The New York Stock Exchange (NYSE) has teamed up with Coindesk Indices to develop cash-settled options contracts that track bitcoin prices. These contracts, based on the Coindesk Bitcoin Price Index (XBX), are currently in the planning stage and awaiting regulatory approval. NYSE and Coindesk Indices Forge New Path With Bitcoin Options Contracts The proposed New […]

The New York Stock Exchange (NYSE) has teamed up with Coindesk Indices to develop cash-settled options contracts that track bitcoin prices. These contracts, based on the Coindesk Bitcoin Price Index (XBX), are currently in the planning stage and awaiting regulatory approval. NYSE and Coindesk Indices Forge New Path With Bitcoin Options Contracts The proposed New […]

The purported sales are the latest measures the embattled firm has taken following moves in recent months to raise capital and preserve liquidity.

Cryptocurrency conglomerate Digital Currency Group (DCG) has reportedly begun to sell its holdings in crypto funds managed by its subsidiary Grayscale Investments as it looks to raise capital and preserve liquidity.

According to a Feb. 7 Financial Times report citing seen United States securities filings, DCG sold around a quarter of its shares in Grayscale’s Ether (ETH)-based fund for around $8 per share, despite each share holding a claim to nearly double that amount in ETH.

It’s also said to have sold down small share parcels in Grayscale’s Litecoin (LTC), Bitcoin Cash (BCH) and Ethereum Classic (ETC)-based trusts in addition to its Digital Large Cap Fund — which combines Bitcoin (BTC), Ether, Polygon (MATIC), Solana (SOL) and Cardano (ADA) into a single fund.

When asked about the share sales DCG was quoted as saying that: “This is simply part of our ongoing portfolio rebalancing.”

Despite the statement, some observers believe Barry Silbert’s DCG may be headed toward g financial strife.

Another one of its subsidiaries — crypto lending firm Genesis Global Capital — filed for bankruptcy on Jan. 19 and is believed to owe creditors over $3 billion.

Companies owned by DCG have been severely affected by the contagion resulting from FTX’s implosion, with over 500 employees laid off in recent weeks.

However, DCG has taken a number of steps to preserve liquidity in 2023, such as announcing to its shareholders in a Jan. 17 letter that it would be halting its quarterly dividend payments as it looks to strengthen its balance sheets.

Related: Genesis creditors to expect 80% recovery under proposed restructuring plan

DCG has also sought the help of financial advisory firm Lazard to help it weigh up options to sell crypto media outlet CoinDesk — another of its subsidiaries — after it claimed to have received offers for the outlet exceeding $200 million.

Grayscale, Genesis, and CoinDesk are among some 200 crypto-related businesses in DCG’s venture capital portfolio according to its website. Other companies that DCG has equity in include the crypto exchange Luno and advisory firm Foundry.

The now-defunct crypto exchange FTX has published its list of creditors, with the names unredacted. The comprehensive list, which is over 100 pages long, shows that FTX owes a lot of money to well-known institutions, including Binance, Airbnb, Apple, Amazon, Linkedin, Coindesk, the Wall Street Journal (WSJ), and more. U.S. government entities, such as the […]

The now-defunct crypto exchange FTX has published its list of creditors, with the names unredacted. The comprehensive list, which is over 100 pages long, shows that FTX owes a lot of money to well-known institutions, including Binance, Airbnb, Apple, Amazon, Linkedin, Coindesk, the Wall Street Journal (WSJ), and more. U.S. government entities, such as the […] According to various reports, investors are reportedly interested in purchasing Coindesk, a cryptocurrency news publication. On Jan. 18, Wang Feng, founder of China-based news publication Marsbit, announced his intentions to purchase Coindesk along with other members of the crypto industry. This news follows a report from Semafor at the end of November 2022 stating that […]

According to various reports, investors are reportedly interested in purchasing Coindesk, a cryptocurrency news publication. On Jan. 18, Wang Feng, founder of China-based news publication Marsbit, announced his intentions to purchase Coindesk along with other members of the crypto industry. This news follows a report from Semafor at the end of November 2022 stating that […]

DCG has reportedly received offers for CoinDesk exceeding $200 million in recent weeks, which at a purchase price of $500 thousand would be a 39,900% return on its initial investment.

Crypto media outlet CoinDesk is reportedly considering a potential sale as its parent company Digital Currency Group (DCG) looks to strengthen its balance sheet.

According to the Wall Street Journal, CoinDesk has sought the help of investment bankers from financial advisory firm Lazard, who are helping the firm weigh options including a full or partial sale.

You know, I just realized that Coindesk is for sale. pic.twitter.com/QqmBPOClpu

— Charles Hoskinson (@IOHK_Charles) January 19, 2023

DCG has purportedly received multiple offers exceeding $200 million to buy out the media firm over the last few months, which would result in a phenomenal return on their investment given DCG supposedly acquired the company for just $500,000 in 2016.

Barry Silbert’s DCG appears to be in serious financial strife recently, and announced to shareholders on Jan. 17 that it would be halting dividends in an effort to strengthen its balance sheet and “preserve liquidity.”

