Nexo, a digital assets wealth platform, has announced the launch of personal USD, EUR, and GBP fiat accounts. This new offering provides clients in over 150 countries with a seamless way to conduct bank transfers directly in their name, enabling efficient multi-currency management within a single platform. The introduction of these fiat accounts marks a […]

Nexo, a digital assets wealth platform, has announced the launch of personal USD, EUR, and GBP fiat accounts. This new offering provides clients in over 150 countries with a seamless way to conduct bank transfers directly in their name, enabling efficient multi-currency management within a single platform. The introduction of these fiat accounts marks a […] Lightspark, a Bitcoin Lightning Network financial services company, has announced the release of its UMA Extend feature, which focuses on increasing the interaction between crypto and legacy rails in the U.S. With UMA Extend, businesses can opt in for a direction that can be linked to an account, allowing them to instantly receive LN payments […]

Lightspark, a Bitcoin Lightning Network financial services company, has announced the release of its UMA Extend feature, which focuses on increasing the interaction between crypto and legacy rails in the U.S. With UMA Extend, businesses can opt in for a direction that can be linked to an account, allowing them to instantly receive LN payments […] According to a local report, South Korean prosecutors have been given the green light by the Criminal Division of the Seoul Southern District Court to seize assets owned by Do Kwon, the co-founder and former CEO of Terraform Labs. The report discloses that a total of 233.3 billion won ($176 million) worth of assets have […]

According to a local report, South Korean prosecutors have been given the green light by the Criminal Division of the Seoul Southern District Court to seize assets owned by Do Kwon, the co-founder and former CEO of Terraform Labs. The report discloses that a total of 233.3 billion won ($176 million) worth of assets have […] A growing number of banking institutions in Russia are offering customers the option to save in Chinese yuan. The trend coincides with declining demand for U.S. dollar and euro deposits amid currency restrictions that triggered a flight of funds to bank accounts abroad. Demand for Dollar, Euro Accounts Expected to Drop Further, Requests for Yuan […]

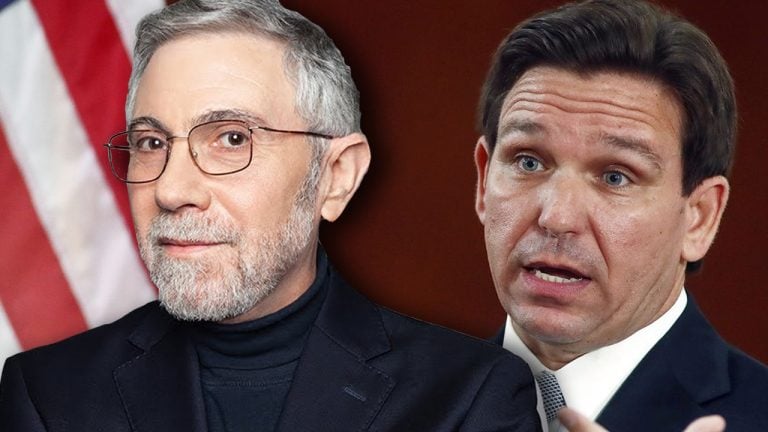

A growing number of banking institutions in Russia are offering customers the option to save in Chinese yuan. The trend coincides with declining demand for U.S. dollar and euro deposits amid currency restrictions that triggered a flight of funds to bank accounts abroad. Demand for Dollar, Euro Accounts Expected to Drop Further, Requests for Yuan […] Economist Paul Krugman questioned why Republican Florida governor Ron DeSantis opposes a central bank digital currency (CBDC) in a recent opinion editorial. Krugman suggested that DeSantis may be motivated by “general paranoia.” He speculated that DeSantis may be influenced by individuals who fear a digital currency could hinder “un-woke activities such as tax evasion and […]

Economist Paul Krugman questioned why Republican Florida governor Ron DeSantis opposes a central bank digital currency (CBDC) in a recent opinion editorial. Krugman suggested that DeSantis may be motivated by “general paranoia.” He speculated that DeSantis may be influenced by individuals who fear a digital currency could hinder “un-woke activities such as tax evasion and […]

Tether has hit back at a Wall Street Journal report detailing alleged shady dealings by it and Bitfinex to open bank accounts.

The company behind stablecoin Tether (USDT) has rebuffed a report by The Wall Street Journal claiming it had ties to entities that faked documents and used shell companies to maintain access to the banking system.

On March 3, the WSJ reported on leaked documents and emails purportedly revealing that entities tied to Tether and its sister cryptocurrency exchange Bitfinex faked sales invoices and transactions and hid behind third parties in order to open bank accounts they otherwise may not have been able to open.

