President Trump just signed an executive order to evaluate the creation of a strategic national Bitcoin and crypto stockpile, as well as prevent the development of a Central Bank Digital Currency (CBDC) while boosting stablecoin adoption. The order, entitled “Strengthening American Leadership in Digital Financial Technology,” states the administration supports the “responsible growth” and use […]

The post President Trump Signs Executive Order To ‘Evaluate’ Strategic Bitcoin and Crypto Reserve, Ban Central Bank Digital Currency, Boost Stablecoins appeared first on The Daily Hodl.

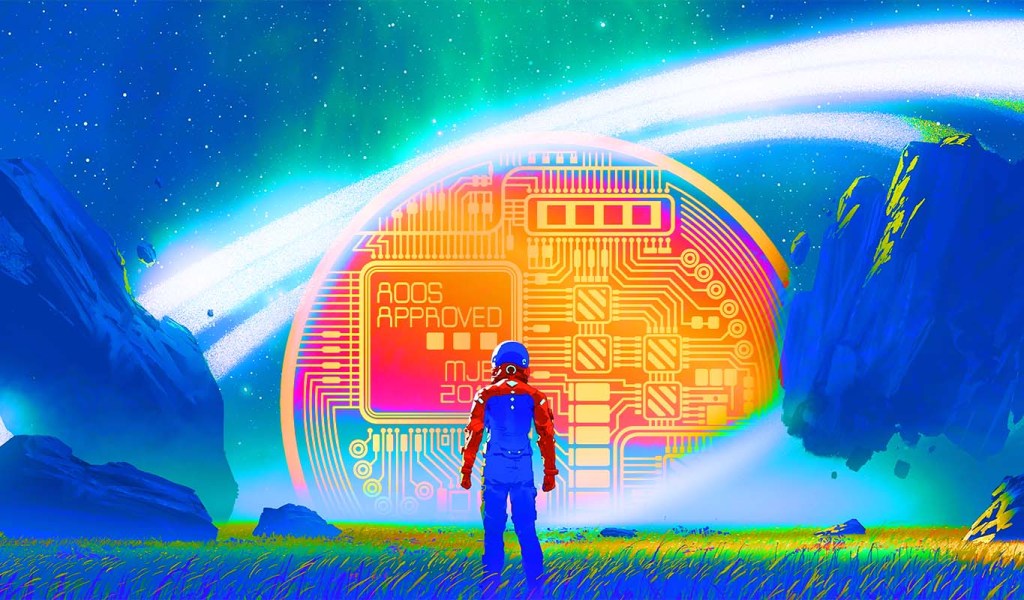

President-elect Donald Trump’s pick for Treasury Secretary does not think that the US needs to launch a central bank digital currency (CBDC). During his nomination hearing on Thursday, Scott Bessent told the Senate Finance Committee that, unlike other countries, the US will not gain much from rolling out a digital dollar. “On CBDCs, I see […]

The post Trump’s Choice for Treasury Secretary Sees ‘No Reason’ for the US To Roll Out a Central Bank Digital Currency appeared first on The Daily Hodl.

The People’s Bank of China (PBOC) has highlighted the utilization of the digital yuan, China’s central bank digital currency (CBDC), and blockchain technology as part of its 2025 strategy. In a post summarizing the issues touched on as part of the new year’s meeting, the Shanghai headquarters of the PBOC remarked that, as part of […]

The People’s Bank of China (PBOC) has highlighted the utilization of the digital yuan, China’s central bank digital currency (CBDC), and blockchain technology as part of its 2025 strategy. In a post summarizing the issues touched on as part of the new year’s meeting, the Shanghai headquarters of the PBOC remarked that, as part of […]

The president-elect cannot officially nominate anyone until after he is inaugurated on Jan. 20, but the US Senate has been holding hearings to question his potential picks.

Scott Bessent, US President-elect Donald Trump’s anticipated pick for the country’s Treasury secretary, faced Senators in a hearing to explain his positions on financial issues.

In a Jan. 16 hearing of the US Senate Committee on Finance, Bessent responded to questions from Republican Senator Marsha Blackburn regarding a US central bank digital currency (CBDC).

The Tennessee lawmaker brought up Chinese officials introducing a digital yuan to foreign attendees at the 2022 Olympics and asked how Bessent could handle a potential digital dollar if officially nominated and confirmed in the Senate.

“I see no reason for the US to have a central bank digital currency,” said Bessent. “In my mind, a central bank digital currency is for countries who have no other investment alternatives. [...] Many of these countries are doing it out of necessity, whereas the US — if you hold US dollars, you can hold a variety of very secure US assets.”

Russia’s largest bank has reportedly joined the country’s digital ruble pilot program ahead of a mid-2025 launch of the central bank digital currency (CBDC). The Russian news agency Interfax reports that Russia’s top financial institution, Sberbank, is now a participant in the program, which conducts transactions with digital rubles. The pilot will eventually involve 22 […]

The post Russia’s Largest Bank Joins Digital Ruble Pilot Program Ahead of 2025 Launch: Report appeared first on The Daily Hodl.

The Monetary Authority of Singapore (MAS) says that stablecoins have the potential to become a widely adopted means of payment. In an interview with The Business Times, MAS managing director Chia Der Jiun says stablecoins have immense potential provided that regulations are in place to keep the crypto assets from straying from their linked value. […]

The post Singapore’s Central Bank Sees Good Potential for Stablecoins To Become Widely Used Payment Instrument appeared first on The Daily Hodl.

The Monetary Authority of Singapore (MAS) says that stablecoins have the potential to become a widely adopted means of payment. In an interview with The Business Times, MAS managing director Chia Der Jiun says stablecoins have immense potential provided that regulations are in place to keep the crypto assets from straying from their linked value. […]

The post Singapore’s Central Bank Sees Good Potential for Stablecoins To Become Widely Used Payment Instrument appeared first on The Daily Hodl.

The Monetary Authority of Singapore (MAS) says that stablecoins have the potential to become a widely adopted means of payment. In an interview with The Business Times, MAS managing director Chia Der Jiun says stablecoins have immense potential provided that regulations are in place to keep the crypto assets from straying from their linked value. […]

The post Singapore’s Central Bank Sees Good Potential for Stablecoins To Become Widely Used Payment Instrument appeared first on The Daily Hodl.

Even with Bitcoin surging past $100,000 for the first time, some critics have remained skeptical about the cryptocurrency’s future.

Bitcoin, the world’s largest cryptocurrency by market capitalization, is no stranger to criticism from economists, politicians, bankers and investors.

Since its launch in 2008, Bitcoin (BTC) has been subject to countless hateful and skeptical reviews, with some critics calling it a scam or prophesying that Bitcoin is poised to go to zero.

As Bitcoin has grown and matured in the past few years, some critics have reinvented themselves as Bitcoin lovers, while others have dialed back their reasons for disliking the cryptocurrency.

The European Parliament’s Sarah Knafo said it’s time to stop “totalitarian temptations” by the European Central Bank and adopt Bitcoin.

European lawmaker Sarah Knafo called on the European Union to establish a strategic Bitcoin reserve while rejecting the proposed adoption of the “digital euro,” a central bank digital currency (CBDC) under development by the European Central Bank (ECB).

Knafo, a French magistrate and a member of the European Parliament since June, delivered a pro-Bitcoin (BTC) speech, calling on European lawmakers to launch a strategic BTC reserve.

“No to the digital euro, yes to a strategic Bitcoin reserve,” Knafo said in an X post, which included a video of her speech before the European Parliament.