If Marathon reaches its 50 EH/s target, it would mark more than a 100% increase in the firm’s hash rate since the start of 2024.

Bitcoin mining firm Marathon Digital has announced it is increasing its 2024 hash rate target from 35-37 exahashes per second to 50 EH/s, citing expanded capacity after recent acquisitions.

“Given the amount of capacity we have available following our recent acquisitions and the amount of hash rate [...] we now believe it is possible for us to double the scale of Marathon’s mining operations in 2024,” explained Marathon’s CEO Fred Thiel.

Thiel said its target would be “fully funded” as there is no need for the firm to raise additional capital to achieve its new target hash rate.

Explore the economics of cryptocurrency mining and the challenges and opportunities that exist in this rapidly evolving industry.

Mining refers to the process of verifying and adding new transactions to a blockchain network, such as in the case of Bitcoin (BTC) or other cryptocurrencies. The economics of mining refers to the economic incentives and costs associated with the mining process, as well as its impact on the broader economy.

The economics of crypto mining are driven by a variety of factors, including cryptocurrency prices, mining difficulty, hardware costs, energy expenses, block rewards and transaction fees. This article will explain economics of mining, including costs, revenues and market trends.

The costs associated with cryptocurrency mining can be broken down into several categories:

Related: Bitcoin miners as energy buyers, explained

The amount of cryptocurrency that a miner is able to produce over a specific time period is often used to determine how much mining revenue a miner generates. The revenue is determined by multiplying the value of the mined cryptocurrency by its current market price.

Consider a scenario in which a miner employs mining equipment that can produce 1 BTC every 10 days. The miner’s profit for each block produced would be as follows if the market price of BTC is $50,000:

However, the amount of revenue made from mining cryptocurrencies fluctuates based on a number of variables, such as the price at which the cryptocurrency is currently trading on the market, the difficulty of the mining process, the price of power and the effectiveness of the mining equipment being utilized.

For example, in the early days of Bitcoin mining, it was possible to generate significant revenue with relatively simple hardware. The revenue per unit of computer power did, however, decline as mining complexity and the number of miners rose.

Related: How to build a cryptocurrency mining rig

In recent years, the cryptocurrency mining market has experienced significant growth and has become an increasingly important part of the overall cryptocurrency ecosystem. Some key trends in the crypto mining market include:

Russia’s market for specialized crypto mining equipment has been seeing high demand over the past couple of months, with buyers attracted by the low price tags. Russian experts also predict an increase in the supply of used coin minting hardware as large foreign companies leave the industry. Russian Demand for Powerful ASIC Miners Skyrockets in […]

Russia’s market for specialized crypto mining equipment has been seeing high demand over the past couple of months, with buyers attracted by the low price tags. Russian experts also predict an increase in the supply of used coin minting hardware as large foreign companies leave the industry. Russian Demand for Powerful ASIC Miners Skyrockets in […]

The company mined 31% more Bitcoin than in the same quarter last year.

According to its second-quarter (ending Sept. 30) earnings presentation released on Nov. 15, Vancouver-based digital assets mining company Hive Blockchain’s revenue declined by 44% year over year to $29.6 million. During the same period, the company’s net income also decreased from $59.8 million in the prior year’s quarter to a loss of $37 million.

Hive Blockchain’s net income was notably higher than its revenue in Q2 2022, as the company also recognized over $22 million worth of gains on the Bitcoin (BTC) and Ether (ETH) it mined. Although the company did not suffer material capital losses on coins in Q2 2023, it did, however, record a $26.2 million impairment expense to its mining rigs.

The company’s losses appear to have intensified even though its Bitcoin mining capabilities have further scaled. Year over year, Hive Blockchain mined 31% more BTC than in Q2 2022 for a total of 858 coins, which still has more value after accounting for a 15.9% year-over-year decline in its ETH mining, which amounted to 7,309 coins in the quarter.

The overall production increase was attributed to the opening of the firm’s New Brunswick Bitcoin mining facility over the past 12 months, which brought over 17,300 application-specific integrated circuit (ASIC) miners online. Expressing his optimism about the company’s operations, executive chairman Frank Holmes commented:

“Strategically, we have not borrowed expensive debt against our mining equipment or pledged our Bitcoins for costly loans, thus our balance sheet remains healthy to weather this storm. We believe our low coupon fixed debt; attractive green renewable energy prices and high performing energy efficient ASIC chips will help us navigate through this crypto winter.”

