Disgraced FTX founder Sam Bankman-Fried reportedly dined with a member of the US Commodity Futures Trading Commission (CFTC), the same federal agency he sought to have regulate the crypto industry, shortly before the crypto exchange collapsed. According to a new report by the Los Angeles Times, FTX employed several former federal regulators, which gave Bankman-Fried […]

The post Sam Bankman-Fried and FTX Executives Met With CFTC Commissioner for Dinner in October 2021: Report appeared first on The Daily Hodl.

Avi Eisenberg’s arrest on commodities fraud charges for the Mango Markets exploit raised eyebrows on crypto Twitter and required some processing to work through its intricacies.

Avraham Eisenberg was arrested in Puerto Rico on Dec. 26 on commodities fraud and manipulation charges relating to the $110 million exploit of the decentralized Mango Markets exchange. Eisenberg had self-identified as the actor behind what he called a “highly profitable trading strategy” and insisted that he had taken “legal open market actions, using the protocol as designed.”

Eisenberg’s arrest predictably lit up crypto Twitter, with some observers paying particular attention to the fact that commodities fraud charges were being pressed in a case involving a crypto coin:

“AVRAHAM EISENBERG, the defendant, willfully and knowingly, directly and indirectly, used and employed, and attempted to use and employ, in connection with a swap, a contract of sale of a commodity in interstate and foreign commerce.”

looks like the Department of Justice is calling MNGO and/or CRV commodities (and not securities)!!!! pic.twitter.com/ZklOlubR8u

— scott (@scott_lew_is) December 27, 2022

Eisenberg had manipulated the price of the exchange’s MNGO coin relative to the USDC (USDC) stablecoin and then took out loans against his collateral. For this, Eisenberg was charged with commodities fraud. In the charges against Eisenberg, U.S. Federal Bureau of Investigation special agency Brandon Racz wrote:

“I understand that virtual currencies, such as USDC, are ‘commodities’ under the Commodity Exchange Act.”

DoJ: "USDC is a Commodity"

— Mike Stroup (@MikeStroup10) December 29, 2022

Guy: "See! Shitcoins like Mango are a commodity, thats totally what the DoJ said."

This is why you pay lawyers folks. Do not do your own lawyer-ing at home, you will get rekt. https://t.co/N9n7k4UdzK

The agent’s understanding that stablecoins are commodities is only partially backed up by government policy, although it cites the McDonnell case prosecuted by the U.S. Commodities Futures Trading Commission (CFTC) as precedent. The claim that USDC is a commodity is not as controversial as claiming the same for MNGO, but may have bee a conscious choice.

(4) the fact that the case doesn't characterize the relevant tokens as securities is not in any way bullish/positive and merely arises from litigation strategy--the fewer predicate issues the govt has to litigate in its case, the better

— _gabrielShapir0 (@lex_node) December 27, 2022

The legal strategy behind the DOJ’s choice of the Commodity Exchange Act (CEA) to prosecute the case seemed to be grounded in expediency. For one thing, the CEA addresses price manipulation directly.

Related: Hackers copied Mango Markets attacker’s methods to exploit Lodestar — CertiK

In addition, the CFTC is often seen as taking a softer approach to crypto regulation than the SEC, although that perception is disputable.

On Dec. 23, 2022, Matthew Russell Lee from the Inner City Press published the recently unsealed guilty plea transcript of Caroline Ellison, Alameda Research’s former CEO. In her statements, Ellison describes that she was the co-CEO and CEO of Alameda, and under those roles, she reported directly to the former FTX CEO Sam Bankman-Fried (SBF). […]

On Dec. 23, 2022, Matthew Russell Lee from the Inner City Press published the recently unsealed guilty plea transcript of Caroline Ellison, Alameda Research’s former CEO. In her statements, Ellison describes that she was the co-CEO and CEO of Alameda, and under those roles, she reported directly to the former FTX CEO Sam Bankman-Fried (SBF). […]

"After thirty-four years of public service, it is time for me to pursue new and different challenges and opportunities," said Dan Berkovitz.

