Sam Bankman-Fried’s political donation activities were allegedly a family affair, involving his brother, mother, and father. Bankman-Fried, the founder of FTX, reportedly directed over $100 million in political contributions with his family’s help, according to emails reviewed by the Wall Street Journal (WSJ) and reporter Alexander Osipovich. Wall Street Journal Report Uncovers Bankman-Fried Family’s Alleged […]

Sam Bankman-Fried’s political donation activities were allegedly a family affair, involving his brother, mother, and father. Bankman-Fried, the founder of FTX, reportedly directed over $100 million in political contributions with his family’s help, according to emails reviewed by the Wall Street Journal (WSJ) and reporter Alexander Osipovich. Wall Street Journal Report Uncovers Bankman-Fried Family’s Alleged […] According to the latest court documents in the fraud case involving former FTX CEO Sam Bankman-Fried in Manhattan, the New York judge presiding over the case unsealed the co-signers of Bankman-Fried’s bond on Wednesday. The names of the two bail bond co-signers that were previously redacted from court documents are Stanford University alumni Larry Kramer […]

According to the latest court documents in the fraud case involving former FTX CEO Sam Bankman-Fried in Manhattan, the New York judge presiding over the case unsealed the co-signers of Bankman-Fried’s bond on Wednesday. The names of the two bail bond co-signers that were previously redacted from court documents are Stanford University alumni Larry Kramer […]

One of the previously undisclosed guarantors of Sam Bankman-Fried’s bond told Cointelegraph why he helped out the former FTX CEO.

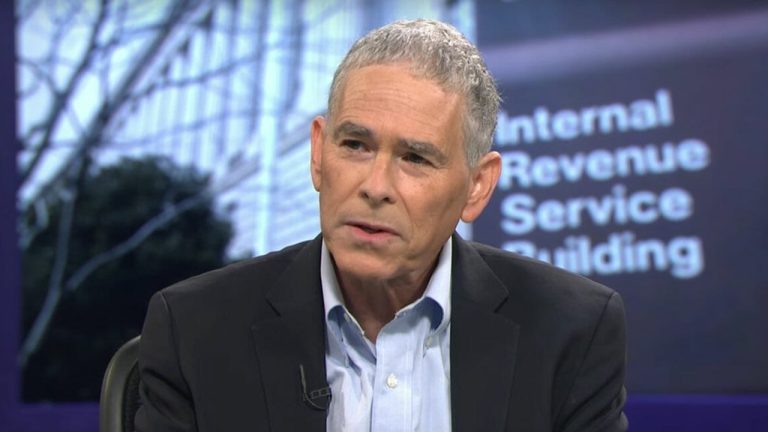

A former dean of Stanford Law School who co-signed Sam Bankman-Fried’s bail said he did so because SBF’s parents have been “the truest of friends” and helped his family through a “harrowing battle with cancer.”

In an emailed statement to Cointelegraph on Feb. 16, Larry Kramer said he co-signed Bankman-Fried’s bail as a way to return the favor.

“Joe Bankman and Barbara Fried have been close friends of my wife and I since the mid-1990s,” said Kramer.

He said that over the past two years, Bankman and Fried provided food and moral support while “frequently stepping in at moment’s notice to help” during his family’s battle with cancer.

“In turn, we have sought to support them as they face their own crisis,” he added.

Kramer emphasized that he had not been influenced to act as guarantor by any payments made to him by any FTX-related entity, writing:

“My actions are in my personal capacity, and I have no business dealings or interest in this matter other than to help our loyal and steadfast friends.”

Previous statements by Bankman-Fried reportedly corroborate this claim, with the former FTX CEO said to have denied that either of the two previously undisclosed guarantors had received any payments from FTX or sister-firm Alameda Research.

The names of SBF’s bail guarantors have been released: Larry Kramer, former dean of Stanford Law School, signed for $500K & Andreas Paepcke, computer scientist, signed for $200K.

