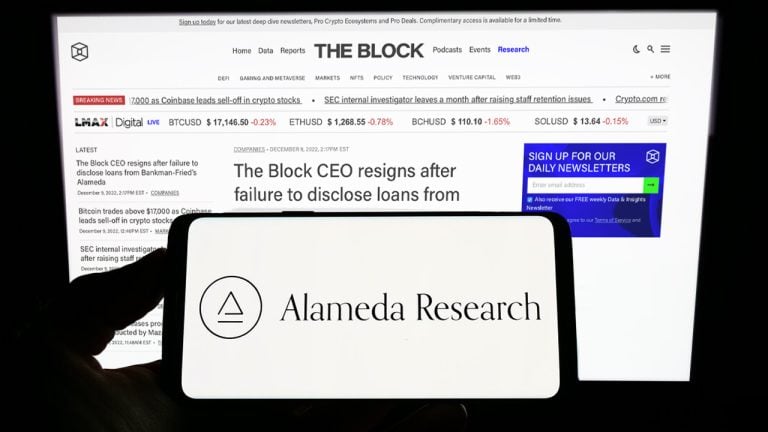

On Dec. 9, 2022, Axios reporter Sara Fischer reported on the CEO of the crypto media The Block after it was discovered that the chief executive was secretly funded by Alameda Research, the now-defunct trading firm co-founded by Sam Bankman-Fried. According to the report, sources say The Block executive Michael McCaffrey received $16 million in […]

On Dec. 9, 2022, Axios reporter Sara Fischer reported on the CEO of the crypto media The Block after it was discovered that the chief executive was secretly funded by Alameda Research, the now-defunct trading firm co-founded by Sam Bankman-Fried. According to the report, sources say The Block executive Michael McCaffrey received $16 million in […] According to a recent report from the Financial Times (FT), Genesis Global Capital allegedly owes $900 million to Gemini customers. The exchange operated by Cameron and Tyler Winklevoss is attempting to recover the funds from Genesis, according to FT’s sources. Report Claims Genesis Owes the Winklevoss-Operated Exchange Gemini $900 Million FT reports that the centralized […]

According to a recent report from the Financial Times (FT), Genesis Global Capital allegedly owes $900 million to Gemini customers. The exchange operated by Cameron and Tyler Winklevoss is attempting to recover the funds from Genesis, according to FT’s sources. Report Claims Genesis Owes the Winklevoss-Operated Exchange Gemini $900 Million FT reports that the centralized […]

"It's net good news for GBTC shareholders and FUD fighting," said Selkis.

According to a new Twitter post by Ryan Selkis, CEO of blockchain research firm Messari, Grayscale Bitcoin Trust's (GBTC) controlling shareholders Genesis Global and Digital Currency Group cannot simply "dump" their holdings to raise more capital. Selkis explained that the restrictions are due to Rule 144A of the U.S. Securities Act of 1933, which forces issuers of over-the-counter, or OTC, traded entities to give advance notice of proposed sales, as well as a quarterly cap on sale of either 1% of outstanding shares or weekly traded volume.

2/ DCG bought nearly $800mm worth of GBTC shares since the premium flipped to a discount in early 2021.

— Ryan Selkis (@twobitidiot) November 28, 2022

DCG's board authorized up to $1.2bn of share purchases across Grayscale Trusts.

In light of the current liquidity issues, the remainder is likely on hold indefinitely.

Based on calculations provided by Selkis, this works to a maximum of $62 million in liquidations per quarter based on the outstanding shares test and $23 million in liquidations per quarter based on the trading volume test. "It's *much* more likely DCG-Genesis refinance using GBTC as collateral," he wrote.

Grayscale Bitcoin Trust, the largest Bitcoin investment trust in the world, is currently trading at a discount to net asset value (NAV) of 40% due to liquidity issues surrounding its operator Genesis Global and rumors of insolvency surrounding its owner Digital Currency Group. It is said that Digital Currency Group bought nearly $800 million worth of GBTC shares since it began trading at a discount to NAV. The firm and its affiliates now own roughly 10% of the trust's outstanding shares.

After Genesis Global began halting withdrawals on Nov. 16, rumors began circulating that its parent company Digital Currency Group, was also in a state of insolvency and would need to liquidate GBTC to pay back its creditors. Grayscale has since clarified that "the laws, regulations, and documents that define Grayscale's digital asset products prohibit the digital assets underlying the products from being lent, borrowed, or otherwise encumbered" and that "the $BTC underlying Grayscale Bitcoin Trust are owned by $GBTC and $GBTC alone."

Grayscale also published a letter signed by Coinbase's CFO, Alesia Haas, and CEO of Coinbase Custody, Aaron Schnarch, showing that it currently holds 635,235 Bitcoins (BTC) under custody in Grayscale's name.

State securities regulators are reportedly investigating Genesis Global Capital in a broad range probe into the “interconnectedness of crypto firms,” Barron’s reported on Friday. The report notes that the Alabama Securities Commission is looking into whether or not cryptocurrency firms have violated securities laws without filing the proper registrations. Report Says Financial Regulators Are Investigating […]

State securities regulators are reportedly investigating Genesis Global Capital in a broad range probe into the “interconnectedness of crypto firms,” Barron’s reported on Friday. The report notes that the Alabama Securities Commission is looking into whether or not cryptocurrency firms have violated securities laws without filing the proper registrations. Report Says Financial Regulators Are Investigating […] Just days after reassuring concerned customers, Marius Reitz, the general manager of crypto exchange Luno Africa, recently reiterated the company has not been impacted by Genesis Capital’s decision to pause withdrawals. He added Luno customers still have access to funds in the savings wallet despite its lending partner’s decision to freeze withdrawals. Customers Retain Access […]

Just days after reassuring concerned customers, Marius Reitz, the general manager of crypto exchange Luno Africa, recently reiterated the company has not been impacted by Genesis Capital’s decision to pause withdrawals. He added Luno customers still have access to funds in the savings wallet despite its lending partner’s decision to freeze withdrawals. Customers Retain Access […]

Bitcoin sentiment is the worst one analyst has ever seen as BTC price action holds its own into Thanksgiving.

