European banking giant Societe Generale has successfully completed a collateralized market transaction using tokenized bonds issued in 2020 on the Ethereum (ETH) blockchain. Tokenized bonds are a digital representation of traditional bonds that can be held and traded on a blockchain. The immutable nature of blockchains aims to promise a tamper-proof recording of ownership and […]

The post Banking Giant Societe Generale and Banque de France Complete Tokenized Bond Transaction on Ethereum appeared first on The Daily Hodl.

The HKMA set up Project Ensemble months ago. Now we know why.

The Banque de France (BDF) and the Hong Kong Monetary Authority (HKMA) have signed a Memorandum of Understanding (MoU) on bilateral collaboration on wholesale central bank digital currency (CBDC) and tokenization. This work is in addition to the numerous larger projects the countries participate in together.

The HKMA and BDF will explore interoperability between their CBDC infrastructures and cross-border transaction settlement efficiency, the HKMA said in a statement. The BDF has infrastructure, called DL3S, in place for the introduction of a CBDC. The HKMA will use the Project Ensemble sandbox for their research.

Related: Issuing digital euro, or ‘Cash+,’ is probably a duty, French central banker says

France has to adopt a licensing regime for crypto service providers, the head of the country’s central bank has suggested. According to the executive, the need to tighten regulatory oversight stems from the “disorder” in the industry throughout the past year. Licensing Should Replace Registration for Crypto Firms in France, Governor Galhau Says Banque de […]

France has to adopt a licensing regime for crypto service providers, the head of the country’s central bank has suggested. According to the executive, the need to tighten regulatory oversight stems from the “disorder” in the industry throughout the past year. Licensing Should Replace Registration for Crypto Firms in France, Governor Galhau Says Banque de […] The governor of France’s central bank, François Villeroy de Galhau, has urged EU regulators to “avoid adopting diverging or contradictory regulations, or regulating too late.” He warned that “To do so would be to create an uneven playing field, risking arbitrage and cherry picking.” French Central Bank Governor Warns About Adopting ‘Unduly Complex’ Crypto Regulations […]

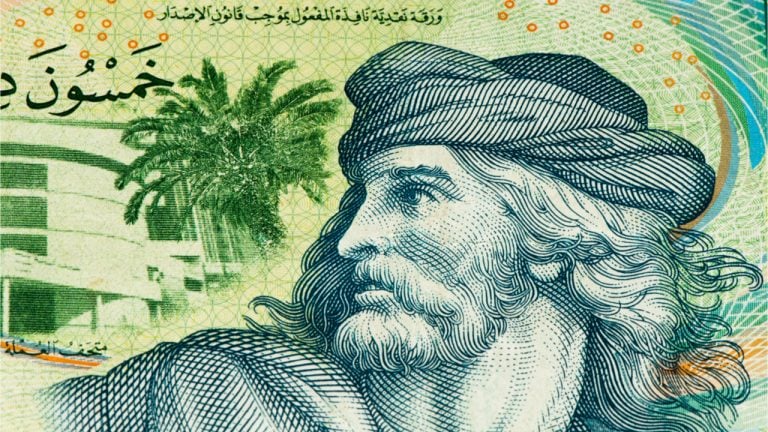

The governor of France’s central bank, François Villeroy de Galhau, has urged EU regulators to “avoid adopting diverging or contradictory regulations, or regulating too late.” He warned that “To do so would be to create an uneven playing field, risking arbitrage and cherry picking.” French Central Bank Governor Warns About Adopting ‘Unduly Complex’ Crypto Regulations […] The French central bank, Banque de France (BOF), recently carried out its fifth experiment on the Central Bank of Tunisia (CBT)’s central bank digital currency (CBDC). According to a statement from BOF, the latest experiment is part of the banks’ joint effort to create conditions that are “conducive to a better inclusion of the Tunisian […]

The French central bank, Banque de France (BOF), recently carried out its fifth experiment on the Central Bank of Tunisia (CBT)’s central bank digital currency (CBDC). According to a statement from BOF, the latest experiment is part of the banks’ joint effort to create conditions that are “conducive to a better inclusion of the Tunisian […]

European financial institutions are using pilots to make a case for the digital euro.

It turns out the 100 million euro digital bond issued by the European Investment Bank earlier this week was actually a trial of a European central bank-issued digital currency, or CBDC.

An April 28 announcement from France’s central bank, Banque de France, revealed the digital bond was settled using a CBDC on a blockchain.

The two year-bond was issued on the Ethereum public blockchain on April 27 and settled the following day, with a maturity date of April 28, 2023. The sale was led by Goldman Sachs, Santander and Société Générale.

“From a technological standpoint, the experiment required the development and deployment of smart contracts under secured conditions, so that the Banque de France could issue and control the circulation of CBDC tokens and so that CBDC transfer occurred simultaneously with the delivery of securities tokens to the investors’ portfolio,” Banque de France said.

The bank also revealed plans for further experiments in the future, noting that its efforts are part a push to provide evidence of use cases for a European CBDC:

“In the coming months and in cooperation with the market, the Banque de France will conduct additional experimentations to assess other uses of central bank digital currency in interbank settlements.”

The news that the EIB had issued the bond on Ethereum pumped the Ether (ETH) price to $2,709 on Wednesday. Danny Kim, head of revenue at crypto broker SFOX told Reuters the announcement “triggered a bullish institutional use case for Ethereum.”

Despite the bullishness on Ethereum, the wait for a digital euro may still take some time, as the European Central Bank did not participate in the pilot.

In January this year, President of the European Central Bank Christine Lagarde said that the development of a digital euro is "going to take a good chunk of time to make sure it's safe," adding, "I would hope that it's no more than five years.”

On April 12, ConsenSys South Africa lead Monica Singer warned that Europe may be left behind if its too slow to pull the trigger:

“If the central bank in Europe is gonna wait until 2028, by then there won’t be a central bank. Because who’s gonna use the euro in its current form? There are gonna be so many choices.”