Bitcoin (BTC) infrastructure firm Blockstream is raising hundreds of millions of dollars in funding ahead of BTC’s next big wave. In a post on the social media platform X, Blockstream confirms that it just concluded a $210,000,000 funding round led by Fulgur Ventures. Fulgur Ventures is a venture capital firm specializing in Bitcoin and Lightning […]

The post Blockstream Closes $210,000,000 in Funding To Accelerate Development ‘Ahead of Next Bitcoin Cycle’ appeared first on The Daily Hodl.

Blockstream, a bitcoin infrastructure firm, announced on Tuesday the successful closure of a $210 million convertible note financing round, led by the investment firm Fulgur Ventures. According to the firm, the funds will be directed toward accelerating the adoption and development of Blockstream’s layer two (L2) technologies, such as the Lightning network and Liquid. Additionally, […]

Blockstream, a bitcoin infrastructure firm, announced on Tuesday the successful closure of a $210 million convertible note financing round, led by the investment firm Fulgur Ventures. According to the firm, the funds will be directed toward accelerating the adoption and development of Blockstream’s layer two (L2) technologies, such as the Lightning network and Liquid. Additionally, […] With the HBO documentary set to release on Wednesday, claiming to reveal the true identity of Satoshi Nakamoto, Polymarket bettors are actively speculating on who it might be. As of this writing, Len Sassaman, who previously led the wagers, has fallen behind, while Blockstream’s Adam Back now leads with a 22.5% probability of being named […]

With the HBO documentary set to release on Wednesday, claiming to reveal the true identity of Satoshi Nakamoto, Polymarket bettors are actively speculating on who it might be. As of this writing, Len Sassaman, who previously led the wagers, has fallen behind, while Blockstream’s Adam Back now leads with a 22.5% probability of being named […]

Blockstream is essentially selling four-year claims on the proceeds from its Bitcoin mining operations in exchange for funding.

Blockstream Mining is raising funds by issuing a security token—Blockstream Mining Note 2 (BMN2)—backed by the Bitcoin (BTC) miner’s hashrate, according to a Sept. 5 announcement.

The BMN2 token is designed to “provide direct exposure to Bitcoin hashrate operated by Blockstream’s… enterprise-grade mining facilities across North America,” Blockstream said.

Priced at $31,000 per token, each BMN2 represents a 48-month claim on one petahash per second (PH/s) of Blockstream’s mining hashrate, the company said. Hashrate measures the computing power used to mine blocks on the Bitcoin network.

The leading US-based crypto exchange by trading volume is adding support for Bitcoin (BTC) payments platform Lightning Network. In a new announcement, Coinbase says it is giving users a choice in how to send BTC payments by integrating the Lightning Network. “Starting today, Coinbase is rolling out support for the Lightning Network enabling instant, low-cost Bitcoin transfers. Users will have the […]

The post Coinbase Integrates Support for Bitcoin Payments Platform Lightning Network appeared first on The Daily Hodl.

Blockstream CEO Adam Back says 2023 presented a unique investment opportunity with Bitcoin’s price doubling amid low ASIC miner prices on secondary markets.

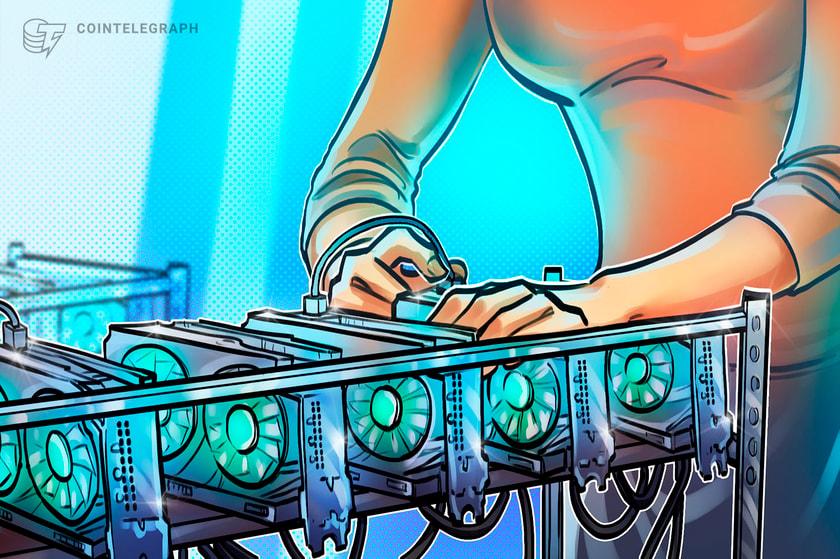

Blockstream will look to raise more capital to buy Bitcoin (BTC) mining hardware through a second series of its Blockstream ASIC (BASIC) Note offering, which aims to accumulate and sell ASICs based on the predicted demand for miners over the next two years.

