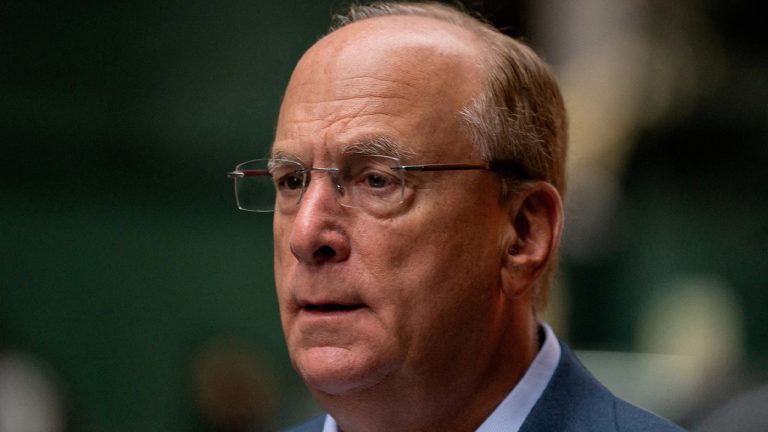

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […]

Blackrock’s CEO, Larry Fink, stated in an interview on Friday that he does not anticipate a “big recession” in the United States. However, he believes that “inflation is going to be stickier for longer.” In contrast to the U.S. central bank’s 2% goal, Fink predicts that “we’re going to have a 4ish floor in inflation.” […] On Wednesday, the U.S. Bureau of Labor Statistics published the Consumer Price Index (CPI) report, which noted that inflation rose 0.1% last month in March and 5% from a year ago. Annual inflation has dropped for nine consecutive months following the nine times the U.S. Federal Reserve raised the federal funds rate. U.S. Inflation Cools […]

On Wednesday, the U.S. Bureau of Labor Statistics published the Consumer Price Index (CPI) report, which noted that inflation rose 0.1% last month in March and 5% from a year ago. Annual inflation has dropped for nine consecutive months following the nine times the U.S. Federal Reserve raised the federal funds rate. U.S. Inflation Cools […] According to worldwide data from Google Trends, the search term “bitcoin” has reached a score of 93 out of 100 in the last seven days. Additionally, the price of bitcoin rose above the $30,000 range for the first time in ten months, or since June 2022. Bitcoin Search Interest Rises as Leading Crypto Asset Taps […]

According to worldwide data from Google Trends, the search term “bitcoin” has reached a score of 93 out of 100 in the last seven days. Additionally, the price of bitcoin rose above the $30,000 range for the first time in ten months, or since June 2022. Bitcoin Search Interest Rises as Leading Crypto Asset Taps […] Economist Peter Schiff praised the artificial intelligence of the Chatgpt assistant for omitting bitcoin in a suggested “recession-proof” portfolio. The long-time gold proponent commented on a report claiming the chatbot has recommended “massive allocations” in precious metals. Schiff Cites Study Alleging Chatgpt Favors Gold and Cash as Investments in Recession Rigorous crypto opponent Peter Schiff […]

Economist Peter Schiff praised the artificial intelligence of the Chatgpt assistant for omitting bitcoin in a suggested “recession-proof” portfolio. The long-time gold proponent commented on a report claiming the chatbot has recommended “massive allocations” in precious metals. Schiff Cites Study Alleging Chatgpt Favors Gold and Cash as Investments in Recession Rigorous crypto opponent Peter Schiff […]

The platform makes the first use case of a so-called “Proof of Climate” blockchain protocol.

Two banks from Sweden and France announced the launch of a new digital bond platform built on blockchain technology. The platform will enable institutional clients to issue, trade, and settle bonds digitally, providing a more efficient and secure process compared to traditional methods.

The platform, a joint project of Skandinaviska Enskilda Banken (SEB) and Credit Agricole Bank, is called so|bond. According to the announcement from April 3, the blockchain network will be using a validation protocol, Proof of Climate awaReness, minimizing its environmental footprint.

The Proof of Climate awaReness protocol is said to enable an energy consumption comparable to non-blockchain systems and incentivize participating nodes to improve the environmental footprint of their infrastructures.

Each node will be remunerated according to a formula linked to its climate impact: the lower the environmental footprint, the larger the reward. so|bond would become the first use case for the protocol, developed by the French-based IT provider Finaxys.

Related: UBS’s acquisition of Credit Suisse brings some good and bad for crypto

Romaric Rolleti, head of innovation and digital transformation at Crédit Agricole CIB, said that the bond blockchain platform was part of a larger plan for the bank’s digital transformation:

“The platform’s innovative approach, both to the blockchain infrastructure and to the securities market, is coupled with the strong commitment to green and sustainable finance that is at the center of our Societal Project.”

