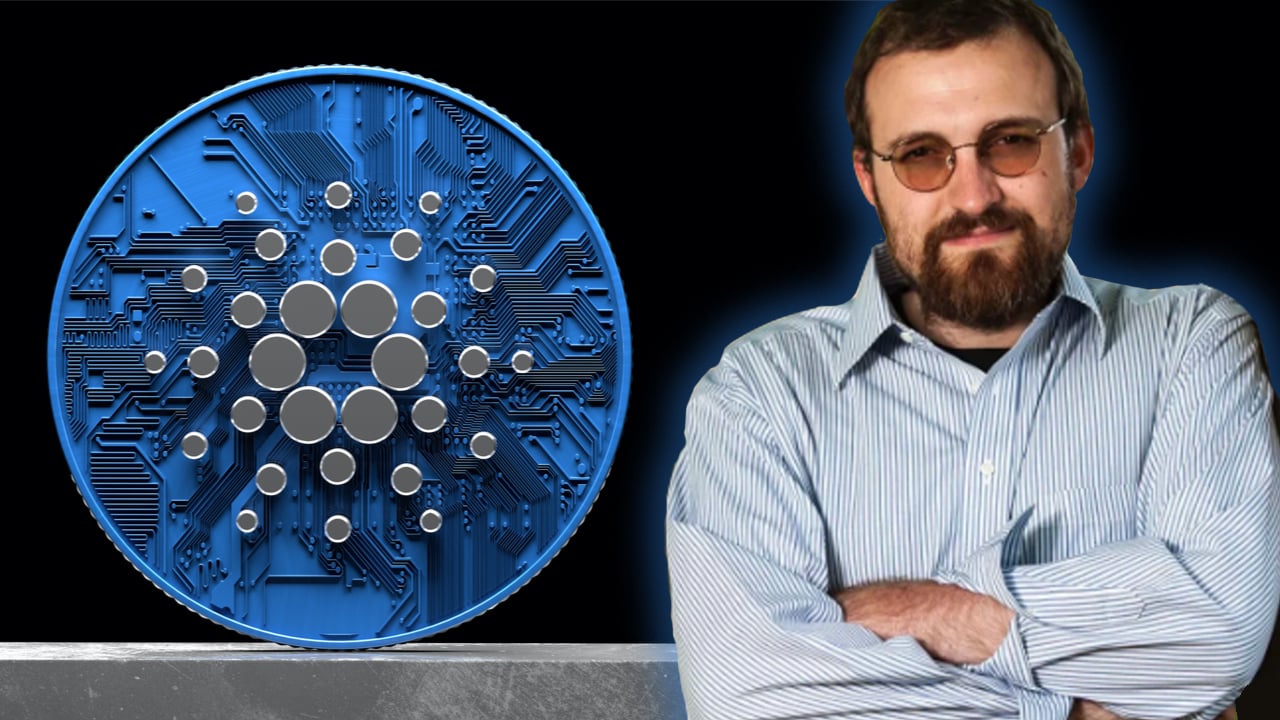

The digital currency cardano has jumped over 8% in value during the last 24 hours and 25% over the last seven days. The price move follows an update on Charles Hoskinson’s and IOHK’s plans for the Cardano network in 2022. Charles Hoskinson’s 2022 Cardano Outlook: ‘A Formal Open-Source Project Structure Is Going to Be Formed’ […]

The digital currency cardano has jumped over 8% in value during the last 24 hours and 25% over the last seven days. The price move follows an update on Charles Hoskinson’s and IOHK’s plans for the Cardano network in 2022. Charles Hoskinson’s 2022 Cardano Outlook: ‘A Formal Open-Source Project Structure Is Going to Be Formed’ […]

Fractals, bullish technical analysis patterns and the fact that 67% of the total supply is staked are key reasons why analysts expect ATOM to hit new highs shortly.

Cosmos (ATOM) has the potential to record major gains in the upcoming weeks primarily because its longer-timeframe chart is showing a bullish continuation pattern.

Dubbed "bull flag," the structure appears as the asset trends lower while bouncing between two downward sloping trendlines. However, it eventually breaks out of the range, in the direction of its previous trend, with a profit target at length equal to the size of its previous uptrend which is also known as the flagpole.

Therefore, in a "perfect" world, if ATOM is to break above the flag's upper trendline (with a rise in trading volume), it may rise by as much as the flagpole's height around $35. This sets a price target near $65 as when measured from the current potential breakout point.

