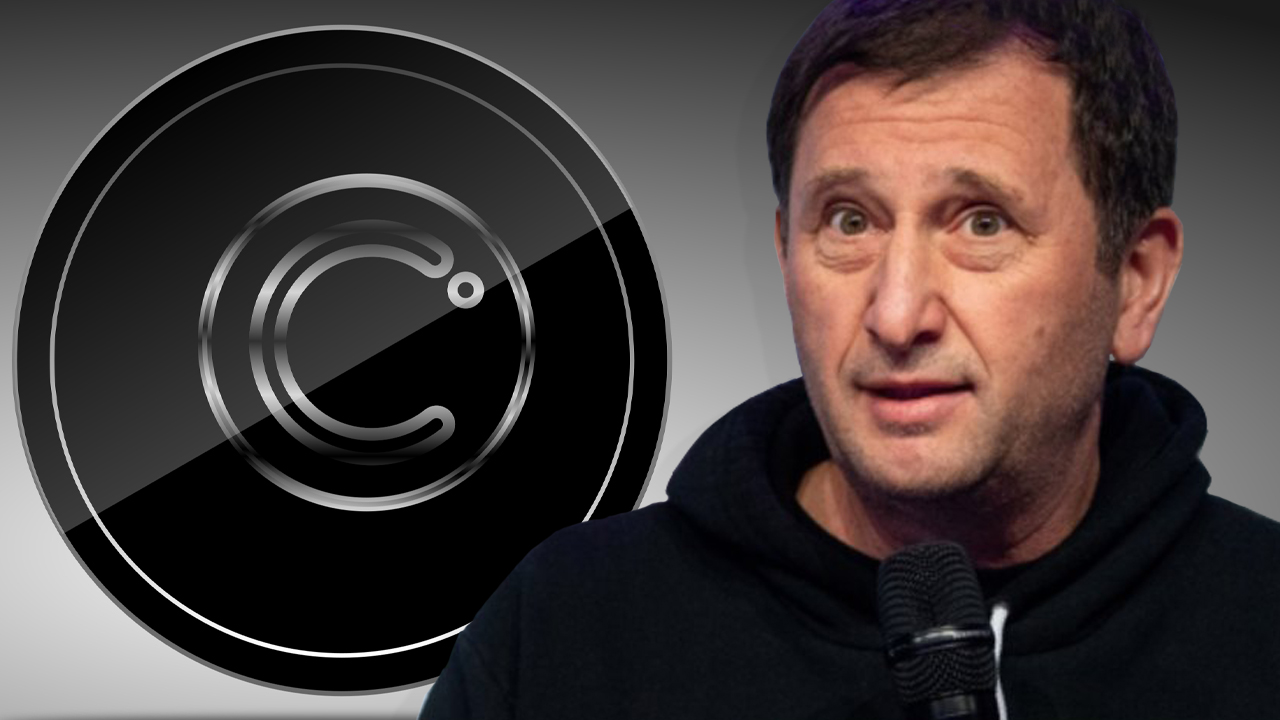

On Tuesday, September 27, 2022, Celsius Network CEO Alex Mashinsky submitted a letter of resignation from the company. Mashinsky added that he still plans to help the embattled crypto lender “achieve a successful reorganization.” Alex Mashinsky Resigns From Embattled Celsius — Founder Apologizes for the ‘Difficult Financial Circumstances’ After Celsius paused withdrawals on June 12, […]

On Tuesday, September 27, 2022, Celsius Network CEO Alex Mashinsky submitted a letter of resignation from the company. Mashinsky added that he still plans to help the embattled crypto lender “achieve a successful reorganization.” Alex Mashinsky Resigns From Embattled Celsius — Founder Apologizes for the ‘Difficult Financial Circumstances’ After Celsius paused withdrawals on June 12, […] According to leaked audio obtained by CNBC, the crypto lender Celsius wants to create an IOU cryptocurrency in order to pay clients back. The audio was provided by a Celsius customer and the recording explains the bankrupt crypto lender wants to create a form of “wrapped tokens” that represents a ratio of what customers are […]

According to leaked audio obtained by CNBC, the crypto lender Celsius wants to create an IOU cryptocurrency in order to pay clients back. The audio was provided by a Celsius customer and the recording explains the bankrupt crypto lender wants to create a form of “wrapped tokens” that represents a ratio of what customers are […] Celsius Network Ltd., the crypto lender that filed for Chapter 11 bankruptcy protection on July 13, is looking to release roughly $50 million worth of crypto assets to Celsius custody account holders. Reportedly, the Celsius custody accounts did not participate in the earn and borrow program. A court hearing concerning the matter of relief will […]

Celsius Network Ltd., the crypto lender that filed for Chapter 11 bankruptcy protection on July 13, is looking to release roughly $50 million worth of crypto assets to Celsius custody account holders. Reportedly, the Celsius custody accounts did not participate in the earn and borrow program. A court hearing concerning the matter of relief will […] According to a recent report published on Tuesday, the Israeli-American founder and CEO of Celsius Network, Alex Mashinsky, was in charge of the company’s trading strategy. The report, citing multiple people familiar with the matter, said Mashinsky sold millions of dollars’ worth of bitcoin in anticipation to buy bitcoin cheap. Except after the CEO allegedly […]