Dan Berkovitz, general counsel for the United States Securities and Exchange Commission, said he will be leaving the agency after more than a year.

In a Dec. 22 announcement, the SEC said Berkovitz will depart on Jan. 31. A former commissioner with the Commodity Futures Trading Commission, Berkovitz joined the agency in November 2021. At the time, he said he planned to work with SEC chair Gary Gensler on a “regulatory agenda that will enhance investor protection.”

"After thirty-four years of public service, it is time for me to pursue new and different challenges and opportunities," said Berkovitz.

It's unclear whether Berkovitz intends to join the private sector after leaving the SEC. Brian Quintenz, who served as a CFTC commissioner from 2017 to 2021, joined venture capital firm Andreessen Horowitz in September 2021 as an advisor to the company's crypto team.

Megan Barbero, the SEC principal deputy general counsel, will assume Berkovitz’s position upon his departure. Gensler said her advancement came at a “critical time” for the SEC.

During his time at the CFTC, Berkovitz said the agency’s enforcement actions in the crypto space were “aggressive,” citing a $100 million civil monetary penalty against derivatives exchange BitMEX. Many have also criticized Gensler and the SEC for the agency’s “regulation by enforcement” approach to crypto.

Related: SEC files unregistered securities charges against Thor Token creators for 2018 ICO

In 2022, the SEC specifically labeled nine tokens as “crypto asset securities” in an insider trading case involving a former manager at crypto exchange Coinbase. The agency has also announced charges against former FTX CEO Sam Bankman-Fried for allegedly defrauding customers and diverting the exchange’s funds to Alameda.

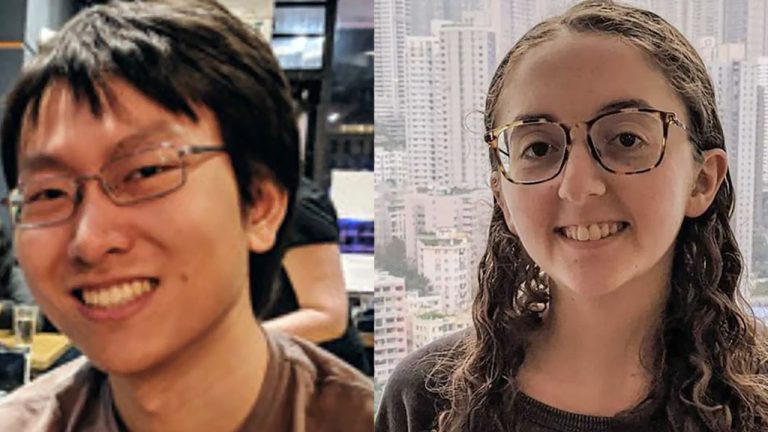

On Dec. 21, 2022, members of U.S. law enforcement detailed that FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison have pleaded guilty to financial fraud charges. The recent charges against Wang and Ellison highlight some key findings and according to the U.S. Securities and Exchange Commission (SEC), FTX’s exchange token FTT is considered […]

On Dec. 21, 2022, members of U.S. law enforcement detailed that FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison have pleaded guilty to financial fraud charges. The recent charges against Wang and Ellison highlight some key findings and according to the U.S. Securities and Exchange Commission (SEC), FTX’s exchange token FTT is considered […] On Dec. 21, U.S. law enforcement officials from the Southern District of New York (SDNY), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC) revealed they imposed fraud charges against FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison. After Wang’s and Ellison’s surrender announcement, the public has been wondering […]

On Dec. 21, U.S. law enforcement officials from the Southern District of New York (SDNY), the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC) revealed they imposed fraud charges against FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison. After Wang’s and Ellison’s surrender announcement, the public has been wondering […]

Arrested crypto billionaire Sam Bankman-Fried's former entourage faces additional charges by key U.S. government agencies.