The bullish setup in ATOM appeared as the token rose over 330% from its June low at $7.82 to this weeks swing high near near $32.

Circulating token scarcity could be playing a role in driving buyers into the market. Data fetched by Messari showed that nearly 64% of the current ATOM supply is staked.

According to data, Cosmos investors have staked over 180 million ATOM tokens to become validators on its 'Cosmos Hub,' a proof-of-stake blockchain that constitutes one of many hubs on the network. In return, users receive a portion of the network transaction fees and block rewards.

Pentoshi, an independent market analyst, noted that the rising number of staked ATOM tokens have been instrumental in pushing its price upward.

The pseudonymous Twitterati added that ATOM sellers have been losing momentum, citing two corrections during the fourth quarter that got stopped midway due to a higher buying pressure near the token's previous all-time high levels.

According to the analyst, ATOM is seeing clear:

"Signs of absorption"

Related: Price analysis 12/1: BTC, ETH, BNB, SOL, ADA, XRP, DOT, DOGE, AVAX, SHIB

Another analyst, known by the pseudonym 'Bluntz,' anticipated that ATOM would continue its rally upward based on similar gains posted by one of its top blockchain rivals, Avalanche (AVAX), earlier this year.

Like Pentoshi, Bluntz views ATOM's chance of revisiting its previous record-high as a base to continue its bull run. In a similar setup, AVAX rallied by nearly 250% after finding a solid footing inside the $50 to $60 support area.

According to Bluntz, ATOM could easily hit $100 in the medium-term.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

SOL price reached another record high on Nov. 7, bringing its YTD gains up by roughly 17,500%.

Solana (SOL) surpassed Cardano (ADA) and leading stablecoin Tether (USDT) to become the fourth-largest cryptocurrency by market capitalization.

At press time, the net worth of total SOL tokens in circulation was a little over $76 billion, falling only behind Binance Coin's (BNB) $109 billion, Ether's (ETH) $540 billion, and Bitcoin's (BTC) $1.17 trillion.

Meanwhile, Cardano and Tether's market cap came out to be $66.39 billion and $74.42 billion, respectively.

Solana's market capitalization surged as its native token, SOL, rose to yet another record high. On Nov. 7, the SOL price crossed above $262 for the first time in history, primarily owing to a market-wide price rally that saw other top cryptocurrencies ink similar gains.

Meanwhile, SOL received additional bullish cues from Solana's foray into Web3 gaming development via its venture capital arm. Dubbed Solana Ventures, the firm announced Friday that it, alongside FTX and Lightspeed Venture Partners, would invest $100 million into the game studios and technology sector.

In doing so, Solana Ventures aims to attract desktop and mobile video game developers to build their projects atop its public blockchain, thereby raising the prospect of higher SOL adoption. A similar adoption boom in 2021 helped send the SOL price up by almost 17,500% YTD — from $1.51 to $262.45.

The uptrend surfaced as speculators started treating Solana as one of the most serious challengers to Ethereum, the leading smart contracts platform grappling with higher gas fees and network congestion issues.

For instance, Solana claims that it could process 50,000-60,000 transactions per second (tps) for an average transaction fee of $0.00025. In comparison, Ethereum transacts 15-30 tps, with its median transaction cost ranging between $4 and $21.

Paul Veradittakit, a partner at Pantera Capital, told Bloomberg, called Solana "the top competition" to Ethereum, Cardano, and other smart contract platforms, regarding "developer adoption and momentum."

Related: Solana battles Cardano for the top-five spot as SOL market cap crosses $70B-mark

Nonetheless, Solana also exhibited signs of resource exhaustion, i.e., a lack of prioritization among SOL transactions and a lower number of validators that led to an eighteen-hour long network outage in September. If not fixed, it could raise the risks of reversed or altered transactions across the Solana network.

Despite its latest rally to an all-time high, SOL risks undergoing a correction due to at least two bearish indicators.

First, the SOL price has been forming a Rising Wedge, a technical pattern that typically results in lower prices. And second, the cryptocurrency has also been confirming a bearish divergence between its rising price and declining momentum (as confirmed by lower highs on its daily relative strength index).

A break below the Wedge's lower trendline, if accompanied by an increase in volume, would risk sending the SOL price lower by as much as the maximum height. That roughly puts SOL's downside target to levels between $205 and $91.52, depending on the level at which the bearish breakout begins.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Solana price rallied to a new record high while SOL entered the top-five cryptocurrencies by market cap for the first time.

