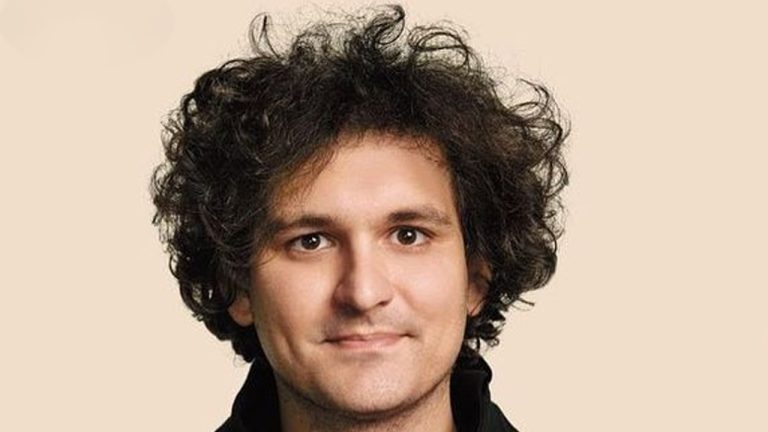

Sam Bankman-Fried’s legal team is seeking permission to cross-examine Gary Wang over FTX lawyers' involvement in Alameda loan approvals.

Sam Bankman-Fried’s legal team is looking for permission to probe the alleged involvement of FTX lawyers in the issuance of $200 million worth of loans from Alameda that were approved by Gary Wang.

As previously reported in the build-up to the highly anticipated trial, an Oct. 1 court ruling provisionally barred Bankman-Fried from apportioning blame to FTX lawyers who were allegedly involved in structuring and approving loans between Alameda and FTX.

United States Judge Lewis Kaplan granted the government’s motion and ruled that Bankman-Fried's legal team would have to request permission to make any mention of FTX lawyers' involvement throughout the trial.

Related: SBF’s Alameda minted $38B USDT to profit off arbitrage trading: Coinbase director

Following the initial cross-examination of former FTX co-founder Gary Wang by the prosecution on Oct. 9, the defense is now seeking permission to question Wang over the alleged involvement of FTX counsel in structuring loans issued to FTX by Alameda.

A letter filed on Oct. 9 highlighted the government’s questioning of Wang over a series of personal loans worth up to $300 million from Alameda that FTX used to fund venture investments. Wang had also used some of the funds to purchase a home in the Bahamas.

During the prosecution's line of inquiry, Wang said that either Bankman-Fried or FTX lawyers had presented him with loans which he was then directed to sign.

Bankman-Fried’s attorneys argue that the prosecution has already established that FTX lawyers were present and involved in structuring and executing the loans and intend to carry out their own line of questioning over the scope of FTX counsel involvement.

The defense adds that it could potentially introduce promissory notes that memorialized the loans to Wang, who has previously indicated to the prosecution in proffer meetings that he did not suspect FTX lawyers would coerce him to sign illegal agreements:

“Mr. Wang's understanding that these were actual loans - structured by lawyers and memorialized in formal promissory notes that imposed real interest payment obligations - is relevant to rebut the inference that these were simply sham loans directed by Mr. Bankman-Fried to conceal the source of the funds.”

Cointelegraph journalist Ana Paula Pereira is on the ground in New York covering the trial of Bankman-Fried. Her latest report from the Federal District Court in Manhattan highlights the defense's efforts to paint Bankman-Fried as a young entrepreneur who tripped up amid the rapid growth of FTX and Alameda.

Magazine: Can you trust crypto exchanges after the collapse of FTX?