Republicans in the U.S. House of Representatives are criticizing the White House, saying the Biden administration’s approach to crypto assets threatens the nascent industry. In a new memo addressed to the members of the House Committee on Financial Services, Republicans acknowledge that digital assets are a thriving trillion-dollar market. “Today, the total digital asset market […]

The post US House Republicans Blast Biden Administration’s Attack on the Crypto Ecosystem appeared first on The Daily Hodl.

Congressman Tom Emmer made the anti-central bank digital currency comments to an audience at the Cato Institute, a libertarian think tank in Washington.

United States Representative Tom Emmer believes the launch of programmable central bank digital currency in the country could strip American citizens of their financial privacy.

Speaking on March 9 at the Cato Institute, a Washington D.C.-based libertarian think tank, Emmer explained that the programmable CBDC would be “easily weaponized” as a spying tool to “choke out politically unpopular activity,” among other things:

"As the federal government seeks to maintain and expand financial control to which it has grown accustomed, the idea of the central bank digital currency has gained traction within the institutions of power in the United States as a government-controlled programmable money that can be easily weaponized into a surveillance tool.”

The Minnesota congressman introduced the CBDC Anti-Surveillance Act on Feb. 22 to halt the progress of the Digital Dollar Project, which has seen considerable developments in how it would be used since the second version of its white paper was released in mid-January.

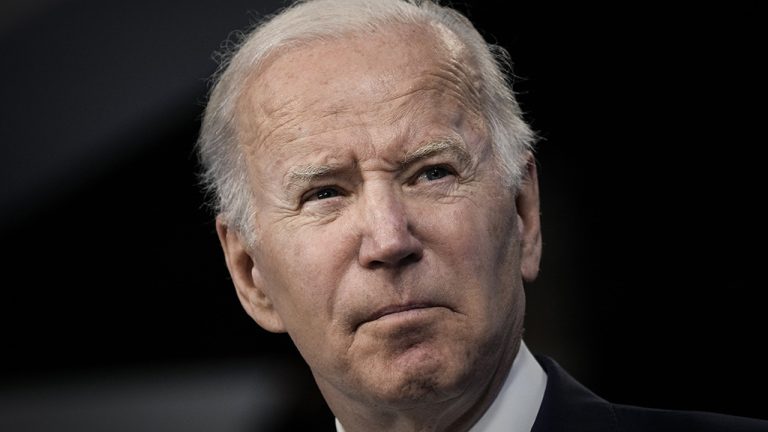

“Recent actions from the Biden Administration make it clear that they are not only itching to create a digital dollar but they are willing to trade Americans' right to financial privacy for the surveillance-style CBDC,” he added.

The Blockchain Regulatory Certainty Act

— Tom Emmer (@GOPMajorityWhip) March 9, 2023

The Securities Clarity Act

The Safe Harbor for Taxpayers with Forked Assets Act

The CBDC Anti-Surveillance State Act

The future of crypto in the US will be determined by Congress and the American People - not the Administrative State. pic.twitter.com/OQ0uwxjVxX

Emmer suggested that the blockchain-enabled “ownership economy” is “threatening” many bureaucrats in Washington, as it “shifts economic power from centralized institutions back into the hands of the people.”

While the latest Federal Reserve discussion paper explained that it would only issue the CBDC in the context of “broad public and cross-governmental support," Emmer and many others are concerned with the potential dangers that could ensue:

“It not only tracks transaction level data down to the individual user but also the ability to program the CBDC to choke out politically unpopular activity.”

Related: ‘Programmable money should terrify you’ — Layah Heilpern

Emmer also argued that decentralized cryptocurrencies can serve as a solution to the mismanagement of the U.S. monetary system and restore many of the “American values” that led the nation to become an economic powerhouse in the 20th century — privacy, individual sovereignty and free markets.

He added that by even experimenting with CBDCs, the U.S. is going against these values:

“Nothing could be more dangerous than adhering to a manufactured sense of urgency like this and ultimately developing a CBDC that is not open, permissionless and private.”

The spokeswoman said that she won’t be commenting specifically on Silvergate, but the White House will be actively monitoring the situation.

The Biden Administration is “aware of the situation” at Silvergate and will continue to monitor reports on the troubled bank as it unfolds, according to a White House spokesperson.

Speaking at a press briefing on March 6, Press Secretary Karine Jean-Pierre said the White House has noted that Silvergate marked another major crypto firm to "experience significant issues" in recent months, but declined to go into any further specifics on the firm.

"In recent weeks banking regulators have released guidelines on how banks should protect themselves from risks associated with crypto," she said, adding that:

"This is a president that has repeatedly called on Congress to take action to protect everyday Americans from the risk posted by digital assets and he will continue to do so. We won’t speak to this particular company as we have not with other cryptocurrency companies, but we will continue to monitor the reports."

Silvergate, known as a “crypto bank” was a key banking partner to a number of major crypto companies and projects.

However, uncertainty over the bank’s solvency began to spread at the start of March, after Silvergate delayed the filing of its annual 10-K report by two weeks. A 10-K report is a legally required document that provides a comprehensive overview of a company’s business and financial condition.

On the back of that news, Coinbase announced on March 2 that it had terminated its partnership with Silvergate, as the crypto exchange also alluded to concerns over the Department of Justice’s investigation into the firm over involvement in the FTX collapse.

At Coinbase all client funds continue to be safe, accessible & available.

— Coinbase (@coinbase) March 2, 2023

In light of recent developments & out of an abundance of caution, Coinbase is no longer accepting or initiating payments to or from Silvergate.