Speaking exclusively to Cointelegraph, Blockstream CEO Adam Back highlighted a surplus of Bitcoin mining hardware on the secondary market as a critical driver for a second series of its investment offering.

Blockstream wound up an initial $5-million raise, which saw the firm purchase unused, boxed Antminer S19k Pro ASIC miners for $4.87 million. The company managed to secure the hardware, one of the Chinese manufacturer’s most popular miners, through SunnySide Digital.

Blockstream intends to buy and store ASIC mining hardware ahead of Bitcoin’s halving in 2024.

Blockchain technology firm Blockstream is looking to raise up to $50 million to purchase and store mining equipment that it perceives to be undervalued on secondary markets.

Speaking exclusively to Cointelegraph, Blockstream mining sales head James Macedonio unpacked the company’s plans to take advantage of a “huge separation” in the value of Bitcoin (BTC) and ASIC mining equipment.

Blockstream is partnering with Luxembourg-based digital securities marketplace STOKR to launch the Blockstream ASIC (BASIC) Note. Macedonio said that blockstream will look to initially secure $5 million for its Series 1 BASIC Notes, each valued at $115,000, to buy ASICs at scale, store and then sell them back to the market as demand for hardware picks up into 2024.

The 24-month investment note is set to be available to accredited international investors, while Macedonio said that the firm anticipates seeing returns in 12 to 18 months, factoring in Bitcoin’s next mining reward halving earmarked for April 2024.

Blockstream also notes that BASIC is intended as a Bitcoin basis investment vehicle that aims to "generate a bitcoin-on-bitcoin return". The company also expects that majority of investments to be made with BTC.

According to Macedonio, the price of ASIC miners — specialized hardware used to mine proof-of-work cryptocurrencies like Bitcoin — is nearly 10 times lower than their peak around December 2021.

“The price of Bitcoin is half of what it was, but ASICS are a tenth of what they were, and historically they’ve been highly correlated.”

Blockstream’s team has previously noted that the value of ASIC miners typically correlates to the price movements of Bitcoin, with BTC appreciation leading to an increase in miner prices.

Macedonio notes some factors that have impacted the stagnant price of mining hardware compared with Bitcoin’s recent price recovery to current levels of around $30,000.

“A lot of companies over-leveraged themselves using Bitcoin as collateral. So when Bitcoin went down, they defaulted. Some of those lenders had a large inventory of miners that were pushed into the market.”

Soaring energy prices in 2022 challenged Bitcoin profitability for miners, which also played a role in the oversupply of ASIC miners on secondary markets. Macedonio said that the lack of recovery for ASIC miner prices is driven by a lack of capacity to operate the machinery and difficulty raising funds to acquire more hardware.

Related: Blockstream raises $125M to finance expanded Bitcoin mining operations

Blockstream anticipates a positive price correction for ASIC hardware and plans to raise capital to purchase ASIC hardware to be stored in bonded warehouses.

Blockstream will look to raise a target of $50 million through $5 million tranches. Macedonio added that while the company will look to acquire the most efficient machines on secondary markets, the possibility of a Bitcoin bull run could drive demand for less efficient machines:

“If Bitcoin goes to $70,000 or more, people are going to try to get their hands on any ASICs they can just to start mining because their profitability would be so great.”

Blockstream is primarily planning to purchase Bitmain and MicroBT mining equipment, with Macedonio highlighting that the hardware is prevalent and historically has good resale value.

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises

Blockstream CEO and Bitcoin (BTC) advocate Adam Back says that the flagship crypto asset can explode to a $200 trillion market cap in the next nine years, meaning a price tag of about $10 million per coin. In a tweet thread, Back says that based on historical performance, BTC is still on track to continue […]

The post Adam Back Says Bitcoin Could Explode to $200,000,000,000,000 Market Cap by 2032 – Here’s Why appeared first on The Daily Hodl.

