The Finance Minister of Pakistan has named Bilal bin Saqib, a Web3 investor, as the chief advisor for the Pakistan Crypto Council. Bilal bin Saqib an Ideal Candidate Pakistan’s Finance Minister has appointed Bilal bin Saqib, a Web3 investor, as the chief advisor for the Pakistan Crypto Council. This appointment is seen as a step […]

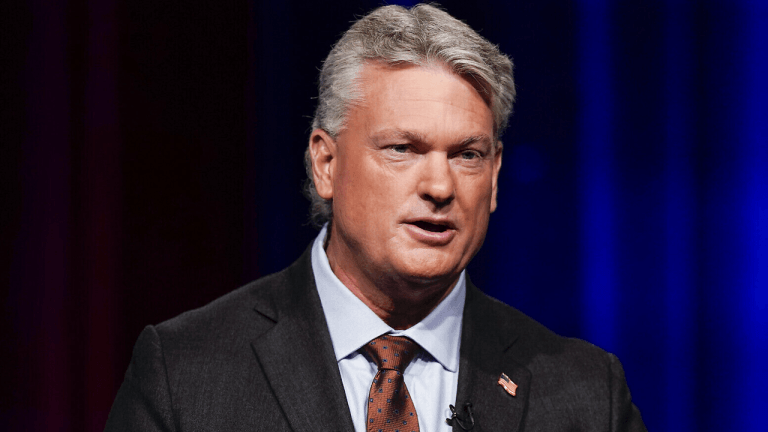

The Finance Minister of Pakistan has named Bilal bin Saqib, a Web3 investor, as the chief advisor for the Pakistan Crypto Council. Bilal bin Saqib an Ideal Candidate Pakistan’s Finance Minister has appointed Bilal bin Saqib, a Web3 investor, as the chief advisor for the Pakistan Crypto Council. This appointment is seen as a step […] U.S. Representative Mike Collins, a strong advocate for alternative financial assets, has said his campaign will now accept cryptocurrency donations. ‘Destigmatizing the Crypto Industry’ U.S. lawmaker and advocate for alternative financial assets Mike Collins has announced that his campaign will accept cryptocurrency donations. The lawmaker, who represents Georgia’s 10th Congressional District, stated that this move […]

U.S. Representative Mike Collins, a strong advocate for alternative financial assets, has said his campaign will now accept cryptocurrency donations. ‘Destigmatizing the Crypto Industry’ U.S. lawmaker and advocate for alternative financial assets Mike Collins has announced that his campaign will accept cryptocurrency donations. The lawmaker, who represents Georgia’s 10th Congressional District, stated that this move […] Blockstream has secured a multi-billion-dollar investment to launch bitcoin-backed lending funds for institutional investors, allowing institutions to borrow against BTC collateral. Blockstream to Launch BTC-Backed Funds Bitcoin infrastructure provider Blockstream has secured billions in investment to roll out three institutional bitcoin-backed funds. The new investment will fuel the launch of the Blockstream Income Fund and […]

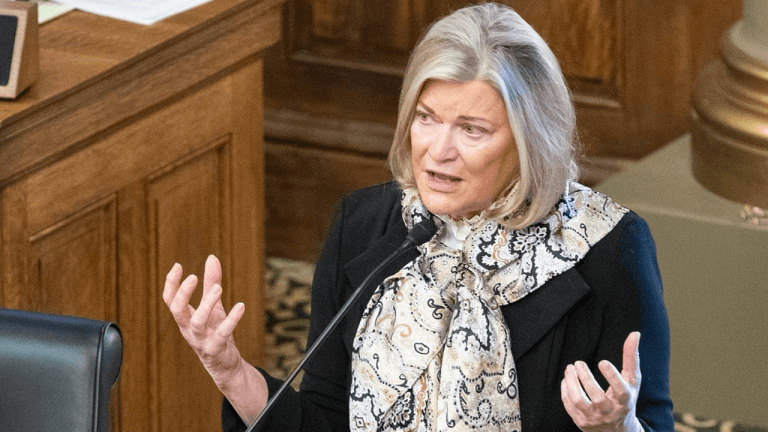

Blockstream has secured a multi-billion-dollar investment to launch bitcoin-backed lending funds for institutional investors, allowing institutions to borrow against BTC collateral. Blockstream to Launch BTC-Backed Funds Bitcoin infrastructure provider Blockstream has secured billions in investment to roll out three institutional bitcoin-backed funds. The new investment will fuel the launch of the Blockstream Income Fund and […] Wyoming Sen. Cynthia Lummis, a leading bitcoin proponent, cast doubt on the immediate feasibility of former President Donald Trump’s proposed cryptocurrency strategic reserve, citing insufficient Congressional backing as a critical barrier. Political Resistance Slows Trump’s Bitcoin Strategic Reserve, Lummis Says Trump’s plan, unveiled March 2, 2025, via Truth Social, calls for a “Crypto Strategic Reserve” […]

