On Sunday, Feb. 12, 2023, the domain registrar Namecheap’s email account was compromised by hackers. Subsequently, a large number of individuals received phishing emails claiming to be from Metamask and DHL. These emails originated from the email platform Sendgrid, a service used by Namecheap for marketing correspondence. Namecheap Confirms Email Account Compromise and Disables Sendgrid […]

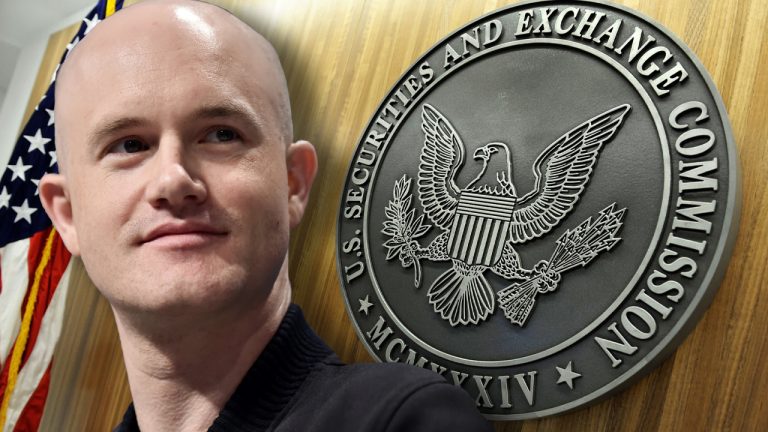

On Sunday, Feb. 12, 2023, the domain registrar Namecheap’s email account was compromised by hackers. Subsequently, a large number of individuals received phishing emails claiming to be from Metamask and DHL. These emails originated from the email platform Sendgrid, a service used by Namecheap for marketing correspondence. Namecheap Confirms Email Account Compromise and Disables Sendgrid […] Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […]

Brian Armstrong, CEO of Coinbase, expressed concern about rumors that the U.S. Securities and Exchange Commission (SEC) may eliminate cryptocurrency staking for retail customers in the United States. Armstrong insisted that “staking is not a security” and that the trend allows users to “participate directly in running open crypto networks.” Coinbase CEO Vocalizes Worry Over […] Judge John Dorsey has delayed his decision on whether to appoint an independent examiner in the FTX case. At the latest hearing, Dorsey acknowledged that the cost to debtors could reach tens of millions of dollars. Currently, the bankruptcy judge is hopeful that the issue will be resolved through a mutually agreed upon solution between […]

Judge John Dorsey has delayed his decision on whether to appoint an independent examiner in the FTX case. At the latest hearing, Dorsey acknowledged that the cost to debtors could reach tens of millions of dollars. Currently, the bankruptcy judge is hopeful that the issue will be resolved through a mutually agreed upon solution between […] As the artificial intelligence (AI) wars intensify, the AI firm Anthropic has raised $300 million from Google and sources say that the tech giant will get roughly a 10% stake in the AI company. Interestingly, in April 2022, Anthropic raised approximately $500 million from sources including Sam Bankman-Fried (SBF), co-founder of FTX; Caroline Ellison, former […]

As the artificial intelligence (AI) wars intensify, the AI firm Anthropic has raised $300 million from Google and sources say that the tech giant will get roughly a 10% stake in the AI company. Interestingly, in April 2022, Anthropic raised approximately $500 million from sources including Sam Bankman-Fried (SBF), co-founder of FTX; Caroline Ellison, former […] According to research from Recap, a cryptocurrency tax software company, London has become the world’s leading hub for cryptocurrencies. The researchers analyzed eight indicators, including the number of cryptocurrency businesses and the quantity of cryptocurrency ATMs in each country. Key Findings of Recap’s Study on Global Cryptocurrency Hubs Crypto tax firm Recap released a research […]

According to research from Recap, a cryptocurrency tax software company, London has become the world’s leading hub for cryptocurrencies. The researchers analyzed eight indicators, including the number of cryptocurrency businesses and the quantity of cryptocurrency ATMs in each country. Key Findings of Recap’s Study on Global Cryptocurrency Hubs Crypto tax firm Recap released a research […] On Jan. 26, 2023, the cryptocurrency asset aptos (APT) reached an all-time high and then lost 20% of its value over the next five days. In the past 24 hours, it also shed 8.3% against the U.S. dollar. Despite the decline from its all-time high, APT is still up 349% compared to last month’s exchange […]

On Jan. 26, 2023, the cryptocurrency asset aptos (APT) reached an all-time high and then lost 20% of its value over the next five days. In the past 24 hours, it also shed 8.3% against the U.S. dollar. Despite the decline from its all-time high, APT is still up 349% compared to last month’s exchange […] Seven months ago, current Twitter owner Elon Musk said, prior to acquiring the social media giant, he would integrate cryptocurrency payments. According to sources, a team is working on the infrastructure for a payment platform, and Twitter is proceeding with regulatory approvals and registrations. Elon Musk’s Plan for Twitter Payment System Advances, Adding Cryptocurrency Later […]

