President Donald Trump has signed an executive order to support the “responsible growth” of the digital assets industry. According to a new memo released by the White House, Trump signed an executive order yesterday promoting the use of blockchains for individuals and entities. Other aspects of the order include protecting US citizens from the risks […]

The post Trump Signs Executive Order Aiming to Support ‘Responsible Growth’ of the Crypto Industry appeared first on The Daily Hodl.

President-elect Donald Trump is reportedly going to issue a crypto-related executive order during the first day of his new term. According to a new report by Bloomberg, anonymous people familiar with his plans say Trump is planning an executive order that will prioritize crypto-focused policymaking. The report says the order will likely name digital assets […]

The post President-Elect Donald Trump Plans a Crypto Executive Order on Day One of His Second Term: Report appeared first on The Daily Hodl.

The executive order would instruct regulatory agencies to work with the industry and create a crypto council to represent the industry, according to people familiar with the plans.

US President-elect Donald Trump is reportedly expected to sign an executive order designating crypto as a national priority that could come as soon as he re-enters office on Jan. 20.

Bloomberg reported on Jan. 17, citing people familiar with the plans, that the order would mean regulatory agencies would be guided to work with the industry. It could also create a crypto council to advocate the industry’s policy wishes.

The order could be signed on Jan. 20 — Trump’s first day back as president — but it’s not final and could change before it’s made public, the report said.

Donald Trump could issue executive orders addressing crypto de-banking and a bank accounting policy when he re-takes the presidency on Jan. 20.

US President-elect Donald Trump’s first day back in the White House on Jan. 20 could see him sign a flurry of executive orders — some of which could impact the crypto industry.

The Washington Post reported on Jan. 13 that Trump is expected to sign executive orders after taking office next week covering crypto de-banking and repealing a bank accounting policy that requires banks holding crypto to list the digital assets as a liability.

“The Trump team has made it very clear that this is a priority,” a person involved with the conversations told the Post.

President-elect Trump will issue an executive order effectively allowing banks and financial institutions to hold Bitcoin (BTC) and crypto assets on behalf of their clients, according to a new report. The incoming order will reverse a regulatory guideline that has shaped how financial institutions account for and custody digital assets, reports the Washington Post. “…Trump […]

The post US Banks Can Hold Bitcoin and Crypto Under Incoming Trump Executive Order: Report appeared first on The Daily Hodl.

The government of Argentina is reportedly preparing to regulate cryptocurrency service providers with an executive order. The measure would be directed to keep Argentina out of the Financial Action Task Force (FATF) gray list, putting crypto service lenders under the oversight of the local securities watchdog. Argentina Reportedly Set to Regulate Cryptocurrency Service Providers by […]

The government of Argentina is reportedly preparing to regulate cryptocurrency service providers with an executive order. The measure would be directed to keep Argentina out of the Financial Action Task Force (FATF) gray list, putting crypto service lenders under the oversight of the local securities watchdog. Argentina Reportedly Set to Regulate Cryptocurrency Service Providers by […] On March 1, 2023, Nellie Liang, undersecretary for domestic finance at the U.S. Treasury, delivered a speech to the Atlantic Council in Washington concerning the subject of central bank digital currencies (CBDCs). Liang detailed during her speech that a CBDC is one of several options for “upgrading the legacy capabilities of central bank money,” and […]

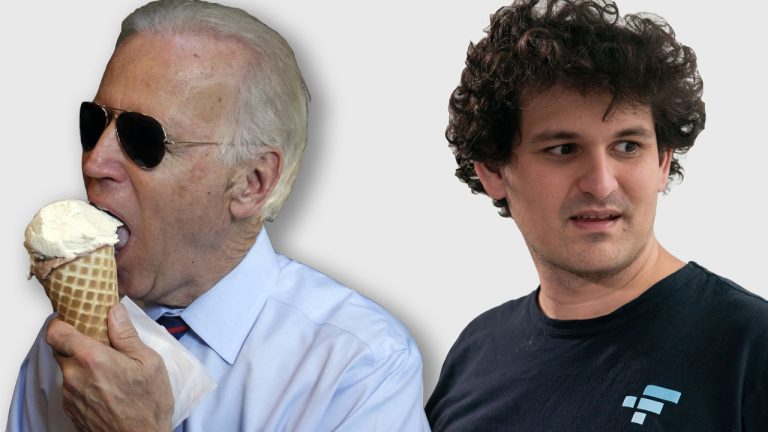

On March 1, 2023, Nellie Liang, undersecretary for domestic finance at the U.S. Treasury, delivered a speech to the Atlantic Council in Washington concerning the subject of central bank digital currencies (CBDCs). Liang detailed during her speech that a CBDC is one of several options for “upgrading the legacy capabilities of central bank money,” and […] According to public filings, former crypto billionaire and FTX co-founder Sam Bankman-Fried met with senior Biden administration officials before he was indicted for financial fraud. When asked about the visits, White House press secretary Karine Jean-Pierre told the press the meetings involved discussions about “pandemic prevention.” Senior White House Staff Met With Former Billionaire Sam […]

