The embattled crypto lender is seeking final court approval for a restructuring plan that will start repaying creditors before the end of 2023.

Embattled crypto lender Celsius Network has told a judge it plans to start paying back its customers by year’s end, amid an Oct. 2 hearing seeking approval for its reorganization plan.

In his opening statements at the confirmation hearing in New York, Celsius’ legal counsel Christopher Koenig said the new company dubbed “NewCo” will emerge from the proceedings with $450 million in seed funding.

A filing on Sept. 29 shows that Celsius plans to partially repay its creditors using $2.03 billion in Bitcoin (BTC) and Ethereum (ETH) and stock in the new company.

#Celsius will distribute at least $2.03B of crypto to Creditors.

— Celsius NewCo Community (@CelsiusNewCo) October 2, 2023

Meanwhile, NewCo will be seeded with up to $450 million in crypto.

NewCo has been backed by a group of companies in a consortium called Fahrenheit LLC which will manage the mining and staking business.

The judge presiding over the case, Martin Glenn, is considering whether to approve Celsius’s restructuring plan. The plan will also need to be cleared by security regulators. Despite garnering an overwhelming majority of votes in favor, it is being challenged by some creditors, according to reports.

“The Debtors arrive at Confirmation with a Plan that has the support of over 95% of voting Account Holders by both number and dollar amount,” Celsius stated in a filing presented at the confirmation hearing.

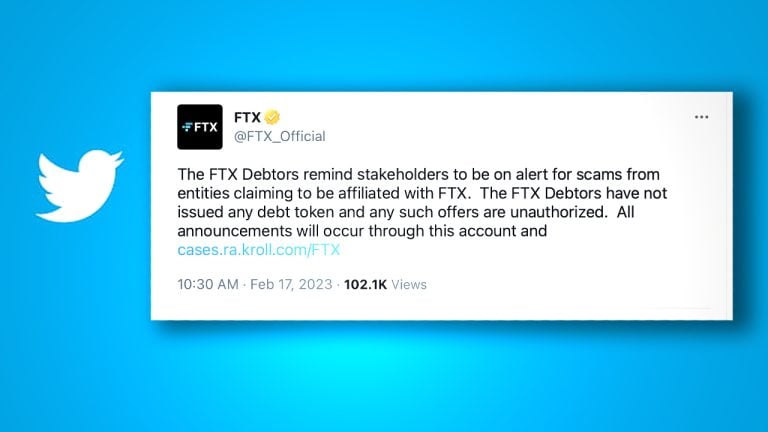

Related: Celsius creditors flag renewed phishing attacks ahead of bankruptcy plan

If the Celsius plan is approved, it would be one of the first failed crypto platforms from 2022 to be resurrected in a Chapter 11 bankruptcy case.

Celsius customers have been waiting to be made whole ever since the company halted withdrawals in June 2022 following the collapse of the Terra/Luna ecosystem.

Magazine: Simon Dixon on bankruptcies, Celsius and Elon Musk: Crypto Twitter Hall of Flame