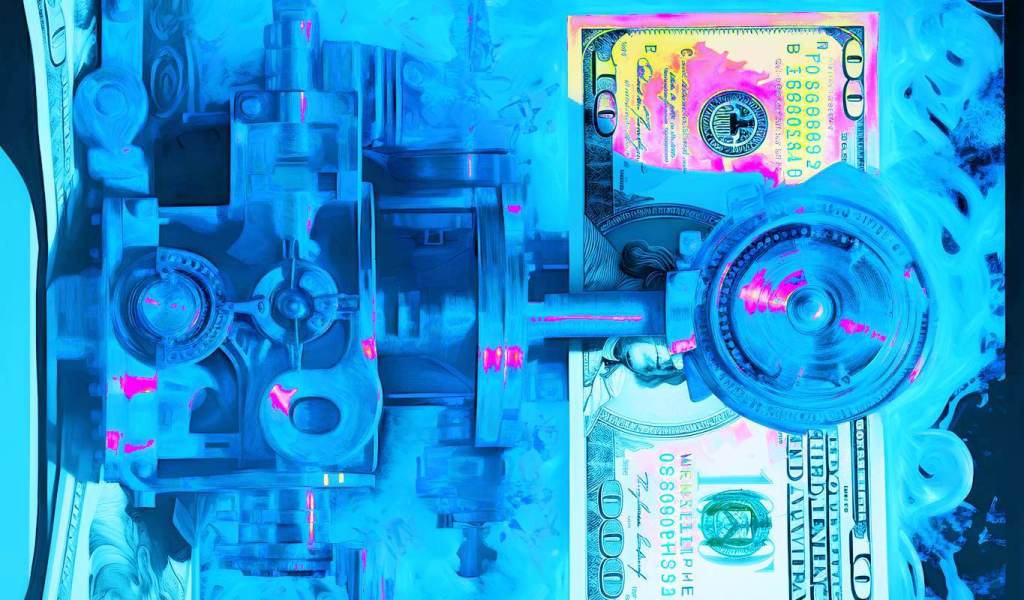

The proposed new industry guidelines are intended to address issues around AML and CFT rules.

The European Union’s banking regulator, the European Banking Authority (EBA), wants to update existing Anti-Money Laundering and Combatting the Financing of Terrorism (AML/CFT) rules for crypto providers.

In a consultation paper published on Nov. 24, the EBA explains that current European regulations are no longer sufficient to govern AML/CFT standards compliance among crypto providers. The proposed new industry guidelines are intended to address these issues, and the EBA has given interested parties until Feb. 26, 2024, to comment.

In particular, the EBA suggests merging the AML/CFT criteria for payment service providers and crypto asset service providers (CASPs). It also proposes obliging CASPs to “enable the transmission of information in a seamless and interoperable manner” by enhancing the interoperability of their protocols.

Related: EU tech coalition warns of over-regulating AI before EU AI Act finalization

Under the proposed new rules, CASPs will also be required to obtain and hold information on self-hosted addresses, ensure that the transfer of crypto assets can be individually identified, and verify whether that address is owned or controlled by the CASP customer. These requirements would be enforced when the transfer amount of the self-hosted account is above the 1,000 euro mark, although the EBA doesn’t specify whether this is a monthly, daily or a single-time threshold.

After the consultation process, the new guidelines should come into force on Dec. 30, 2024.

In October, the EBA released a consultation paper assessing the suitability of management body members and shareholders or members holding qualifying stakes in issuers of asset-referenced tokens and CASPs.

In July, the EBA encouraged stablecoin issuers to voluntarily adhere to specific “guiding principles” related to risk management and consumer protection.

Magazine: This is your brain on crypto. Substance abuse grows among crypto traders