The founder and CEO of crypto hedge fund Morgan Creek Digital, Mark Yusko, is optimistic that Bitcoin (BTC) will reach six figures. Yusko says in a new Wolf of All Streets interview that if Bitcoin is considered the digital equivalent of gold, it could potentially reach the same market cap as the precious metal, which […]

The post Bitcoin Exploding Over 880% From Here on Is ‘So Easy We Don’t Even Have To Debate’, Says Mark Yusko – Here’s Why appeared first on The Daily Hodl.

Rosbank has brokered Russia’s first deal involving the exchange of tokenized gold with the digital version of the Russian national fiat currency, the ruble. The successful transaction demonstrates the growing interest in digital financial assets and the need for digital ruble payments, the banking institution stated. Rosbank and Atomyze Exchange Gold and Rubles in Digital […]

Rosbank has brokered Russia’s first deal involving the exchange of tokenized gold with the digital version of the Russian national fiat currency, the ruble. The successful transaction demonstrates the growing interest in digital financial assets and the need for digital ruble payments, the banking institution stated. Rosbank and Atomyze Exchange Gold and Rubles in Digital […]

Rich Dad Poor Dad author Robert Kiyosaki says the hottest investments in the markets today are Bitcoin (BTC) along with the precious metals gold and silver. In a tweet to his 2.3 million followers, the best-selling author says the only way to build wealth and reduce debt is to invest in the strongest appreciating assets […]

The post Rich Dad Poor Dad Author Details Why Bitcoin Is Exploding, Says Top Crypto Is One of the ‘Hottest Subjects’ on Earth appeared first on The Daily Hodl.

The Bank for International Settlements (BIS) studied the main motives behind Bitcoin adoption by retail investors.

Bitcoin (BTC) investors are more likely enticed by the cryptocurrency’s rising prices, rather than their dislike of banks or its perceived use as a store of value, a new report from the Bank for International Settlements (BIS) suggests.

In a “BIS Working Papers” report published on Nov. 14, the central bank body looked into the relationship between Bitcoin prices, crypto trading, and retail adoption.

It studied the drivers of crypto adoption by retail investors using crypto trading app downloads as a proxy for adoption and user investments at the time of download.

It found that “a rise in the price of Bitcoin is associated with a significant increase in new users, ie entry of new investors” and that most retail investors “downloaded crypto apps when prices were high.”

The BIS presented evidence that daily downloads of crypto exchange apps increased with the rapidly rising price of Bitcoin between Jul. and Nov. 2021, peaking when Bitcoin’s price was between $55,000 and $60,000 roughly one month before its Nov. 2021 all-time high of just over $69,000.

It added 40% of crypto app users were men under 35 and were part of the most “risk-seeking” segment of the population, from this, it surmised:

“Users [are] being drawn to Bitcoin by rising prices — rather than a dislike for traditional banks, the search for a store of value or distrust in public institutions.”

“The price of Bitcoin remains the most important factor when we control for global uncertainty or volatility, contradicting explanations based on Bitcoin as a safe haven,” it added.

The BIS assumed app users purchased Bitcoin at the time of downloading a crypto app and subsequently supposed that up to “81% of users would have lost money” if they had purchased Bitcoin over $20,000.

The BIS’s assumptions seemingly correlate with data from blockchain analysis firm Glassnode, who on Nov. 14 confirmed that just over half of Bitcoin addresses are in profit, reaching a two-year low.

#Bitcoin $BTC Percent Addresses in Profit (7d MA) just reached a 2-year low of 51.881%

— glassnode alerts (@glassnodealerts) November 14, 2022

View metric:https://t.co/ik5IkrdoPk pic.twitter.com/boVDTqG8YL

The BIS added its analysis of blockchain data found as Bitcoin prices rose, smaller users purchased, and “the largest holders (the so-called ‘whales’ or ‘humpbacks’) were selling – making a return at the smaller users’ expense.”

Related: Turbulence for blockchain industry despite strong Bitcoin fundamentals: Report

It also documented the geography of crypto app adoption and found between Aug. 2015 to Jun. 2022 that Turkey, Singapore, the United States, and the United Kingdom had the highest total downloads per 100,000 people respectively.