In a March 3 statement, Tether called the findings of the report “stale allegations from long ago” and “wholly inaccurate and misleading,” adding:

“Bitfinex and Tether have world-class compliance programs and adhere to applicable Anti-Money Laundering, Know Your Customer, and Counter-Terrorist Financing legal requirements.”

The firm went on to say that it was a “proud” partner with law enforcement and “routinely and voluntarily” assists authorities in the United States and abroad.

Tether and Bitfinex chief technology officer Paolo Ardoino tweeted on March 3 that the report had “misinformation and inaccuracies” and insinuated that the WSJ reporters were clowns.

I'm at the PlanB anniversary in #lugano

— Paolo Ardoino (@paoloardoino) March 3, 2023

So much energy and people excited to talk about #Bitcoin

While I was on on stage I heard some clown honks, pretty sure was WSJ.

As always ton of misinformation and inaccuracies. Poor guys, must be difficult be them but need better media.

Cointelegraph contacted Tether and Binfinex for comment on the report and their statement but did not receive a response by the time of publication.

The WSJ article outlines — through its reported review of leaked emails and documents — Tether and Bitfinex’s apparent dealings to stay connected to banks and other financial institutions that, if cut off from, would be “an existential threat” to their business, according to a lawsuit filed by the pair against Wells Fargo bank.

One of the leaked emails suggests the firm’s China-based intermediaries were attempting to “circumvent the banking system by providing fake sales invoices and contracts for each deposit and withdrawal.”

There were also accusations in the report that Tether and Bitfinex used various means to skirt controls that would have restricted them from financial institutions, and had links to a firm that allegedly laundered money for a United States-designated terrorist organization, among others.

Meanwhile, a person familiar with the matter told the WSJ that Tether has been under investigation by the Department of Justice in a probe headed by the U.S. Attorney’s Office for the Southern District of New York. The nature of the investigation could not be determined.

Related: Silvergate closes exchange network, releases $9.9M to BlockFi

Tether has faced multiple allegations of wrongdoing over the past few months and recently had to downplay a separate WSJ report in early February that claimed four men controlled approximately 86% of the firm since 2018.

It similarly had to combat what it called “FUD” (fear, uncertainty, and doubt) from a WSJ report last December concerning its secured loans and subsequently pledged to stop lending funds from its reserves.

The Central Bank of Uzbekistan has permitted foreign-based businesses to open domestic bank accounts and deposit funds received from cryptocurrency trading. These companies will also be able to transfer the money abroad, but operations in the country will be restricted. Uzbekistan Updates Rules for Operations With Proceeds From Crypto Exchange Transactions The Central Bank of […]

The Central Bank of Uzbekistan has permitted foreign-based businesses to open domestic bank accounts and deposit funds received from cryptocurrency trading. These companies will also be able to transfer the money abroad, but operations in the country will be restricted. Uzbekistan Updates Rules for Operations With Proceeds From Crypto Exchange Transactions The Central Bank of […] Federal prosecutors have seized $697 million in assets, mostly comprised of more than 56 million Robinhood shares worth $526 million, from FTX co-founder Sam Bankman-Fried. Court filings detailed that the U.S. government seized a series of bank accounts belonging to Bankman-Fried, holding millions in cash. US Government Seizes Millions in Cash and Robinhood Shares From […]

Federal prosecutors have seized $697 million in assets, mostly comprised of more than 56 million Robinhood shares worth $526 million, from FTX co-founder Sam Bankman-Fried. Court filings detailed that the U.S. government seized a series of bank accounts belonging to Bankman-Fried, holding millions in cash. US Government Seizes Millions in Cash and Robinhood Shares From […] The conflict between banks and cryptocurrency exchanges in Chile is still developing, as some banks are reticent to serve this kind of institution. A new report prepared by exchanges reports that most of these banks refuse to include crypto companies as customers for risks that are nevertheless managed in the case of servicing other kinds […]

The conflict between banks and cryptocurrency exchanges in Chile is still developing, as some banks are reticent to serve this kind of institution. A new report prepared by exchanges reports that most of these banks refuse to include crypto companies as customers for risks that are nevertheless managed in the case of servicing other kinds […] Sudeban, the Venezuelan banking watchdog, is currently working on a mechanism to review crypto-related transactions in real-time to control the influence these have on the stability of the exchange market. Analysts have recently linked the situation in peer-to-peer (P2P) crypto markets to the recent drop in the value of the bolivar. Venezuelan Government to Monitor […]

Sudeban, the Venezuelan banking watchdog, is currently working on a mechanism to review crypto-related transactions in real-time to control the influence these have on the stability of the exchange market. Analysts have recently linked the situation in peer-to-peer (P2P) crypto markets to the recent drop in the value of the bolivar. Venezuelan Government to Monitor […]