However, the company has warned of higher operating expenses going forward due to record-high mining difficulty. Currently, Hive Blockchain encompasses approximately 0.85% of the Bitcoin network’s hash rate. At the quarter’s end, Hive Blockchain reported holding 1,116 BTC, worth $48.4 million, and 25,154 ETH, worth $74.7 million, on its balance sheet.

Soaring hash rate, high electricity costs and BTC price hovering under $20,000 for months is complicating matters for Bitcoin miners.

October witnessed a surge in Bitcoin’s (BTC) hash rate which is pushing the metric to a new high of 245 Exahashes per second. These changes led to a sharp decrease in the hash price, resulting in a drop in the profit margins for BTC miners reaching a low of $66.8 USD/PH (per one quadrillion hashes per second) on Oct. 24, 2022.

According to Luxor Technologies, “hashprice” is the revenue BTC miners earn per unit of hash rate, which is the total computational power deployed by miners processing transactions on a proof-of-work network.

Not only has volume been inconsistent, the Bitcoin hash rate increased last week to an average of 269 EH/s. This means the difficult hash rate has been rising since July 2022.

Several factors, including expansion of mining operations, which creates miner competitiveness, increased use of ASIC miners which are more efficient than their alternatives and the Ethereum Merge led to some Ethereum (ETH) mining firms to fill empty rack space from non-operating ETH GPU mining with BTC specific ASIC miners.

Consequently, the surge in the hash rate resulted in an adjustment of the Bitcoin difficulty at a time when BTC’s price was dropping. As expected, after the spike of the hash rate and the increase in the Bitcoin difficulty, the hash price plummeted to $0.0657 tera hash per day, thereby reducing the level of profit.

A contributing factor to the depressed profit level is the general rise in BTC mining costs. For example, there has been a sharp increase in the price of electricity in the U.S. From July 2021 to July 2022 alone, its price increased by 25%, from $75.20 to $94.30 per megawatt hour. Energy prices also tend to increase in winter as people need to heat their homes. The Bitcoin mining industry is already seeing a rise of mining in Kazakhstan due to affordable energy.

Bitcoin miners face other rising costs such as the hosting fee, acquisition of miners and installing or upgrading of the cooling systems. During the 2020 to 2021 crypto bull market, Bitcoin mining companies took out loans when BTC and equipment prices were also much higher. This means that the interest on existing debts themselves could hurt newer and overleveraged mining firms.

It is clear that the increase in hash rate and Bitcoin difficulty, as well as the decrease in hash price leads to a compressed profit margins. The following graph shows a decrease in profits in a landscape where hash rate, difficulty and the cost of electricity continue to rise.

If the hash rate continues to increase amid a falling hashprice, the profit margin will continue to decrease, possibly leading some mining firms to close up shop permanently.

One possible outcome is that lean (cooler balance sheets) mining firms like Marathon may be able to purchase liquidated equipment and rack space from bloated mining companies that fail.

Mining firms that are staying lean while attempting to scale may prove victorious. Mining companies such as Core Scientific, Marathon, Riot, Bitfarm and CleanSpark are preparing for expansion even as many miners are finding profitability difficult.

Related: Public Bitcoin miners' hash rate is booming — but is it actually bearish for BTC price?

In view of the difficulties discussed, BTC mining firms should adopt sustainable BTC mining models for both profitability potential and to ease regulators. This should include using renewable energy sources, increasing production capacity and installing advanced cooling systems.

Mining firms can enhance their operations by using renewable energy from wind power, solar power and hydro which concurrently reduces costs and the carbon footprint. This approach can lead to more consistency and sustainability in Bitcoin mining energy costs. Norway has managed to capture 1% of all Bitcoin mining through a 100% renewable energy approach.

