A message from Coinbase CEO and Cofounder, Brian Armstrong

By Brian Armstrong, CEO and Cofounder

Earlier today, I shared the following note with all Coinbase employees.

Team,

Today I am making the difficult decision to reduce the size of our team by about 18%, to ensure we stay healthy during this economic downturn. I want to walk you through why I am making this decision below, but first I want to start by taking accountability for how we got here. I am the CEO, and the buck stops with me.

What has changed?

Over the past month, I’ve had many conversations with our Exec team and our Board to discuss recent market events as well as the state of our business. Several realities have become clear to me in these discussions:

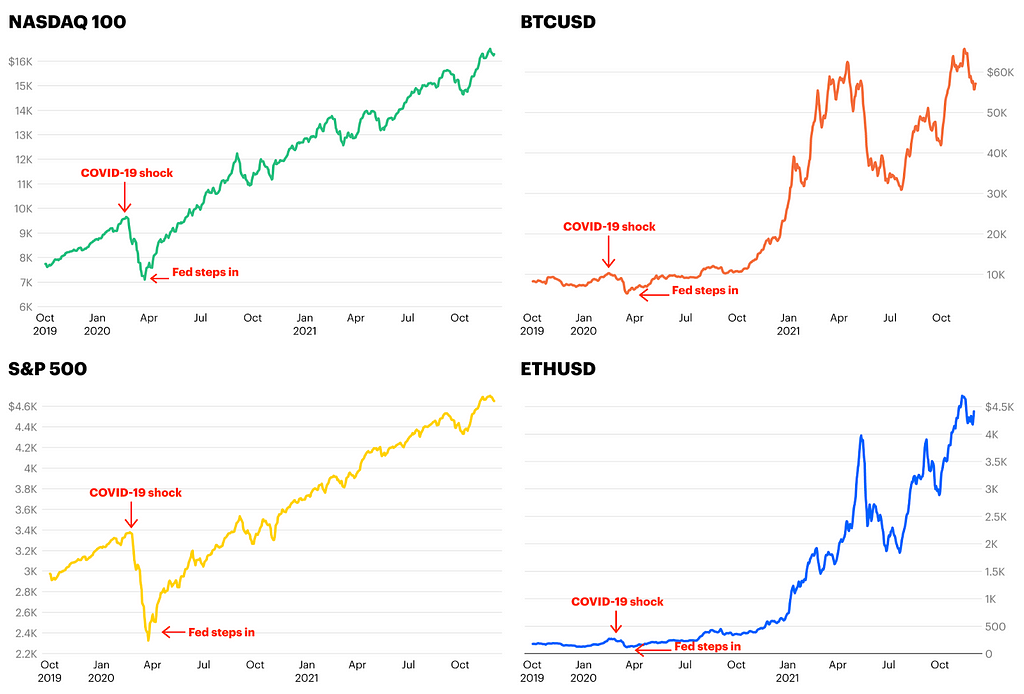

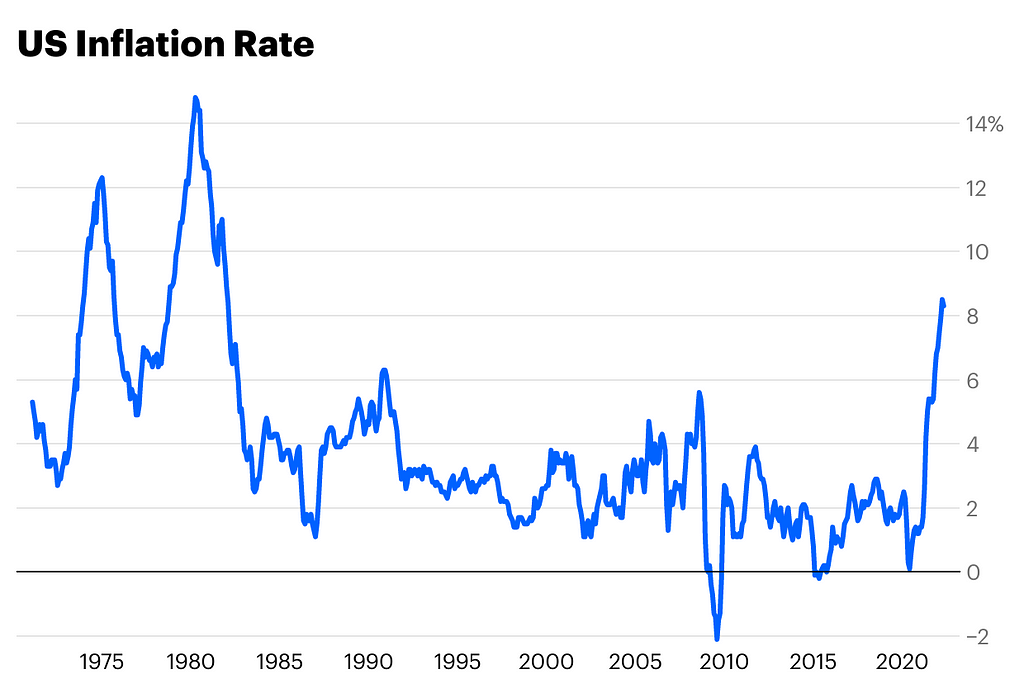

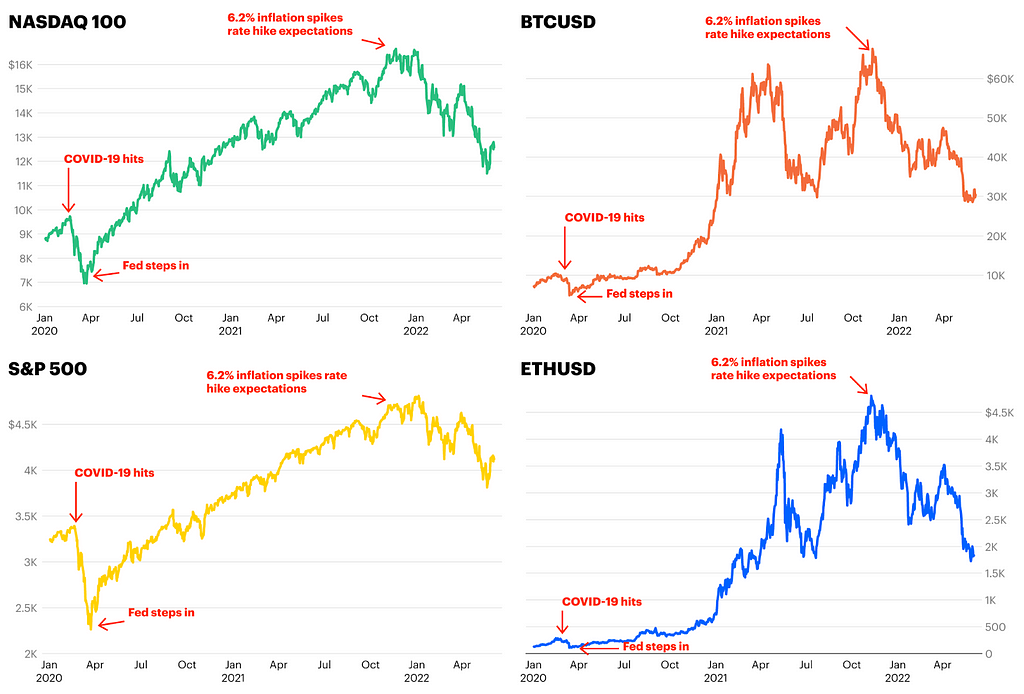

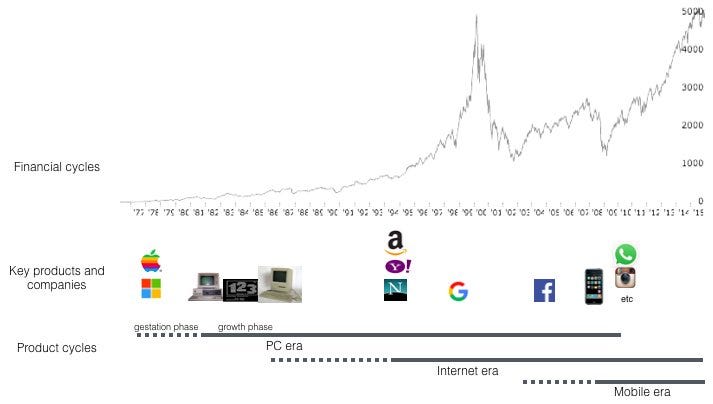

- Economic conditions are changing rapidly: We appear to be entering a recession after a 10+ year economic boom. A recession could lead to another crypto winter, and could last for an extended period. In past crypto winters, trading revenue (our largest revenue source) has declined significantly. While it’s hard to predict the economy or the markets, we always plan for the worst so we can operate the business through any environment.

