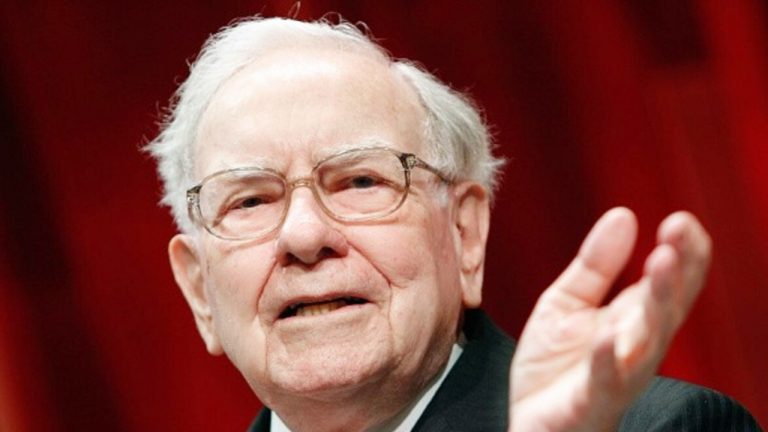

Comments made by Warren Buffet’s right-hand man and vice chairman of Berkshire Hathaway have gone viral for their imaginative depiction of cryptocurrency.

Charlie Munger, the ancient vice chairman of Berkshire Hathaway and Warren Buffet’s right hand man, has no issue with providing his honest thoughts on cryptocurrency: He hates it.

Speaking at a shareholder’s Q&A session at the annual meeting for LA-based newspaper company, Daily Journal Corp, the 98-year-old investing icon likened crypto to a sexually transmitted disease.

"I certainly didn't invest in crypto. I'm proud of the fact that I avoided it. It's like some venereal disease."

Munger continued to express his contempt for Bitcoin and other cryptocurrencies, adding, “I wish it had been banned immediately… I admire the Chinese for banning it. I think they were right and we were wrong to allow it.”

Munger and Buffet are no strangers to criticizing and downplaying the emergence of cryptocurrency. Buffett has previously ridiculed Bitcoin for being an asset that "does not create anything," he’s called it "rat poison squared” and said that it is nothing more than a “delusion that attracts charlatans”.

Munger’s imaginative depiction of cryptocurrency do not seem to be reflected in the new investment thesis of Berkshire Hathaway, which is softening up on its exposure to cryptocurrency.

In a securities filing late Feb. 14, Berkshire Hathaway disclosed that it had increased its exposure to cryptocurrency by purchasing $1 billion worth of Nubank stock, Brazil’s largest fintech bank which is popular amongst Brazil’s crypto investors.

"The Nubank investment can be tagged as Buffett's way of supporting the fintech/crypto world without taking back his criticisms of the past," asserted Greg Waisman, co-founder and chief operating officer of crypto wallet service Mercuryo, adding that Berkshire is now backing the "digital currency ecosystem indirectly."

Related: Warren Buffett Doesn’t Want to Own any Cryptocurrency

Crypto Twitter has been quick to respond to Munger’s comments on digital assets.

@gmoneyNFT called out the irony in Munger’s recent remarks point blank to their 225,000 followers:

Charlie Munger: Fiat currency is going to zero

— gmoney.eth (@gmoneyNFT) February 17, 2022

Also Charlie Munger: Crypto is like some venereal disease. I'm proud of the fact that I've avoided it. pic.twitter.com/ua85ubdy35

While @cryptonator1337 took aim at Munger’s age, stating to his 35k followers that Munger may not be the best person to consult when it comes to new technology.

When Munger was born in 1924...

— CR1337 (@cryptonator1337) February 16, 2022

.. Lenin died

.. the Ottoman Empire ended

.. Disney created the first cartoon

.. IBM was founded in New York State

.. the US president delivered a radio broadcast the first time

But sure let's listen to him talking about #Bitcoin