On Monday, the San Francisco-based retirement plan provider for small to medium-sized businesses, Forusall, announced the launch of an alternative 401(k) plan that offers in-plan cryptocurrency access. According to the alt 401(k) investment option, Forusall is working with Coinbase Institutional as its retirement plan partner. Forusall and Coinbase’s Institutional Arm Offer Crypto-Infused Alt 401(k) Plan […]

On Monday, the San Francisco-based retirement plan provider for small to medium-sized businesses, Forusall, announced the launch of an alternative 401(k) plan that offers in-plan cryptocurrency access. According to the alt 401(k) investment option, Forusall is working with Coinbase Institutional as its retirement plan partner. Forusall and Coinbase’s Institutional Arm Offer Crypto-Infused Alt 401(k) Plan […]

By Greg Tusar, Vice President, Institutional Product

Coinbase Institutional has become a mainstay for sophisticated investors and institutions that invest in digital assets. With the most complete and robust suite of services, we offer the performance, liquidity, and security that investors need to trade with confidence. We are a leader in the institutional market operating at scale with over 8,000 clients and $122 billion assets on platform as of the end of March 2021. Coinbase Custody supports more than 100 assets across 15 different blockchains.

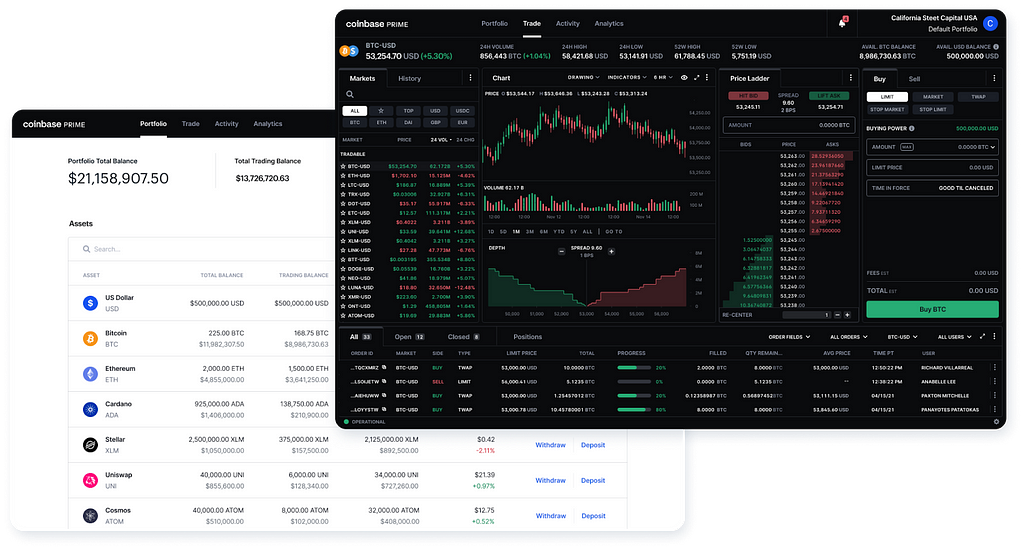

Today we are doubling down on our commitment to serving the growing Institutional market by launching the beta version of Coinbase Prime, our fully integrated prime brokerage solution that provides best-in-class custody, advanced trading, data analytics, and prime services.

