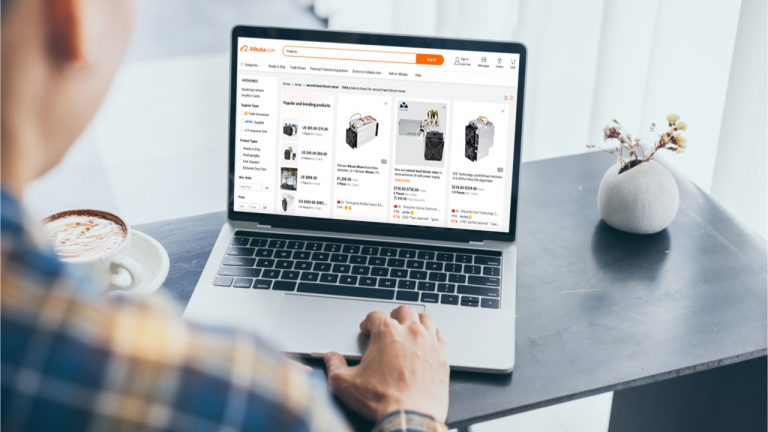

Alibaba, the Chinese e-commerce giant, has announced it will no longer allow the sale of cryptocurrency mining gear on its platform. The sales behemoth made this announcement yesterday via its official website. The move is a direct consequence of the latest ban the Chinese government has applied to cryptocurrency trading and mining. Other institutions and […]

Alibaba, the Chinese e-commerce giant, has announced it will no longer allow the sale of cryptocurrency mining gear on its platform. The sales behemoth made this announcement yesterday via its official website. The move is a direct consequence of the latest ban the Chinese government has applied to cryptocurrency trading and mining. Other institutions and […]

Any sellers that list crypto miners or relevant products on Alibaba’s platforms after Oct. 15 will face significant penalties.

Chinese e-commerce giant Alibaba is the next company to wrap its cryptocurrency-related services in response to the ongoing crypto crackdown in China.

Alibaba officially announced Monday that its platform will prohibit sales of cryptocurrency miners and suspend categories for blockchain miners and accessories from its website on Oct. 8.

In addition to stopping sales of crypto mining devices, Alibaba will impose a ban on using its platforms to sell major cryptocurrencies like Bitcoin (BTC), Ether (ETH), Litecoin (LTC), as well as smaller coins like Quark (QRK).

The new restrictions involve but are not limited to crypto mining-related hardware and software, as well as relevant tutorials, guides and strategies, the announcement notes.

Any sellers that continue listing crypto miners or relevant products on Alibaba’s platforms after Oct. 15 will face penalties under applicable rules, the firm warned in a detailed description of new restrictions. Some of the listed penalties include blocking stores, freezing and closing merchant accounts for maliciously evading the new rules like intentionally placing relevant products into other categories, Alibaba said.

The firm noted that the latest policy changes come in response to compliance issues in listing products and handling transactions.

Related: Alibaba launches NFT marketplace for copyright trading

“Members have responsibility for complying with relevant laws and regulations applicable to any country of sale. We will keep track of policy changes in each country and adjust our control policies accordingly,” the company stated. Alibaba did not immediately respond to Cointelegraph’s request for comment.

Alibaba’s move came soon after the Chinese government announced a set of new measures to combat the crypto adoption, declaring all crypto-related transactions illegal in the country on Sept. 24. In response to a renewed crypto crackdown, major crypto exchanges like Binance and Huobi subsequently halted some services in mainland China, while Sparkpool, the second-largest Ethereum mining pool in the world, announced a total shutdown of operations.

The local news publication, acting as the party's spokesperson, warned of a major decrease in the value of NFT assets once its bubble pops.

According to local sources, the Chinese government has released a series of statements denouncing the value of the non-fungible token, or NFT, market, despite two of the nation’s major tech firms pursuing the technology.

The story was first released locally by the Securities Times — a news publication service acting as a spokesperson for the official Chinese Communist Party outlet People’s Daily — and reported by the South Morning China Post.

The remarks claimed that “it is common sense that there is a huge bubble in NFT transactions”, and that most NFT buyers solely focus on the value of the assets when acquiring with a financial motive, rather than appreciating the visual qualities of the piece.

