The top court in the US won’t hear Battle Born Investments’ case claiming it purchased rights to 69,370 Bitcoin seized by the US from the online black market Silk Road.

The United States Supreme Court declined to take on a case concerning the ownership of 69,370 Bitcoin — worth $4.38 billion — that the US government seized from the dark web marketplace Silk Road.

The request for review was brought by Battle Born Investments, a company that claimed it had purchased rights to the seized Bitcoin (BTC) through a bankruptcy estate.

The Supreme Court’s refusal to hear the case could clear the US government to sell the stack of Bitcoin.

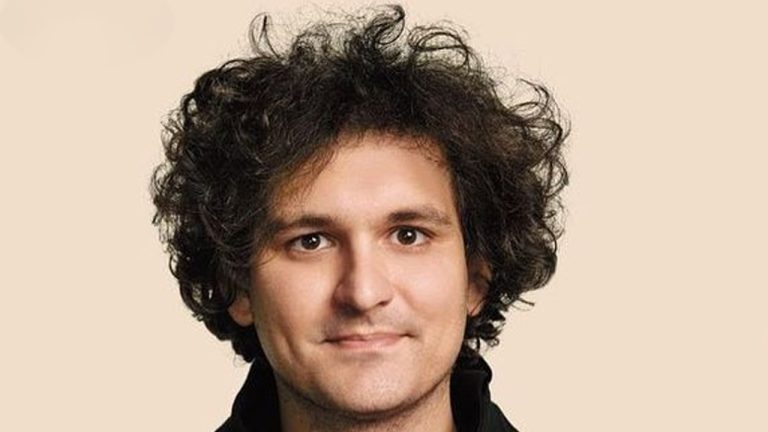

Court filings reveal that the FTX co-founder is seeking access to a $10 million insurance plan to cover his attorney fees. FTX debtors and unsecured creditors have opposed Sam Bankman-Fried’s request, arguing that every dollar spent on his defense is “one less dollar” available to cover the losses of the debtors. FTX Debtors and Unsecured […]

Court filings reveal that the FTX co-founder is seeking access to a $10 million insurance plan to cover his attorney fees. FTX debtors and unsecured creditors have opposed Sam Bankman-Fried’s request, arguing that every dollar spent on his defense is “one less dollar” available to cover the losses of the debtors. FTX Debtors and Unsecured […]

The creditor's committee and FTX lawyers have raised several arguments in objecting to Bankman Fried’s request. A hearing date is set for April 12.

Sam Bankman Fried’s new petition to have his legal expenses reimbursed has been met with fierce objection from lawyers representing the crypto exchange and its creditors committee.

As per previous reporting by Cointelegraph, Bankman-Fried’s lawyers had filed a motion on March 15 seeking to have his court costs covered by directors and officers (D&O) insurance policies, which if approved by the judge would see him placed at the top of the payout queue.

Defense costs are covered in most policies (after a deductible) but insurers have provisions for selection of counsel so even if approved the insurer is unlikely to approve the high priced lawyers SBF has (or needs).

— Mr. Purple (@MrPurple_DJ) March 16, 2023

In March 29 objection filing, FTX’s lawyers objected to Bankman-Fried’s attempt to prioritize his own legal fees at the expense of other potential claimants, stating:

“It would be unfair, inequitable, and contrary to the interests of justice to allow Mr. Bankman-Fried to drain the D&O Policies for his sole benefit”

FTX’s lawyers argue that if the court rules in favor of Bankman-Fried then the insurance payout should apply to other directors and officers who have a claim to the funds.

The Official Committee of Unsecured Creditors also filed an objection on the same day, noting that D&O insurance policies only apply “where they make honest decisions in the ordinary course of the business,” which it argues “is not the case” regarding Bankman-Fried’s request.

The committee argued that the court should thus decline the request, labeling Bankman-Fried the “alleged perpetrator of one of the largest criminal frauds in the last decade.”

This sentiment has been echoed by some from the crypto community prior to Sam Bankman Fried’s request.

Directors and officers (D&O) liability insurance is a type of insurance coverage that protects individuals from personal losses if they are sued as a result of serving as a director or an officer for a firm. Such policies can also be used by the firm to cover legal fees and costs incurred as a result of a lawsuit against a former officer or director.

The creditors committee however argued that Bankman-Fried had failed to justify his claim to the $10 million in available coverage which should instead go towards covering FTX’s losses.

Related: SBF banned from using online messengers under new bail agreement

According to reports, the former FTX CEO is currently paying his legal fees with $10 million he had previously gifted to his father Joseph Bankman, after Bankman-Fried loaned the funds from Alameda Research.