Several crypto heavyweights promptly followed suit by either cutting ties or distancing themselves from the bank, including Circle, Paxos, Bitstamp, Galaxy, MicroStrategy and Tether to name a few.

On March 4, Silvergate also announced that it was shutting down its digital asset payment network Silvergate Exchange Network due to “risk-based” concerns, sparking further uncertainty over the firm’s financials.

Related: Investor concerns persist as crypto investment products see 4th week of outflows

As a result, Silvergate's stock price (SI) has plummeted roughly 60% since Mar. 1, while the total combined market cap of crypto has dropped around 5.5% to $1.072 trillion in that same time frame.

Speaking with CNBC on March. 6, economist and author of the Crypto is Macro Now newsletter Noelle Acheson, suggested that if Silverbank were to file for bankruptcy, it could give regulators a far greater excuse to clamp down on crypto than before, given the bank’s ties to traditional finance.

“Up until now we’ve been able to say that the fallout of everything that happened last year was contained within the crypto industry – painful, but contained,” said Acheson, adding that:

“If Silvergate goes under then the regulators will be able to say ‘aha, systemic risk, we told you so.’ That will give them even more ammunition to go after crypto and increase their choke on fiat access for crypto businesses.”

The White House has published a “roadmap to mitigate cryptocurrencies’ risks.” The roadmap calls for authorities to “ramp up enforcement where appropriate” and Congress “to step up its efforts” to regulate the crypto sector. It also notes that legislation should not greenlight mainstream institutions “to dive headlong into cryptocurrency markets.” ‘The Administration’s Roadmap to Mitigate […]

The White House has published a “roadmap to mitigate cryptocurrencies’ risks.” The roadmap calls for authorities to “ramp up enforcement where appropriate” and Congress “to step up its efforts” to regulate the crypto sector. It also notes that legislation should not greenlight mainstream institutions “to dive headlong into cryptocurrency markets.” ‘The Administration’s Roadmap to Mitigate […]

The Biden Administration is asking the public how they feel about digital assets and blockchain technology as a means of forming upcoming crypto policies. In a new government document, The White House’s Office of Science and Technology Policy (OSTP) is asking for the public’s help in identifying key areas of the crypto industry that need […]

The post White House Asks for Public Comments on Crypto Assets, Blockchain Technology and Decentralized Finance appeared first on The Daily Hodl.

A Washington, D.C., townhome tied to FTX co-founder Sam Bankman-Fried has been listed on the market for roughly $3.28 million. The property was purchased by Bankman-Fried’s brother’s nonprofit, Guarding Against Pandemics, for the same price it is selling for today. FTX Co-Founder’s Luxury Property Suspected to Have Been Used for Wining and Dining Political Elite […]

A Washington, D.C., townhome tied to FTX co-founder Sam Bankman-Fried has been listed on the market for roughly $3.28 million. The property was purchased by Bankman-Fried’s brother’s nonprofit, Guarding Against Pandemics, for the same price it is selling for today. FTX Co-Founder’s Luxury Property Suspected to Have Been Used for Wining and Dining Political Elite […] Several U.S. House of Representatives Republicans have proposed legislation that would significantly decrease funding for the Internal Revenue Service (IRS). The move comes after the newly elected Speaker, Kevin McCarthy, stated that he would challenge the funding granted to the U.S. tax agency in the previous year. Biden Administration Opposes Bill for Rescinding Funding for […]

Several U.S. House of Representatives Republicans have proposed legislation that would significantly decrease funding for the Internal Revenue Service (IRS). The move comes after the newly elected Speaker, Kevin McCarthy, stated that he would challenge the funding granted to the U.S. tax agency in the previous year. Biden Administration Opposes Bill for Rescinding Funding for […] While the former CEO of FTX, Sam Bankman-Fried, awaits his trial at the end of the year, reports indicate that the company donated millions of dollars to early Covid-19 researchers. The research was reportedly used to cast doubt on specific treatments, such as the use of ivermectin and hydroxychloroquine. Controversy Surrounds Former CEO of FTX […]

While the former CEO of FTX, Sam Bankman-Fried, awaits his trial at the end of the year, reports indicate that the company donated millions of dollars to early Covid-19 researchers. The research was reportedly used to cast doubt on specific treatments, such as the use of ivermectin and hydroxychloroquine. Controversy Surrounds Former CEO of FTX […] The U.S. Department of Homeland Security (DHS) and the Federal Bureau of Investigation (FBI) are reportedly working closely with major social media platforms, like Facebook and Twitter, to police “disinformation.” Leaked documents further show their plans to expand censorship. Leaked Documents Reveal How Department of Homeland Security Plans to Police Disinformation Leaked documents and court […]

The U.S. Department of Homeland Security (DHS) and the Federal Bureau of Investigation (FBI) are reportedly working closely with major social media platforms, like Facebook and Twitter, to police “disinformation.” Leaked documents further show their plans to expand censorship. Leaked Documents Reveal How Department of Homeland Security Plans to Police Disinformation Leaked documents and court […] JPMorgan Chase CEO Jamie Dimon says the tensions between the U.S. and China and the Russia-Ukraine war are “far more concerning than whether there’s a mild or slightly severe recession.” He stressed: “I would worry much more about the geopolitics in the world today.” JPMorgan Boss Jamie Dimon Warns of Something ‘Far More Concerning’ Than […]

JPMorgan Chase CEO Jamie Dimon says the tensions between the U.S. and China and the Russia-Ukraine war are “far more concerning than whether there’s a mild or slightly severe recession.” He stressed: “I would worry much more about the geopolitics in the world today.” JPMorgan Boss Jamie Dimon Warns of Something ‘Far More Concerning’ Than […]