On Wednesday, U.S. spot bitcoin exchange-traded funds (ETFs) experienced another high-activity trading session, pulling in $458.54 million in gains. Meanwhile, ether ETFs also saw inflows, with $24.22 million moving into the nine funds. U.S. Bitcoin and Ether ETFs Absorb Millions – A Key Shift in Market Dynamics Data from sosovalue.xyz showed that $458.54 million was […]

On Wednesday, U.S. spot bitcoin exchange-traded funds (ETFs) experienced another high-activity trading session, pulling in $458.54 million in gains. Meanwhile, ether ETFs also saw inflows, with $24.22 million moving into the nine funds. U.S. Bitcoin and Ether ETFs Absorb Millions – A Key Shift in Market Dynamics Data from sosovalue.xyz showed that $458.54 million was […]

Bitcoin bears are closing in on a rare win, as they have the advantage in this week’s $600 million BTC options expiry.

This week’s Bitcoin (BTC) options expiry on Friday, July 21, could solidify the $30,000 resistance level and give the bears the upper hand for the first time since the 21% rally between June 14 and June 21.

A review of Bitcoin’s recent price action shows that three out of the last four BTC options expiries triggered significant price movements, making it crucial for traders to pay close attention to these events.

Notably, Bitcoin’s price has consistently shown strong reactions following the weekly 8:00 am UTC options expiry. While causation cannot be established, the magnitude of these price swings warrants extreme caution leading up to the weekly expiry on July 21.

While this week’s options expiry could give bears control of Bitcoin’s price in the short term, bulls have the potential advantage of the United States Securities and Exchange Commission reviewing spot exchange-traded fund proposals.

Although these proposals are still in the early stages of regulatory scrutiny, the slow progression could partially explain why the bears have managed to defend $31,000 multiple times since late June.

However, their best chance of keeping Bitcoin’s price below $30,000 lies in the worsening regulatory environment. On July 19, the global securities exchange Nasdaq suspended the launch of its cryptocurrency custodian solution due to a lack of regulatory clarity in the United States. This change of plans was justified by Nasdaq’s CEO, Adena Friedman.

Related: Bipartisan bill to regulate DeFi, crypto security risks introduced into US Senate

Furthermore, on July 14, cryptocurrency exchange Coinbase announced the suspension of its staking services for clients in California, New Jersey, South Carolina and Wisconsin. This decision followed a June 6 lawsuit from the SEC that accused the exchange of operating as an unregistered security broker since 2019.

Bitcoin’s price briefly surpassed $31,000 on July 13 and July 14, fueling bullish bets by traders using options contracts. However, a four-hour correction brought the price back down to $30,000.

The 0.39 put-to-call ratio reflects the difference in open interest between the $430 million call (buy) options and the $170 million put (sell) options. However, the outcome will be lower than the $600 million total open interest since the bulls were overconfident.

For example, if Bitcoin’s price trades at $30,500 at 8:00 am UTC on July 14, only $18 million worth of call options will be accounted for. This distinction arises from the fact that the right to purchase Bitcoin at $31,000 or $32,000 becomes invalid if BTC trades below those levels upon expiration.

Below are the three most likely scenarios based on the current price action. The number of options contracts available on July 21 for call (buy) and put (sell) instruments varies depending on the expiration price. The imbalance favoring each side constitutes the theoretical profit:

Considering the recent weak macroeconomic indicators, it’s likely that bears will continue suppressing Bitcoin’s price until Friday’s expiry. Moreover, China’s second-quarter gross domestic product grew by 6.3% year-on-year, falling short of the 7.3% market expectation. Meanwhile, U.S. retail sales in June increased by 0.2% from the previous month, below the 0.50% consensus.

Consequently, the bulls find themselves in a challenging position, as their call (buy) instruments will be invalidated if Bitcoin’s expiry price falls below $30,000. Therefore, the bears’ $35 million favorable outcome may not be a significant win, but it does increase the chances of $30,000 becoming a new resistance area.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Regulatory uncertainty and the lack of transparency on stablecoins caused crypto markets to trade at its lowest levels in 3 months.