Solana's (SOL) autumn rally continued on Nov. 3 with its price and market cap hitting a new record high.

SOL surged by 7% in the past 24 hours to $236, pushing its market capitalization to over $70 billion for the first time in history. As the token wobbled near its record high levels, it flipped Cardano (ADA) briefly to become the world's fifth-most valuable crypto asset.

Currently, SOL's market cap was around $69.37 billion, just $500 shy of ADA's $69.87 billion market valuation.

Solana battling for the top-five cryptocurrency spot came on the heels of SOL's renewed upside strength heading into the fourth and the final quarter of 2021. For instance, the Solana blockchain's native token grew by over 65% since Oct. 1. On the other hand, ADA's returns in the same period came out to be just 2.13%.

ADA underperformed primarily on "sell-the-news" sentiment. As Cointelegraph covered, the Cardano token started plunging right after it rolled out its much-awaited smart contracts functionality via a so-called Alonzo upgrade on Sept. 13.

In the days leading up to the hard fork, ADA's best year-to-date returns were around 1,630%. At press time, they came out to be around 1,050%. In comparison, SOL's YTD returns at the time of this writing were over 12,700%.

Independent market analyst Pentoshi credited the rising number of nonfungible token (NFT) projects on Solana as one of the main reasons behind its price boom, recalling a tweet from Aug. 16 that accurately predicted a bull run for the token.

$Sol has passed $Ada and taken the #3 spot

— Pentoshi Won’t Dm You. hates Dm’s. DM's are scams (@Pentosh1) November 2, 2021

Balance has been restored in the world

The Endless #solana summer https://t.co/DD18hgroEJ

Related: Solana secondary NFT sales reach half a billion dollars in three months

Messari's researcher Mayson Nystrom also noted a "formidable growth" of NFTs in the Solana ecosystem, noting that the blockchain processed $500 million worth of total NFT secondary sales volumes since April 2021. Excerpts:

"Whether or not Solana can manifest this initial energy into long-term NFT growth is yet to be determined, but current signs present valid reasons to be optimistic about Solana's burgeoning NFT ecosystem."

SOL's latest run-up to its record high also came as a breakout out of its Bullish Pennant structure, as shown in the chart below.

Bullish Pennants appear as the price consolidates inside a Triangle-like structure after logging a strong move higher, dubbed as Flagpole. Traders typically wait for the price to break above the Triangle's upper trendline before placing their profit target at a length equal to the Flagpole's height.

Solana's Flagpole height is rough, $175. As a result, its breakout move from the Triangle's resistance trendline (~$158) prompts SOL to grow by another $175, thereby setting its profit target above $275.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

SOL price continues to climb, with Solana’s TVL also hitting a new high of nearly $14 billion.

The price of Solana’s native SOL coin edged up on Oct. 25 in the wake of a marketwide rally led by Bitcoin (BTC), with the total value locked (TVL) on Solana hitting record highs and SOL’s price seeing a promising technical setup.

SOL climbed by more than 6% to hit an intraday high of around $214. The price of SOL is now up a little over 35% over the past week, pushing it closer to its record high of about $222 set in early September.

Bitcoin’s run-up to its new record high of $67,000 last week resulted in the total crypto market capitalization passing the $2.5-trillion mark, a new milestone for the cryptocurrency.

That helped push SOL higher, with rival cryptocurrencies Ether (ETH) and Cardano’s ADA also jumping by over 10% and 1% in the past week, respectively.

The SOL price rally also appeared as the TVL of all the decentralized finance (DeFi) projects built on the Solana blockchain reached a new record high of $13.53 billion, as per data aggregator service DeFi Llama.

The most dominant DeFi project on the Solana blockchain is Saber, an automated market maker (AMM) protocol that enables Solana users and applications to trade between stable pairs of assets efficiently and earn yields by providing liquidity to the platform.

Its contribution to the Solana liquidity pool was $2.05 billion at press time.

Meanwhile, there are four other DeFi projects with a TVL of more than $1 billion. These include Raydium ($1.91 billion), Sunny ($1.73 billion), Serum ($1.69 billion), and Marinade Finance ($1.63 billion).

Solana also declared that it would add more DeFi projects to its list after the completion of its “Ignition” hackathon on Oct. 18. Users would need to hold SOL tokens to use these applications, to pay for transaction fees, thus raising the prospect of the token’s higher demand in the future.