Bitcoin (BTC) lingered near $16,500 at the Nov. 23 Wall Street open as United States markets awaited Thanksgiving cues.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD shunning volatility after fresh two-year lows the day prior.

The pair left analysts guessing the day before U.S. markets closed for the Thanksgiving holiday, with crypto commentators still focused on Digital Currency Group (DCG).

Potential liquidity problems with DCG-owned Genesis Trading continued to agitate those already expecting further losses across Bitcoin and altcoins.

As Cointelegraph reported, concerns had already spread to doubt the future of the Grayscale Bitcoin Trust (GBTC), the largest Bitcoin institutional investment vehicle with assets under management worth over $10 billion.

On Nov. 22, Grayscale’s ex-CEO, Barry Silbert, released a letter to DCG shareholders, widely shared on social media, seeking to shore up morale.

“Not sure how to interpret the mixed reports around DGC, GENESIS, Grayscale, but Barry Silbert 's letter yesterday gave the crypto market some hopium,” analytics resource Material Indicators wrote in part of a Twitter thread on the day.

It added that announcements on GBTC could nonetheless come after hours in a potential volatility catalyst.

An accompanying chart of buy and sell pressure on largest global exchange Binance showed strong resistance in place at just below $17,000.

On the buy side, only $15,000 presented any solid support at the time of writing, with the bulk at $14,000.

Commenting on the general state of the crypto market after the FTX debacle, meanwhile, popular commentator William Clemente said that sentiment should not be confused with Bitcoin's underlying strength.

Related: Bitcoin may need $1B more on-chain losses before new BTC price bottom

"Never have seen sentiment this bad," he acknowledged.

"Concerns about every centralized company in the industry, people giving up, losing hope, depression. Meanwhile the fundamentals of Bitcoin are completely unchanged. Posting this to revisit when BTC is pushing to new highs in a few years."

According to classic yardstick, the Crypto Fear & Greed Index, there was nonetheless room to fall, with a score of 22/100 still more than double that which traditionally accompanies bear market bottoms.

"The word dead has been rapidly circulating around crypto platforms in November," research firm Santiment added in insights of its own on Nov. 22.

"As one of the more bearish sentiment words, this is a sign of traders giving up on markets rebounding. Ironically, this capitulation is historically when markets rebound."

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Digital asset mining and staking firm Foundry has agreed to purchase two “turnkey” bitcoin mining facilities from Compute North, a bitcoin miner that filed for Chapter 11 bankruptcy protection on Sept. 22, 2022. Foundry says the two data centers have a total power capacity of around 17 megawatts (MW), and the company also has the […]

Digital asset mining and staking firm Foundry has agreed to purchase two “turnkey” bitcoin mining facilities from Compute North, a bitcoin miner that filed for Chapter 11 bankruptcy protection on Sept. 22, 2022. Foundry says the two data centers have a total power capacity of around 17 megawatts (MW), and the company also has the […] Following Blockfi, Liquid Global, and Salt Lending halting withdrawals, reports indicate that Genesis Global Trading’s lending unit has halted customer withdrawals. Genesis’ interim chief executive officer Derar Islim said that the company’s trading and custody units were still operational. DCG-Owned Genesis Halts Lending Unit’s Redemptions and New Loans On Nov. 16, 2022, Coindesk reporter Nelson […]

Following Blockfi, Liquid Global, and Salt Lending halting withdrawals, reports indicate that Genesis Global Trading’s lending unit has halted customer withdrawals. Genesis’ interim chief executive officer Derar Islim said that the company’s trading and custody units were still operational. DCG-Owned Genesis Halts Lending Unit’s Redemptions and New Loans On Nov. 16, 2022, Coindesk reporter Nelson […]

Crypto investment giant Digital Currency Group (DCG) has filed for one of its executives to lobby on the company’s behalf. An August 15th filing shows DCG’s vice president of public policy Julie Stitzel registering to be DCG’s representative to “support Bitcoin & blockchain companies by leveraging insights, network & access to capital.” DCG owns equity […]

The post Crypto Behemoth Digital Currency Group Files Registration To Become Lobbyist appeared first on The Daily Hodl.

On May 6, the financial services company Robinhood announced the firm has listed Grayscale’s Bitcoin Trust (GBTC) and Ethereum Trust (ETHE). Robinhood customers can now gain access the crypto investment products in order to get exposure to bitcoin or ethereum without actually owning the digital currencies. In Addition to Cryptos, Robinhood Adds Grayscale’s GBTC and […]

On May 6, the financial services company Robinhood announced the firm has listed Grayscale’s Bitcoin Trust (GBTC) and Ethereum Trust (ETHE). Robinhood customers can now gain access the crypto investment products in order to get exposure to bitcoin or ethereum without actually owning the digital currencies. In Addition to Cryptos, Robinhood Adds Grayscale’s GBTC and […]