist Paul Krugman questioned why Republican Florida governor Ron DeSantis opposes a central bank digital currency (CBDC) in a recent opinion editorial. Krugman suggested that DeSantis may be motivated by “general paranoia.” He speculated that DeSantis may be influenced by individuals who fear a digital currency could hinder “un-woke activities such as tax evasion and […] Finance mogul Warren Buffett, one of the most successful investors in history, discussed bitcoin during an interview on CNBC’s Squawk Box on April 12. As he has done in previous interviews, the business magnate likened bitcoin to a gambling scheme and chain letters he received as a child. Buffett Shares His Two Cents on Bitcoin, […]

Finance mogul Warren Buffett, one of the most successful investors in history, discussed bitcoin during an interview on CNBC’s Squawk Box on April 12. As he has done in previous interviews, the business magnate likened bitcoin to a gambling scheme and chain letters he received as a child. Buffett Shares His Two Cents on Bitcoin, […] As Ripple and the U.S. Securities and Exchange Commission (SEC) persist in their legal dispute over XRP’s classification as a security, the consequences for both parties and the wider cryptocurrency market cannot be understated. This case offers a unique opportunity to attain much-needed regulatory clarity, which could ultimately promote growth and stability throughout the sector. […]

As Ripple and the U.S. Securities and Exchange Commission (SEC) persist in their legal dispute over XRP’s classification as a security, the consequences for both parties and the wider cryptocurrency market cannot be understated. This case offers a unique opportunity to attain much-needed regulatory clarity, which could ultimately promote growth and stability throughout the sector. […]

Bitcoin, the original blockchain, struggles to gain traction among blockchain advocates; an opinion from one of Europe's largest blockchain conferences.

Bitcoin (BTC) popularised the term blockchain. Blockchains, or “decentralized and distributed digital ledgers used to record transactions across a network of computers,” have been around for over thirty years, the household name for a blockchain is Bitcoin.

That’s despite the fact that the Genesis block was mined well over 14 years ago when George W. Bush was president and “I Gotta Feeling” by Black Eyed Peas topped the charts–Bitcoin is still top of the blocks.

It’s to be expected, then, that most blockchain advocates would have used, understood or a the very least experimented with Bitcoin.

Nope. Not so.

Here’s an example. While MC’ing at the European Blockchain Conference in February, I asked the audience for a show of hands. I inquired of the circa 250 blockchain believers sitting in front of me:

"Who here has used Bitcoin?"

Maybe 20 audience hands shot up. “Okay. Keep your hand up if you’ve used Bitcoin’s Lightning Network,” I said. The Lightning Network or (LN) is the payments network built on top of Bitcoin which allows near-instant, near-free transactions. Over half those hands went down.

One data sample is insufficient. So, the following day I quizzed the audience on stage. I was surprised to receive the same result. Four-fifths of the blockchain conference audience had never used Bitcoin.

Why is that? Why is it that so few people have touched arguably the only blockchain that solves what is known as the “scalability trilemma;” that of decentralization, security and scalability?

The Bitcoin blockchain, or timechain as Satoshi Nakamoto called it in the white paper, is still relatively small. Anyone with an old laptop can download the entirety of all transactions in order to run a node; the network can scale to reach millions and soon billions of people with layers, while the Bitcoin blockchain has never been hacked. And yet at the blockchain conference, very few attendees run nodes or have transacted on Bitcoin.

However, there are not enough data points to yet form this conclusion. I wanted to quiz individuals across the conference if they were blockchainers or Bitcoiners–and if so, why is that the case?

I quizzed conference-goers about a simple question. I asked around 15 conference goers to choose Web3 or Web5, and only one person of the fifteen chose Web5. Ironically, the sole Web5 proponent in the interview is Bitcoiner Antonia Roupell, whose job title is “Web3 lead” for Save the Children.

If @JoeNakamoto happened to give you one #Bitcoin at the @EBlockchainCon, what would you do with it? pic.twitter.com/tV3hdEIA0n

— Cointelegraph (@Cointelegraph) February 20, 2023

Most respondents looked confused when presented with the choice of webs. “What is Web5?” They queried.