SOL’s latest price rally came as part of a breakout move out of what appears like a Bullish Pennant. As Cointelegraph reported earlier, the technical outlook aims to send SOL to levels equal to the maximum distance between the Pennant’s upper and lower trendline around $85.

As a result, adding $85 to the breakout level around $158, the SOL price’s Pennant target is $243, i.e., almost $250. Meanwhile, a retest of the pennant’s upper trendline as support would risk invalidating the bullish setup.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

ADA price has been struggling against the U.S. dollar in October.

Cardano (ADA) has formed a deadly "death cross" on its daily chart against Bitcoin (BTC) — a market signal that's generally seen as a warning of more downside in the near term.

The ominously-titled indicator kicks in when an asset's short-term moving average closes below its long-term moving average. In doing so, it calls for technically-minded traders to increase their bearish positions in the market.

On Tuesday, ADA's 50-day exponential moving average (50-day EMA; the velvet wave) dropped below its 100-day exponential moving average (100-day EMA; the blue wave). That marked the sixth 50–100 EMA bearish crossover ever on the ADA/BTC daily chart, raising fears of further declines ahead.

That is partly due to ADA's earlier price reactions to death crosses. For instance, in September 2020, the Cardano token's price dropped almost 38.50% against Bitcoin after painting a 50–100 EMA bearish crossover.

Similarly, a death cross pattern on May 12, 2019, subsequently saw a 62.50% price decline.

Nonetheless, the likelihood of an immediate selloff remains relatively low. That is mainly because ADA's daily relative strength index (RSI), which alerted the token's status against Bitcoin as oversold, is below 30. Traders typically treat an excessively sold RSI as their cue to enter the market.

For instance, in May 2019, the death cross's formation coincided with the RSI treading below 30. Later, the price bounced by over 30% to retest the 50-day and 100-day EMA waves as resistance, underscoring traders' intention to buy oversold cryptos.

Applying the same fractal to the current price action, one can expect the ADA/BTC rates to bounce back, especially as it drops to its two-month-low at 0.00003372 BTC runs down to retest a five-month-old support area defined by 0.00003192–0.00003075 BTC (the red bar in the first chart above).

A weakening ADA/BTC rate merely reflects Cardano's clumsy performance against the U.S. dollar in recent sessions versus Bitcoin, which has surged massively against the greenback in the same timeframe.

For instance, Bitcoin's month-to-date gains against the dollar sit around 43%. In comparison, Cardano's price has slid by over 6% during the same period.

But further weakness could be expected, according to an inverse Cup and Handle pattern taking shape on its dollar-quoted charts.

In detail, inverse Cup and Handle patterns appear when the price forms a large crescent shape followed by a modest upward retracement.

Analysts consider them as bearish reversal indicators, for they tend to send the price down by as much as the maximum distance between the Cup's top and its right-hand's bottom level if the price breaks below the pattern's support.

Related: Buy the rumor... buy the news? BTC price passes $63K as US Bitcoin ETF launches

ADA's recent price action fits the inverse Cup and Handle description, with the price now looking to break below the structure's resistance line near $1.97. As a result, the downside target price is the $0.772–$0.820 area if Cardano confirms a bearish breakout.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Following the successful Alonzo hard fork, the Cardano network now has a large swathe of new smart contracts. However, developers must wait to use them as they are locked in a timelock contract. At the time of writing, metrics show an aggregate total of 2,352 smart contracts since the Alonzo upgrade was implemented. Cardano Has […]

Following the successful Alonzo hard fork, the Cardano network now has a large swathe of new smart contracts. However, developers must wait to use them as they are locked in a timelock contract. At the time of writing, metrics show an aggregate total of 2,352 smart contracts since the Alonzo upgrade was implemented. Cardano Has […]

The so-called "Alonzo" upgrade did little in protecting Cardano from falling in tandem with the rest of the cryptocurrency market, though bullish technical factors remain.

The price of Cardano (ADA) fell on Sept. 13 in line with the other top cryptocurrencies despite the completion of its hard fork upgrade dubbed "Alonzo," which introduces smart contract functionality.

The ADA/USD exchange rate dropped 10.67% to reach its intraday low of $2.3, partly due to profit-taking sentiment among traders following the pair's 1,200%-plus price rally this year. Additionally, the intraday sell-off also surfaced in the period of an overall crypto market decline, with top tokens Bitcoin (BTC) and Ether (ETH) falling 4% and 6.97%, respectively.

