The institutional arm of US-based digital asset exchange platform Coinbase says crypto investors should be prepared for more consolidation this quarter. According to new research by Coinbase Institutional, crypto traders are wary of the possibility that the US economy will experience a recession. However, Coinbase says bullish catalysts are on the horizon as long as […]

The post Coinbase Institutional Forecasts Choppy Q3, Says Crypto Still Lacking Strong Narratives appeared first on The Daily Hodl.

The third quarter of 2024 has been tumultuous for the crypto market, with significant selling pressures and regulatory uncertainties affecting bitcoin and other digital assets. Coinbase Institutional reports that indiscriminate selling by the German government and the Mt Gox Rehabilitation Trust repayments have contributed to market volatility. Coinbase Institutional Highlights Bitcoin Sales Impact on Crypto […]

The third quarter of 2024 has been tumultuous for the crypto market, with significant selling pressures and regulatory uncertainties affecting bitcoin and other digital assets. Coinbase Institutional reports that indiscriminate selling by the German government and the Mt Gox Rehabilitation Trust repayments have contributed to market volatility. Coinbase Institutional Highlights Bitcoin Sales Impact on Crypto […] Cryptocurrency exchange Coinbase says bitcoin dips are likely to be “more aggressively bought compared to previous cycles, even as volatility persists during price discovery.” The crypto firm noted that the impact of U.S. spot bitcoin exchange-traded funds (ETFs) and the larger inflow of institutional demand can be seen in the open interest of bitcoin futures. […]

Cryptocurrency exchange Coinbase says bitcoin dips are likely to be “more aggressively bought compared to previous cycles, even as volatility persists during price discovery.” The crypto firm noted that the impact of U.S. spot bitcoin exchange-traded funds (ETFs) and the larger inflow of institutional demand can be seen in the open interest of bitcoin futures. […]

The research branch of top US-based crypto exchange platform Coinbase says that going forward, investors are likely to aggressively purchase Bitcoin (BTC) when it dips. In a new blog post, Coinbase Institutional says that gold is a winner this cycle due to rising economic and geopolitical concerns. According to Coinbase, the success of gold can […]

The post Bitcoin Dips Likely To Be Aggressively Bought Up As Investors See BTC As Digital Gold, Says Coinbase Institutional appeared first on The Daily Hodl.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy. Coinbase’s Halving Handbook The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a […]

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy. Coinbase’s Halving Handbook The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a […] On August 4, the head of Coinbase Institutional, Brett Tejpaul, and the vice president of institutional product, Greg Tusar, announced that Coinbase has been selected by the financial giant Blackrock to provide the firm’s Aladdin platform access to cryptocurrencies. Blackrock Chooses Coinbase to Connect Aladdin Clients to Crypto Coinbase’s institutional arm will help the world’s […]

On August 4, the head of Coinbase Institutional, Brett Tejpaul, and the vice president of institutional product, Greg Tusar, announced that Coinbase has been selected by the financial giant Blackrock to provide the firm’s Aladdin platform access to cryptocurrencies. Blackrock Chooses Coinbase to Connect Aladdin Clients to Crypto Coinbase’s institutional arm will help the world’s […]Tl;dr: Coinbase and BlackRock to create new access points for institutional crypto adoption by connecting Coinbase Prime and Aladdin

By Brett Tejpaul, Head of Coinbase Institutional and Greg Tusar, Vice President, Institutional Product

Over the past few years, Coinbase has played a central role in developing and strengthening crypto markets as the safest, most trusted bridge to the cryptoeconomy. Today marks an exciting next step on our journey as we announce that Coinbase is partnering with BlackRock, the world’s largest asset manager, to provide institutional clients of Aladdin®, BlackRock’s end-to-end investment management platform, with direct access to crypto, starting with bitcoin, through connectivity with Coinbase Prime. Coinbase Prime will provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase.

Built for institutions, Coinbase Prime integrates advanced agency trading, custody, prime financing, staking, and staking infrastructure, data, and reporting that supports the entire transaction lifecycle. We combine these capabilities with leading security, insurance, and compliance practices to provide institutional clients of Coinbase with a full-service platform to access crypto markets at scale. Coinbase’s clients include hedge funds, asset allocators, financial institutions, corporate treasuries and other institutions.