— Tiffany Fong (@TiffanyFong_) February 15, 2023

In our last conversation, Sam denied that either guarantor has received payments from FTX or Alameda… https://t.co/cJq2Txi5zY

Kramer refrained from commenting on the legal predicament faced by Bankman-Fried, noting that this “is what the trial will be for.”

The other guarantor is Andreas Paepcke, a senior research scientist at Stanford University. He did not respond to questions by the time of publication.

The crypto community has been searching the web looking for more details on Paepcke, but there appears to be little information connecting him to Bankman-Fried outside of their association at Stanford University, where Bankman and Fried used to be law professors.

Via his Stanford bio: "Dr. Andreas Paepcke is a Senior Research Scientist at Stanford University. His interests include user interfaces and systems for teaching and learning. He uses data analytics to create tools that benefit these online efforts." pic.twitter.com/xWEDVeNOId

— Molly White (@molly0xFFF) February 15, 2023

United States District Judge Lewis Kaplan had allowed the identities of the two former law professors to be made public on Feb. 15, after being petitioned by eight major media outlets in a Jan. 12 letter.

Related: Charity tied to former FTX exec made $150M from insider deal on FTT tokens: Report

Bankman-Fried’s lawyers had sought to keep the two anonymous, arguing that the pair could be subject to intrusions, threats and harassment if their names were made public.

Kaplan disagreed, however, noting that the pair had voluntarily signed individual bonds in a “highly publicized criminal proceeding,” and had therefore opened themselves up to public scrutiny.

The appeal, filed on the last possible day, prevents the names of two bond guarantors for SBF from being revealed until at least Feb. 14.

The names of two guarantors who signed off on part of Sam Bankman-Fried’s $250 million bail bond will continue to remain a secret for now.

A judge has also rejected an agreement that would have permitted Bankman-Fried to use certain messaging apps.

Bankman Fried’s lawyers filed an appeal to block the release of the guarantors' names last-minute on Feb. 7. The appeal did not contain further arguments against the disclosure but it will prevent the order from being enforced until Feb. 14 to allow for an application for a further stay.

The appeal was expected after a Jan. 30 ruling in which United States District Judge Lewis Kaplan granted a joint petition from eight major media outlets seeking to unseal the guarantors' names.

At the time, Kaplan noted his order was likely to be appealed given the novelty of the circumstances.

He stated arguments by Bankman-Fried’s lawyers that guarantors “would face similar intrusions” as Bankman-Fried’s parents lacked merit given the size of their individual bonds was much smaller, at $200,000 and $500,000.

Bankman Fried’s parents — Joseph Bankman and Barbara Fried — were the other two parties who signed off on the bond.

Additionally, the judge said the guarantors had voluntarily signed individual bonds in a “highly publicized criminal proceeding,” and had therefore opened themselves up to public scrutiny.

Related: US Attorney requests SEC and CFTC civil cases against SBF wait until after criminal trial

Meanwhile, on Feb. 7 Kaplan rejected a joint agreement between Bankman-Fried’s legal team and prosecutors that would have modified bail conditions and allowed Bankman-Fried to use certain messaging apps.

Kaplan did not provide a reason for denying the motion but added the subject would be further discussed in a Feb. 9 hearing.

Kaplan ruled on Feb. 1 that Bankman-Fried was barred from contacting FTX or Alameda Research employees citing a risk of “inappropriate contact with prospective witnesses” after it was revealed the former CEO had been contacting past and present staff.