Cardano's drop appeared when its core foundation rolled out a long-awaited smart contracts feature on its public blockchain for the first time. The launch expects to tap the booming decentralized finance (DeFi) and nonfungible token (NFT) sector as they grapple with slower and costlier transaction fees on the leading smart contracts platform, Ethereum.

As a result, anticipations for an extended upside boom in the ADA markets were high, with the Value Trend, a financial analyst at Seeking Alpha, expecting the Cardano native token to hit $10 should it flip Ethereum to become the leading smart contracts platform.

Overall, the belief helped ADA/USD deliver strong profits in the days approaching the Alonzo upgrade. On July 20, the pair was trading for as low as $1. Later, on Sept. 2, its value has risen to a record high of $3.16, a 200% rebound.

Bullish assets tend to consolidate sideways or lower following a strong move upside, majorly as some traders decide to secure their profits. At the same time, investors with a long-term bullish outlook buy the asset from weak hands to build long-term investment strategies.

The Cardano chart below hints at undergoing a similar consolidation phase after delivering a strong 200%-plus bull run. As a result, the probability of the ADA/USD exchange rate continuing its uptrend remains high.

The rectangle pattern appears like a Bull Flag. And, as a general rule, the profit target for bulls in a Bull Flag scenario is the same as the length of the previous uptrend.

A break above the upper Bull Flag trendline (at $2.93) could put ADA/USD en route toward $4.5.

Additionally, the Cardano token would need to maintain its foothold above its 50-day exponential moving average (50-day EMA; the velvet wave) near $2.27 to keep its interim bullish bias intact. A drop below the Bull Flag support and 50-day EMA floor would risk sending ADA to $1.92, its support line from mid-August.

Related: Institutional exposure to altcoin products retests all-time high

Analysts shared deeper price targets, with a pseudonymous Twitterati spotting a "Double Bottom" scenario, adding that traders are selling the news.

#Cardano smart contract upgrade so far going as I have predicted: Sell the news.

— Rautakansleri (@rautakansleri_) September 13, 2021

The price also formed a double top and now forming a lower low. If $2.25 is breached then down we go even more.

$1.20 soon? pic.twitter.com/riFirqmCgz

Cerbul, another market analyst, said ADA's ongoing plunge was not due to the "sell the news" sentiment, adding that more capital would flow into the Cardano ecosystem from the DeFi sector.

"Accumulate," he said.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The total number of Cardano wallets with a balance of at least $1 million has surged, from 3,625 on July 20 to 9,830 on Aug. 24.

Cardano (ADA) addresses with a balance greater than $1 million have surged 173% during the latest ADA price rally.

Specifically, the ADA/USD exchange rate gained almost 200% after bottoming out at $1.007 on July 20. The pair reached its record high of $3.02 in the previous session, a move that was followed by a 6.42% price correction to $2.73 at the time of writing.

Meanwhile, the same period saw the total number of Cardano wallets that hold at least $1 million worth of ADA tokens surge from 3,625 to 9,830, per information provided by data analytics platforms CoinMetrics and Messari.

Additionally, against ADA's 1,455% year-to-date (YTD) gains, the total number of Cardano millionaires surged from 504 to 9,830 — a 1,850% jump. That coincided with erratic spikes in Google Trends searches for the keyword "Cardano," signaling retail interest.

Furthermore, the number of Cardano wallets holding more than $10 million worth of ADA tokens climbed from 504 on July 20 to almost 1,000. On Jan. 1, there were only 86 wallets with balances above $10 million.

ADA's rise in 2021 also led to a spike in the sum of its unspent transaction outputs, or UTXOs.

UTXOs represent cryptocurrencies that have remained unspent in their crypto wallets after deposit. Therefore, if a blockchain network sees a rise in UTXOs, it indicates that most wallets are holding the cryptocurrency instead of transferring it to other addresses — i.e., a weaker selling sentiment.

CoinMetrics data fetched by Messari shows that Cardano's UTXO count surged from 816,600 on Jan. 1 to 2.85 million at the time of writing. That illustrates an incredible rise in Cardano investors' "hodling" sentiment, something that might have worked as a backstop to ADA's 1,455% YTD rally.

The decision to hold instead of selling ADA tokens found its cues in Cardano's potential to unseat its top blockchain rival, Ethereum, as the latter experienced problems with network congestion and higher transaction fees at the beginning of this year.

For instance, ADA/USD surged 579% in the first quarter on optimism around its "Mary" upgrade, a protocol update that made Cardano a multi-asset blockchain. In doing so, the blockchain became compatible with host projects involved in the emerging decentralized finance (DeFi) and nonfungible tokens (NFTs) space.

