The Biden administration is reportedly expected to take sweeping action on the digital asset space in the weeks ahead. According to a new Bloomberg report, a number of unnamed insiders reveal that senior administration officials plan to unveil an executive order that will provide details on the regulatory, economic and national security risks posed by […]

The post Biden Administration Preparing To Release Government-Wide Strategy for Dealing With Digital Assets: Report appeared first on The Daily Hodl.

With the addition of Caroline Pham’s and Summer Mersinger’s names sent to the Senate for confirmation, the U.S. president has the opportunity to completely reshape the CFTC leadership.

The White House has officially submitted President Joe Biden’s nominations to fill two seats at the Commodity Futures Trading Commission with the upcoming departure of another commissioner.

In a Friday announcement, the White House said it had sent Citi managing director Caroline Pham’s and Summer Mersinger’s names to the Senate for confirmation. Mersinger previously served as chief of staff to commissioner Dawn Stump — who is expected to leave the agency this year — as well as the director of the Office of Legislative and Intergovernmental Affairs. She and Pham will be taking the places of recently departed Commissioner Dan Berkovitz, whose term expires in April 2023, and that of Stump, with a term ending in April 2027, respectively.

The CFTC nominations came the same week the White House officially announced it had sent the nominations of Jerome Powell and Lael Brainard to the Senate to await confirmation before serving as the next chair and vice-chair of the Federal Reserve, respectively. Confirmation from the Senate would allow Powell and Brainard to act as two of the top leaders of the Fed until 2026. President Biden also submitted Christy Goldsmith Romero’s and Kristin Johnson’s names for the remainder of the empty CFTC seats on Tuesday.

With the nominations for four CFTC commissioners — subject to confirmation from U.S. lawmakers — there will no longer be any vacancies at the agency in 2022 after a shakeup in leadership. Berkovitz announced in September that he was planning to leave the CFTC on Oct. 15 to join the Securities and Exchange Commission as general counsel, and the Senate confirmed the nomination of Rostin Behnam to chair the CFTC in December.

At the moment, the Democratic party under the leadership of President Joe Biden controls 50 of the 100 seats in the Senate, with Vice President Kamala Harris able to act as a tiebreaker if needed. A simple majority vote is needed to confirm the president’s CFTC picks.

While the White House has put forth four names for CFTC commissioners, it has yet to officially name candidates to fill upcoming vacancies at the Federal Reserve. Board member Randal Quarles resigned his position effective as of the end of December 2021, while current vice-chair Richard Clarida is expected to leave by February 2022. A Wednesday report from the Washington Post suggested the U.S. president is considering Duke University law professor Sarah Bloom Raskin to join the group of seven governors serving at the Fed, in addition to economists Lisa Cook and Philip Jefferson.

Related: It's now or never — The US has to prepare itself for digital currency

There may also be an opportunity for Biden to shake up the leadership at another government agency responsible for digital asset regulation in the United States, the Securities and Exchange Commission. SEC commissioner Elad Roisman is expected to leave the agency by the end of January and commissioner Allison Lee’s term is set to expire in June. Some experts have noted that placing different financial experts across these three major U.S. government agencies could have an impact on crypto-related policy.