Following a request from FTX lawyers to subpoena FTX co-founder Sam Bankman-Fried (SBF) and members of his family, the U.S. Trustee appointed by the Department of Justice has filed an opposition to the request. The U.S. Trustee explained that the motion would duplicate the efforts of the federally appointed independent examiner. U.S. Trustee Argues for […]

Following a request from FTX lawyers to subpoena FTX co-founder Sam Bankman-Fried (SBF) and members of his family, the U.S. Trustee appointed by the Department of Justice has filed an opposition to the request. The U.S. Trustee explained that the motion would duplicate the efforts of the federally appointed independent examiner. U.S. Trustee Argues for […] According to court documents in the FTX bankruptcy case, the company’s attorneys seek to subpoena FTX co-founder Sam Bankman-Fried, his brother Gabriel Bankman-Fried, and his parents, Joseph Bankman and Barbara Fried. Additionally, the attorneys intend to question some of Bankman-Fried’s top deputies, including FTX co-founder Gary Wang, ex-Alameda Research CEO Caroline Ellison, the former chief […]

According to court documents in the FTX bankruptcy case, the company’s attorneys seek to subpoena FTX co-founder Sam Bankman-Fried, his brother Gabriel Bankman-Fried, and his parents, Joseph Bankman and Barbara Fried. Additionally, the attorneys intend to question some of Bankman-Fried’s top deputies, including FTX co-founder Gary Wang, ex-Alameda Research CEO Caroline Ellison, the former chief […]

The media’s lawyers argued the public’s right to know Bankman-Fried's sureties outweighed their privacy and safety rights, but Bankman-Fried’s lawyers strongly disagreed.

Eight major media companies including Bloomberg, The Financial Times and Reuters have demanded public disclosure of the two individuals responsible for guaranteeing FTX former CEO Sam Bankman-Fried's $250 million bond.

In a Jan. 12 letter addressed to New York District Court Judge Lewis Kaplan, attorneys from Davis Wright Tremaine LLP — acting on behalf of the media giants — argued that “the public’s right to know Bankman-Fried's guarantors outweighed their privacy and safety rights.”

Media organizations looking to persuade the judge to unseal the identities of Bankman-Fried's guarantors include the Associated Press, Bloomberg, CNBC, Dow Jones, The Financial Times, Insider and the Washington Post.

In making their case, the media’s lawyers used case precedent from Ghislaine Maxwell’s Dec. 2020 case — where the bond guarantors' names weren’t revealed — to argue that Sam Bankman-Fried’s financial crimes were not as serious as Maxwell’s involvement in Jeffery Epstein’s child sex traffic ring scandal:

"While Mr. Bankman-Fried is accused of serious financial crimes, a public association with him does not carry nearly the same stigma as with the Jeffrey Epstein child sex trafficking scandal.”

According to a Jan. 12 report from Reuters, Bankman-Fried’s lawyers previously argued that Bankman-Fried's sureties should be kept under wraps as Joseph Bankman and Barbara Fried — the parents and co-signers of Bankman-Fried’s $250 million bond — have received ongoing physical threats since FTX's catastrophic collapse in early November.

Related: Sam Bankman-Fried: ‘I didn’t steal funds, and I certainly didn’t stash billions away’

If the guarantor’s names were revealed, there would be a “serious cause for concern” for the safety and welfare of those two people, Bankman-Fried’s lawyers argued.

On Jan. 3, Bankman-Fried pleaded not guilty against all eight criminal charges related to the shock collapse of his former cryptocurrency exchange FTX, which includes wire fraud and violations of campaign finance laws among other charges.

The crypto community raised many questions about how FTX's former CEO was able to secure bail and the conditions it will come with.

Crypto Twitter has seemingly taken issue with Sam Bankman-Fried’s $250 million bail bond, allowing him to spend Christmas in his parent’s Palo Alto home without paying a single dime upfront.

The former FTX CEO arrived in New York from the Bahamas on Dec. 21 and appeared in court on Dec. 22 where he was released on bail via a “personal recognizance bond” — essentially a written promise from the defendant that they will show up for future court appearances and not engage in any illegal activity while out on bail.

According to the release agreement filed on Dec. 22, no cash was required to be deposited with the court, but the bond conditions see to it that Bankman-Fried’s parent’s five-bedroom home in Palo Alto will be used as collateral for the $250 million bond.

Some of the crypto community on Twitter were initially confused by the $250 million no-upfront-cost bail conditions, questioning how Sam Bankman-Fried was able to post the $250 million bail figure after he previously claimed he had less than $100,000 in his bank account.