The United States Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC) have hit former Alameda Research CEO Caroline Ellison and former FTX co-founder Gary Wang with fresh fraud charges.

The new charges from the SEC and CFTC come as the pair plead guilty to federal fraud charges filed by the U.S. Department of Justice (DOJ) earlier on Dec. 22.

SEC states that Ellison and Wang were charged for their role in the "multiyear scheme to defraud equity investors in FTX,” with the SEC also investigating whether other securities laws were violated as well.

The SEC alleges that Ellison, under the direction of former FTX CEO Sam Bankman-Fried, furthered the scheme by manipulating the price of FTX Token (FTT), which is described as a crypto security token in the document. The said manipulation was conducted by “purchasing large quantities on the open market to prop up its price,” which took effect between 2019 and 2022.

As for the CFTC’s charges, amendments were made to its Dec. 13 fraud filing against Samuel Bankman-Fried, FTX Trading, and Alameda Research to now include Ellison and Wang as named defendants.

The amended complaint now lays charges against Ellison for “fraud and material misrepresentations in connection with the sale of digital asset commodities in interstate commerce.” As for Wang, the former FTX exec has been charged with “fraud in connection with the sale of digital asset commodities in interstate commerce.”

As for the conduct involved that led to the charges, both the SEC and CFTC allege that Wang created FTX’s software code that enabled Alameda to divert customer funds from FTX, which then allowed Ellison to misappropriate those funds for Alameda’s trading activities.

Related: SBF signs extradition papers, set to return to face charges in the US

Former FTX CEO Sam Bankman-Fried has also reportedly landed in the U.S. after being extradited from The Bahamas for fraud charges laid by the U.S. Government. The indictment against SBF is signed by the U.S. Attorney for the Southern District of New York, Damian Williams, and contains eight counts.

SBF is facing charges from the Justice Department, along with SEC and CFTC, for defrauding investors and lenders. Royal Bahamas police arrested the former crypto billionaire on Dec. 12, and his initial application for bail was denied in a Bahamian court.

On Dec. 21, 2022, U.S. attorney Damian Williams announced that the Southern District of New York (SDNY) Department of Justice (DOJ) filed charges against Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang. Williams declared that both Ellison and Wang have been cooperating with law enforcement officials. The U.S. Securities and Exchange Commission (SEC) […]

On Dec. 21, 2022, U.S. attorney Damian Williams announced that the Southern District of New York (SDNY) Department of Justice (DOJ) filed charges against Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang. Williams declared that both Ellison and Wang have been cooperating with law enforcement officials. The U.S. Securities and Exchange Commission (SEC) […]

The FTX founder has reportedly signed on the dotted line, bringing him a step closer to returning to US soil.

Sam Bankman-Fried, the jailed founder of the FTX cryptocurrency exchange has reportedly signed papers on Dec. 20 waiving his extradition hearing in the Bahamasand see him flown to the United States to face multiple criminal charges.

A hearing in the Bahamas Supreme Court was set for Dec. 21 regarding the matter. Bankman-Fried reportedly wanted to see the indictment against him before he agreed to extradition to the U.S. and was expected to drop his extradition fight according to reports on Dec. 19.

ABC News first reported the development on Dec. 20 citing the Bahamas acting commissioner of corrections Doan Cleare.

Cointelegraph contacted the acting commissioner’s office for confirmation but did not immediately receive a response.

With the papers signed, Bankman-Fried should be permitted to transit to New York where he faces eight counts in an indictment from the U.S. Attorney for the Southern District of New York.

He faces charges from the Department of Justice relating to wire fraud, conspiracy to commit money laundering, conspiracy to commit wire, commodities and securities fraud, and campaign finance violations.

The FTX founder faces further charges relating to commodity law violations and defrauding investors from the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) respectively.

The charges carry a maximum sentence of 115 years in prison if convicted of all counts.

