Within two days, the token’s price plummeted from an all-time high of $0.00067279 to an all-time low of $0.00004827.

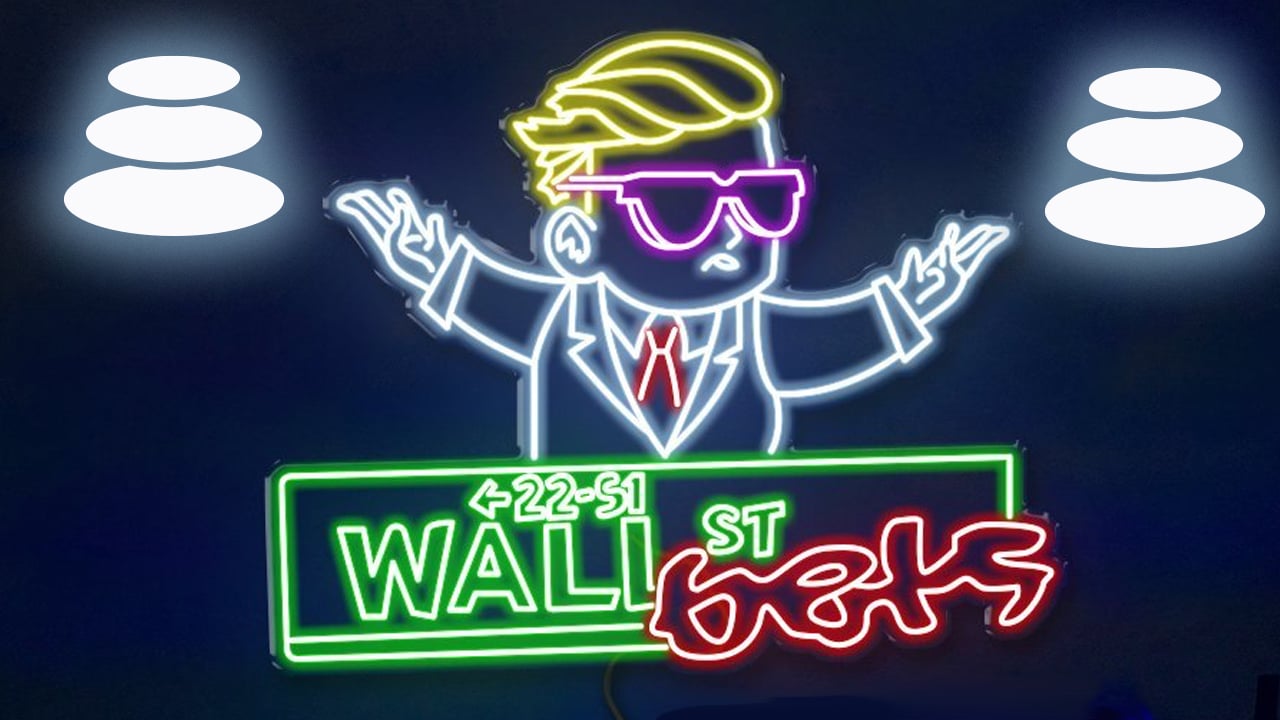

A moderator of the popular trading subreddit r/WallStreetBets has dumped a large portion of the WSB Coin (WSB), a token project that claims to be the official memecoin of Wall Street Bets.

On May 2, WSB was launched by people involved in moderating the WallStreetBets Reddit forum. The subreddit gained notoriety for the GameStop short squeeze, sending hedge funds to their knees in January 2021.

The creators of the WSB token claimed that there would be no allocation for the team and that 10% of the coins would be reserved for the subreddit. The website writes:

“It’s the fairest launch memecoin you will find with no team allocation and no presale. Just a free airdrop and some coins for the community. 10% of the $WSB supply is reserved as a treasury for the r/wallstreetbets sub to do with as they please.”

However, just days later, one of the token’s team members started to dump massive amounts of tokens. On May 4, on-chain detective ZachXBT tweeted that “zjz.eth,” who runs the moderation bots for the subreddit, has allegedly pulled the rug on WSB investors. On-chain data shows that zjz.eth has sold WSB coins in exchange for 334 Ether (ETH), worth around $635,000 at the time of writing.

Related: KuCoin confirms an exchange user is behind alleged daily rug pulls

The token price dropped massively after the dump, going from an all-time high of $0.00067279 to an all-time low of $0.00004827 in two days. Community members warned people to refrain from buying the dip as the moderators still have access to 10% of the total supply.

DO NOT BUY THE $WSB DIP@zjzWSB is hard rugging, there will be no bounce. He has 10% of the supply and every single buy is his exit liquidity.

— Eric Cryptoman (@EricCryptoman) May 4, 2023

This is not a drill.https://t.co/H1c7NidXHI pic.twitter.com/bOKFFi97jU

Meanwhile, another moderator who goes by WSBmod has threatened to report those who were involved in the dump to the police and the FBI if they don’t reach out. The moderator urged zjz.eth to return the money.

Cointelegraph tried to reach out to zjz.eth but did not get an immediate response.

Magazine: US enforcement agencies are turning up the heat on crypto-related crime