The authority responsible for crypto oversight in Uzbekistan has determined the order of issuing and circulating digital assets in the country. The main reason behind the move is to establish a mechanism that would allow local companies to attract capital through coins and tokens. Uzbekistan Government Sets Out to Regulate Digital Asset Investments The National […]

The authority responsible for crypto oversight in Uzbekistan has determined the order of issuing and circulating digital assets in the country. The main reason behind the move is to establish a mechanism that would allow local companies to attract capital through coins and tokens. Uzbekistan Government Sets Out to Regulate Digital Asset Investments The National […] On Monday, the team behind the Solana Web3 wallet platform Phantom announced it had raised $109 million in a Series B fundraise. The crypto company is now a Unicorn with a post valuation of $1.2 billion in value. Solana Web3 Wallet Phantom Raises $109 Million The Phantom wallet team has raised $109 million in a […]

On Monday, the team behind the Solana Web3 wallet platform Phantom announced it had raised $109 million in a Series B fundraise. The crypto company is now a Unicorn with a post valuation of $1.2 billion in value. Solana Web3 Wallet Phantom Raises $109 Million The Phantom wallet team has raised $109 million in a […]

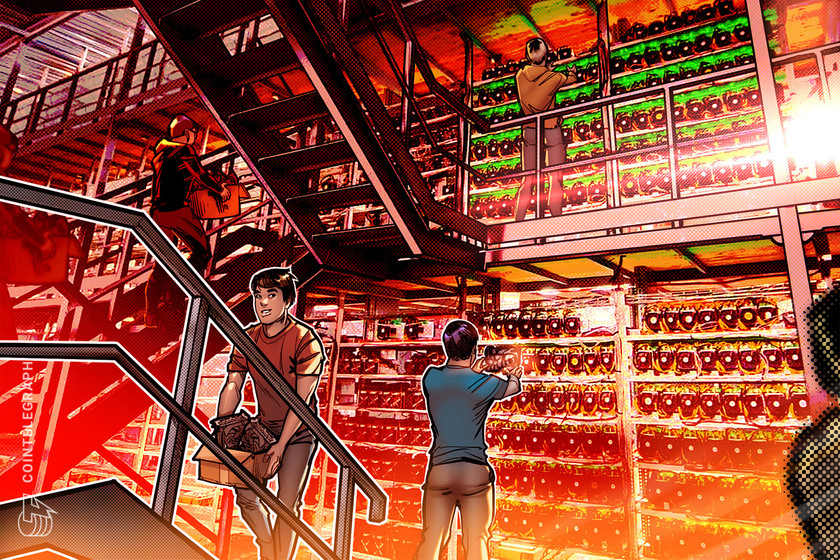

“The claim that Bitcoin miners jeopardize the electricity network is completely misinformed,” says EU-based fund manager Melanion Capital.

A Swedish financial watchdog’s call for a European Union-wide ban on proof-of-work (PoW) crypto mining, mainly known as the method of minting new Bitcoin (BTC), has received backlash from crypto-related fund managers.

Melanion Capital, a Paris-based alternative investment firm known for its Bitcoin ETF, addressed the Swedish Financial Supervisory Authority and Swedish Environmental Protection Agency’s call to ban PoW mining across Europe.

“The claim that Bitcoin miners jeopardize the electricity network is completely misinformed,” noted Melanion, reminding that Bitcoin miners’ business model is prone to collapse when the electricity demand increases as it would also increase energy prices.

The statement points to the authorities that have chosen to welcome miners instead of banning them, such as Texas, adding that Bitcoin miners are complementary for renewable energy power generation, “as they capture wasted energy and provide a baseload for a volatile resource like wind or hydropower.”

Due to its decentralized nature, the Bitcoin mining industry has no lobby to defend its interests and negotiate with governments, Melanion Capital reminded, adding:

“The absence of such a political counterbalance [for Bitcoin miners] should not be taken as an opportunity to implement measures rendering illegal an industry for its lack of defensive powers.”

The environmental footprint of Bitcoin mining was a major conversation at the United Nations Climate Change Conference. Speaking at a panel, Cointelegraph editor-in-chief Kristina Cornèr said it’s more important to have people in the blockchain space who are ready to think with a new mindset and search for solutions.

Related: Climate Chain Coalition advocates for the creation of a green economy at COP26

After surveying one-third of the global Bitcoin network, the Bitcoin Mining Council estimated that the global mining industry’s sustainable electricity mix grew to 56% in the second quarter of 2021.

Bitcoin miners are also looking for other energy resources, and nuclear is not off the table. Panelists at the Bitcoin & Beyond Virtual Summit reminded the potential of nuclear energy to introduce “enormous amounts of clean, carbon-free” power to the baseload.

Investors now have a better understanding not only about crypto assets but also the operational and procedural side of crypto, a new report states.

Crypto and blockchain investments continue to grow thanks to the ever-rising investor interest, according to a new report from Big Four accounting firm KPMG.