India and China had the lowest, the latter seeing only 1,000 crypto app downloads per 100,000 people with the BIS opining that greater legal restrictions on crypto hamper retail adoption in those countries.

A Shark Tank investor is laying out what he thinks must happen for Bitcoin (BTC) to take off as the better version of gold. In a new interview with the Bankless podcast, billionaire Mark Cuban says BTC faces a problem of relative lack of utility and resulting lack of mainstream popularity. “Part of the challenge […]

The post Billionaire Mark Cuban Reveals Reason He Owns Bitcoin, Names Catalyst That Will Push BTC to New Heights appeared first on The Daily Hodl.

From a desperate investor’s ill-advised visit to Terra co-founder Do Kwon’s house resulting in an arrest, the announcement of a new Terra network, and blockchain talk at Davos, to predictions of U.S. economic collapse if inflation isn’t reigned in quickly, there’s no shortage of action-packed crypto stories this past week. Without further ado, this is […]

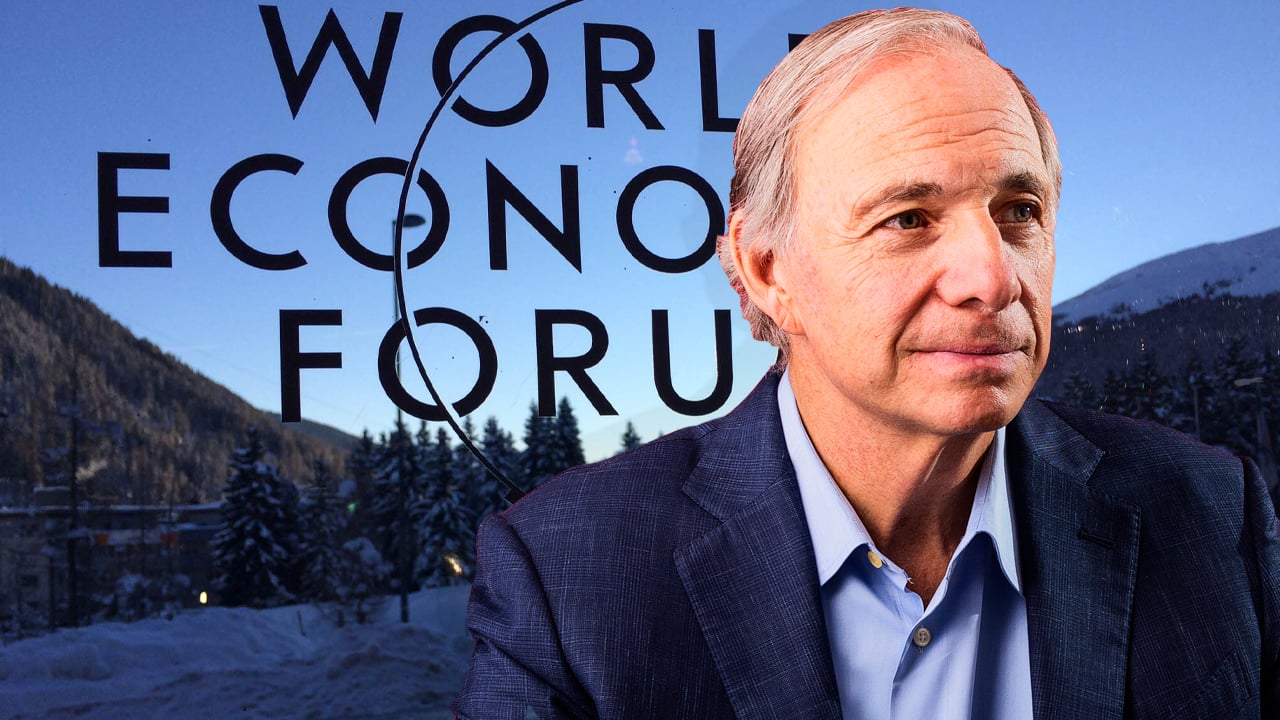

From a desperate investor’s ill-advised visit to Terra co-founder Do Kwon’s house resulting in an arrest, the announcement of a new Terra network, and blockchain talk at Davos, to predictions of U.S. economic collapse if inflation isn’t reigned in quickly, there’s no shortage of action-packed crypto stories this past week. Without further ado, this is […] This week the world has been talking about the World Economic Forum (WEF) meeting in Davos, Switzerland, which started on May 22 and ends on May 26. At the event, Bridgewater Associates founder Ray Dalio spoke about today’s economy, the Federal Reserve, cash, and cryptocurrencies. Dalio noted at the WEF conference that he believes blockchain […]