Staff reporter for the SMCP, Wang Junhui writes:

“Once market enthusiasm wanes and the hype cools, the value of these many strange NFTs will greatly decrease.”

This echoed the rhetoric of a June publication from People’s Daily in which they stated that the NFT market “can be hyped up, leading to chaos, while decentralisation may lead to security concerns”.

Earlier this year, the Chinese government delivered a crushing blow to crypto mining operations in a deliberate attempt to oust unfavored activity from its borders.

The country’s major tech players Tencent Holdings and Alibaba Group Holding have progressed with NFT-focused research and development initiatives, however, and now actively participate in the space.

Last month, Tencent launched it’s NFT trading platform Huanhe with a view to integrate NFT assets onto its music streaming platform, QQ Music.

Likewise, Alibaba’s fintech partner, Ant Group, recently listed two NFT images for sale within its wallet application Alipay.

Despite this, Chinese NFT advocates still remain restricted in their trading activities. For example, only the nation’s official currency Renminbi can be used for transactions. In addition, NFT’s cannot be resold once purchased as this would constitute a breach of the nation’s financial laws.

The Chinese multinational technology giant, Alibaba Group, has launched a non-fungible token (NFT) marketplace. According to regional reports, the Alibaba NFT platform not only provides customers with the ability to purchase and sell NFTs, but the marketplace also allows people to license and sell intellectual property (IP), as it is copyrighted by blockchain technology. Alibaba’s […]

The Chinese multinational technology giant, Alibaba Group, has launched a non-fungible token (NFT) marketplace. According to regional reports, the Alibaba NFT platform not only provides customers with the ability to purchase and sell NFTs, but the marketplace also allows people to license and sell intellectual property (IP), as it is copyrighted by blockchain technology. Alibaba’s […]

Alibaba has launched a new marketplace allowing trademark holders to sell NFT representing licenses to their copyright.

Chinese multinational e-commerce firm, Alibaba Group Holding, has launched a new nonfungible tokens (NFTs) marketplace allowing trademark holders to sell tokenized licenses to their intellectual property.

The new NFT marketplace, dubbed “Blockchain Digital Copyright and Asset-Trade,” can be accessed via Alibaba's Auction platform. NFTs launched via the platform will be issued on the “New Copyright Blockchain” — a distributed ledger technology platform centrally operated by the Sichuan Blockchain Association Copyright Committee.

According to an Aug. 17 report from the Alibaba-owned news publication, South China Morning Post (SCMP), the marketplace hopes to target writers, musicians, artists, and game developers.

The marketplace is already live, hosting several NFTs that are set to be auctioned next month. Bidders must post a deposit of 500 yuan (roughly $77) to participate in auctions. Each upcoming auction has set a reserve price of $15 each.

Buyers can view their collections via crypto portfolio application, Bit Universe, which is integrated into WeChat.

Commenting on the new marketplace, SCMP reporter Josh Ye tweeted that “although the technology itself does not prevent unauthorised copying. Sales include complete ownership of works purchased through the platform.”

Many NFTs on display do not articulate what rights are afforded to purchasers, with one NFT even appearing to depict unlicensed Star Wars fan art.

Related: Musician sells rights to deepfake her voice using NFTs

While this is Alibaba’s biggest NFT announcement to date, many of the firm’s subsidiaries have are already embracing nonfungible tokens.

In July, Cointelegraph reported that Alibaba-owned e-commerce platform Taobao showcased NFTs for the first time in its annual Maker Festival celebrating Chinese art and entrepreneurship. The event hosted the sale of NFT-based real estate created by Chinese artist, Huang Heshan.

In the same month, SCMP launched an NFT project named ‘ARTIFACT’ which included tokenized historical moments reported by the publication from its 118- year-old archive, such as the handover of Hong Kong from the U.K. to China in 1997.

While Visa and other major private payments networks see the potential of stablecoins, China's central bank believes they pose serious risks to global financial systems.

The Chinese central bank is “quite worried” about the global financial risks associated with digital currencies, particularly stablecoins, according to a senior official.

Fan Yifei, a deputy governor of the People’s Bank of China (PBoC), expressed concerns over the reportedly serious threat stablecoins like Tether (USDT) pose to global financial and settlement systems, CNBC reported Thursday.