On Jan. 18, Bloomberg reported that another DCG subsidiary, crypto lending firm Genesis Global, was planning to file for bankruptcy after revealing it owed creditors over $3 billion — likely a leading factor contributing to DCG’s financial woes.

CoinDesk and Genesis are among some 200 crypto-related businesses in DCG’s venture capital portfolio, according to its website. Other companies that DCG owns include asset management firm Grayscale Investments, crypto exchange Luno, and advisory firm Foundry.

Related: Gemini and Genesis’ legal troubles stand to shake up industry further

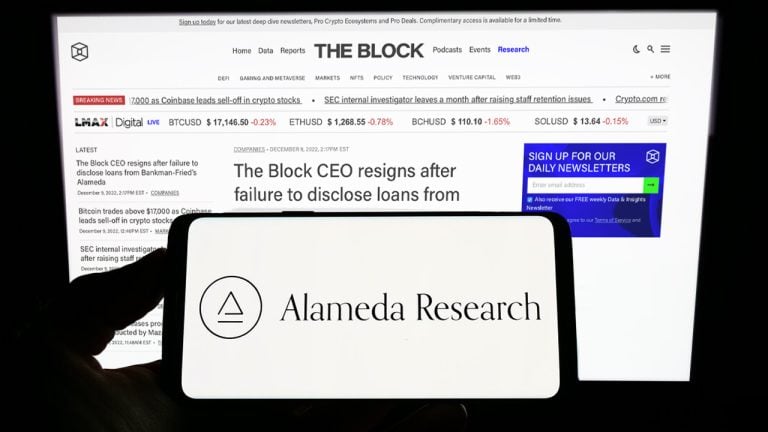

Some believe that CoinDesk’s article in November exposing the irregularities in Alameda Research’s balance sheet was the first domino that eventually led to the fall of crypto exchange FTX and the liquidity issues now being faced by Genesis and its parent company DCG and the wider crypto market.

Cointelegraph has reached out to CoinDesk for confirmation that a potential sale was being considered, but was yet to receive an answer at the time of publishing.

According to a shareholders’ letter from Digital Currency Group (DCG) viewed by finance and crypto publication Coindesk, the company has suspended dividends until further notice. This news follows the U.S. Securities and Exchange Commission (SEC) charging a subsidiary firm of DCG, Genesis Global Capital, with operating an “unregistered offer and sale of securities to retail […]

According to a shareholders’ letter from Digital Currency Group (DCG) viewed by finance and crypto publication Coindesk, the company has suspended dividends until further notice. This news follows the U.S. Securities and Exchange Commission (SEC) charging a subsidiary firm of DCG, Genesis Global Capital, with operating an “unregistered offer and sale of securities to retail […] On Dec. 9, 2022, Axios reporter Sara Fischer reported on the CEO of the crypto media The Block after it was discovered that the chief executive was secretly funded by Alameda Research, the now-defunct trading firm co-founded by Sam Bankman-Fried. According to the report, sources say The Block executive Michael McCaffrey received $16 million in […]

On Dec. 9, 2022, Axios reporter Sara Fischer reported on the CEO of the crypto media The Block after it was discovered that the chief executive was secretly funded by Alameda Research, the now-defunct trading firm co-founded by Sam Bankman-Fried. According to the report, sources say The Block executive Michael McCaffrey received $16 million in […] Since Tesla’s Elon Musk attempted to purchase Twitter and tried to get information on the number of bots on the social media platform, Twitter bots have infested tens of thousands of posts day after day. In the cryptocurrency industry, bots are very prevalent and any time a popular crypto account posts, the thread is teeming […]

Since Tesla’s Elon Musk attempted to purchase Twitter and tried to get information on the number of bots on the social media platform, Twitter bots have infested tens of thousands of posts day after day. In the cryptocurrency industry, bots are very prevalent and any time a popular crypto account posts, the thread is teeming […] The embattled crypto lending platform Celsius has kept withdrawals and transfers frozen since June 12 and told the Celsius Network community that the “process will take time.” Since then, Celsius users are wondering why they are still receiving weekly rewards, and reportedly the company’s management has been arguing with its lawyers over whether or not […]

The embattled crypto lending platform Celsius has kept withdrawals and transfers frozen since June 12 and told the Celsius Network community that the “process will take time.” Since then, Celsius users are wondering why they are still receiving weekly rewards, and reportedly the company’s management has been arguing with its lawyers over whether or not […]

Cryptocurrency conglomerate Digital Currency Group has raised $700 million in funding, including investments from Japanese multinational holding company SoftBank and the venture capital arm of Google’s parent company Alphabet, CapitalG. The fundraising deal helped push valuation of the crypto conglomerate to more than $10 billion, according to CNBC. Digital Currency Group’s CEO Barry Silbert says […]

The post Crypto Giant Digital Currency Group Reaches $10 Billion Valuation in Latest Capital Raise appeared first on The Daily Hodl.