According to public filings, former crypto billionaire and FTX co-founder Sam Bankman-Fried met with senior Biden administration officials before he was indicted for financial fraud. When asked about the visits, White House press secretary Karine Jean-Pierre told the press the meetings involved discussions about “pandemic prevention.” Senior White House Staff Met With Former Billionaire Sam […]

The collapse of FTX has raised alarm bells across Washington, D.C.

United States congressman Brad Sherman, a known crypto skeptic, has pointed the finger at “billionaire crypto bros” for slowing down much-needed cryptocurrency regulation.

In a Nov. 13 statement addressing the collapse of crypto exchange FTX, Sherman said the exchange’s implosion has demonstrated the need for regulators to take immediate and aggressive action:

“The sudden collapse this week of one of the largest cryptocurrency firms in the world has been a dramatic demonstration of both the inherent risks of digital assets and the critical weaknesses in the industry that has grown up around them.”

“For years I have advocated for Congress and federal regulators to take an aggressive approach in confronting the many threats to our society posed by cryptocurrencies,” he added.

Sherman announced his plans to work with his Congress colleagues to examine options for federal legislation, which he hopes can be carried out without the financial influence of members in the cryptocurrency industry:

“To date, efforts by billionaire crypto bros to deter meaningful legislation by flooding Washington with millions of dollars in campaign contributions and lobbying spending have been effective.”

“I believe it is important now more than ever that the SEC take decisive action to put an end to the regulatory gray area in which the crypto industry has operated,” the senator added.

While Sherman made a direct reference to former FTX CEO Sam Bankman-Fried and political donations to the Democratic Party, he also mentioned Ryan Salame, the co-CEO of FTX, who donated to Republicans in 2022.

Bankman-Fried was also reported to have donated $39.8 million into the recent 2022 U.S. midterm election, which he said was distributed to both the Democratic and Republican parties. The nearly $40 million figure made him the sixth largest contributor.

While Sherman has advocated for an “aggressive approach” to crypto regulation, Thomas Hook, a Professor on Cryptocurrency Regulation at Boston University School of Law recently told Cointelegraph that regulators should be looking to implement “common sense regulation:”

“[Regulators] are reacting to an industry that is evolving constantly but overregulation could stifle that innovation [...] poorly thought-out regulation could create a two-fold issue: first it could limit US consumers’ ability to participate in the cryptocurrency ecosystem and it could also drive these businesses to less regulated jurisdictions.”

“This actually creates more risk for customers as it puts them in a position of dealing with less regulated institutions to participate in the ecosystem,” he added.

His comments, however, were made before the collapse of the FTX crypto exchange. Cointelegraph has reached out to Hook to understand if his position has changed in light of the new events.

Related: US senators commit to advancing crypto bill despite FTX collapse

Meanwhile, Shark Tank host and millionaire venture capitalist Kevin O’Leary stated in a Nov. 11 interview with CNBC that U.S. regulators “need to start with one thing” rather than regulating everything at once — with the investor recommending Congress start with the Stablecoin Transparency Act.

O’Leary said that given the recent events at FTX, he believes institutional investors will likely put a pause on deploying “serious capital” into new investments until a legitimate regulatory framework is set in place:

“That would signal to everybody around the world that regulators in the United States are taking crypto on, starting to put rules in place, putting the guard rails on, no one is going to play ball in this space on an institutional level with serious capital until we get it done.”

Among the most notable cryptocurrency bills to have been introduced into U.S. Congress include the Central Bank Digital Currency Study Act of 2021, the Digital Commodities Consumer Protection Act of 2022 (DCCPA), the Stablecoin Transparency Act and the Cryptocurrency Tax Clarity Act.

Future bills will center around President Joe Biden’s executive order in March 2022 — which will include bills aimed at improving consumer and investor protection, promoting financial stability, countering illicit finance and improving the United States’ standing in the global financial system, financial inclusion and responsible innovation.

The Biden administration is concerned about digital currency mining operations affecting climate change, after the U.S. Office of Science and Technology Policy published a report that says politicians should take action against crypto mining. The federal government’s entity recommends the Biden administration should encourage more research about mining’s electricity consumption and codify public policy for […]

The Biden administration is concerned about digital currency mining operations affecting climate change, after the U.S. Office of Science and Technology Policy published a report that says politicians should take action against crypto mining. The federal government’s entity recommends the Biden administration should encourage more research about mining’s electricity consumption and codify public policy for […]