Our scale, experience and integrated product offering represented what BlackRock believes to be a logical partner for Aladdin.

“Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets,” said Joseph Chalom, Global Head of Strategic Ecosystem Partnerships at BlackRock. “This connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes.”

The Coinbase partnership between BlackRock and Aladdin is an exciting milestone for our firm. As the trusted partner enabling institutions to participate and transact in the cryptoeconomy, we are committed to pushing the industry forward and creating new access points as institutional crypto adoption continues to rapidly accelerate. We are honored to partner with an industry leader and look forward to furthering Coinbase’s goal of providing greater access and transparency to crypto.

BlackRock and Coinbase will continue to progress the platform integration and will roll out functionality in phases to interested clients. Access is available for institutions contracted with both Aladdin and Coinbase. To gain access or learn more about the capabilities, please reach out to aladdinpartnership@coinbase.com.

About Coinbase Prime

Coinbase Prime is the leading institutional prime broker platform for crypto assets, trusted by over 13,000 institutional clients.

Coinbase Prime is a fully integrated platform built specifically for institutions to support the entire transaction lifecycle including advanced multi-venue agency trade execution for 200 assets, custody for more than 300 assets, prime financing, staking and staking infrastructure, data and analytics, and reporting.

Institutions can access Coinbase Prime directly via a user interface or as an integrated platform via APIs to offer crypto related products such as ETPs and ETFs, custodial solutions, or brokerage for institutional, private wealth, and retail clients.

Coinbase Prime’s custodian, Coinbase Custody Trust Company, is a qualified custodian and a New York limited purpose trust company regulated by the New York Department of Financial Services. Coinbase Custody Trust Company is a fiduciary under New York state banking law.

To learn more about Coinbase Institutional’s solutions, including more information about Coinbase Prime, click here.

Disclaimer: This content is intended for informational purposes only, and does not constitute the provision of investment advice. For more information, please visit www.coinbase.com.

Coinbase selected by BlackRock; provide Aladdin clients access to crypto trading and custody via… was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

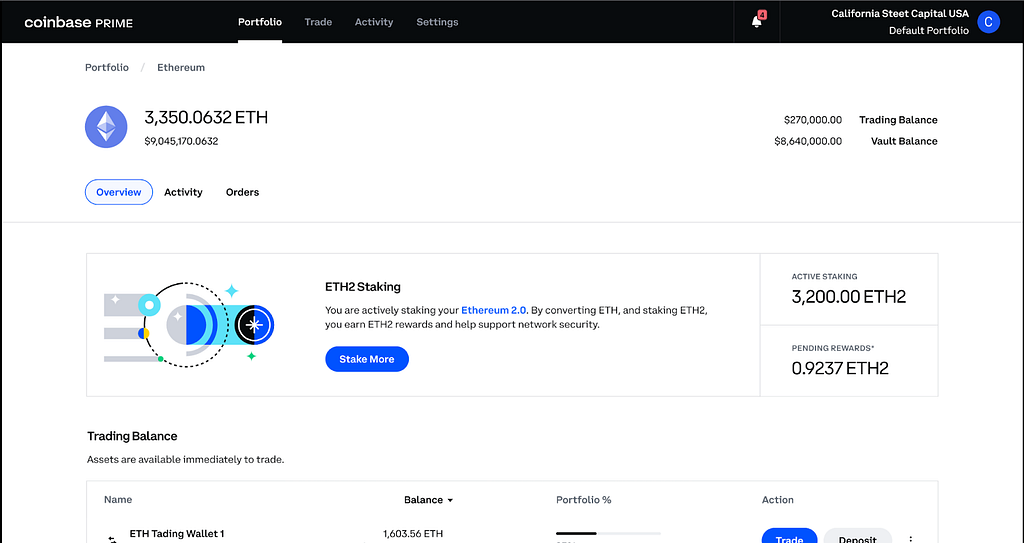

Tl:dr: We’re launching Ethereum staking to US domestic institutional clients on Coinbase Prime. Using our industry-leading cold storage, clients can now generate yield by staking ETH.

By Aaron Schnarch, Vice President of Product, Custody

Fully-integrated staking on Coinbase Prime

Coinbase Prime provides institutions with an end-to-end staking experience. Clients can create a wallet, decide how much to stake, and initiate staking from the ETH asset page on their Coinbase Prime account.