Meanwhile, a Dec. 20 Instagram post from local media outlet Bahamas Press claiming Bankman-Fried was “rushed” to hospital from prison had made the rounds on social media, but was later debunked.

Related: SBF's legal battle still has "a lot to play out," according to legal commentators

New York Times financial reporter Rob Copeland tweeted soon after that he spoke to the head of the prison who said the exchange founder was eating lunch in the medical bay and that the rumor was false.

There are reports that @SBF_FTX was rushed from his Bahamian prison to the hospital.

— Rob Copeland (@realrobcopeland) December 20, 2022

These are false, the head of the prison tells me. As a few moments ago, Sam was eating lunch. He is still there in the medical bay where he has been held in a single room with four roommates.

Soon after, Bahamas Press posted an update saying its sources were now reporting the claim was untrue.

The entrepreneur reportedly reconsidered his earlier decision to contest extradition and now would be able to appear in a United States court.

Welcome to Law Decoded, your weekly digest of all the major developments in the field of regulation.

The FTX drama escalated last week when the Royal Bahamas Police Force arrested its former CEO, Sam Bankman-Fried, at the request of the United States government. Within hours, politicians, crypto executives and influencers had all booted up their Twitter apps to comment on the arrest of the former CEO, who had to miss his testimony before the U.S. Congress. However, the text of SBF’s planned testimony was obtained by the media, wherein he blamed the inclusion of FTX.US in the Chapter 11 bankruptcy on John J. Ray III, a restructuring lawyer who assumed the role of FTX CEO after the bankruptcy filing.

The body of allegations against FTX and SBF personally is stacking up. The United States Securities and Exchange Commission (SEC) charged Bankman-Fried with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. At the same time, the Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Sam Bankman-Fried, FTX and Alameda Research, claiming violations of the Commodity Exchange Act and demanding a jury trial. A fresh indictment, signed by United States Attorney for the Southern District of New York Damian Williams, is 14 pages long and contains eight counts.

Bankman-Fried reportedly reconsidered his earlier decision to contest extradition and is expected to appear in court in the Bahamas on Dec. 19 to seek a reversal. By consenting to extradition, he would be able to appear in a United States court, where If convicted, he could get up to 115 years in jail. However, there is a “lot to play out” in the case until he gets a final sentence within the next few months or even years, legal commentators told Cointelegraph.

U.S. Senators Elizabeth Warren and Roger Marshall introduced the Digital Asset Anti-Money Laundering Act of 2022. The seven-page bill would expand the classification of a money service business (MSB), prohibit financial institutions from using technology such as digital asset mixers and regulate digital asset kiosks, otherwise known as ATMs.

Money service businesses would be required to have written Anti-Money Laundering policies and to implement them. The bill would finalize reporting requirements already proposed by FinCEN and impose new requirements, including reporting transactions over $10,000 in accordance with the Bank Secrecy Act.

The Canadian Securities Administrators (CSA), the council of Canada’s provincial and territorial securities regulators, issued an update to crypto trading platforms operating in the country. According to the statement, all crypto trading firms operating in Canada — both local and foreign ones — have to comply with newly expanded terms, which ban them from offering margin or leverage trading services to any Canadian clients. The expanded terms also require crypto exchange services providers in Canada to segregate custody assets from the platform’s proprietary business.

The Nigerian government will reportedly soon pass a law that will recognize the usage of Bitcoin (BTC) and other cryptocurrencies as a means to keep up to date with global practices. If the Investments and Securities Act 2007 (Amendment) Bill is signed into law, it would allow the local Securities and Exchange Commission to “recognize cryptocurrency and other digital funds as capital for investment.”

The report comes almost 24 months after Nigeria banned crypto activity in February 2021, with the Central Bank of Nigeria (CBN) ordering local crypto exchanges and service providers to cease activity and mandating banks to shutter the accounts of any individuals or entities found to be engaging in trading activities.