According to a recent report published on Tuesday, the Israeli-American founder and CEO of Celsius Network, Alex Mashinsky, was in charge of the company’s trading strategy. The report, citing multiple people familiar with the matter, said Mashinsky sold millions of dollars’ worth of bitcoin in anticipation to buy bitcoin cheap. Except after the CEO allegedly […] According to a Ripple Labs spokesperson, the distributed ledger company is interested in learning about the bankrupt crypto lender Celsius and its assets. When Ripple’s spokesperson was asked if the blockchain firm was interested in acquiring Celsius, the company declined to say. The news follows Celsius customers begging the bankruptcy court to release funds over […]

According to a Ripple Labs spokesperson, the distributed ledger company is interested in learning about the bankrupt crypto lender Celsius and its assets. When Ripple’s spokesperson was asked if the blockchain firm was interested in acquiring Celsius, the company declined to say. The news follows Celsius customers begging the bankruptcy court to release funds over […] Ever since Celsius paused withdrawals on June 12, the company has been the focus of attention due to the lender’s financial hardships. A month later, Celsius filed for bankruptcy in the U.S. by leveraging the Chapter 11 process. Two days after the bankruptcy filing, a report disclosed that two people familiar with the matter allege […]

Ever since Celsius paused withdrawals on June 12, the company has been the focus of attention due to the lender’s financial hardships. A month later, Celsius filed for bankruptcy in the U.S. by leveraging the Chapter 11 process. Two days after the bankruptcy filing, a report disclosed that two people familiar with the matter allege […] Another crypto lender, Celsius Network, has sought bankruptcy protection in the U.S. “Customer claims will be addressed through the Chapter 11 process,” the company said. Two other crypto firms recently filed for bankruptcy protection: Voyager Digital and Three Arrows Capital (3AC). Celsius Follows Voyager, Files for Chapter 11 Bankruptcy Crypto lender Celsius Network announced Wednesday […]

Another crypto lender, Celsius Network, has sought bankruptcy protection in the U.S. “Customer claims will be addressed through the Chapter 11 process,” the company said. Two other crypto firms recently filed for bankruptcy protection: Voyager Digital and Three Arrows Capital (3AC). Celsius Follows Voyager, Files for Chapter 11 Bankruptcy Crypto lender Celsius Network announced Wednesday […]

KeyFi Inc.’s complaint alleges that Celsius failed to honor a multi-million dollar profit sharing agreement after deploying numerous successful staking and DeFi strategies for the firm.

Staking software and investment firm KeyFi Inc. has filed a complaint against beleaguered crypto-lending firm Celsius, alleging the company had been operating in a “Ponzi” style fashion and that it failed to honor a profit-sharing agreement “worth millions of dollars.”

The complaint, filed on July 7, alleges that Celsius has refused to honor a “handshake agreement” in which KeyFi would receive various percentages on the profits it made on Celsius behalf via a number staking and DeFi strategies.

The complaint also accuses Celsius of “negligent misrepresentation” over its risk management controls and “fraud in the inducement” via misleading information of its business operations, which were deployed to induce KeyFi to work with Celsius.

The plaintiff is Jason Stone, CEO of KeyFi. He founded the company in January 2020 and has a background as an investor/investment advisor.

According to the court documents KeyFi served as an investment manager to Celsius between August 2020 and March 2021, during which the duo entered into a Memorandum of Understanding (MOU) which saw the KeyFi work under a special purpose vehicle to be owned by Celsius, dubbed Celsius KeyFi.

While a specific figure owed to KeyFi is not outlined in the complaint, it states the sum is worth “millions of dollars,” and that the companies had agreed on profit shares ranging from 7.5% to 20% depending on the investment strategy.

Notably, there is also a lengthy section of the complaint alleging that Celsius was running a “Ponzi” style operation by luring in new depositors with high interest rates as a way to “repay earlier depositors and creditors.”

Celsius operated as a Ponzi scheme. pic.twitter.com/pGC8vrH3a0

— Dylan LeClair (@DylanLeClair_) July 7, 2022

The complaint seeks a trial by jury, and an award of damages in “an amount to be determined at trial” along with punitive damages in the same vein, pre and post-judgment interest, and an accounting of all assets/funds generated via KeyFi trading activities.

A person claiming to be Stone revealed himself to be the leader of the group of pseudonymous DeFi traders behind the Oxb1 address and Twitter account on July 7. The account provided a long rundown of Celsius’ alleged dealings with KeyFi since 2020.

Given the public speculation about the company’s solvency, and my observation of Celsius’ loose relationship with the truth, I feel it is only prudent to finally set the record straight. I have brought legal action against Celsius to settle this issue once and for all.

— 0xb1 (@0x_b1) July 7, 2022

Celsius was said to have struck a business partnership with KeyFi in mid-2020 which saw the creation of the Oxb1 address for KeyFi to receive, manage and invest customer deposits from Celsius. The assets under management (AUM) totaled almost $2 billion by the end of their partnership in March 2021, according to the account.