Funny how SBF is able to post the $250M bail not long after saying he only had $100k.

— Benjamin Cowen (@intocryptoverse) December 22, 2022

So he probably is using stolen customer deposits to stay out of jail.

Under the bail agreement, the bond is only paid up if Sam Bankman-Fried doesn’t appear for future court appearances or violates other conditions of his bail, such as appearing for court proceedings and surrendering to serve a court sentence.

Meanwhile, those who reviewed the court documents instead shared concerns over Bankman-Fried’s guarantors — including his father, Allan Joseph Bankman, and mother, Barbara Fried, who would be on the hook should SBF violate the conditions of his bail.

Host of the Wall of All Streets Podcast Scott Melker tweeted on Dec. 23 saying that while SBF didn’t have to pay $250 million to stay out of jail, if he “skips bail,” his parents will have to work “17 extra jobs” to come up with the money.

Vocal crypto Twitter user Autism Capital elaborated on the matter explaining that while he has not had to pay any money upfront, he has put his parents, relatives, and non-relatives in a difficult situation.

Sam is out on a personal recognizance bail. What this means is that NO MONEY has been paid. His parents put up their home as collateral, one relative and a non-relative have also put up collateral. All of them would be on the hook for $250M if Sam runs. https://t.co/F85qHFVQDQ

— Autism Capital (@AutismCapital) December 22, 2022

While the host of the Regulatory Jason Podcast, Jason Brett, tweeted on Dec. 23 that while it might not be fair that SBF is staying in a luxurious home while on trial, he reminded his followers that everyone in the United States is entitled to a fair trial and the presumption of innocence.

People are impatient to see @SBF_FTX pay for his crimes. However, the reason America is different is how we treat those accused. Is it fair that he gets to be in a luxury home in a warm climate during trial? Life isn’t fair but we can get a shot at the truth of what happened.

— Jason Brett (@RegulatoryJason) December 22, 2022

Steven McClurg tweeted a statement implying that SBF’s parents shouldn’t be allowed to put up their home as collateral on the $250 million bail as the home was bought with “stolen FTX funds.”

So @SBF_FTX parents, who bought a home in Bahamas with stolen FTX funds, will use their other home as collateral on the $250mm bail?

— Steven McClurg (@stevenmcclurg) December 22, 2022

Related: SBF sent home after his parents put up their house to cover his astronomical bail bond

Some Twitter users also found it amusing that SBF’s bail conditions did not restrict him from using a computer whilst being released on bail.

So @SBF_FTX is out on bail, has no restrictions on his use of computers, and follows me on Twitter. Awkward.

— David "JoelKatz" Schwartz (@JoelKatz) December 23, 2022

On Dec. 21, 2022, members of U.S. law enforcement detailed that FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison have pleaded guilty to financial fraud charges. The recent charges against Wang and Ellison highlight some key findings and according to the U.S. Securities and Exchange Commission (SEC), FTX’s exchange token FTT is considered […]

On Dec. 21, 2022, members of U.S. law enforcement detailed that FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison have pleaded guilty to financial fraud charges. The recent charges against Wang and Ellison highlight some key findings and according to the U.S. Securities and Exchange Commission (SEC), FTX’s exchange token FTT is considered […] According to multiple reports, FTX co-founder Sam Bankman-Fried’s parents face scrutiny over their reported involvement with their son’s business operations. The two Stanford professors Joseph Bankman and Barbara Fried have not been charged with any wrongdoing, but the current FTX CEO, John J. Ray III, recently told members of the U.S. Congress that Joseph Bankman […]

According to multiple reports, FTX co-founder Sam Bankman-Fried’s parents face scrutiny over their reported involvement with their son’s business operations. The two Stanford professors Joseph Bankman and Barbara Fried have not been charged with any wrongdoing, but the current FTX CEO, John J. Ray III, recently told members of the U.S. Congress that Joseph Bankman […]