Embracing Decentralization: Integrating and Building Protocols at Coinbase

By Jesse Pollak, Senior Director of Engineering at Coinbase

Tl;dr:

- Coinbase is committed to its vision of investing in web3 and the broader cryptoeconomy.

- We’re embodying this vision by integrating, building, and supporting protocols at Coinbase.

- Protocols are increasingly integrated into our products, a focus for teams across the company, and a major investment area for Coinbase Ventures.

- To support this work, we’re growing our Smart Contract Engineering team and building protocol expertise across every role.

Over the past year, Coinbase has begun laying the groundwork to transform into a web3 company. We’re doing this because we expect that large portions of the global economy will move “on-chain” in the coming years. This transition will occur as people globally demand greater access to financial services and ownership in the success of the businesses they support. Coinbase is positioned to play a key role in increasing economic freedom by doubling down on web3 innovation and supporting the development of protocols that put powerful financial tools in the hands of people around the world. Today, we’re sharing an update on how we’re integrating, building, and supporting these protocols.

Protocols offer a range of products and services that allow people anywhere in the world to transact directly with each other. For example, Compound makes it easier for individuals to lend or borrow crypto assets, giving them access to capital and higher yields with no intermediaries involved. Another example is USD Coin, the largest stablecoin on Ethereum with a market capitalization over $50B, that allows people to easily send and receive funds globally using a digital asset that is pegged to the US dollar. Protocols like these form the foundation of the cryptoeconomy that millions of people interact with daily.

In just over two years, the value locked in these protocols has gone from a few hundred million to over $200B. People all over the world want greater control over their financial futures and web3 protocols are making that a reality.

At Coinbase, we are embracing protocols across all our strategic pillars with four key initiatives:

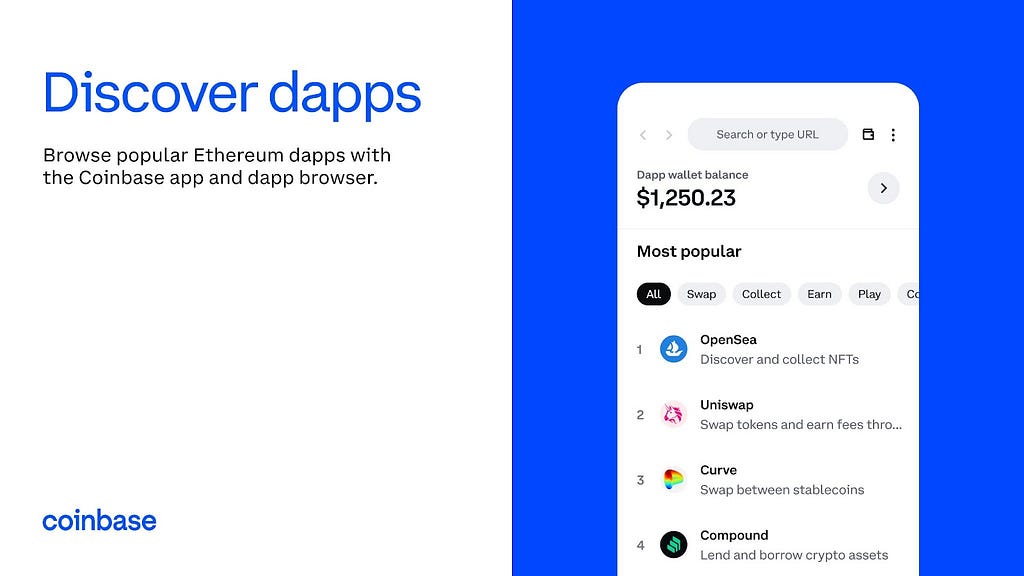

- Integrating protocols into our products. In Coinbase Wallet, and our recently launched dapp wallet, we are natively integrating trading and yield features supported by protocols as well as enabling open access to protocols through our browser. We recently launched Coinbase NFT, which is powered by the 0x protocol to enable low fee NFT swaps. Additionally, through our DeFi Yield product, we are integrating with protocols like Compound to offer users in eligible jurisdictions higher yields on their holdings. We are excited about how protocols can enable better user experiences and aim to keep integrating them deeply into our products.

- Building protocols and supporting innovation. We support protocols, regardless of how they will directly integrate into Coinbase. We support protocol innovation through our Project 10% program, which funds moonshot ideas including the recent Coinbase Ventures investment in Backed. We’re also supporting protocol work in the ecosystem through our developer grants program and open source contributions like Rosetta, which makes it easier to integrate protocols into Coinbase. Today, we also announced that Coinbase Cloud is supporting a group of experienced founders and operators who are building the first enterprise-grade liquid staking protocol.

- Funding protocols in the broader ecosystem. Coinbase Ventures has invested in protocols throughout its lifetime and is an early investor in some of the most exciting web3 protocols, including Compound, UMA, Saddle, Radicle, Synthetix, Notional, Goldfinch, and others. In the first quarter of 2022 alone, Coinbase Ventures closed 70+ deals (300+ to date). It invests across the web3 technology stack and is expanding cross-chain investments beyond Ethereum with the goal of promoting an open multi-chain future of finance.

- Investing in top talent and core technology. We’re building a best-in-class Smart Contract Engineering team to support our protocol work and integrating protocol thinking into our product management practice. Through developer tooling, hackathons, and company wide knowledge sharing and experimentation, we are building a community that sets the standard for web3 talent. In the year ahead, we are also excited to contribute open source developer tools and libraries to support building protocols at scale.

Last year we wrote about Coinbase embracing decentralization by adding more assets, expanding internationally, integrating with third-party platforms, and emphasizing self-custody. We closed by saying:

Many of the most innovative use cases in crypto are being created in decentralized apps. By fully embracing this trend we can put crypto in the hands of more people around the world and thereby increase their economic freedom.

We’ve been hard at work embracing this vision by investing in web3 protocols at Coinbase — and while we’ve made extensive progress, we’ve got a long way to go. We’re excited for the journey.

If these challenges excite you, join our team and help build an open financial system for the world.

Embracing Decentralization: Integrating and Building Protocols at Coinbase was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.