This week, the American economist and Nobel laureate Paul Krugman officially stepped away from his role as an opinion columnist for the New York Times. Social media buzzed with criticism, as many voiced sharp opinions about his track record, accusing him of repeatedly missing the mark on economic predictions. From Fax Machine to Bitcoin ‘Bubble’: […]

This week, the American economist and Nobel laureate Paul Krugman officially stepped away from his role as an opinion columnist for the New York Times. Social media buzzed with criticism, as many voiced sharp opinions about his track record, accusing him of repeatedly missing the mark on economic predictions. From Fax Machine to Bitcoin ‘Bubble’: […] Jeremy Siegel, a finance professor and chief economist, has called for an emergency 75 basis point cut in the fed funds rate following a market downturn. He emphasized the necessity of this cut and suggested another rate cut next month to align with the Federal Reserve’s targets on inflation and employment. Siegel warned that failing […]

Jeremy Siegel, a finance professor and chief economist, has called for an emergency 75 basis point cut in the fed funds rate following a market downturn. He emphasized the necessity of this cut and suggested another rate cut next month to align with the Federal Reserve’s targets on inflation and employment. Siegel warned that failing […] Gold advocate Peter Schiff has conducted two polls regarding bitcoin’s value and investors’ actions if the crypto’s price falls significantly. Despite his consistent criticism of bitcoin, the majority of respondents expressed strong commitment to holding their BTC even if the price drops drastically. Schiff maintains that bitcoin’s value proposition is flawed and anticipates a significant […]

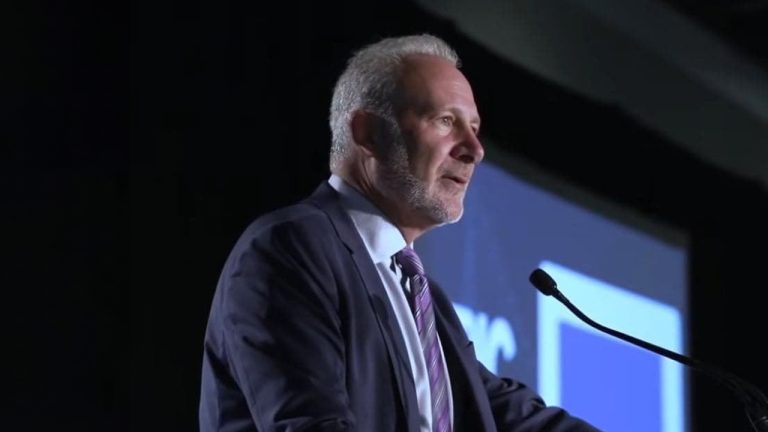

Gold advocate Peter Schiff has conducted two polls regarding bitcoin’s value and investors’ actions if the crypto’s price falls significantly. Despite his consistent criticism of bitcoin, the majority of respondents expressed strong commitment to holding their BTC even if the price drops drastically. Schiff maintains that bitcoin’s value proposition is flawed and anticipates a significant […] In a recent editorial, economist Peter St Onge explores the potential of a hidden economic recession, suggesting that official figures might not reveal the full extent of the decline. St Onge raises concerns about the accuracy of U.S. inflation data and its implications for measuring true economic growth. Peter St Onge, Official Figures May Understate […]

In a recent editorial, economist Peter St Onge explores the potential of a hidden economic recession, suggesting that official figures might not reveal the full extent of the decline. St Onge raises concerns about the accuracy of U.S. inflation data and its implications for measuring true economic growth. Peter St Onge, Official Figures May Understate […] In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […]

In a recent analysis, economist Peter Schiff draws stark comparisons between the current U.S. economic optimism and the prelude to the 2008 financial crisis. Schiff, leveraging his expertise, warns of impending financial turmoil, emphasizing the critical role of money supply in understanding economic health. Peter Schiff Warns: U.S. Economy on the Brink, Echoes of 2008 […] In recent years, discussions have flourished around the visionary predictions of famed architect and systems theorist Buckminster Fuller, who is said to have anticipated a concept akin to Bitcoin. Similarly, industrial magnate Henry Ford is credited with imagining a novel energy currency with the potential to halt wars. Furthermore, Friedrich Hayek, a towering figure in […]

In recent years, discussions have flourished around the visionary predictions of famed architect and systems theorist Buckminster Fuller, who is said to have anticipated a concept akin to Bitcoin. Similarly, industrial magnate Henry Ford is credited with imagining a novel energy currency with the potential to halt wars. Furthermore, Friedrich Hayek, a towering figure in […]

Dr. Saifedean Ammous thinks El Salvador will be debt free if it accumulates Bitcoin for the next five years.

