Valentina Matvienko, Chairman of the Russian Federation Council, talked about the role of national digital currencies, also known as CBDCs, in increasing the use of national currencies in BRICS trade. Matvienko stated that a hypothetical BRICS bridge, a joint payment system, would leverage the digital currencies of all the bloc states. Russian Senate Chairman Profiles […]

Valentina Matvienko, Chairman of the Russian Federation Council, talked about the role of national digital currencies, also known as CBDCs, in increasing the use of national currencies in BRICS trade. Matvienko stated that a hypothetical BRICS bridge, a joint payment system, would leverage the digital currencies of all the bloc states. Russian Senate Chairman Profiles […] The Bank of Israel (BOI) is exploring a central bank digital currency (CBDC), a digital shekel, to modernize Israel’s payment system and drive innovation. However, BOI Deputy Governor Andrew Abir stated that the BOI is waiting for a major central bank, likely the European Central Bank (ECB), to introduce a digital currency before proceeding. This […]

The Bank of Israel (BOI) is exploring a central bank digital currency (CBDC), a digital shekel, to modernize Israel’s payment system and drive innovation. However, BOI Deputy Governor Andrew Abir stated that the BOI is waiting for a major central bank, likely the European Central Bank (ECB), to introduce a digital currency before proceeding. This […]

The central bank has been experimenting with multiparty computation, which could support the entire European economy in the future.

Central banks worldwide are increasingly exploring blockchain technology adoption, with the European Central Bank (ECB) being the latest example.

The ECB recently completed a blockchain experiment for its central bank digital currency (CBDC) with Zama, according to the firm's chief academic officer, Nigel Smart.

He said during a panel discussion at FHE Summit 2024:

North Carolina Governor Roy Cooper has declined to sign a bill that opposes the issuance and use of a Federal Reserve-backed digital currency in the state. Last week, Cooper, a Democrat, vetoed a bill titled “No Central Bank Digital Currency Payments to State” (HB 690), saying that it’s too early to ban the use of […]

The post North Carolina Governor Vetoes Bill That Would Have Banned a US CBDC in the State appeared first on The Daily Hodl.

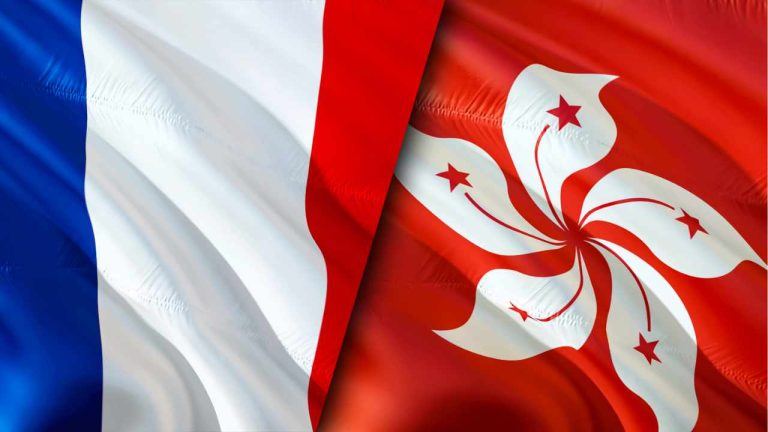

The Banque de France (BDF) and the Hong Kong Monetary Authority (HKMA) have announced a collaboration on wholesale central bank digital currency (wCBDC). This partnership includes the HKMA’s involvement in Wave 2 of the European Central Bank’s Eurosystem exploratory work. The institutions signed a Memorandum of Understanding (MoU) to innovate in wCBDC and tokenization markets, […]

The Banque de France (BDF) and the Hong Kong Monetary Authority (HKMA) have announced a collaboration on wholesale central bank digital currency (wCBDC). This partnership includes the HKMA’s involvement in Wave 2 of the European Central Bank’s Eurosystem exploratory work. The institutions signed a Memorandum of Understanding (MoU) to innovate in wCBDC and tokenization markets, […]

The Central Bank of the Republic of China mentioned handling government tenders through special purpose tokens to improve operational efficiency using smart contracts for bids and performance bonds.

The President of the Central Bank of the Republic of China, Yang Chin-long, said that developing a central bank digital currency (CBDC) is not a competition and that the central bank is focused on steady progress over speed.

Yang stated that being the first to introduce a CBDC does not guarantee success, as countries that have already issued or tested CBDCs have not seen the desired outcomes, according to a July 7 news report by UDN.

In a report released on June 7 before his presentation to the Finance Committee of the Legislative Yuan on Wednesday, June 10, Yang outlined the central bank’s plans for a digital New Taiwan dollar.

The governor of the U.S. state of North Carolina has vetoed House Bill 690, which seeks to ban state payments using central bank digital currencies (CBDCs) and the state’s participation in the Federal Reserve’s CBDC testing. The governor argued the bill was premature and emphasized the need for more funding for cybersecurity. House Bill 690 […]

The governor of the U.S. state of North Carolina has vetoed House Bill 690, which seeks to ban state payments using central bank digital currencies (CBDCs) and the state’s participation in the Federal Reserve’s CBDC testing. The governor argued the bill was premature and emphasized the need for more funding for cybersecurity. House Bill 690 […] The Bahamas, the first country to issue a central bank digital currency (CBDC) called the Sand Dollar, is preparing regulations to mandate commercial banks to provide access to the e-money to boost adoption. Central Bank Governor John Rolle indicated that these regulations would be implemented within two years. “We’ve begun to signal that to our […]

The Bahamas, the first country to issue a central bank digital currency (CBDC) called the Sand Dollar, is preparing regulations to mandate commercial banks to provide access to the e-money to boost adoption. Central Bank Governor John Rolle indicated that these regulations would be implemented within two years. “We’ve begun to signal that to our […] The General Assembly of the U.S. state of North Carolina has approved a bill that prevents the state from participating in the Federal Reserve’s testing of a central bank digital currency (CBDC). The General Assembly is North Carolina’s legislative body, comprising two chambers: the House of Representatives and the Senate. The bill passed with significant […]

The General Assembly of the U.S. state of North Carolina has approved a bill that prevents the state from participating in the Federal Reserve’s testing of a central bank digital currency (CBDC). The General Assembly is North Carolina’s legislative body, comprising two chambers: the House of Representatives and the Senate. The bill passed with significant […]

The HKMA set up Project Ensemble months ago. Now we know why.

The Banque de France (BDF) and the Hong Kong Monetary Authority (HKMA) have signed a Memorandum of Understanding (MoU) on bilateral collaboration on wholesale central bank digital currency (CBDC) and tokenization. This work is in addition to the numerous larger projects the countries participate in together.

The HKMA and BDF will explore interoperability between their CBDC infrastructures and cross-border transaction settlement efficiency, the HKMA said in a statement. The BDF has infrastructure, called DL3S, in place for the introduction of a CBDC. The HKMA will use the Project Ensemble sandbox for their research.

Related: Issuing digital euro, or ‘Cash+,’ is probably a duty, French central banker says