The project joins a significant amount of other efforts to explore the use of blockchain, smart contracts and the Internet of Things (IoT) for a global environment cause. For example, in October 2022, The Bank for International Settlements (BIS), the Hong Kong Monetary Authority and the United Nations Climate Change Global Innovation Hub presented the results of their Genesis 2.0 initiative — two prototypes of tokenized green bonds.

The emergency proposal increases MakerDAO’s holdings of United States bonds by 150%, aiming to diversify the Dai stablecoin’s collateral exposure.

Lending protocol and stablecoin issuer MakerDAO passed a proposal on March 16 to increase its portfolio holdings of United States Treasury bonds by 150%, from $500 million to $1.25 billion.

The proposal aims to increase the protocol’s exposure to real-world assets and “high-quality bonds,” following its Dai (DAI) stablecoin losing its $1 peg during market volatility on March 11. The $750 million debt ceiling hike was approved by 77% of Maker’s delegates. A representative of MakerDAO told Cointelegraph:

“Under this new deployment, MakerDAO would use $750 million of USDC in the PSM to purchase more US Treasury bonds, thus diversifying its liquid assets that back DAI.”

The bonds will be purchased with equal maturities, biweekly and over a six-month period, totaling 12 slots of $62.5 million each. Under the strategy, MakerDAO said it expects to deliver a net annualized yield of 4.6% to 4.5% after custody. Maker’s revenue stream could also be boosted by trading costs, the proposal noted.

The proposal would allow Maker “to take advantage of the current yield environment, and generate further revenue on Maker’s PSM Assets, in a flexible, liquid, manner,” it read. Federal Reserve data shows that Treasury’s yields for 10-year constant maturity were at 3.64% on March 14.

The move is an extension of a current $500 million U.S. Treasury allocation managed by decentralized finance (DeFi) asset adviser Monetalis Clydesdale since October 2022. “As of January 2023, this investment strategy has brought ~$2.1 million in lifetime fees,” MakerDAO claimed.

Participants in the governance forum, however, said that “Maker has not yet received any payment from the first half billion DAI” from Monetalis. Delegates also complained that questions in Maker’s Discord and governance forum were not answered promptly, thus not offering enough time to analyze the proposal.

On March 11, the collapse of Silicon Valley Bank spread panic across markets and led to the depeg of several stablecoins, including USD Coin (USDC) and Dai. In a March 13 Twitter thread about the volatility, MakerDAO noted that its community was working on proposals to switch its stablecoin exposure to money market investments, such as U.S. Treasurys, “with the purpose of diversifying DAI’s liquid collateral.”

Popular macro strategist Lyn Alden is warning investors that the US banking system is sitting on hundreds of billions of dollars worth of unrealized losses. In a fresh installment of the macro guru’s newsletter, Alden explains how the current banking crisis is different from the one witnessed in 2008 when the US housing and financial […]

The post US Banking System Nursing Over $600,000,000,000 Worth of Unrealized Losses, Warns Macro Guru Lyn Alden appeared first on The Daily Hodl.

Celsius creditors have filed a proposal to sue Alex Mashinsky, while creditors of FTX are turning their attention to the exchange's venture backers.

The stunning collapses of Celsius and FTX destroyed many lives — early adopters who had the foresight to understand the unique value propositions of Bitcoin (BTC) and crypto were left with practically nothing when both platforms halted withdrawals, shuttered their doors and eventually filed for bankruptcy. While there’s still hope that creditors will be made partially whole again, the road to recouping financial losses is expected to be long. While they’re waiting, creditors are banding together to sue these firms for various alleged infractions.

This week’s Crypto Biz delves into recent lawsuits targeting Celsius co-founder Alex Mashinsky and several venture capital firms that backed FTX during previous investment rounds. We also survey the latest news surrounding the United States Securities and Exchange Commission (SEC) and end on a positive note about a potential blockchain use case.

Once the darling of yield-seeking crypto investors, bankrupt lending platform Celsius is accused of “fraud, recklessness, gross mismanagement and self-interested conduct” by former customers. In a complaint filed in a bankruptcy court on Feb. 14, attorneys representing Celsius’ creditors proposed to sue co-founder Alex Mashinsky and other former executives for such misdeeds. “Mr. Mashinsky, Mr. Leon, Mr. Goldstein, Mr. Beaudry, Ms. Urata-Thompson, and Mr. Treutler breached their fiduciary obligations to Celsius,” the lawyers wrote about Celsius’ executives. “Those parties were aware Celsius was promising its customer’s interest payments that it could not afford and did nothing to fix the problem.” It looks like Mashinsky’s problems are only just getting started.

1-In connection with its investigation, the UCC has identified significant claims and causes of action that Celsius has against Alex Mashinsky and other insiders for breaching their fiduciary obligations, fraudulent transfers, and other causes of action.