This week the world has been talking about the World Economic Forum (WEF) meeting in Davos, Switzerland, which started on May 22 and ends on May 26. At the event, Bridgewater Associates founder Ray Dalio spoke about today’s economy, the Federal Reserve, cash, and cryptocurrencies. Dalio noted at the WEF conference that he believes blockchain […]

Billionaire hedge fund veteran Ray Dalio says that the global financial landscape is now in an environment where investors need to ask what money really is and that a “digital gold” like Bitcoin (BTC) may be the answer. In an interview with CNBC’s Squawk Box, Dalio says that Bitcoin’s purpose as a store of value […]

The post Ray Dalio Warns of 1930s-Style Currency Devaluation, Says Bitcoin (BTC) Is Part of His Portfolio appeared first on The Daily Hodl.

A finance professor at the Wharton School of the University of Pennsylvania has warned about inflation and the Fed hiking rates many more times than the market expects. He also said that bitcoin has become the new gold for the millennials. Finance Professor on Bitcoin and Inflation Wharton’s finance professor Jeremy Siegel shared his outlook […]

A finance professor at the Wharton School of the University of Pennsylvania has warned about inflation and the Fed hiking rates many more times than the market expects. He also said that bitcoin has become the new gold for the millennials. Finance Professor on Bitcoin and Inflation Wharton’s finance professor Jeremy Siegel shared his outlook […]

The partnership enables investors to purchase grams of accredited gold as ERC-20 tokens.

Gold wholesalers are starting to find new ways to expand their businesses to retail, thanks to blockchain-based tokenization. International bullion trading company AgaBullion and United Kingdom-based fintech Aurus Technologies have signed a partnership to offer gold-backed tokens in the Turkish market.

The partnership will see investors own grams of LBMA-accredited gold via AurusGOLD. As a gold-backed ERC-20 token on the Ethereum blockchain, AurusGOLD (AWG) is minted and distributed by precious metals dealers using Aurus’ blockchain-based solution.

“Gold is the oldest decentralized finance system in the world,” AgaBullion chairman Gökhan Yılmaz said, “It has become a globally recognized and established ecosystem.” He added that since the lack of underlying assets and high volatility renders other cryptocurrencies unreliable, a physically-backed token makes sense.

“We see a huge potential for digital precious metals,” AgaBulllion CEO Sarp Tarhanaci stated. “By partnering with Aurus, we can now use their blockchain platform to facilitate fractional gold ownership in Turkey.”

Turkey’s history in investing physical gold, along with the high adoption rate of crypto as an alternative way to protect wealth, makes the country an attractive market for digital gold, AgaBullion told Cointelegraph.

Speaking on the opportunities in the market, AgaBullion explained that the COVID-19-related lockdown in Turkey made it impossible for citizens to access physical gold:

“People in Turkey are looking for something reliable and sustainable. Due to its centralized structure, it’s not efficient for consumers to buy gold from online platforms provided by banks. For AgaBullion, the most logical next step is a digital product.”

Turkey is known as one of the largest gold markets globally, where the precious metal is widely recognized as a form of wealth. Aurus business development manager Mark Gesterkamp said:

“AgaBullion is an approved member of Borsa İstanbul, offering the infrastructure, market knowledge, and network of clients for us to expand further the usability of digital gold and other precious metals in Turkey.”

Aurus told Cointelegraph that the ultimate goal for AWG is to position it as a means of payment. The team does not want to compete with fiat currencies, but they aim to offer a reliable and stable alternative.

Blockchain technology allows for an inclusive and efficient system, the firm said. "It makes precious metals accessible to ordinary people and not just the privileged sophisticated investors that largely dominate the market currently."