Titled “Pulse of Fintech H1 2021,” the study covers global investment activities in different financial technology verticals for the first half of the year. It details 2,456 investment deals worth $98 billion made between January and June. One of the top fintech trends for 2021 is the explosive growth in the crypto and blockchain investments, the report reads.

The first six months of 2021 saw 548 investments activities, including venture capitals, private equities, and mergers and acquisitions in the blockchain and cryptocurrency sectors. The total value of investments during the first half of the year is $8.7 billion, already doubling the total value of 580 investment deals made during 2020, worth $4.3 billion.

Companies that raised more than $100 million in funding rounds, including BlockFi, Paxos, Blockchain.com and Bitso, led the growth in investment volume.

“Cryptocurrency and blockchain are exploding globally,” said KPMG Global Fintech co-leader Anton Ruddenklau, adding:

“There’s so much happening in the space right now, between the eCNY project running in China, Facebook’s Diem, a number of ecosystem initiatives — not to mention all the different trading platforms raising money. Digital currencies and virtual assets are a big, big topic of conversation. I think for the rest of this year at least, crypto will be a very hot ticket for investors.”

The study points to rising investor awareness as a key driver of the growth in investment. Investors now have “a better understanding not only about crypto assets, but also the operational and procedural side of crypto — from custody and storage to storekeeping and the competitiveness and maturity of service providers.”

Related: What bear market? Investors throw record cash behind blockchain firms in 2021

KPMG predicted in the report that the cryptocurrency space would continue to mature while the distinction between cryptocurrencies and blockchain technologies would get stronger. Nonfungible tokens (NFTs), a key focus during the first half, would contribute to the evolution of crypto exchanges in the form of NFT-focused trading platforms.

The report expects a further focus on regulatory frameworks for the rest of the year. One specific case, India, would impact the whole ecosystem should it regulate cryptocurrencies as an asset class in the second half of 2021.

An investment firm says it has purchased a sizable stake in MicroStrategy, an enterprise software company founded by Bitcoin (BTC) bull Michael Saylor. According to a filing with the U.S. Securities and Exchange Commission (SEC), Capital International Investors added 953,242 shares of MicroStrategy (MSTR) to its holdings, worth nearly $600 million. With the investment, Capital […]

The post $395 Billion Investment Firm Buying Massive Stake in Michael Saylor’s MicroStrategy appeared first on The Daily Hodl.

Melanion Bitcoin Exposure Index tracks an equities basket with the highest correlation and revenue exposure to Bitcoin.

Institutional investors are looking for ways to participate in the crypto market without going out of the regulated space or mastering the advanced technology behind Bitcoin (BTC), and asset managers are finding alternative solutions to meet the need.

Paris-based investment management company Melanion Capital partnered with index platform Bita to launch the Melanion Bitcoin Exposure Index, according to information shared with Cointelegraph.

The index tracks a beta-weighted equities basket exhibiting the highest correlation and revenue exposure to BTC to follow the biggest cryptocurrency’s performance in a traditional investment fund format.

Melanion Bitcoin Exposure Index is built to provide investors “with exposure to the daily price movements of Bitcoin through a diversified basket of equities that meets traditional investment fund standards,” the announcement reads. The index would enable banks and asset managers to offer Bitcoin exposure to their clients in various wrappers such as investment funds, exchange-traded funds, certificates or structured products in a European regulatory compliant format.

Using Europe- and North America-based companies that operate or invest in the crypto space as a basis, the index is comprised of the 30 companies that are most correlated to Bitcoin, with their weights allocated accordingly. Liquidity filters and weight caps are applied to guarantee the stability and scalability of the Index.

Related: Crypto needs a decentralized daily reference rate

Reminding that the European regulators’ look-through approach renders a majority of Bitcoin-backed exchange-traded products ineligible for institutional investors and funds, Melanion Capital president Jad Comair said that the Melanion Bitcoin Exposure Index closes the gap between Bitcoin and EU regulation. “This index is a true bridge between two worlds,” he added.

Since it closely tracks the performance of BTC in a diversified basket and eliminates usual risks like loss or hacking, the index has its own set of advantages in comparison to a straight investment in Bitcoin, Comair said.

“Bitcoin’s main concerns for institutional investors are hack, theft, loss, storage, security or crime. By investing in equities replicating the Bitcoin performance, investors can achieve diversified asset allocation that was not available before.”

On March 19, 2021, the U.S. Federal Reserve Board published a press release that detailed the temporary supplementary leverage ratio easements will be expiring as scheduled. U.S. banks will no longer have the relaxed capital requirements they once held since the onset of the Covid-19 outbreak. Despite Wall Street’s Protest Federal Regulators Deny SLR Extension […]

On March 19, 2021, the U.S. Federal Reserve Board published a press release that detailed the temporary supplementary leverage ratio easements will be expiring as scheduled. U.S. banks will no longer have the relaxed capital requirements they once held since the onset of the Covid-19 outbreak. Despite Wall Street’s Protest Federal Regulators Deny SLR Extension […]