The cryptocurrency total market capitalization fell to $1.02 trillion on June 15, its lowest level in three months. But while the derivatives market's resilience and end-of-week price gains amid uncertainty in stablecoins' reserves provides hope for bulls, it might be too soon to celebrate.

The past few week have seen a bearish trend fueled by regulatory uncertainty. Last week, Bitcoin (BTC) and BNB saw 2.5% gains, but XRP dropped 5.2%, and Ether (ETH) traded down 0.7%.

Notice that the 10-week long pattern has tested the support level in multiple instances, signaling that bulls will have a hard time breaking from the bearish trend while regulatory conditions have worsened across the globe.

For starters, New York-based derivatives exchange Bakkt is delisting Solana (SOL), Polygon (MATIC) and Cardano (ADA) due to recent regulatory developments in the United States. The decision follows last week's lawsuits brought by the Securities and Exchange Commission (SEC) against crypto exchanges Binance and Coinbase.

Related: Why is the crypto market up today?

More recently, on June 16, Binance has been the subject of a preliminary investigation in France since February 2022. The France-based arm of the crypto exchange reportedly failed to obtain an operating license and illegally offered its services to French customers. Furthermore, the exchange lacked Know-Your-Customer procedures, according to regulators.

Also on June 16, Binance announced its departure from the Netherlands, with users being asked to withdraw their funds as soon as possible. The decision to exit the Dutch market occurred after the exchange failed to obtain a virtual asset service provider (VASP) license.

Despite the worsening crypto regulatory environment, two derivatives metrics indicate that bulls are not yet throwing in the towel. Nevertheless, they'll likely have a hard time breaking the bearish price formation to the upside.

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours.

A positive funding rate indicates that longs (buyers) demand more leverage. Still, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

The seven-day funding rate for BTC and ETH is neutral, indicating balanced demand from leveraged longs (buyers) and shorts (sellers) using perpetual futures contracts.

BNB was the only exception, with traders paying up to 1% per week for short bets, which can be explained by the added risks after regulatory scrutiny over the Binance exchange.

The Tether (USDT) premium is a good gauge of China-based crypto retail trader demand. It measures the difference between China-based peer-to-peer trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, Tether’s market offer is flooded, causing a 2% or higher discount.

The Tether premium in Asian markets fell to 99.2% after being flat since June 6, indicating moderate discomfort. Reports on June 16 on Tether reserves' exposure to Chinese debt markets could have been the cause.

Derivatives metrics displayed resilience considering the strong regulatory activity aimed at crypto exchanges. Consequently, bears are yet to prove their strength if they intend to push crypto below the $1 trillion mark.

Related: 3 key Ether price metrics point to growing resistance at the $1,750 level

Despite the most recent bounce from the support level, any gains above $1.12 trillion in capitalization (up 10% from the $1.02 trillion low) will likely be short-lived over the next few months.

Therefore, with the Bitcoin halving still over 300 days away, the bulls are currently pinning their hopes on a Bitcoin ETF approval and/or a Federal Reserve rate cut as potential bull market catalysts.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

