Brian Quintenz, Head of Policy at Andreessen Horowitz’s (a16z) crypto division and a fierce champion for crypto innovation, has been nominated by Donald Trump to lead the CFTC. Trump’s CFTC Pick Brian Quintenz Praised for Pro-Crypto Stance and Regulatory Vision Brian Quintenz announced on social media platform X on Feb. 12 that he has been […]

Brian Quintenz, Head of Policy at Andreessen Horowitz’s (a16z) crypto division and a fierce champion for crypto innovation, has been nominated by Donald Trump to lead the CFTC. Trump’s CFTC Pick Brian Quintenz Praised for Pro-Crypto Stance and Regulatory Vision Brian Quintenz announced on social media platform X on Feb. 12 that he has been […] A Florida man must repay over $7.6 million after deceiving investors with a fake cryptocurrency, using their funds for luxury goods instead of promised assets. Cryptocurrency Fraudster Ordered to Repay Millions A federal court has ruled that Randall Crater of Heathrow, Florida, must pay more than $7.6 million in restitution for deceiving investors through a […]

A Florida man must repay over $7.6 million after deceiving investors with a fake cryptocurrency, using their funds for luxury goods instead of promised assets. Cryptocurrency Fraudster Ordered to Repay Millions A federal court has ruled that Randall Crater of Heathrow, Florida, must pay more than $7.6 million in restitution for deceiving investors through a […]

The U.S. Commodity Futures Trading Commission (CFTC) plans to hold a “CEO forum” for the heads of digital asset firms. The summit will include participants from Ripple, Coinbase, Circle, Crypto.com and MoonPay and will involve discussions about the “launch of the CFTC’s digital asset markets pilot program for tokenized non-cash collateral such as stablecoins,” according […]

The post CFTC Acting Chairman To Hold a Crypto Summit To Discuss the Launch of ‘Digital Asset Markets Pilot Program’ appeared first on The Daily Hodl.

The Commodity Futures Trading Commission (CFTC) which regulates the U.S. derivatives market said it will hold a CEO Forum with leaders from Coinbase, Ripple, Circle, Crypto.com, and Moonpay to evaluate a digital asset markets pilot program. The announcement was made on Friday and the purpose of the program will be to establish regulatory clarity around […]

The Commodity Futures Trading Commission (CFTC) which regulates the U.S. derivatives market said it will hold a CEO Forum with leaders from Coinbase, Ripple, Circle, Crypto.com, and Moonpay to evaluate a digital asset markets pilot program. The announcement was made on Friday and the purpose of the program will be to establish regulatory clarity around […]

US-based crypto exchange platform Gemini is reportedly mulling over pursuing an initial public offering (IPO) in 2025. According to a new report by Bloomberg, anonymous people familiar with the matter say the billionaire Winklevoss twins’ crypto firm is considering launching an IPO sometime this year. An IPO is when a company sells shares of its […]

The post US-Based Crypto Exchange Gemini Considering IPO Launch Later This Year: Report appeared first on The Daily Hodl.

The U.S. Commodity Futures Trading Commission (CFTC) has pushed back against Super Bowl event contracts launched by the exchange Crypto.com and the retail betting market Kalshi. The retail trading giant Robinhood announced on Monday that it planned to roll out a prediction market for the Super Bowl on Kalshi. The company walked back that announcement […]

The post CFTC Investigates Crypto.com and Kalshi for Super Bowl Event Contracts appeared first on The Daily Hodl.

The CFTC has launched public roundtables to discuss market structure innovation, focusing on prediction markets and digital assets. Balancing Innovation and Investor Protection The Commodity Futures Trading Commission (CFTC) has launched a series of public roundtables to discuss innovation in market structure. According to the Commission’s chairperson, Caroline D. Pham, the series will focus on […]

The CFTC has launched public roundtables to discuss market structure innovation, focusing on prediction markets and digital assets. Balancing Innovation and Investor Protection The Commodity Futures Trading Commission (CFTC) has launched a series of public roundtables to discuss innovation in market structure. According to the Commission’s chairperson, Caroline D. Pham, the series will focus on […] The CFTC’s new leadership will prioritize cryptocurrency, defi, and digital asset oversight, signaling a shift in regulatory focus toward innovation and market engagement. CFTC and SEC Leadership Transitions Mark Crypto Policy Shift Acting Chairman Caroline D. Pham of the U.S. Commodity Futures Trading Commission (CFTC) announced on Jan. 22 significant leadership changes, underscoring the agency’s […]

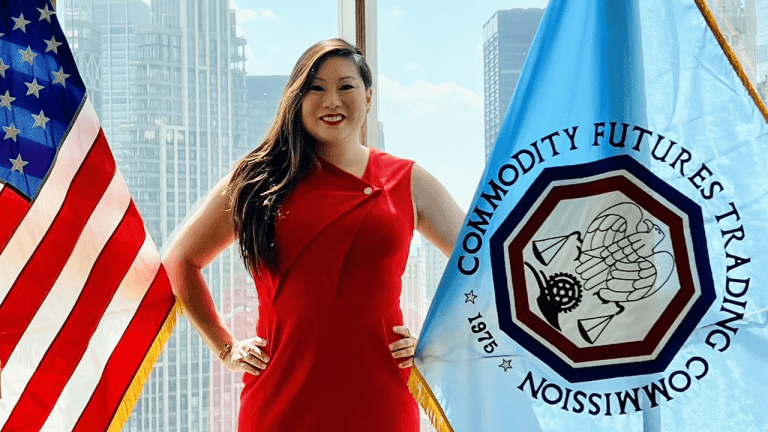

The CFTC’s new leadership will prioritize cryptocurrency, defi, and digital asset oversight, signaling a shift in regulatory focus toward innovation and market engagement. CFTC and SEC Leadership Transitions Mark Crypto Policy Shift Acting Chairman Caroline D. Pham of the U.S. Commodity Futures Trading Commission (CFTC) announced on Jan. 22 significant leadership changes, underscoring the agency’s […] President Donald Trump has designated Commissioner Caroline Pham as the acting chair of the Commodity Futures Trading Commission (CFTC), heralding a pivotal shift in the leadership of the regulatory institution tasked with overseeing derivatives markets and digital assets. Caroline Pham Sworn in as CFTC Acting Chair Caroline Pham, a Republican commissioner appointed under former President […]

President Donald Trump has designated Commissioner Caroline Pham as the acting chair of the Commodity Futures Trading Commission (CFTC), heralding a pivotal shift in the leadership of the regulatory institution tasked with overseeing derivatives markets and digital assets. Caroline Pham Sworn in as CFTC Acting Chair Caroline Pham, a Republican commissioner appointed under former President […] A crypto firm has been fined $1.1 million for deceiving customers and misusing funds, as the CFTC highlights growing concerns about unregistered investment schemes. CFTC Strikes: Fraudulent Crypto Firm Banned, $1.1 Million Fine Issued The Commodity Futures Trading Commission (CFTC) announced on Monday that Mosaic Exchange Ltd. and its CEO, Sean Michael, have been ordered […]

A crypto firm has been fined $1.1 million for deceiving customers and misusing funds, as the CFTC highlights growing concerns about unregistered investment schemes. CFTC Strikes: Fraudulent Crypto Firm Banned, $1.1 Million Fine Issued The Commodity Futures Trading Commission (CFTC) announced on Monday that Mosaic Exchange Ltd. and its CEO, Sean Michael, have been ordered […]