Wyoming Sen. Cynthia Lummis, a leading bitcoin proponent, cast doubt on the immediate feasibility of former President Donald Trump’s proposed cryptocurrency strategic reserve, citing insufficient Congressional backing as a critical barrier. Political Resistance Slows Trump’s Bitcoin Strategic Reserve, Lummis Says Trump’s plan, unveiled March 2, 2025, via Truth Social, calls for a “Crypto Strategic Reserve” […] Bitcoin ETFs experienced net outflows of $143 million, with major funds like Fidelity’s FBTC and Ark 21Shares’ ARKB leading the declines. In contrast, Ether ETFs ended an eight-day outflow streak, attracting $15 million in net inflows, primarily driven by Fidelity’s FETH. Bitcoin ETFs See Another Day of Withdrawals With Positive Rebound for Ether ETFs On […]

Bitcoin ETFs experienced net outflows of $143 million, with major funds like Fidelity’s FBTC and Ark 21Shares’ ARKB leading the declines. In contrast, Ether ETFs ended an eight-day outflow streak, attracting $15 million in net inflows, primarily driven by Fidelity’s FETH. Bitcoin ETFs See Another Day of Withdrawals With Positive Rebound for Ether ETFs On […] The U.S. Department of the Treasury blacklisted 49 bitcoin (BTC) and monero (XMR) addresses connected to Behrouz Parsarad, an Iran-based figure accused of overseeing the defunct Nemesis darknet marketplace (DNM), as part of persistent initiatives to disrupt fiscal channels underpinning illicit narcotics trade and digital malfeasance. After Takedown, Treasury Targets Nemesis Founder and 49 Cryptocurrency […]

The U.S. Department of the Treasury blacklisted 49 bitcoin (BTC) and monero (XMR) addresses connected to Behrouz Parsarad, an Iran-based figure accused of overseeing the defunct Nemesis darknet marketplace (DNM), as part of persistent initiatives to disrupt fiscal channels underpinning illicit narcotics trade and digital malfeasance. After Takedown, Treasury Targets Nemesis Founder and 49 Cryptocurrency […] Hut 8 Corp. has reported $80.7 million in crypto-related revenue for 2024, driven by bitcoin mining and GPU-as-a-service operations. The company expanded its bitcoin reserve to 10,171 BTC and secured a $125 million partnership with Bitmain. Hut 8 Expands Bitcoin Mining and Digital Infrastructure with $125M Bitmain Deal Hut 8 Corp., a bitcoin mining and […]

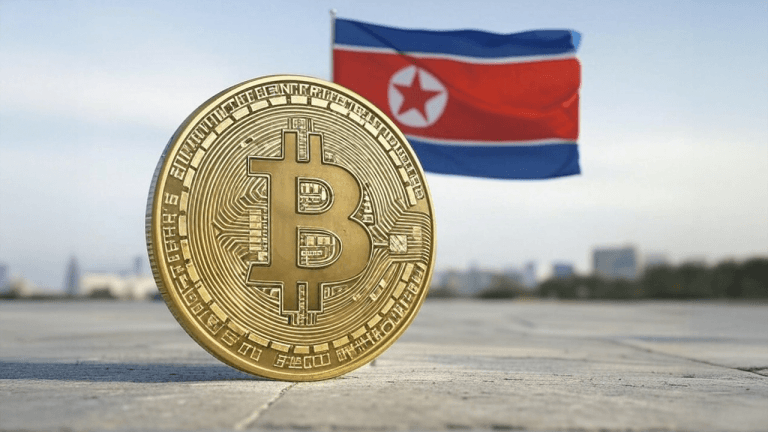

Hut 8 Corp. has reported $80.7 million in crypto-related revenue for 2024, driven by bitcoin mining and GPU-as-a-service operations. The company expanded its bitcoin reserve to 10,171 BTC and secured a $125 million partnership with Bitmain. Hut 8 Expands Bitcoin Mining and Digital Infrastructure with $125M Bitmain Deal Hut 8 Corp., a bitcoin mining and […] Blockchain analysis reports from Arkham Intelligence indicate that North Korea’s Lazarus Group has fully laundered the ethereum (ETH) proceeds from the Bybit breach, with a significant share of the assets now converted into bitcoin (BTC). From ETH to BTC: Lazarus Group Now Holds 6,706 Bitcoin Worth $591M Examining 57 separate accounts, the hackers behind the […]