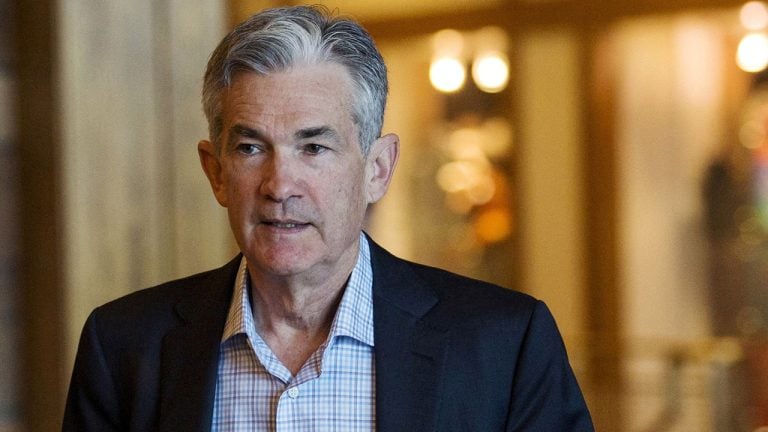

On Friday, Jerome Powell spoke at the annual Jackson Hole Economic Symposium and the Federal Reserve chair explained that the U.S. central bank is focused on fighting the country’s red-hot inflation. Powell stressed at the event that strict monetary policy is necessary, and his commentary hinted that the Fed won’t hit the brakes on monetary […]

On Friday, Jerome Powell spoke at the annual Jackson Hole Economic Symposium and the Federal Reserve chair explained that the U.S. central bank is focused on fighting the country’s red-hot inflation. Powell stressed at the event that strict monetary policy is necessary, and his commentary hinted that the Fed won’t hit the brakes on monetary […] Several reports detail that U.S. Federal Reserve officials are resolute on tightening monetary policy and increasing the federal funds rate until inflation in America is alleviated. Chicago Fed president Charles Evans explained on Tuesday that the central bank would likely keep up the larger than usual rate hikes until inflation is remedied. The Fed Is […]

Several reports detail that U.S. Federal Reserve officials are resolute on tightening monetary policy and increasing the federal funds rate until inflation in America is alleviated. Chicago Fed president Charles Evans explained on Tuesday that the central bank would likely keep up the larger than usual rate hikes until inflation is remedied. The Fed Is […] While the cryptocurrency prices dropped toward the end of the week, precious metals, energy stocks, and global commodities skyrocketed in value amid the ongoing war in Ukraine. The price of one ounce fine gold is nearing the $2K mark, benchmark coal prices have been surging, aluminum values broke records and nickel tapped an 11-year high. […]

While the cryptocurrency prices dropped toward the end of the week, precious metals, energy stocks, and global commodities skyrocketed in value amid the ongoing war in Ukraine. The price of one ounce fine gold is nearing the $2K mark, benchmark coal prices have been surging, aluminum values broke records and nickel tapped an 11-year high. […] The chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, has called for more investor protection in crypto markets. “This asset class is rife with fraud, scams, and abuse in certain applications,” he said. “In many cases, investors aren’t able to get rigorous, balanced, and complete information on tokens or trading and lending […]

The chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, has called for more investor protection in crypto markets. “This asset class is rife with fraud, scams, and abuse in certain applications,” he said. “In many cases, investors aren’t able to get rigorous, balanced, and complete information on tokens or trading and lending […] Crypto assets have climbed in value during the last 24 hours as the price of bitcoin tapped a high on Friday, reaching $42,411 per unit at 8:00 p.m. (EDT). The entire market capitalization of all 10,000+ crypto assets is $1.64 trillion on Saturday, up over 6% during the last day. Bitcoin Climbs Over 20% This […]

Crypto assets have climbed in value during the last 24 hours as the price of bitcoin tapped a high on Friday, reaching $42,411 per unit at 8:00 p.m. (EDT). The entire market capitalization of all 10,000+ crypto assets is $1.64 trillion on Saturday, up over 6% during the last day. Bitcoin Climbs Over 20% This […] Vanda Research has warned of a broad correction in the cryptocurrency market. Ben Onatibia, the firm’s partner and senior strategist, said that the surge in cryptocurrency prices this year is reminiscent of bitcoin’s rally in 2017. A Correction in Crypto Market Appears to Be Brewing, Says Analyst Vanda Research published a report Monday warning of […]

Vanda Research has warned of a broad correction in the cryptocurrency market. Ben Onatibia, the firm’s partner and senior strategist, said that the surge in cryptocurrency prices this year is reminiscent of bitcoin’s rally in 2017. A Correction in Crypto Market Appears to Be Brewing, Says Analyst Vanda Research published a report Monday warning of […]