By L.J Brock, Chief People Officer

Overnight I saw the note from Brian Chesky announcing to Airbnb employees that they would be moving to a permanent remote-working model. I applaud Brian and his team. While it may sound simple in a post-pandemic era, the logistics can be anything but. I am ecstatic to see them join the growing ranks of remote-first companies because more people, more ideas, and more experiments will make remote work better for everyone. Redesigning the nature of work, is work that should not be done in isolation (no pun intended).

When we went remote-first in May 2020 we were not shy to admit that we did not have all the answers, and while we still don’t, there have been some important learnings along the way. As Airbnb starts off on their journey and in our crypto-mindset of being transparent and open source, here are some of our key learnings from operating a remote-first company over the last two years…

Flex on location, consistent on experience

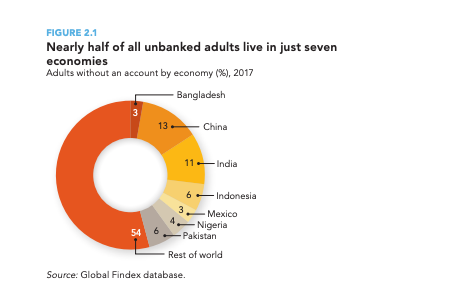

One of the most obvious benefits that drew us to remote-first was the ability to give our people the flexibility to choose where they live and work, while also giving Coinbase access to a much broader talent market. What followed was that we needed to put the practices in place to protect those employee choices and ensure that you are neither privileged or punished for your choice. It’s one thing to say ‘you can choose to work from the office if you prefer’ and another to say ‘you will receive the same opportunities and experience regardless of where you chose to work’.

Some of the practices we’ve introduced include, ‘one person, one device’ meaning regardless of your location, all attendees should join from their own device — creating an equal experience for all. We also have deliberately tried to remove one standard time zone for all employees. Prior to going remote, we had a high density of employees on the west coast and knew that if this was the norm it would penalize those who had chosen to live and work elsewhere. Today we are completely decentralized, without a physical headquarters and we’ve worked hard to instill cultural norms where no standard hours exist. For some employees, this could look like adopting west coast hours and taking the mornings to themselves and for others it may be prioritizing synchronized work in common working hours and async work at other times.

Redesigning how we connect

Human connection is still core to the way we work and going remote-first meant redesigning the way our people connect. When it comes to connection we’ve learned that one-size does not fit all. As we sought to design centralized processes, we realized that our teams needed the flexibility and discretion to design experiences to fit their needs. What has resulted is a set of guidelines and guardrails.

Offsites play a big role in our approach to connection. Each org is designated a bi-annual offsite budget on a use-it-or-lose-it basis. In the past I think there has been pressure to prove ROI for offsites based on the cost of travel, accommodation etc, but we openly recognize that ~90% of the value of coming together is to build relationships. We have optimized our offsite guidance to recommend that teams include just 1–2 days of content, to focus on the most valuable in-person activities and avoid burnout.

Quarterly offsites alone can not carry the full weight of our need for connection, so we complement this approach with remote-first tactics to build connection between in-person meetings. Some tactics that have worked for us include all company virtual events, bi-weekly town halls, quarterly all hands, social neighborhood budgets (an individual discretionary budget to fund meet-ups with colleagues) and team connection budgets (a discretionary manager budget to drive connection within immediate teams).

Async norms

When we committed to remote-first for the long term we had to address some of the more complex realities of working apart, such as how we can make decisions efficiently and asynchronously. This was an important challenge for us to solve and one which Emilie Choi discussed on our blog last year (see ‘How we make decisions at Coinbase’). Having norms around a few types of decision making tool sets (Problem/Proposed Solution and RAPIDs) has made a huge difference in driving consistency, clarifying our thinking and understanding of each other, while being able to move quickly. Another key element of this framework for us has been the use of collaborative technology like Google Docs and the concept of a ‘DRI’ or Directly Responsible Individual for each action item.

Congratulations again, Airbnb. I look forward to continuing to share learnings as we each navigate a remote-first world, and seeing more companies take the leap.

Dear Airbnb: Congratulations and Some Lessons Learned was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.