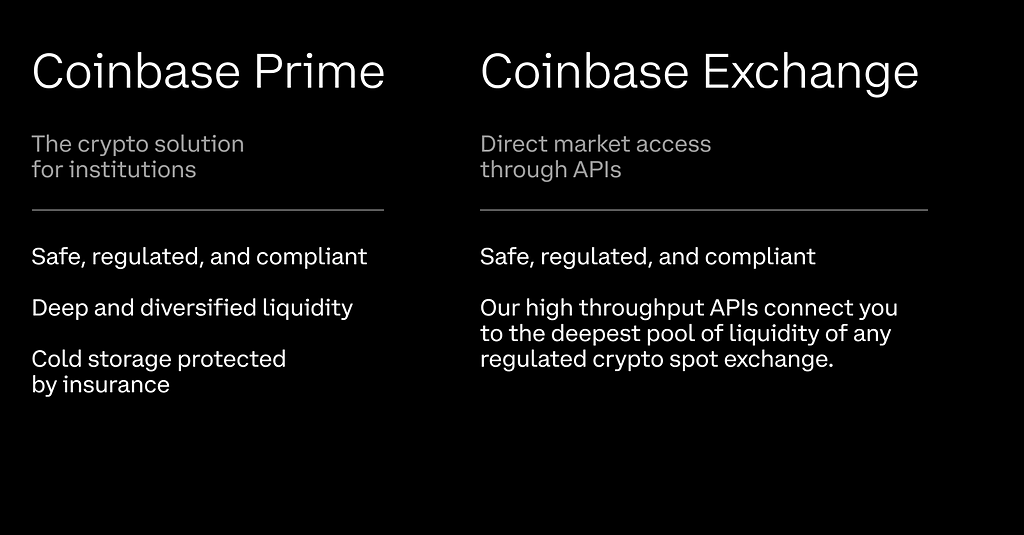

Coinbase Prime, separate from Coinbase Exchange, was built with the specific requirements and services clients need to participate in digital assets. Whether you’re a financial institution, institutional investor, or company looking to add crypto to your balance sheet, Coinbase Prime has the tools and services you need.

Institutional acceptance of crypto has grown at a breakneck pace — as we’ve seen over the past six months alone, leading investors are either actively allocating a portion of their portfolios to crypto or are seriously exploring it. At the same time, we’re seeing tremendous interest from corporations that are looking to diversify their balance sheets with crypto including MicroStrategy and Meitu.

Coinbase has reimagined our Prime offering based on feedback from hundreds of clients to bring the first integrated product offering to market. We are bringing trading, algos, smart order routing, along with one of the strongest custody offerings in the industry — building our institutional product suite to provide institutions with the most seamless, intuitive, and trusted solution to manage crypto assets. We have invested in multiple acquisitions over the past three years signalling our commitment to the institutional space (skew, Tagomi and Xapo) and our desire to bring a fully integrated solution to the market. Advanced traders need more complex tooling, trading features, and reporting — we are proud to bring them that and much more with the launch of Coinbase Prime.

Coinbase Prime will offer clients a variety of new features and benefits, including:

Coinbase Institutional product suite includes:

To learn more about Coinbase Prime, Custody, OTC trading, or Coinbase’s white label brokerage services click here.

Coinbase Institutional is proud to announce the unveiling of our new Prime offering was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Read more in our Global Fund Management Report

By Brett Tejpaul, Head of Institutional Sales, Trading, Custody and Prime Services

Serving a global client base across multiple sectors, Coinbase Institutional provides a full range of trading services and custody for new public funds and approved bitcoin ETFs.

Coinbase Institutional has become one of the most trusted, safe and regulated centers for the cryptoeconomy. Offering access to over 10 pools of liquidity globally, including regulated exchanges and electronic market makers on an agency basis, giving users the ability to trade directly, through our OTC desk or algorithmically, Coinbase Institutional has become one of the leading provider for companies like Grayscale, Wisdom Tree, Purpose Investments, Ninepoint and many more.

Our recently released Global Fund Management Report provides a broad overview of the crypto fund landscape, including the latest updates on regulatory changes and product trends. Coinbase has witnessed an increase in crypto fund activity to meet demand from investors seeking crypto exposure without buying, holding, and selling these assets directly. Our report shares clients’ insights on managing crypto investment products with our secure custody, advanced trading platform, and 24/7 support. Read our full report here.

“There is incredible potential for financial institutions who are expanding access to the cryptoeconomy through these fund structures,” said Brett Tejpaul, Head of Institutional Sales, Trading, Custody and Prime Service. “We are excited to partner with these clients as public interest and demand for these offerings grows.”

To learn more about Coinbase Prime Broker or Coinbase’s white label brokerage services, custody, or OTC trading, click here.

Coinbase helps public funds and ETFs around the world with trading and custody was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.