Web3 is a world of reportedly decentralized blockchains in which tokens (and token sales) drive the economy forward; Web5 is the decentralized internet built on Bitcoin. Naturally, Bitcoin maximalist Jack Dorsey champions Web5.

Dorsey explained in December 2021 that Web5 will allow true ownership of identity and data, unlike Web3. Dorsey explains that “Web3" has the “Same corporate incentives [as Twitter] but hides it under "decentralization.”

The Twitter founder reckons Web3 will never achieve true decentralization as underneath the marketing spiel and tokenomics it’s the venture capitalists and limited Partners who own the blockchains and the data underpinning the systems.

Web5 already boasts social media applications such as Zion in which users can easily send Bitcoin to one another and own their data, built atop one decentralized blockchain and. Which blockchain? You guessed it, Bitcoin.

Web3 has existed since Ethereum coder Gavin Wood coined the term in 2014 and thus has more time on its side. Plus it’s a catchy, catch-all term that is often used interchangeably with blockchain, crypto and metaverse. It’s hard to define, underline or frame without referring to financially lucrative projects.

It finally struck me that the focus of most attendees at the European Blockchain Convention was business over Bitcoin. Or to put it another way–and to attempt to be a little less naive–the attendees wanted to make money over work towards a new monetary policy.

I had the same experience when discussing Nostr, which stands for Notes and Other Stuff Transmitted by Relays. The relatively new, decentralized network enables private messaging and uncensorable communication–among other projects.

One of the applications of Nostr, called iPhone app Damus, helped Nostr reach nearly half a million daily users in mid-February. User count multiplied by 5 since its listing on the Apple iOS store and the protocol is full of Bitcoin advocates.

I asked conference attendees for their public key so I could follow them on Nostr. I was met with bemused looks. The blockchain believers and champions of decentralized protocols had not tested nor heard of Damus.

Do you want one more example?

An employee at a popular Bitcoin company–who I won’t dox in this opinion piece–approached me during the conference. “I saw you sending sats to people on stage. You sound like a [Bitcoin] maxi,” he joked.

“Guilty, officer” I joked. I only hold Bitcoin and am passionate about bringing Bitcoin to the world, especially those living in financially kneecapped countries.

“You would probably recognize the company I represent then. I work for Blockstream.”

Of course! I told him. I actually played Jenga in the park with Blockstream’s CEO, Adam Back, recently. We immediately bonded.

Related: Regulation stole the show at Barcelona’s European Blockchain Convention

The Blockstream employee confided in me that not a single conferencegoer had clocked his employer. Blockstream is a well-known Bitcoin companies. Blockstream pioneers lightning adoption, side chains, affordable hardware wallets and liquid, while Back was one of the few names mentioned in the Bitcoin white paper published in 2008.

He shared his surprise with me, but it was 5pm on the last day of the conference–by this point I understood. “It’s a Bitcoin company, mate” I explained. And after all, “Bitcoin and blockchain don’t really mix.” Bitcoin has a marketing problem, I said.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Recently, Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), expressed his opinion in a detailed interview with New York Magazine’s Intelligencer regarding why he believes crypto assets other than bitcoin are securities. However, Stuart Alderoty, Ripple’s chief legal officer, argues that Gensler must “recuse himself from voting on any enforcement case […]

Recently, Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), expressed his opinion in a detailed interview with New York Magazine’s Intelligencer regarding why he believes crypto assets other than bitcoin are securities. However, Stuart Alderoty, Ripple’s chief legal officer, argues that Gensler must “recuse himself from voting on any enforcement case […] There’s been no shortage of news in past weeks when it comes to the United States Securities and Exchange Commission (SEC) taking action against crypto exchanges and companies. From Kraken, to Paxos, to Terraform Labs, it seems enforcement is in the air when it comes to chair Gary Gensler’s organization. In other news, South Sudan […]

There’s been no shortage of news in past weeks when it comes to the United States Securities and Exchange Commission (SEC) taking action against crypto exchanges and companies. From Kraken, to Paxos, to Terraform Labs, it seems enforcement is in the air when it comes to chair Gary Gensler’s organization. In other news, South Sudan […]