Securing client funds is our highest priority. We hold withdrawal keys in our cold storage custody vault at all times, meaning staked ETH and accumulated yield are always safe. To further ensure the security of client accounts, staking transactions must first complete consensus before they are executed.

ETH vs ETH2

The term eth2 has been used frequently to describe an upgrade to the Ethereum network that aims to improve the network’s security and scalability. This upgrade involves a shift in Ethereum’s security model from mining (“Proof-of-Work”) to staking (“Proof-of-Stake”).

Once a client stakes their ETH, our system uses the ticker ETH2 to represent those staked ETH tokens. Note that there is no separate/new “eth2” token or asset. The price of ETH and ETH2 is identical. Once the upgrade to the Ethereum network is complete, the tickers ETH and ETH2 will merge into a single ticker: ETH. The merge is currently expected to occur in September 2022, so moving forward you likely will see the term ETH2 fall into disuse.

Why institutions are staking

Staking can offer passive income on assets already held in custody by providing useful work in the form of security to the underlying blockchain. The Ethereum blockchain rewards stakers that do a good job, but also punishes those that fail in their duties, for example by having downtime. This is why it’s important to stake with a reputable and effective provider to earn maximal rewards while minimizing risk.

Staking rewards for most assets can be thought of similarly to compound interest, not unlike in traditional markets when dividends are reinvested. Because staking rewards are paid in the token being staked, users may “reinvest” those tokens to receive a higher payout at the next period. Furthermore, staked tokens are typically stored within their respective wallets, meaning that users earn yield without rehypothecation.

Staking on Coinbase Prime

With Coinbase Prime, institutional customers have the ability to stake their ETH and a number of other assets to begin generating yield. Staking is also supported for Solana, Polkadot, Cosmos, Tezos, Celo, and more. Read more about institutional staking in our Staking 101 for Institutions article.

Coinbase Prime grows its staking offering with ETH was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

by Brett Tejpaul, Head of Coinbase Institutional, and Elke Karskens, Head of EMEA Marketing

We recently won the Best Prime Broker Award in Hedgeweek’s annual European Digital Assets Awards. This success not only underlines the strength of our platform and our integral role within the cryptoeconomy, particularly in terms of further enabling institutional engagement, but also celebrates the incredible talents of our amazing team here at Coinbase.

Over the past three years we have seen widespread adoption of cryptocurrencies across the world. Coinbase now has over 13,000 institutional clients as of March 2022, including a wide range of banks, introducing brokers, pension funds, corporates, hedge funds and asset managers.

Increased adoption of crypto assets by institutional investors follows the wider trend of the asset class becoming more mainstream, underpinned by a belief in the range of benefits that can be unlocked.

The largest and most sophisticated hedge funds in the world have collectively decided that Coinbase offers the best crypto Prime Broker platform because of its extensive product suite and depth of experience in the sector. Our clients trust us as the largest crypto custodian that also combines multi-venue execution capabilities with a strong balance sheet to enable prime financing. Most clients also take advantage of our full suite of services that is completed by best in class data and analytics and staking directly from cold storage. The robustness of our operations is reinforced by our listing on NASDAQ and validated by the fact we are authorised and regulated by the New York Department of Financial Services.

As a market leader we will continue to work with individuals and other stakeholders in the wider financial and political world to shape policy to create a safer and more efficient financial system that’s accessible to all.

We would like to take this opportunity to publicly thank Coinbase’s entire institutional team for their hard work and dedication through an ever-shifting macro environment. We’re just as passionate and hungry as we’ve always been, and will continue to cement our position as the leading prime broker and digital asset custodian supporting institutions of all kinds in their engagement with the world of cryptocurrency.

Coinbase wins Best Prime Broker Award was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Tl;dr: In recent weeks, some firms have struggled to remain solvent due to insufficient risk controls. See how Coinbase implements secure and comprehensive risk management practices that enable institutions to successfully navigate the cryptoeconomy.