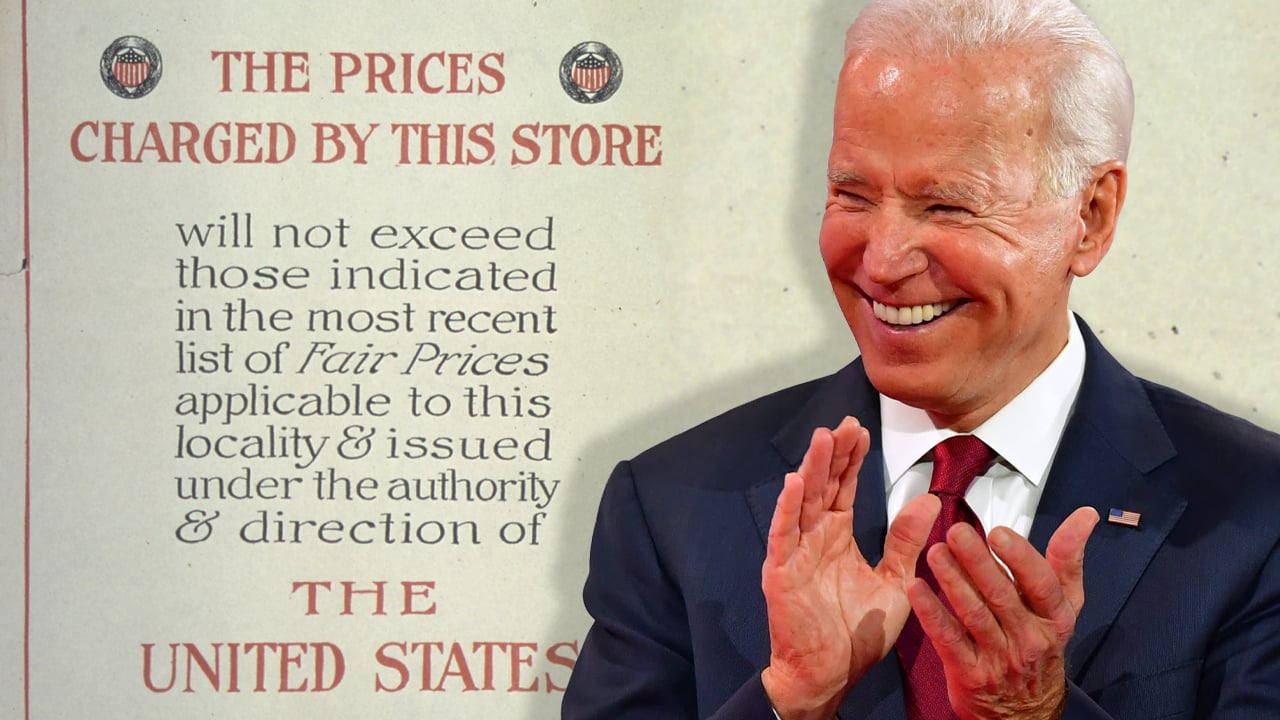

U.S. inflation is red hot and a number of analysts and economists are predicting America will face further economic issues as politicians and the Biden administration blame corporations. This perspective on rising inflation has led finance authors like Isabella Weber to believe that price controls could ease America’s economic burdens. Biden Administration Blames Inflation on […]

U.S. inflation is red hot and a number of analysts and economists are predicting America will face further economic issues as politicians and the Biden administration blame corporations. This perspective on rising inflation has led finance authors like Isabella Weber to believe that price controls could ease America’s economic burdens. Biden Administration Blames Inflation on […]

Under the pretext of holding corrupt actors accountable, the new taskforce will address crimes related to the criminal misuse of cryptocurrency.

The White House, under the Biden-Harris administration, introduced a five-pillar strategy to counter corruption as a part of the core United States national security interest. The strategy involves establishing a new task force to address potential illicit activities on crypto exchanges and other services that can serve as avenues for money laundering.

With the motive to enhance enforcement of Anti-Money Laundering (AML) regulations, as well as criminal and civil laws, the Federal government plans to implement new tools for investigating and prosecuting money laundering offenses. Specifically for cryptocurrencies, “PILLAR THREE: Holding Corrupt Actors Accountable” highlights:

“DOJ [Deparment of Justice] will utilize a newly established task force, the National Cryptocurrency Enforcement Team, to focus specifically on complex investigations and prosecutions of criminal misuses of cryptocurrency.”

The White House mentioned that the National Cryptocurrency Enforcement Team would be particularly responsible for overseeing “crimes committed by virtual currency exchanges, mixing and tumbling services, and money laundering infrastructure actors.”

The DOJ has also expanded subpoena power for certain financial records maintained abroad while imposing new disclosure requirements for beneficial ownership information. The department also plans to incentivize whistleblowers for sharing information that leads to the identification and seizure of illicit proceeds.

Related: House committee announces crypto CEOs will testify at Dec. 8 hearing on digital assets

Running parallel to the White House’s latest initiative, Representative Maxine Waters, the Chair of the House Committee on Financial Services, has invited CEOs of eight major crypto companies to discuss digital assets and the future of finance, to be held on Dec. 8.

As Cointelegraph reported, the CEOs of Circle, FTX, Bitfury, Paxos, Stellar Development Foundation, Coinbase and Coinbase Global CFO will be attending the committee hearing.

Looking forward to hearing next week with @RepMaxineWaters, ranking member @PatrickMcHenry, and the full committee (@FSCDems) to discuss Crypto and national economic competitiveness for the United States. https://t.co/rVHAvaPMUd

— Jeremy Allaire (@jerallaire) December 1, 2021

Such a move would require broad consensus among Congress, the U.S. central bank and the White House.

U.S. Treasury Secretary Janet Yellen has given her opinions on the potential of a digital dollar but is hesitant to come to any conclusions at this stage in proceedings. Yellen said on Thursday that she had not formed a view on whether the Federal Reserve should create a digital version of the dollar, but such a move would require broad consensus among Congress, the U.S. central bank and the White House.

