By Casper Sorensen, Vice President, Customer Experience

The following is the latest update in our series of blog posts describing our commitment to continually improving our customer experience.

At Coinbase, we strive to be the most trusted and easy to use platform to help our customers access the cryptoeconomy. We recognize the challenges some of our customers have experienced with their Coinbase accounts, and we want to reiterate that continually improving the customer experience remains a top priority. In my last post, we committed to providing you ongoing updates on the investments we’re making to better serve customers. Since then, we’ve continued to add even more support staff, improve and simplify our products, and identify additional opportunities to serve you more quickly and competently. Here’s an update:

Reduced customer support backlogs.

We have recently eliminated our backlog across most queues and have sufficient agent capacity in place to minimize the risk of potential future backlogs. Since January, our customer contact rate (the number of times customers contact customer service divided by the number of monthly transacting users) has been reduced by 70%. Over that same period, we saw our total number of verified users increase from 43 million to 56 million.

But we realize we still have work to do. Here’s what we’re doing to make our customer service even better:

Adding more support staff.

One of the biggest investments we’ve made is in our support staff. We now have more than 3,000 people dedicated to solving customer issues. This represents a more than 5x increase in support staff since January. We’re continuing to hire great people to quickly support our customers’ needs, as well as ensure we’re meeting customers where they are, which includes a growing number of social media platforms.

Offering live support.

We’re on track to support customers live, via chat and phone. We’ve already begun rolling out a virtual assistant to help customers navigate common issues, and live chat via messaging is coming later this year. We’re working to offer live phone support in the coming months to assist customers with several issues including account security.

Keeping you safe.