The account also stated that Celsius’ risk management team, who monitored the activity of Oxb1, assured KeyFi that “their trading teams were adequately hedging any potential” impermanent loss (IL) and fluctuations in token prices relating to KeyFi investment activities.

However, Oxb1 alleges that this was not true and they “had not been hedging our activities, nor had they been hedging the fluctuations in crypto asset prices.”

“The entire company’s portfolio had naked exposure to the market,” he said.

Oxb1 claims that KeyFi opted to terminate the partnership as a result, and gradually unwind its investment positions over the course of a few months. KeyFi was said to have increased total AUM by $800 million during the partnership.

However, when the firm exited its positions, Celsius allegedly suffered impermanent loss and blamed Stone.

Related: Celsius pays down 143M in DAI loans since July 1

Oxb1 stated that he filed the lawsuit and took the matter public after a year of trying to privately settle the dispute with Celsius. To date, he claims KeyFi is owed a “significant amount of money,” and that Celsius has “refused” to acknowledge its lack of risk management and honor the initial profit sharing terms of the deal.

“Despite our reasonableness, and due to what I believe was motivated by the massive hole in their balance sheet, Celsius has refused to acknowledge the truth or their failures in risk management and accounting. They have tried to deflect blame to me instead.”

BnkToTheFuture's three proposals include two different ways to restructure and relaunch the firm, or an option to co-invest in the firm with a bunch of Bitcoin whales.

Celsius’ lead investor BnkToTheFuture has outlined three proposals to save Celsius from bankruptcy while finding a good outcome for shareholders and depositors with funds stuck on the platform.

Shared on Twitter by BnkToTheFuture CEO Simon Dixon on June 30, the three distinct proposals include either two options of restructuring and relaunching Celsius, or potentially co-investing in the platform alongside wealthy Bitcoin Whales.

“Proposal #1: A restructuring to relaunch Celsius and allow depositors to benefit from any recovery through financial engineering.

Proposal #2: A pool of the most influential whales in Bitcoin to co-invest with the community.

Proposal #3: An operational plan that allows a new entity and team to rebuild and make depositors whole.”

Dixon previously referred to “financial innovation” being needed to be applied to Celsius, similar to the issuance of equity debt tokens like in the case of Bitfinex in 2016, which were designed to represent $1 of debt per token.

“We believe all attempts should be made to make depositors whole in order to maintain shareholder value,” the team wrote, adding it will be calling for a shareholder meeting that “legally cannot be ignored by the Celsius board.”

“Bnk To The Future Capital SPC holds over 5% of Celsius shares and therefore we believe that this allows us to call a shareholder meeting as part of our statutory shareholder rights that legally cannot be ignored by the Celsius board.”

#DepositorsFirst Celsius Recovery Plan https://t.co/YkGy3N0Gwd

— Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) June 30, 2022

BnkToTheFuture also suggested that after first submitting these proposals to Celsius and its advisors, is it now looking to “apply pressure” to the firm after getting “worried that time was running out” with its lack of a distinct plan of action. These sentiments were also echoed by Dixon in a Digital Assets News Interview on the same day:

“You have to move really fast, because the longer you go on, the more FUD comes out, bad PR comes out, more predatory offers come out, the more the community stops believing in what they originally believed in.”

Celsius’ users have been unable to withdraw assets from the platform since June 13 amid the firm’s ongoing liquidity issues, and there are fears that users may never get their funds back if the company were to go bankrupt.

In a blog post from July 1, Celsius stated that it is working as fast as it can to stabilize its liquidity problems so that it can be “positioned to share more information with the community.”

While the firm did not reveal much about what this entails, Celsius stated that it is exploring options to protect its assets such as pursuing strategic transactions as well as a restructuring of our liabilities, among other avenues.”

“These exhaustive explorations are complex and take time, but we want the community to know that our teams are working with experts from many different disciplines,” the blog post read.

Related: Contagion: Genesis faces huge losses, BlockFi’s $1B loan, Celsius’s risky model

Reports surfaced on June 30 that Sam Bankman-Fried’s crypto exchange FTX recently walked away from a deal to purchase Celsius after finding a $2 billion hole in the company’s finances.

According to two unnamed sources close to the matter, FTX had entered talks with Celsius to either provide financial support or acquire the firm outright, however apart from having $2 billion an account for Celsius was said to be difficult to deal with.

The embattled crypto lending platform Celsius has kept withdrawals and transfers frozen since June 12 and told the Celsius Network community that the “process will take time.” Since then, Celsius users are wondering why they are still receiving weekly rewards, and reportedly the company’s management has been arguing with its lawyers over whether or not […]

The embattled crypto lending platform Celsius has kept withdrawals and transfers frozen since June 12 and told the Celsius Network community that the “process will take time.” Since then, Celsius users are wondering why they are still receiving weekly rewards, and reportedly the company’s management has been arguing with its lawyers over whether or not […]