Bankman-Fried was charged with 12 criminal counts on Feb. 22, which included numerous fraud charges, and was rounded up to a baker’s dozen on Feb. 28 following allegations that he used $40 million in an attempt to bribe a Chinese official.

Web3 Gamer: Shrapnel wows at GDC, Undead Blocks hot take, Second Trip

Administrative expenses from the bankruptcy proceedings have already topped $53 million, and continued delays are chipping away at Celsius’ estate.

Bankrupt crypto lender Celsius Network is planning to file a motion that would extend the deadline for users to submit their claims by another month.

The crypto community has started to grow impatient, noting that Celsius’ lawyer fees have continued to stack up and are eating away at the lender's estate.

In a Dec. 29 tweet, Celsius announced that it would seek to extend the current deadline for claims from Jan. 3 to early February.

The bankruptcy court is set to hear the motion on Jan. 10, and according to Celsius, the Jan. 3 deadline will be extended until at least then.

Celsius is preparing to file a motion later this week requesting an extension of the bar date, which is the deadline to file a claim, from January 3, 2023, until early February.

— Celsius (@CelsiusNetwork) December 29, 2022

The claims process allows creditors who believe they have a right to payment to file claims during bankruptcy proceedings. Celsius’ creditors had made over 17,200 claims as of Dec. 29.

However, Celsius’ creditors appear antsy as Celsius’ administrative fees have continued to rack up since it first filed for bankruptcy in July. A Dec. 27 Financial Times report noted that the fees charged by bankers, lawyers and other advisers in the bankruptcy case had already reached $53 million.

As an example, a Dec. 15 fee statement from one of the law firms representing Celsius, Kirkland & Ellis, requested a fee of over $9 million for work done during the months of September and October.

In comparison, only $44 million has so far been earmarked by Celsius to be returned to customers. This money belongs to users who only ever held funds within the Custody Program, and represents a minority of the $4.72 billion of user deposits held by Celsius.

Some in the crypto community have been unimpressed with the latest postponement in the proceedings, alleging that it’s yet another “delay tactic.” For example, one user noted “Stop wasting time stop extending, just go on with proceedings and give me my money back!!!!” while another simply said: “Stop wasting time and my money.”

So the lawyers get millions but I wonder what us small fry folks get?

— Chris (@browncoat1of1) December 29, 2022

Related: 7 biggest crypto collapses of 2022 the industry would like to forget

Global investment platform BnkToTheFuture founder Simon Dixon, who has been an active voice in the Celsius bankruptcy proceedings, noted in a Dec. 23 tweet that by the time users are able to get their funds back from Celsius, they should only expect around to receive around hal what they put in.

Prepare yourself for 50% in 6 months with #Celsius Chapter 11 to manage your expectations | Focus on your family over XMas & rebuilding in 2023. https://t.co/E0WeDuPem0

— Simon Dixon (@SimonDixonTwitt) December 23, 2022

At the behest of Celsius, the U.S. trustee, and the unsecured creditors’ committee, judge Martin Glenn appointed fellow judge Christopher Sontchi to be a “fee examiner” on Oct. 20. His job is to negotiate and approve the fees set by lawyers and other professionals in the case.

The fee examiner is also being paid out of Celsius’ estate, with the latest fee statement submitted on Dec. 21 requesting just under $20,000 for work done during November.

The four businesses FTX wants to sell had only recently been acquired, and lawyers argue this simplifies the sale process.

On Dec. 15 lawyers representing FTX filed a motion with the United States Bankruptcy Court seeking permission to sell off the firm's Japanese and European branches, derivatives exchange LedgerX and stock-clearing platform Embed.

The lawyers note that each of these businesses have been under pressure from regulators, which “merit[s] an expeditious sale process,” adding:

“The longer operations are suspended, the greater the risk to the value of the assets and the risk of a permanent revocation of licenses.”

FTX Japan is currently subject to a business suspension and improvement orders, while FTX Europe has had its licenses and operations suspended.

They also point to the loss of customers and employees the businesses have experienced since FTX filed for bankruptcy on Nov. 11, and believe selling these businesses now would allow the resumption of operations and therefore maximize value to the FTX estate.

The lawyers said these businesses were recently acquired and have been operating relatively independently of FTX, which would make a potential sale process much less complex.

Assuming there is more than one potential bidder the auctions for the businesses would start with Embed on Feb. 21 2023, with the other three occurring the following month.

Related: FTX Bahamas co-CEO Ryan Salame blew the whistle on FTX and Sam Bankman-Fried

More than 110 parties are said to be interested in purchasing one or more of the 134 companies included in the bankruptcy proceedings, and FTX has already entered into 26 confidentiality agreements with counterparties interested in the businesses or assets of FTX.