The update, which went live on March 1, was followed up with another hard fork in July, called "Shelley." The new mainnet introduced Cardano’s proposed proof-of-stake layer, allowing users to contribute to the transaction validation process either directly (by operating a stake pool) or indirectly (via delegation) in exchange for staking rewards.

But despite solid fundamentals, ADA/USD surged a mere 19.21% during the second quarter, partly due to China's crackdown on its regional cryptocurrency industry and Tesla CEO Elon Musk's anti-Bitcoin (BTC) tweets.

Related: Cardano chalks a bearish wedge as ADA price soars by over 100% in Q3

Nonetheless, the Cardano UTXO count kept surging during the second quarter's turbulence in the crypto market. It topped out at 2.93 million on July 26, when ADA was changing hands for $1.25.

The third quarter has witnessed Cardano finalizing its plans to become a smart contract platform similar to Ethereum via its so-called "Alonzo" upgrade. As a result, speculative bids for ADA, alongside investors' hodling sentiment, have surged.

Ethereum TVL 114 billion, daily NFT over 100 million, daily transactions 1.2 million, 166 million addresses total. Plus first mover advantage and near universal acceptance of ETH and ETH standard tokens on exchanges and in defi.

— Lark Davis (@TheCryptoLark) August 24, 2021

Cardano has a lot of work to do post launch!

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, and you should conduct your own research when making a decision.

The ADA/USD exchange rate has moved further into its "overbought" area, suggesting that a trend correction might follow suit.

Cardano blockchain's native asset ADA reached a new record high on Aug. 23 as investors pinned hopes on an upcoming smart contracts feature that expects to boost the cryptocurrency's adoption.

The ADA/USD exchange rate topped out at $2.899 around 09:00 UTC, raising anticipations that it would easily close above $3 in the coming sessions.

Many analysts, including pseudonymous chartist PostXBT, noted that the Cardano token had entered a "price discovery mode." Meanwhile, David Gokhshtein hinted that ADA/USD might continue its bull run until Sep. 12, the day Cardano would integrate smart contracts feature to its blockchain via a so-called "Alonzo" upgrade.

$ADA is just a monster right now.

— David Gokhshtein (@davidgokhshtein) August 23, 2021

I’m trying to figure out it’s price before 9/12/2021.

In detail, Alonzo upgrade introduces a native smart contract development language called Plutus to the Cardano ecosystem. Plutus is already available for testing and brings functional programming to smart contract creation to everyday users.

As a result, ADA bulls anticipate the token's adoption to boom in the sessions ahead as Cardano attracts dapp developers—operating in the emerging decentralized finance (DeFi) and non-fungible tokens (NFT) sector—to its smart contracts ecosystem.

But Cardano's technical indicators predict a short-term shock, something that might have the ADA/USD corrected lower by as much as 40% despite maintaining its long-term bullish outlook.

The Cardano token's daily relative strength index (RSI) has ventured deeper into its overbought territory, at around 83. Traders consider an RSI reading above 70 as overvalued. As a result, it prompts them to sell the asset to secure maximum profits.

For instance, a run-up in ADA/USD rates in the first quarter of 2021 pushed its RSI reading above 90. Later, the pair started consolidating sideways while maintaining support near its 50-day exponential moving average (50-day EMA; the scarlet wave).

Related: Cardano defies Peter Brandt’s 90% crash warning, ADA price doubles to new high

ADA price now sits atop 114% month-to-date and 1,511% year-to-date profits. At the same time, an oversold RSI pictures an interim profit-taking scenario. So if the Q1/2021 fractal repeats, ADA's next line of support comes to be near its 50-day EMA at $1.73, almost 40% below the current prices of $2.83.

$ADA Alonzo fork is in less than 3 weeks. Allegedly 100+ launches coming

— Pentoshi Wont DM You (@Pentosh1) August 19, 2021

And a major Summit

My first targets are going to be above $3 for TP1

I don’t know how high this goes in price discovery so will just play it as we go. Exciting weeks ahead https://t.co/47tnpZS3Rw pic.twitter.com/0ZRUZrMcpy

But a correction does not necessarily exhaust Cardano's long-term bullish outlook. Given the potential success of its Alonzo upgrade, the project could end up attracting more speculative upside bids for its ADA token. As a result, the ADA/USD exchange rate expects to remain in a price discovery mode.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.