Dr. Saifedean Ammous, the author of an explanatory book about Bitcoin (BTC) called The Bitcoin Standard, has been appointed the economic adviser to the National Bitcoin Office of El Salvador.

On May 30, the Office announced that the Austrian economist had joined the team as its advisor for matters related to various economic policies.

Dr. Ammous’ now-famous book was first published in April 2018. It analyzes the transition between solid stores of value to inflated assets and fiat currencies, traces the history of money and aims to show how civilizations have changed with their monetary systems.

Regarding the new position, he tweeted on May 30 that he was “excited” to work in the office in “the first country to adopt a Bitcoin standard!”

When the author of the Bitcoin Standard met the leader of Bitcoin Country, great things were bound to happen.

— The Bitcoin Office (@bitcoinofficesv) May 30, 2023

We are excited to announce that @saifedean is joining us as Economic Advisor to the National Bitcoin Office of El Salvador.

Welcome to the winning team, Dr Ammous! pic.twitter.com/LyIljvKvtz

Speaking to local media outlet Diario El Salvador on May 30, Ammous said, “What makes Bitcoin unique is that it gives you the opportunity to have a strong asset that doesn’t depreciate over the years.”

“If you have money that depreciates over time, there is no point in saving and it makes sense to get into debt,” he added.

“If you continue to accumulate Bitcoin for the next five years, there is a good chance that El Salvador will be debt free.”

The National Bitcoin Office (ONBTC) reported that Dr. Ammous recently traveled to El Salvador to lecture students of CUBO+, a Bitcoin and Lightning Network developers program to teach locals the code and concepts.

He also met with President Nayib Bukele and shared his thoughts on the “remarkable benefits of the policy of economic liberty.”

The ONBTC stated that Dr. Ammous declined any remuneration for the role and was only interested in supporting President Bukele’s Bitcoin policy.

El Salvador’s National Bitcoin Office was created in November 2022 by Bukele to manage all things crypto-related.

Related: Strike moves global headquarters to El Salvador, expands to 65 countries

American broadcaster Max Keiser and television presenter Stacy Herbert are also part of Bukele's Bitcoin team, in addition to the recently appointed professor.

Max Keiser commented that The Bitcoin Standard “‘Orange Pilled’ millions, including [MicroStrategy founder Michael Saylor] and many corporate and financial heavyweights who keep adding Bitcoin to their coffers daily.”

Magazine: What it’s actually like to use Bitcoin in El Salvador

The stablecoins with the largest market cap are pegged to the U.S. dollar, so what risk does de-dollarization pose to stablecoin users?

It is an empirical fact that the United States dollar is continuing to lose its dominant role as the global reserve currency, but what might happen to the stablecoin market should it be superseded?

According to data from the International Monetary Fund, the U.S. dollar now accounts for just over 58% of global foreign exchange reserves, a considerable decrease from the 71% share it had in 2001.

Jeremy Allaire — the CEO of USD Coin (USDC) issuer Circle — highlighted this shift at the April 26 Consensus 2023 conference, arguing that the U.S. must implement stablecoin legislation and digitize the U.S. dollar to remain competitive amid the “very active de-dollarization taking place.”

De-dollarization refers to the process of reducing the use of the U.S. dollar in a country’s economy, and powerhouses like Russia and China are actively pursuing de-dollarization as they look to replace the U.S. dollar with digital assets, other fiat currencies, and potentially a BRICS currency between Brazil, Russia, India, China and South Africa.

As an example of this de-dollarization taking place, the Chinese yuan has recently overtaken the U.S. dollar as China’s most used cross-border currency according to Bloomberg, increasing to a high of 48% of transactions after it made up nearly 0% in 2010.

Chinese Yuan overtakes US dollar as most-used currency in China's cross-border transactions for the first time in history.

— Genevieve Roch-Decter, CFA (@GRDecter) April 26, 2023

Yuan-share rose to a record high of 48%, UP from nearly zero in 2010.

U.S-share declined to 47%, DOWN from 83% over the same period.

Wow. pic.twitter.com/Lm3Rygpm45

Another example that may be more familiar to crypto users can be seen in El Salvador, which in 2021 became the first country in the world to use Bitcoin (BTC) as a legal tender.

Following news that crypto exchange Coinbase is launching a derivatives exchange in Bermuda, some crypto proponents such as venture capitalist David Sacks have even suggested that the U.S. may be attempting to prevent crypto firms from accessing bank services in the country in an intentional effort to drive them overseas out of fear that crypto could further eat into the dominance of the U.S. dollar.