Members of the crypto community have been discussing the number of bitcoins that have been bridged over to the Avalanche network, which is now larger than the total value locked on the Lightning Network. At the time of writing, there are 5,493 bitcoins circulating on the Avalanche blockchain, while the Lightning Network holds 5,248 bitcoins. […]

Members of the crypto community have been discussing the number of bitcoins that have been bridged over to the Avalanche network, which is now larger than the total value locked on the Lightning Network. At the time of writing, there are 5,493 bitcoins circulating on the Avalanche blockchain, while the Lightning Network holds 5,248 bitcoins. […]

Is the U.S. investment bank looking to buy up distressed crypto firms amid the bear market?

One of the oldest pieces of contrarian investment wisdom is to buy when there is blood in the streets. If it were that easy, crypto investors would be euphoric at all the buy opportunities right now. If you’re rattled by the bear market, which has been especially brutal even by crypto standards, don’t beat yourself up over it. Cryptocurrency is still an unproven asset class that operates in the shadow of regulators. I don’t blame you for not buying an asset class that’s down over 70% this year.

With those caveats in mind, a quiet herd of smart money investors believes that now is the best time to invest in Bitcoin (BTC), digital assets and crypto infrastructure companies — even after the monumental collapse of FTX. Although nothing is confirmed yet, United States investment giant Goldman Sachs is also signaling that crypto is evenly priced after the year-long bear market.

This week’s Crypto Biz explores Goldman’s intrigue with crypto, a new cold wallet design from Ledger, Blockstream’s plunging valuation amid the bear market and the latest news surrounding Three Arrows Capital.

Goldman Sachs’ embrace of crypto appears to be growing, even during the bear market, as the U.S. investment behemoth looks poised to acquire distressed firms in the wake of FTX’s collapse. In an interview with Reuters, Goldman executive Mathew McDermott said crypto companies are “priced more sensibly” today than they were over a year ago and that calls to regulate the industry will ultimately be a positive catalyst for adoption. Although FTX has become the “poster child” for crypto, and not in a good way, the underlying technology behind the industry “continues to perform,” McDermott said.

The collapse of centralized platforms has been a boon for Ledger, the hardware company known for providing cold-storage crypto devices. After an influx of new orders for its Ledger Nano devices, the hardware company announced this week that it has partnered with Tony Fadell, the inventor of the iPod Classic, to design its newest wallet device. The new wallet, known as Ledger Stax, is said to be about the size of a credit card and features a large E Ink display, wireless charging and Bluetooth support. Remember: Not your keys, not your Bitcoin.

Bitcoin infrastructure company Blockstream is reportedly looking to raise fresh financing — but it, too, acknowledges that won’t be easy during a bear market. The Adam Back-led company is prepared to raise capital at a valuation of less than $1 billion, which is 70% below its $3.2 billion valuation in August 2021. According to Back, the additional financing will go toward scaling the company’s mining capacity. As Cointelegraph reported, Blockstream is working with Jack Dorsey’s Block to develop a solar-powered Bitcoin mining facility in Texas.

The disgraced founders of Three Arrows Capital, Su Zhu and Kyle Davies, will be required to give up financial information related to their failed hedge fund, a federal judge has decreed. The approved subpoenas to be delivered to the founders require that they give up any “recorded information, including books, documents, records, and papers” in their custody relating to 3AC’s financial affairs. Once valued at $10 billion, 3AC essentially blew up in the wake of Terra Luna’s infamous death spiral earlier this year. Arrogant as they once were, Zhu and Davies were exposed for a series of horrendous trades that eventually bankrupted their firm.

Bitcoin’s price has been fairly stable over the past few weeks, even as the FTX contagion continued to spread. The flagship digital asset scraped above $17,000 earlier this week, raising cautious optimism that the worst of the market downturn has passed. In this week’s Market Report, I sat down with Marcel Pechman and Joe Hall to discuss whether BTC can expect a relief rally soon. I also broke down the so-called “Santa Claus” rally, which many expect to play out later this month. You can watch the full replay below.

Crypto Biz is your weekly pulse of the business behind blockchain and crypto delivered directly to your inbox every Thursday.