Tl;dr: We’re announcing two big updates to our Commerce platform: instant, free payments from Coinbase users to Commerce merchants, and seven new cryptocurrencies that can be used for payments through Commerce.

One of Coinbase’s goals is to become a platform that brings together consumers and businesses in the cryptoeconomy. By making cryptocurrency transactions easier and more accessible, we are continuing to drive towards this goal. One of our key strategic pillars is to build products that enable crypto as a new financial system. Coinbase Commerce supports this pillar by providing access to safe and convenient payments.

Instant and Free Payments:

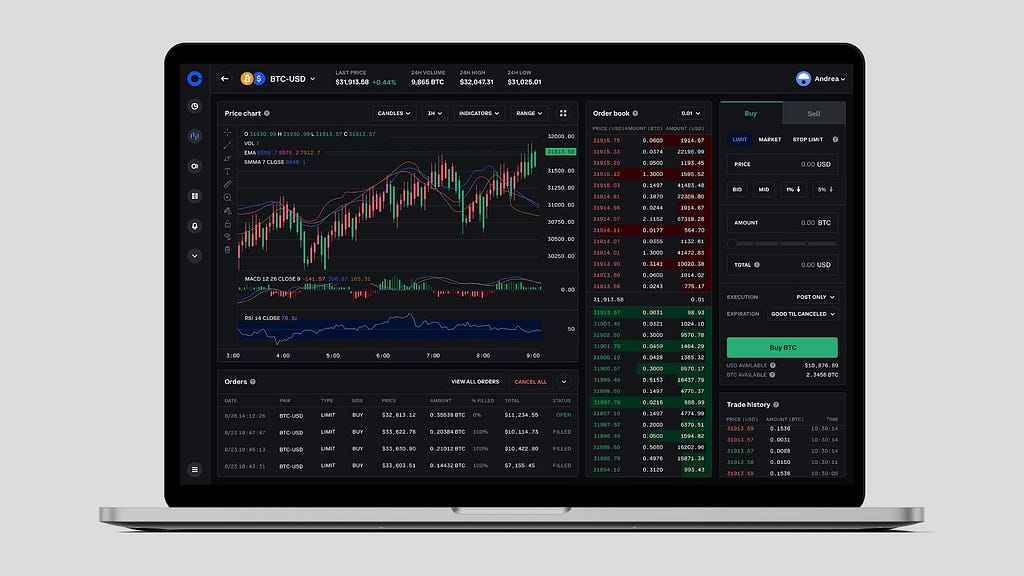

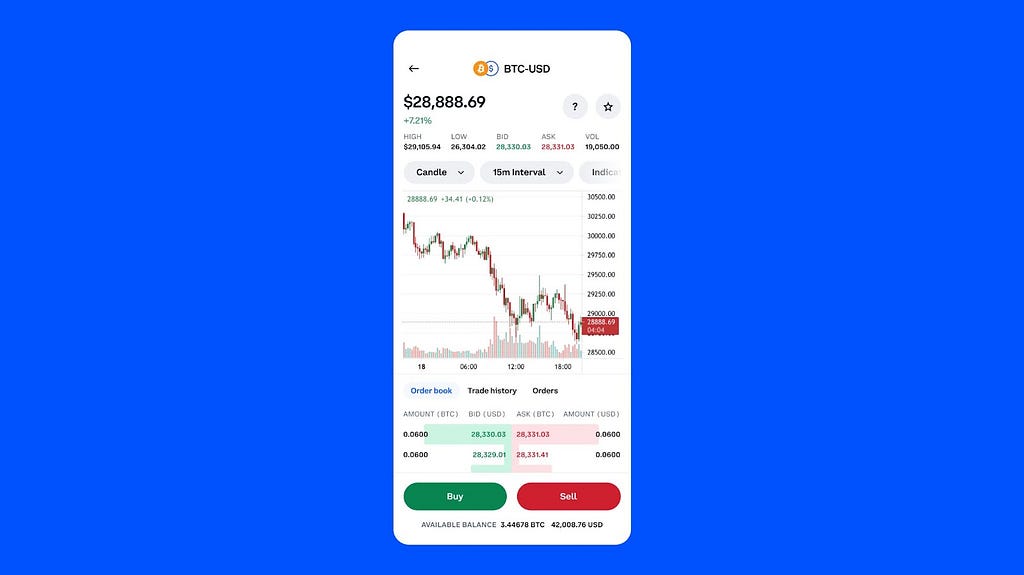

Earlier this year, we launched instant and free payments from Coinbase users to Coinbase-Managed Commerce merchants. This new feature leverages Coinbase’s unique access to both Coinbase customers as payers and to merchants as payees to enable instant, free payments using off-chain transactions. An off-chain transaction involves an account-to-account transfer processed outside of the blockchain through a separate channel, which means we can offer this benefit to payers with Coinbase accounts. Off-chain transactions are cheaper and faster, allowing parties to swap currency until they are ready to settle.

Payer Benefits

Consumers have told us that fees are among the top reasons they choose not to pay in cryptocurrency. Following this launch, existing Coinbase users will be able to complete crypto payments for free if they are sending money to a Commerce merchant on our Coinbase-Managed product, and funds will be settled to the merchant instantly. This makes online and in-person payments even more seamless.

Merchant Benefits

One of the biggest drawbacks for merchants looking to accept cryptocurrency is price volatility. Instant transactions (10 minutes or less) along with auto conversions to fiat currency can help to ensure that you are receiving the right amount from the payer.