- Managing our costs is critical in down markets: Coinbase has survived through four major crypto winters, and we’ve created long term success by carefully managing our spending through every down period. Down markets are challenging to navigate and require a different mindset.

- We grew too quickly: At the beginning of 2021, we had 1,250 employees. At the time, we were in the early innings of the bull run and adoption of crypto products was exploding. There were new use cases enabled by crypto getting traction practically every week. We saw the opportunities but we needed to massively scale our team to be positioned to compete in a broad array of bets. It’s challenging to grow at just the right pace given the scale of our growth (~200% y/y since the beginning of 2021). While we tried our best to get this just right, in this case it is now clear to me that we over-hired.

What decision was reached?

- The need to manage expenses: As we operate in this highly uncertain period in the world, we want to ensure we can successfully navigate a prolonged downturn. Our team has grown very quickly (>4x in the past 18 months) and our employee costs are too high to effectively manage this uncertain market. The actions we are taking today will allow us to more confidently manage through this period even if it is severely prolonged.

- The need to increase efficiency: We have now exceeded the limit of how many new employees we can integrate while growing our productivity. For the past few months, adding new employees has made us less efficient, not more. We have seen ourselves slow down considerably due to coordination headwinds, and difficulty fully integrating new team members. We believe the targeted resourcing changes we are making today will allow our organization to become more efficient.

Both of these come back to my decision to significantly scale our team over the past two years, so this accountability rests fully with me.

Who is affected?

Our senior leaders have worked diligently to identify the appropriate changes for each of their teams based on our clarified priorities.

In the next hour every employee will receive an email from HR informing if you are affected or unaffected by this layoff. Every affected employee will receive an invitation to have a direct conversation with your HRBP and the senior leader of your organization.

If you are affected, you will receive this notification in your personal email, because we made the decision to cut access to Coinbase systems for affected employees. I realize that removal of access will feel sudden and unexpected, and this is not the experience I wanted for you. Given the number of employees who have access to sensitive customer information, it was unfortunately the only practical choice, to ensure not even a single person made a rash decision that harmed the business or themselves.

I also wanted to make sure that all affected employees are taken care of in this transition, and that we support them in finding a new role. Employees who are departing today will receive:

- Minimum of 14 weeks of severance plus an additional 2 weeks for every year of employment beyond 1 year

- 4 months of COBRA health insurance in the US, and 4 months of mental health support globally

- Access to Talent Hub, where members of Coinbase’s team will work to connect with you with open positions at other firms (including portfolio companies from Coinbase Ventures and other top crypto VC funds)

Coinbase employees are among the most talented in the world, and I am certain that the skills you all possess will continue to be sought after by companies around the world. I realize it may take longer in this environment to find new employment, and so my hope is that this financial and non-financial assistance helps make this unexpected transition for you as seamless as possible.

How do we move forward?

To our colleagues who are departing, I want to say thank you for giving everything to this company, and that I am sorry. I hope that as we grow again we get a chance to hire you back. We would not be where we are today without your hard work and dedication to our mission. I am incredibly grateful for everything you have done to contribute to our success.

To our team that is staying, I know this will be a difficult day for you all too. You will say goodbye to your colleagues that you’ve been in the trenches with. I also expect you will all feel some level of fear, uncertainty and doubt about the future. Know that we made these hard decisions to ensure our future is bright. We’ll share more on how we rally as a team in the next few days. Right now, let us thank all our colleagues who are departing for the important contribution they’ve made to our mission.

Brian

###

This blog post contains forward looking statements. These forward looking statements are only predictions and may differ materially from actual results due to a variety of factors. The risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed in our filings with the Securities and Exchange Commission. Any forward looking statements contained herein are based on assumptions that we believe to be reasonable as of the date of this blog post. We undertake no obligation to update these statements as a result of new information or future events.

A message from Coinbase CEO and Cofounder, Brian Armstrong was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.