Blockchain analysis reports from Arkham Intelligence indicate that North Korea’s Lazarus Group has fully laundered the ethereum (ETH) proceeds from the Bybit breach, with a significant share of the assets now converted into bitcoin (BTC). From ETH to BTC: Lazarus Group Now Holds 6,706 Bitcoin Worth $591M Examining 57 separate accounts, the hackers behind the […] As bitcoin holds steady above the $88,000 threshold, Michael Saylor’s Strategy (formerly Microstrategy) maintains a 29% gain on its extensive BTC holdings. Meanwhile, MSTR shares have climbed more than 11% over the past week, defying the broader downturn in the crypto sector. What If Strategy Bought Ether Instead of Bitcoin? A Massive Difference Answers That […]

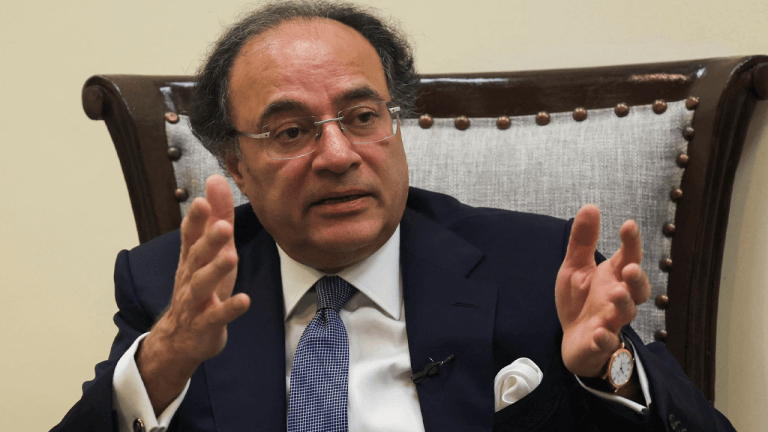

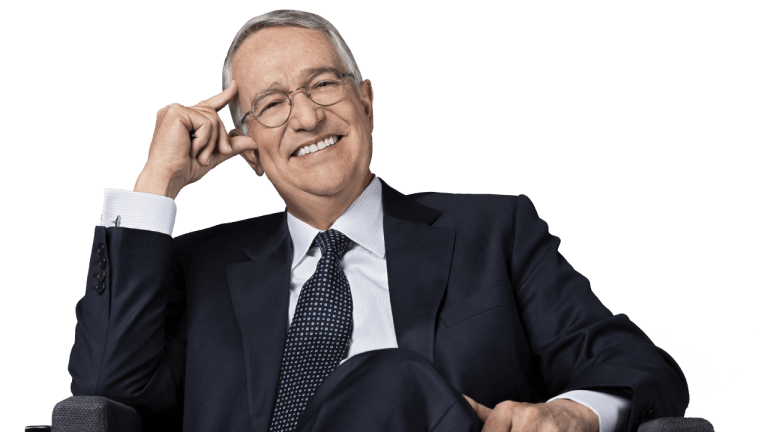

As bitcoin holds steady above the $88,000 threshold, Michael Saylor’s Strategy (formerly Microstrategy) maintains a 29% gain on its extensive BTC holdings. Meanwhile, MSTR shares have climbed more than 11% over the past week, defying the broader downturn in the crypto sector. What If Strategy Bought Ether Instead of Bitcoin? A Massive Difference Answers That […] Salinas revealed details of how much bitcoin exposure he has in his personal portfolio in an interview with Bloomberg and described the cryptocurrency as “the hardest asset in the world.” Ricardo Salinas Doubles Down on Bitcoin, Holds 70% of His Portfolio in BTC Mexico’s third richest man, Ricardo Salinas, chairman and CEO of corporate conglomerate […]

Salinas revealed details of how much bitcoin exposure he has in his personal portfolio in an interview with Bloomberg and described the cryptocurrency as “the hardest asset in the world.” Ricardo Salinas Doubles Down on Bitcoin, Holds 70% of His Portfolio in BTC Mexico’s third richest man, Ricardo Salinas, chairman and CEO of corporate conglomerate […]