By Brett Tejpaul, Head of Coinbase Institutional, Matt Boyd, Head of Prime Finance, and Caroline Tarnok, Head of Credit and Market Risk

The shocks to the crypto credit environment over the last few weeks are likely to be a major inflection point for the industry. Solvency concerns surrounding entities like Celsius, Three Arrows Capital (3AC), Voyager, and other similar counterparties were a reflection of insufficient risk controls, and reports of additional struggling firms are fast becoming stories of bankruptcy, restructuring, and failure. Notably, the issues here were foreseeable and actually credit specific, not crypto specific in nature. Many of these firms were overleveraged with short term liabilities mismatched against longer duration illiquid assets.

We believe these market participants were caught up in the frenzy of a crypto bull market and forgot the basics of risk management. Unhedged bets, huge investments in the Terra ecosystem, and massive leverage provided to and deployed by 3AC meant that risk was too high and too concentrated. These events are, unfortunately, more common in traditional financial markets than we would hope. We are reminded frequently of Long Term Capital Management in the 1990s, Lehman Brothers in the 2000s, and even Archegos Capital Management in 2021.

Coinbase had no financing exposure to the groups above.¹ We have not engaged in these types of risky lending practices and instead have focused on building our financing business with prudence and deliberate focus on the client. Now, more than ever, our leading institutional clients demand a high-quality financing counterparty.

Our goal is to be the safest, easiest, and most trusted bridge to the cryptoeconomy. We offer the most secure, comprehensive, and scalable products and services — including financing — and our multifaceted risk management programs are designed to protect our clients, our shareholders, and the broader cryptoeconomy.

Prudent risk management is key to our long-term strategy.

At Coinbase, risk management is a first principle in our product design. We hold customer assets 1:1. Any institutional lending activity at Coinbase is at the discretion of the customer and backed by collateral, which serves as a first layer of protection against potential default contagion. Our standard practice is to require 100%+ in collateral, and we always measure risk against a substantially higher stressed price move.

As a result, we have a record of:

We use the following principles to understand and manage counterparty credit risk.

This time isn’t different. This environment isn’t different. That’s why we rely on our risk team, which consists of professionals with decades of experience risk-managing financing businesses across a range of economic cycles. Specifically, our team:

Conducts rigorous due diligence. Counterparties are complicated relationships. Financial, business, and structural considerations form the baseline for credit risk management. Beyond that, a company’s behavior and actions must ultimately match their financial statements and stated business objectives. A management team should be experienced and competent and should, critically, implement checks and balances inside the organization.

Stress tests our exposures. Exposures take a variety of forms, so we evaluate them from a variety of perspectives: size, tenor, directionality, volatility, liquidity, concentration, and correlation to our counterparties’ health. We run Monte Carlo simulations to several standard deviations. Further, in a portfolio, assets and liabilities need to be matched together to mitigate liquidity risk and ensure there is no misalignment in the duration of our borrowing vs. loan making. And all this needs to happen continuously as the environment can change. When it does, the risk has changed.

Understands how things go wrong. Every product, trade, and counterparty has at least one potential point of failure. Every single one. We work to find it, calculate how bad it can be, and target our mitigants to the point of failure.

Anticipates internal deficiencies. The information we have about the future is always imperfect. There are no perfect models, and there are no perfect decisions. Reporting can be incomplete. People miss things, or give the benefit of the doubt. Processes fail. We manage our “known unknowns” and keep a buffer for “unknown unknowns.”

Anticipates external surprises. A mitigation plan is critical. As is knowing what might bring you back to the negotiating table. Leave room for Murphy’s law — and limit the size of risk wherever possible.

We think our careful risk management explains why institutional clients continue to diligently and actively explore our financing products, including during the recent market stress.

A healthy and well functioning financing market is essential to the expansion and sustainability of any economy. We believe well-designed risk management programs will help usher in new waves of capital and fuel the next expansion. A leading prime broker, whether in crypto or other asset classes, should understand and effectively manage counterparty and liquidity risk for the safety of their clients, shareholders, and the market. We do.

Ultimately, it may still take time for the broader industry to learn the right lessons from the systemic deficiencies we have seen. If you would like to explore a counterparty you can trust or learn more about our financing products, contact sales@coinbase.com.

¹ While Coinbase does not have counterparty exposure to the companies listed above, Coinbase’s venture program did make non-material investments in Terraform Labs.

Disclaimer: This document is for informational purposes only, and does not constitute the provision of investment advice. For more information, please consult your Coinbase legal agreement and visit www.coinbase.com.

Institutional Insights: Our Approach to Crypto Financing was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.