The depressed Bitcoin price, high hash rate and Bitcoin difficulty as well as low hash price contribute to small profit margins which may lead to sustainable, decentralized mining practices across the industry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

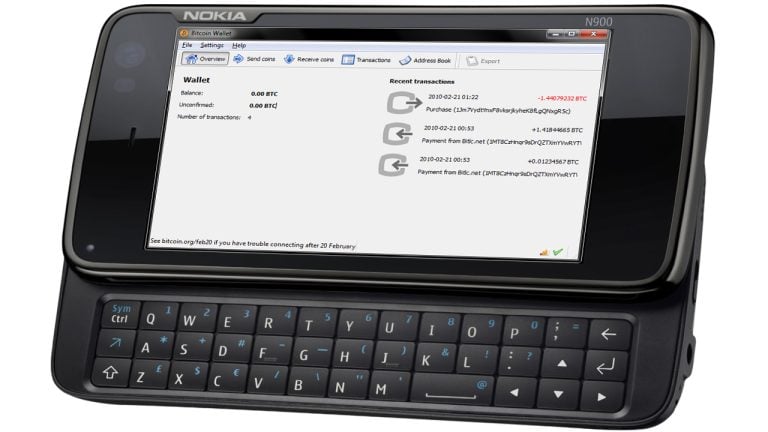

When Satoshi Nakamoto created Bitcoin, the full node client came with a wallet often referred to as Bitcoin-Qt. Nakamoto’s simplified payment verification (SPV) concept was not available until two years later, after the former Bitcoin Core developer Mike Hearn published BitcoinJ in 2011. However, prior to the first SPV client or optimized lightweight bitcoin wallet, […]

When Satoshi Nakamoto created Bitcoin, the full node client came with a wallet often referred to as Bitcoin-Qt. Nakamoto’s simplified payment verification (SPV) concept was not available until two years later, after the former Bitcoin Core developer Mike Hearn published BitcoinJ in 2011. However, prior to the first SPV client or optimized lightweight bitcoin wallet, […] According to a representative from the bitcoin mining company backed by the Chinese crypto billionaire Jihan Wu, Bitdeer is crafting a $250 million fund to buy distressed assets from embattled bitcoin miners. Bitdeer’s chief executive officer Matt Kong details that “opportunities” arise in “every cycle.” Bitdeer Wants to Acquire Cheap Machines From Distressed Bitcoin Miners […]

According to a representative from the bitcoin mining company backed by the Chinese crypto billionaire Jihan Wu, Bitdeer is crafting a $250 million fund to buy distressed assets from embattled bitcoin miners. Bitdeer’s chief executive officer Matt Kong details that “opportunities” arise in “every cycle.” Bitdeer Wants to Acquire Cheap Machines From Distressed Bitcoin Miners […] The world’s largest producer of application-specific integrated circuit (ASIC) bitcoin miners, Bitmain Technologies, has revealed the company is offering a discount on Antminer S19 Pro mining rigs. The 100 terahash per second (TH/s) machine is selling for $19 per terahash or $1,900 per unit. The Antminer mining rigs are 80% cheaper than they were five […]

The world’s largest producer of application-specific integrated circuit (ASIC) bitcoin miners, Bitmain Technologies, has revealed the company is offering a discount on Antminer S19 Pro mining rigs. The 100 terahash per second (TH/s) machine is selling for $19 per terahash or $1,900 per unit. The Antminer mining rigs are 80% cheaper than they were five […] Since the transition from proof-of-work (PoW) to proof-of-stake (PoS), ethereum cannot be mined and miners are now dedicating hashrate to different PoW chains. Since ethereum can no longer be mined, the most profitable PoW consensus algorithms are Kadena, Scrypt, and Cuckatoo32. Five days ago, before The Merge, the consensus algorithm Ethash was the most profitable, […]

Since the transition from proof-of-work (PoW) to proof-of-stake (PoS), ethereum cannot be mined and miners are now dedicating hashrate to different PoW chains. Since ethereum can no longer be mined, the most profitable PoW consensus algorithms are Kadena, Scrypt, and Cuckatoo32. Five days ago, before The Merge, the consensus algorithm Ethash was the most profitable, […] This week the bitcoin mining company Genesis Digital Assets announced that the firm has secured 708 megawatts (MW) in capacity and revealed plans to create 130 full-time jobs in the United States. The chief operating officer at Genesis, Andrey Kim, said the firm has been pleased with “the pace” of the bitcoin mining company’s U.S. […]

This week the bitcoin mining company Genesis Digital Assets announced that the firm has secured 708 megawatts (MW) in capacity and revealed plans to create 130 full-time jobs in the United States. The chief operating officer at Genesis, Andrey Kim, said the firm has been pleased with “the pace” of the bitcoin mining company’s U.S. […]