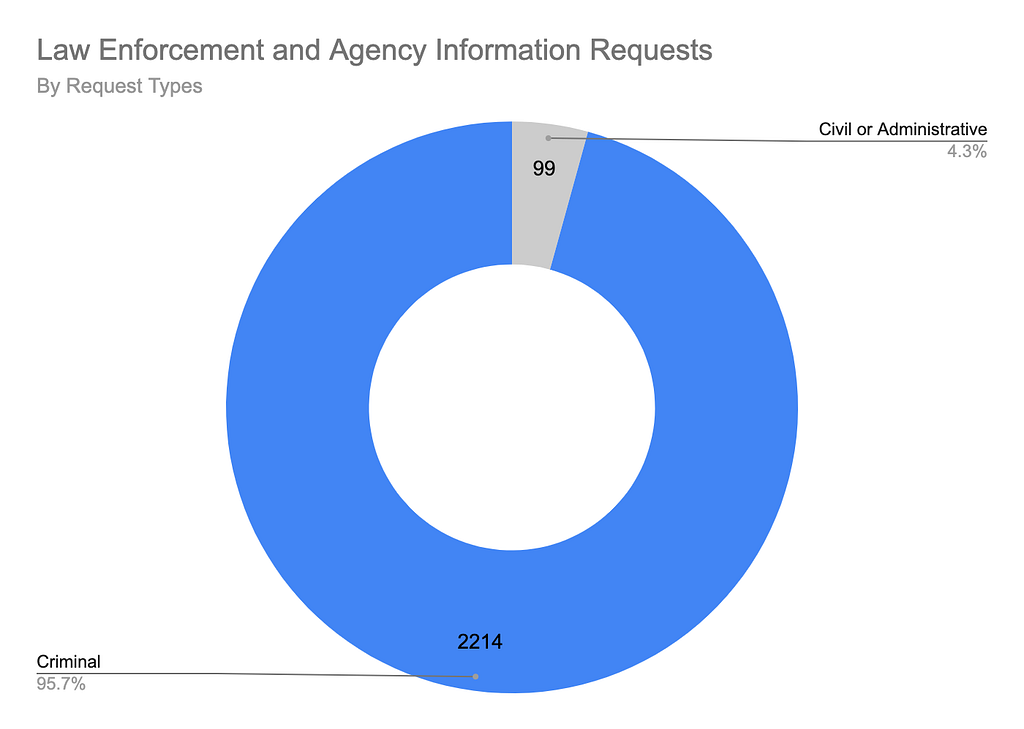

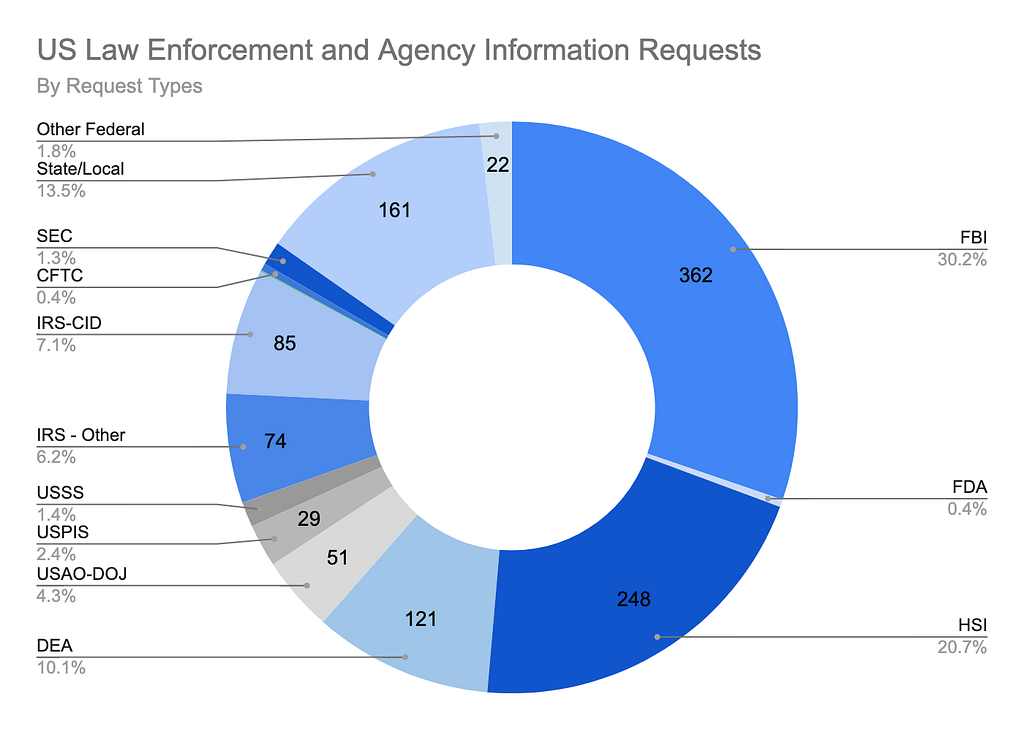

Coinbase takes extensive security measures to ensure your account and cryptocurrency investment remains as safe as possible. In addition, we provide ongoing education and resources for how to protect your accounts from Account Take-Overs — also referred to as “ATOs”. This happens when a bad actor is able to use your login credentials to access your account and perform fraudulent activity. While ATOs have only impacted a very small subset of our customers (a tiny fraction of one percent), we recognized that when they do occur, they can cause stress and confusion for our customers. That’s why we are standing up a phone support team which will guide these customers through the necessary steps to quickly lock down accounts, and restore access.

Improving product User Experience (UX) and workflows.

Our product teams continually ship new features designed to simplify and improve our products, including in-product alerts to provide relevant and useful information to customers. Through systematic customer pain point identification and close collaboration with our engineering team, we’ve been able to further reduce the possibility of high severity issues. For example, we’re implementing two-factor authentication recommendations for users with high balances to provide these users with additional security. By helping our customers avoid potential issues in the first place, we’ve made a meaningful impact on the number of customers coming to customer support for help. Further, we are hyper-focused on making sure our site is stable, ensuring during bull and bear markets you have the ability to buy and sell.

Expanding education and training tools.

We’re improving our self-service online Coinbase Help resources. The cryptoeconomy continues to rapidly change, with new technologies introduced every week. Through initiatives like Coinbase Learn, we’re committed to helping our customers navigate these changes and our platform of products.

We appreciate your patience as we continue to improve the Coinbase experience for our customers. We will never tire in our pursuit of creating more value for our customers. For support questions, please visit our support page.

Customer Support Improvements at Coinbase was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.