Seven months ago, current Twitter owner Elon Musk said, prior to acquiring the social media giant, he would integrate cryptocurrency payments. According to sources, a team is working on the infrastructure for a payment platform, and Twitter is proceeding with regulatory approvals and registrations. Elon Musk’s Plan for Twitter Payment System Advances, Adding Cryptocurrency Later […] The crypto firm Matrixport, led by former Bitmain CEO Jihan Wu, is laying off 10% of the company’s staff, according to reports published on Friday. Matrixport’s COO, Cynthia Wu, cited a “shift in the regulatory climate” and “industry-wide capitulations” as reasons for the layoffs. Matrixport Lays Off 10% of Staff as Crypto Winter Continues Jihan […]

The crypto firm Matrixport, led by former Bitmain CEO Jihan Wu, is laying off 10% of the company’s staff, according to reports published on Friday. Matrixport’s COO, Cynthia Wu, cited a “shift in the regulatory climate” and “industry-wide capitulations” as reasons for the layoffs. Matrixport Lays Off 10% of Staff as Crypto Winter Continues Jihan […]

Grayscale’s chief was the latest to take a swing at the authority for its so-called “regulation by enforcement” actions.

The approach to crypto regulatory enforcement by the United States Securities and Exchange Commission (SEC) stalled the advancement of Bitcoin (BTC) in the country, according to the CEO of Grayscale Investments.

In a letter published in The Wall Street Journal on Jan. 23, the chief of the cryptocurrency asset management firm, Michael Sonnenshein, said he agreed with an assertion that the SEC was “late to the game” regarding crypto regulation and preventing the bankruptcy of FTX, adding:

“‘Late’ doesn’t capture what transpired here. The problem is the Securities and Exchange Commission’s one-dimensional approach of regulation by enforcement.”

Grayscale is currently suiting the SEC for denying the conversion of its Bitcoin trust to a spot-based Exchange Traded Fund (ETF).

He clarified the SEC “should certainly try to eliminate bad actors” but it shouldn’t hinder “efforts to develop appropriate regulation.”

Doing our part to re-instill trust and confidence in #bitcoin and #crypto cc @Grayscale @CraigSalm @jenn_rosenthal $GBTC pic.twitter.com/u72RHmGTmJ

— Sonnenshein (@Sonnenshein) January 23, 2023

The inaction by the regulator to stop such bad actors from entering the crypto industry “prevented Bitcoin's advancement into the U.S. regulatory perimeter” according to Sonnenshein.

This has thus forced American investors to offshore crypto businesses “with less protection and oversight," he said.

“We are seeing the consequences of the SEC’s priorities play out in real-time — at the expense of U.S. investors.”

Cointelegraph has reached out to the Securities and Exchange Commission for comment.

Sonnenshein’s opinion piece comes amid an ongoing lawsuit between Grayscale and the SEC for having “arbitrarily denied” Grayscale’s plans to convert its Grayscale Bitcoin Trust (GBTC) to a spot ETF.

The SEC argued Grayscale’s proposal did not sufficiently protect against fraud and manipulation. Grayscale countered saying the SEC was arbitrarily treating spot-traded products differently from futures-traded products.

Grayscale is owned by the crypto conglomerate Digital Currency Group (DCG), which is currently undergoing financial difficulties.

DCG also owns the bankrupt Genesis Trading which was charged by the SEC on Jan. 12 for allegedly selling unregistered securities.

Related: SEC leaked crypto miners’ personal information during investigation: Report

Over the weekend, John Reed Stark, a crypto skeptic and former SEC chief lambasted the term “regulation by enforcement” labeling it a “Bogus Big Crypto Catch Phrase.”

In a Jan. 22 post on Linkedin, he said the term was a “misguided, deflective effort designed to tap into sympathetic libertarian and anti-regulatory mores” calling it “utter nonsense.”

He argued that “litigation and SEC enforcement are actually how securities regulation works.”

Following recent disclosure that FTX debtors and bankruptcy administrators located $5.5 billion in liquid assets, the new FTX CEO John J. Ray III discussed the business in his first interview since taking over the exchange’s restructuring process. Ray detailed during the interview that he is open to the possibility of reviving the now-defunct digital currency […]

Following recent disclosure that FTX debtors and bankruptcy administrators located $5.5 billion in liquid assets, the new FTX CEO John J. Ray III discussed the business in his first interview since taking over the exchange’s restructuring process. Ray detailed during the interview that he is open to the possibility of reviving the now-defunct digital currency […]