LedgerX in particular has been hailed as a success story during the bankruptcy proceedings of FTX, with Commodity Futures Trading Commission Chairman Rostin Behnam noting that the firm had essentially been “walled off” from other companies within FTX Group, and “held more cash than all the other FTX debtor entities combined.”

FTX wants to sell off parts of its failed crypto empire before they lose too much of their value or have their licenses permanently revoked, arguing it is in the best interests of all stakeholders.

The Japanese subsidiary one of 134 companies been caught up in FTX’s bankruptcy proceedings but has been drafting a plan to return client funds.

The Japanese subsidiary of the now-defunct FTX crypto exchange has come out with a roadmap to resume withdrawals, after confirming that its customers’ assets are not part of FTX's bankruptcy proceedings.

The firm provided an update on Dec. 1, stating it has been able to confirm that its customers’ assets "should not" be part of FTX Japan's estate due to Japanese regulations which mandate that crypto exchanges must separate client funds from their own assets.

This was according to Landis Rath & Cobb LLP, the law firm representing FTX Group in the Chapter 11 bankruptcy proceedings.

FTX Japan was only launched in June this year after acquiring Japanese crypto exchange Liquid on Feb. 2. It was aimed at serving the exchange's Japanese customers.

However, with liquidity issues experienced by its parent company in early November, withdrawals were halted at FTX Japan on Nov. 8, similar to its parent company.

Days later, the Financial Services Agency of Japan announced on Nov. 10 it had taken administrative action against FTX Japan and ordered it to suspend other business operations such as accepting new deposits while complying with a business improvement order.

The company was then listed as one of the 134 companies that formed part of FTX Trading’s chapter 11 bankruptcy filing on Nov. 11.

Since then FTX Japan has claimed their primary focus is to re-enable withdrawals, and are reportedly aiming to do so by the end of 2022.

Related: US Senate committee hearing on FTX fail brings gaps in regulatory authority to light

With the recent confirmation that its users' assets are not considered part of FTX Japan’s estate, this would effectively provide them with a pathway to resume withdrawals for its users.

“Japanese customer cash and crypto currency should not be part of FTX Japan’s estate given how these assets are held and property interests under Japanese law,” the firm noted.

FTX Japan said its management is in regular dialogue with Japanese regulators and has sent through the first draft of their plan to resume withdrawals, suggesting regular consultations will occur “as key milestones are met.”

London-born advisory and accountancy network Moore Global has published a new report gathering expert opinions worldwide about the future of the tokenized real estate market.

Tokenized property remains niche, largely due to its relative novelty and remaining regulatory uncertainties. Yet a new report has noted that even if just 0.5% of the total global property market were to be tokenized in the next five years, it would be on track to become a $1.4 trillion market

In recent years, the total value of the global real estate market has hit a staggering $280 trillion, eclipsing most other major asset classes and on par with the value of total global debt accrued by 2020. Moore Global, a London-born international advisory and accountancy network, has published a report collating expert opinions worldwide on the potential of tokenization for this thriving, if traditionally illiquid, asset class.

For Dan Natale, Moore Global’s real estate and construction leader and a managing partner of Segal LLP in Toronto, blockchain's key benefit to the sector is a boost to liquidity by providing efficient, disintermediated infrastructure to underpin new secondary markets. David Walker, a managing partner of Moore Cayman who works as an auditor specializing in digital assets, has for his part claimed that the transparency and security of the technology also offer evident advantages from an auditor’s perspective.

Until now, the expansion of real estate tokenization has fallen short of expectations, due in part to institutional investors’ hesitancy and the absence of established secondary markets for security token trading. This, however, may be gradually changing, with the United Kingdom’s Financial Conduct Authority granting an operational license to digital security exchange Archaz in August of last year. One year prior, Germany’s Federal Financial Supervisory Authority (BaFin) had approved its first blockchain-based real estate bond, issued on Ethereum.

Related: Tokenized Real Estate Hasn’t Lived Up to the Hype: Property Researcher

Andrew Baum, director of the Future of Real Estate Initiative at Oxford University’s Said Business School, thinks that tokenization in real estate could finally take off if there is evidence of investor demand for fractional ownership – something that advocates of tokenization have championed since 2017.

Last summer, a security token representing fractional ownership in the luxury St. Regis Aspen Resort in Colorado went live on Overstock’s regulated tZERO exchange, attracting record trading volumes. Within less than a month, however, with the token seeing a relatively flat performance amid the coronavirus slowdown, investors were being offered major discounts on their stays at the resort to help boost the token sales. tZERO has nonetheless recently struck a partnership to tokenize $18 million worth of shares in NYCE Group – a platform hyped as a potential “Robinhood of real estate investing.”