Speaking to Cointelegraph, Dr. Joachim Schwerin — principal economist for the European Commission — suggested changes in the world’s leading reserve currency regularly occur, adding:

“Since we have records on financial data, the role of globally leading currency has changed every 80 to 110 years. Times of accelerated global frictions that significantly affect trade patterns vastly accelerate such changes.”

The sanctions placed on Russia by the U.S. are a prime example of this global friction, and on April 16 Treasury Secretary Janet Yellen noted that sanctions could risk the U.S. dollar hegemony as targeted countries look for alternative currencies.

Many people are likely familiar with the video “Principles for Dealing with the Changing World Order’ by billionaire investor and hedge fund manager Ray Dalio, in which Dalio suggested that having the leading reserve currency “is a key factor in a country becoming the richest and most powerful empire,” which is an opinion shared by many pundits.

The US used its advantage of US dollar hegemony to build an aggressive military to bully the whole world.

— Richard (@ricwe123) April 18, 2023

De-dollarization will cause the US dollar to collapse, exactly similar to what happens when Ponzi schemes collapse. pic.twitter.com/GALHzBj0AI

One of the main benefits of being the dominant reserve currency is thought to be the increased level of demand it experiences relative to other countries due to it being widely accepted globally and regarded as a safe-haven asset, thus making it more valuable.

In response to questions from Cointelegraph, Tether — the issuer of the largest stablecoin by market capitalization Tether (USDT) — noted that stablecoins which are pegged to the U.S. dollar also increase demand for the currency.

Increased demand for the U.S. dollar theoretically makes it more valuable relative to other currencies, which makes importing goods and services relatively cheaper for the U.S. and allows the country to borrow funds at lower costs.

Yet in response to concerns about what would occur if the U.S. dollar lost its hegemony, many economists cite the words of Nobel Prize-winning economist Paul Krugman, who argued back in August 2015 that “while reserve-currency status may have political symbolism attached, it's essentially irrelevant as an economic goal” due to its benefits being worth “a small fraction of one percent of GDP.”

It is worth noting that economists are famous for disagreeing with one another. In an April 11 survey of economists, 50% of them disagreed with Krugman’s assertion that the benefits are only minor.

According to CoinMarketCap, every stablecoin with a market cap exceeding $1 billion is pegged to the U.S. dollar, which makes sense given its dominant status.

As the U.S. dollar continues to lose its dominance, however, these stablecoins may see their usage diminish.

Tether highlighted that stablecoins are “particularly beneficial for citizens in emerging markets who may face high levels of inflation and currency instability,” or those in countries with limited access to financial services, so even if the U.S. dollar and stablecoins pegged to it diminish, others will likely step in.

Schwerin noted that “big issues are already now reaching out outside the U.S. to cater for exactly this scenario,” referencing stablecoins like Circle’s Euro Coin (EUROC) which is pegged to the euro, adding:

“There will have to be quite a lot of improvisation and experimentation, which is good for innovation.”

Schwerin noted that he didn’t know exactly what would work, but expressed optimism that the crypto community would be able to quickly find solutions.

Tether said that it “has always been at the forefront of innovation,” and pointed to other products it has released such as Tether Gold (XAUT) — a stablecoin collateralized by gold — as well as other fiat-backed stablecoins.

While stablecoins can be designed in very different ways, the most frequently used ones are currently both fully/over-collateralized and exogenous (backed by external assets).

As long as stablecoins have sufficient collateral, their users should not be worried that a transition away from U.S. pegged stablecoins will cause any liquidity issues, particularly when a high proportion of the collateral is stored as highly liquid assets.

Magazine: Here’s how Ethereum’s ZK-rollups can become interoperable

On Monday, Morgan Stanley’s equity strategist, Michael Wilson, shared his thoughts on the state of Wall Street. He expressed his belief that a sell-off could be imminent, and that this could occur as a result of U.S. Federal Reserve chairman Jerome Powell’s upcoming remarks on Wednesday. Furthermore, there has been a great deal of conjecture […]

On Monday, Morgan Stanley’s equity strategist, Michael Wilson, shared his thoughts on the state of Wall Street. He expressed his belief that a sell-off could be imminent, and that this could occur as a result of U.S. Federal Reserve chairman Jerome Powell’s upcoming remarks on Wednesday. Furthermore, there has been a great deal of conjecture […] Within the next decade, the U.S. dollar will play a much less dominant role than it is today, according to Jeffrey Sachs. The renowned economist listed a few factors for the diminishing status of the greenback such as its use as a political weapon by Washington, the introduction of currencies like the digital yuan, and […]

Within the next decade, the U.S. dollar will play a much less dominant role than it is today, according to Jeffrey Sachs. The renowned economist listed a few factors for the diminishing status of the greenback such as its use as a political weapon by Washington, the introduction of currencies like the digital yuan, and […]