— Celsius Official Committee of Unsecured Creditors (@CelsiusUcc) February 14, 2023

Customers of bankrupt crypto exchange FTX are turning their attention to the platform’s financiers and promoters to recoup some of the massive losses they’ve incurred. According to Bloomberg, FTX users have filed a class-action lawsuit against venture capital firm Sequoia Capital and private equity firms Thoma Bravo and Paradigm — all three companies were involved in FTX’s massive $900 million Series B round in July 2021. Meanwhile, a separate class-action lawsuit filed in California on Feb. 14 alleged that Silvergate Bank and its CEO Alan Lane were responsible for “aiding and abetting” Sam Bankman-Fried in carrying out his fraud. It looks like FTX’s venture capital and business backers are about to feel the blowback of the exchange’s failure.

The United States was always supposed to be a bedrock for innovation and first-mover advantage. In the case of crypto, however, regulators are coming down with an iron fist. In addition to stablecoins and staking protocols, the SEC is reportedly eyeing “qualified custodians” in its regulatory guidance and enforcement actions. According to Bloomberg, the SEC is working on a proposal that would make it difficult for crypto companies to serve as “qualified custodians” on behalf of clients. In practice, this may deter hedge funds and private equity funds from continuing to work alongside crypto custodians.

Yesterday, our Division of Examinations announced its 2023 examination priorities.

— Gary Gensler (@GaryGensler) February 8, 2023

Read more

Blockchain’s use cases may have extended to bond offerings after German engineering company Siemens issued a digital bond using distributed ledger technology. On Feb. 14, Siemens disclosed that it sold $60 million worth of digital bonds directly to investors, which included DekaBank, DZ Bank and Union Investment. The company said blockchain-based bonds have several advantages compared to traditional bond sales. “For instance, it makes paper-based global certificates and central clearing unnecessary,” Siemens said. “What’s more, the bond can be sold directly to investors without needing a bank to function as an intermediary.” It’s important to note that the bonds were still paid for using traditional methods because the digital euro is not yet available.

Crypto Biz is your weekly pulse of the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

The bonds were underwritten by four banks and priced at a yield of 4.05%.

The Government of the Hong Kong Special Administrative Region of the People’s Republic of China (HKSAR Government) announced on Feb 16 that it had issued HK$800 million in tokenized green bonds, under the Government's Green Bond Program (GBP). The bonds were underwritten by four banks and priced at a yield of 4.05%.

According to the announcement, the platform used Goldman Sachs' tokenization protocol GS DAP for the bond, which uses a private blockchain network to settle security tokens representing the beneficial interests of bonds in a T+1 payment-vs-payment (DvP) manner, and cash tokens representing claims on the HKMA's Hong Kong dollar legal tender.

Tokenization, the process of representing assets or securities as digital tokens, is a relatively new concept in the financial world. By using blockchain technology to create digital tokens, issuers can provide more transparency, efficiency, and accessibility in the issuance and trading of securities. This move towards the digital settlement of bonds on private blockchain networks marks a significant shift from traditional settlement processes, which often rely on manual verification and paper-based documentation.

Financial Secretary Paul Chan noted that the successful issuance of tokenized green bonds marks a milestone for Hong Kong. He shared:

“Hong Kong has been actively promoting the application of innovative technologies in the financial sector, actively exploring new concepts and technologies to improve the efficiency, transparency, and security of financial transactions."

The successful issuance of the tokenized green bond highlights the growing adoption of blockchain technology in the financial industry and marks an important step towards the development of sustainable finance globally.

Related: NASDAQ-listed Interactive Brokers to offer crypto trading in Hong Kong

The government of Hong Kong continues to indicate that it remains committed to the development of digital asset infrastructure. In December 2022, Hong Kong introduced two exchange-traded funds (ETFs) for cryptocurrency futures, raising over $70 million before its launch.

In October 2022, Cointelegraph reported that Hong Kong’s securities regulator wants to allow retail investors to invest directly in virtual assets and to reconsider current crypto trading requirements. According to Elizabeth Wong, head of the fintech unit at the Securities and Futures Commission (SFC), the government of Hong Kong is considering introducing its own bill to regulate crypto in its own China-free way.

German conglomerate Siemens has for the first time issued a blockchain-based digital bond denominated in euros. In an announcement, the corporation highlighted the benefits of using blockchain, including the opportunity for direct sale to investors. Digital Bond Issued Under Germany’s Electronic Securities Act The largest industrial manufacturer in Europe, Siemens, announced it has become one […]

German conglomerate Siemens has for the first time issued a blockchain-based digital bond denominated in euros. In an announcement, the corporation highlighted the benefits of using blockchain, including the opportunity for direct sale to investors. Digital Bond Issued Under Germany’s Electronic Securities Act The largest industrial manufacturer in Europe, Siemens, announced it has become one […]