The official emphasized that the speed of development in private payment systems is “very alarming,” and the PBoC is working against monopolies and the “disorderly expansion of capital,” adding:

“Some commercial organizations’ so-called stablecoins, especially global stablecoins, may bring risks and challenges to the international monetary system, and payments and settlement system.”

Fan noted that the Chinese government has already taken some measures to limit the expansion of global stablecoins in the country. The deputy governor stressed that the PBoC will apply the same restrictive measures that it took on Alibaba’s Ant Group to other entities in the payment services market.

As previously reported, the Chinese state halted Ant’s $37 billion IPO last November, also launching an antitrust probe into Alibaba. Mu Changchun, head of digital currency research at the PBoC, later said that China’s central bank digital currency is designed to provide backup for major retail payment services like AliPay and WeChat Pay as its key objective. According to Fan, China’s invite-only digital yuan system has amassed more than 10 million users so far.

Apart from cautioning against stablecoins, Fan also criticized major cryptocurrencies like Bitcoin (BTC), stating that such digital currencies have “become speculation tools” and pose potential threats to “financial security and social stability.”

Related: Stablecoins under scrutiny: USDT stands by ‘commercial paper’ tether

China has taken a tough stance on the cryptocurrency industry, recently renewing its crackdown on crypto mining activity as well as cryptocurrency trading.

Meanwhile, some of the world’s biggest payment companies like Visa have doubled down on their positive stance on stablecoins. “Stablecoins are on track to become an important part of the broader digital transformation of financial services, and Visa is excited to help shape and support that development,” the company wrote in its official crypto update on Wednesday.

Despite the drop in value during the last three months, the leading crypto asset bitcoin is still the ninth most valuable asset in the world in terms of market capitalization. Moreover, bitcoin could flip some of the world’s most valuable assets in the future, as the crypto asset is 67% away from turning over tech […]

Despite the drop in value during the last three months, the leading crypto asset bitcoin is still the ninth most valuable asset in the world in terms of market capitalization. Moreover, bitcoin could flip some of the world’s most valuable assets in the future, as the crypto asset is 67% away from turning over tech […] While bitcoin miners in China have been scrambling, second-hand markets offering cryptocurrency mining rigs from ASICs to GPUs have been exploding with an excess surplus. Additionally, the ASIC manufacturer Bitmain suspended machine sales on Wednesday, ceasing international spot deliveries. Official Crypto Mining Rig Dealers Are Either Sold-out or Suspending Deliveries, Second-Markets Explode With Mining Products […]

While bitcoin miners in China have been scrambling, second-hand markets offering cryptocurrency mining rigs from ASICs to GPUs have been exploding with an excess surplus. Additionally, the ASIC manufacturer Bitmain suspended machine sales on Wednesday, ceasing international spot deliveries. Official Crypto Mining Rig Dealers Are Either Sold-out or Suspending Deliveries, Second-Markets Explode With Mining Products […] China’s central bank digital currency (CBDC) continues to gain further ground as the Beijing Local Financial Supervision and Administration Bureau revealed 40 million worth of the country’s digital yuan ($6.3 million) will be distributed to Chinese citizens. Beijing and China’s Central Bank Launches Digital Yuan Lottery The People’s Bank of China (PBoC) and Beijing Local […]

China’s central bank digital currency (CBDC) continues to gain further ground as the Beijing Local Financial Supervision and Administration Bureau revealed 40 million worth of the country’s digital yuan ($6.3 million) will be distributed to Chinese citizens. Beijing and China’s Central Bank Launches Digital Yuan Lottery The People’s Bank of China (PBoC) and Beijing Local […] China, the world’s most populous country, has jumped leaps and bounds in comparison to a great number of other countries when it comes to the creation of a central bank digital currency. As each day passes, China’s digital yuan is seemingly getting closer to large-scale adoption, as big-name corporations like the e-commerce giant JD.com, Mastercard, […]

China, the world’s most populous country, has jumped leaps and bounds in comparison to a great number of other countries when it comes to the creation of a central bank digital currency. As each day passes, China’s digital yuan is seemingly getting closer to large-scale adoption, as big-name corporations like the e-commerce giant JD.com, Mastercard, […]