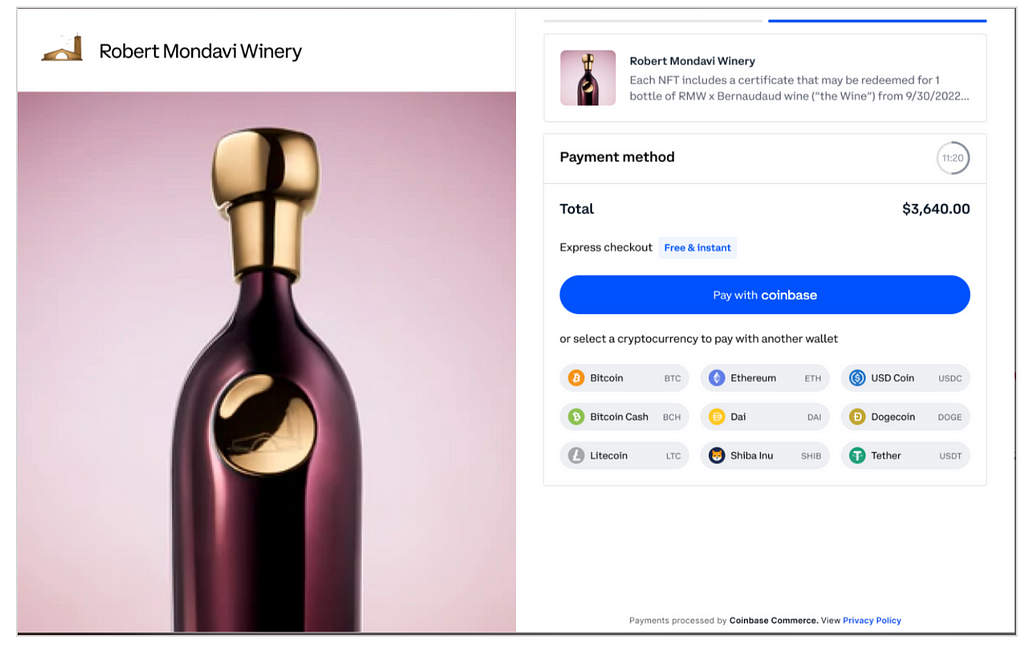

Nathan Scherotter, Vice President of Direct-To-Consumer at Commerce client Constellation Brands commented on the company’s excitement about the new capability for the Robert Mondavi NFT store: “Coinbase was the perfect partner for Robert Mondavi to launch our NFT project. The product, team and infrastructure allowed for seamless crypto transactions, automatic conversion and easy integration. Without Coinbase’s Commerce product we would not have been able to accept crypto for this project, and being able to offer instant and free payments is a huge win.”

More Crypto Payment Options on Commerce:

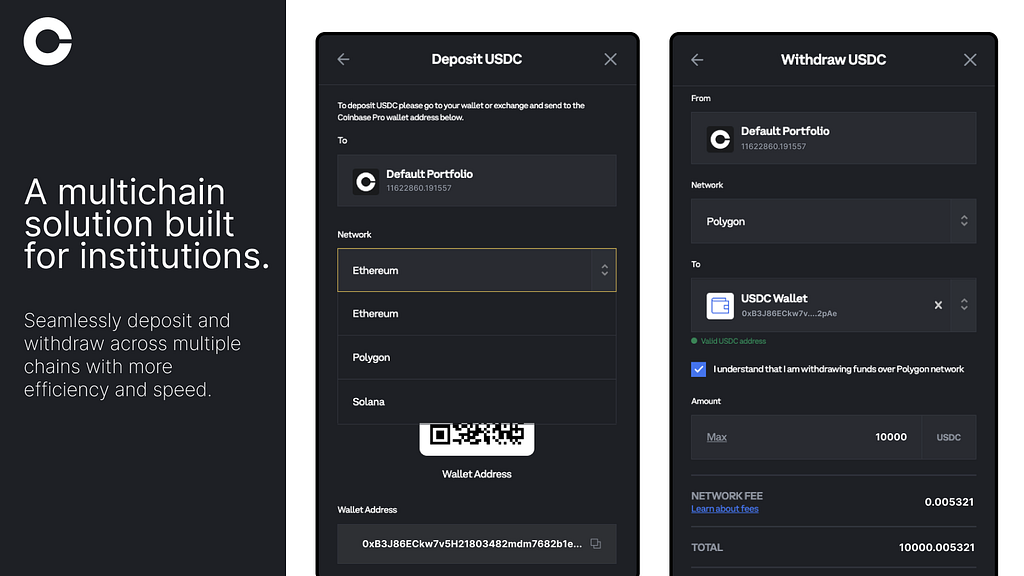

We’ve also added support for seven new crypto assets on the Commerce platform. Merchants and consumers now have more options for their crypto payments. We’ve been getting requests to enable payments with additional cryptocurrencies and we’re excited to add this new capability that will meet the needs of both sellers and payers.

We now support BTC, ETH, USDC, BCH, LTC, DOGE, DAI, USDT, APE, and SHIB. Merchants can easily manage which cryptocurrencies they want to accept, turn off the ones they don’t, and choose to hold or auto-convert any cryptocurrency balance to USD.¹

By removing friction and increasing flexibility within the crypto payment process on both sides of the ecosystem, we are taking another step towards mainstream adoption and leveraging the network effect of our brand. Log in to your account to explore these new features. You can also visit our Help Center or contact us if you need support.

Keep an eye out for more exciting Commerce updates to come later this year!

¹Only Coinbase-managed accounts are eligible for auto-conversion. Settlement limits apply for auto-conversions:

- $1M — BTC, ETH, USDC, DAI

- $500k — LTC, SHIB, USDT

- $250k — APE, BCH, DOGE

Coinbase Commerce Updates: Faster Payments, No Fees, More Currency Options was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.