This follows the recent reports that the Federal Reserve is currently researching whether an electronic version of the greenback would be beneficial or not. Yellen said that she sees both pros and cons to the digital dollar. Although she does have thoughts on its implementation, she feels more research needs to be done before coming up with any definite answers.

According to Yellen, the advantages of a central bank digital currency need further study, including its effects on banking institutions.

In contrast, Federal Reserve Governor Lael Brainard, whom President Biden has chosen for vice-chair of the US central bank, has called for urgency in establishing a digital dollar. She suggested that she can't fathom not having one when China and other nations are developing their own central bank digital currencies, which she considers a race to the top.

Related: It's now or never — The US has to prepare itself for digital currency

According to the Fed secretary, a consensus is required before moving forward. Yellen said that the Federal Reserve was working on a study on the issue and that it would be available soon, and they are cognizant that broad agreement among authorities would need to take place before they could move forward.

"This is a decision that's important and needs to command consensus. There are some benefits, but there are also meaningful costs."

As Cointelegraph reported in September, Fed Chair Jerome Powell stated that there was no need for the central bank to hurry their digital currency development plans. Despite several central banks creating their own CBDCs, Powell said the Fed was not rushing to embrace the movement.

The infrastructure bill was first proposed by the Biden administration aimed at primarily improving the national transport network and internet coverage.

The United States House of Representatives passed the $1.2 trillion bipartisan infrastructure bill, which if signed into law by President Joe Biden, would enforce new provisions in relation to crypto-tax reporting for all citizens.

The infrastructure bill was first proposed by the Biden administration aimed at primarily improving the national transport network and internet coverage. However, the bill mandated stringent reporting requirements for the crypto community, requiring all digital asset transactions worth more than $10,000 to be reported to the IRS.

As Cointelegraph reported, the bill was first approved by the Senate on Aug. 10 with a 69-30 vote, which was met with a proposal to compromise amendment by a group of six senators — Pat Toomey, Cynthia Lummis, Rob Portman, Mark Warner, Kyrsten Sinema and Ron Wyden. According to Toomey:

“This legislation imposes a badly flawed, and in some cases unworkable, cryptocurrency tax reporting mandate that threatens future technological innovation.”

Despite the lack of clarity in the bill’s verbatim, the infrastructure bill intends to treat the crypto community’s software developers, transaction validators and node operators similar to the brokers of the traditional institutions.

The House of Representatives passed the controversial infrastructure bill to President Biden after securing a win of 228-206 votes. In addition, the crypto community showed concerns over the vague description of the word ‘broker’ that may consequently impose unrealistic tax reporting requirements for sub-communities such as the miners.

this bill is unconstitutional and inherently anti-American

— Meltem Demir◎rs (@Melt_Dem) November 4, 2021

private citizens have the right to financial privacy and financial freedom

absolutely shameful to see this https://t.co/O9FkVC2CF4

As a repercussion, the inability to disclose crypto-related earnings will be treated as a tax violation and felony.

Related: 8-word crypto amendment in Infrastructure Bill an ‘affront to the rule of law’

Legal experts recommended amendments to the infrastructure bill that considers failure to report digital asset transactions as a criminal offense.

Abraham Sutherland, a lecturer from University of Virginia School, cited concerns over the US government's decision to blanket term crypto sub-communities as brokers:

“It’s bad for all users of digital assets, but it’s especially bad for decentralized finance. The statute would not ban DeFi outright. Instead, it imposes reporting requirements that, given the way DeFi works, would make it impossible to comply.”

One of the largest darknet markets (DNM), White House, announced the market is retiring as the DNM’s administrators say the team has reached its goal. After revealing the retirement plan, White House admins explained that user registration and orders have been disabled. Darknet Market White House Plans to Close Its Doors Soon, User Registration and […]

One of the largest darknet markets (DNM), White House, announced the market is retiring as the DNM’s administrators say the team has reached its goal. After revealing the retirement plan, White House admins explained that user registration and orders have been disabled. Darknet Market White House Plans to Close Its Doors Soon, User Registration and […]

The White House is weighing in on a last-minute dash to modify a set of cryptocurrency tax provisions in the bipartisan infrastructure bill. The provisions are designed to help pay for the repair of roads and bridges, among other projects, by clamping down on potential tax evasion through the use of cryptocurrencies. The original, unmodified […]

The post Biden Administration Weighs In on Competing Crypto Amendments As Final Vote Approaches appeared first on The Daily Hodl.