The government of Argentina is reportedly preparing to regulate cryptocurrency service providers with an executive order. The measure would be directed to keep Argentina out of the Financial Action Task Force (FATF) gray list, putting crypto service lenders under the oversight of the local securities watchdog. Argentina Reportedly Set to Regulate Cryptocurrency Service Providers by […]

The government of Argentina is reportedly preparing to regulate cryptocurrency service providers with an executive order. The measure would be directed to keep Argentina out of the Financial Action Task Force (FATF) gray list, putting crypto service lenders under the oversight of the local securities watchdog. Argentina Reportedly Set to Regulate Cryptocurrency Service Providers by […] On March 1, 2023, Nellie Liang, undersecretary for domestic finance at the U.S. Treasury, delivered a speech to the Atlantic Council in Washington concerning the subject of central bank digital currencies (CBDCs). Liang detailed during her speech that a CBDC is one of several options for “upgrading the legacy capabilities of central bank money,” and […]

On March 1, 2023, Nellie Liang, undersecretary for domestic finance at the U.S. Treasury, delivered a speech to the Atlantic Council in Washington concerning the subject of central bank digital currencies (CBDCs). Liang detailed during her speech that a CBDC is one of several options for “upgrading the legacy capabilities of central bank money,” and […] According to public filings, former crypto billionaire and FTX co-founder Sam Bankman-Fried met with senior Biden administration officials before he was indicted for financial fraud. When asked about the visits, White House press secretary Karine Jean-Pierre told the press the meetings involved discussions about “pandemic prevention.” Senior White House Staff Met With Former Billionaire Sam […]

According to public filings, former crypto billionaire and FTX co-founder Sam Bankman-Fried met with senior Biden administration officials before he was indicted for financial fraud. When asked about the visits, White House press secretary Karine Jean-Pierre told the press the meetings involved discussions about “pandemic prevention.” Senior White House Staff Met With Former Billionaire Sam […]

The collapse of FTX has raised alarm bells across Washington, D.C.

United States congressman Brad Sherman, a known crypto skeptic, has pointed the finger at “billionaire crypto bros” for slowing down much-needed cryptocurrency regulation.

In a Nov. 13 statement addressing the collapse of crypto exchange FTX, Sherman said the exchange’s implosion has demonstrated the need for regulators to take immediate and aggressive action:

“The sudden collapse this week of one of the largest cryptocurrency firms in the world has been a dramatic demonstration of both the inherent risks of digital assets and the critical weaknesses in the industry that has grown up around them.”

“For years I have advocated for Congress and federal regulators to take an aggressive approach in confronting the many threats to our society posed by cryptocurrencies,” he added.

Sherman announced his plans to work with his Congress colleagues to examine options for federal legislation, which he hopes can be carried out without the financial influence of members in the cryptocurrency industry:

“To date, efforts by billionaire crypto bros to deter meaningful legislation by flooding Washington with millions of dollars in campaign contributions and lobbying spending have been effective.”

“I believe it is important now more than ever that the SEC take decisive action to put an end to the regulatory gray area in which the crypto industry has operated,” the senator added.

While Sherman made a direct reference to former FTX CEO Sam Bankman-Fried and political donations to the Democratic Party, he also mentioned Ryan Salame, the co-CEO of FTX, who donated to Republicans in 2022.

Bankman-Fried was also reported to have donated $39.8 million into the recent 2022 U.S. midterm election, which he said was distributed to both the Democratic and Republican parties. The nearly $40 million figure made him the sixth largest contributor.

While Sherman has advocated for an “aggressive approach” to crypto regulation, Thomas Hook, a Professor on Cryptocurrency Regulation at Boston University School of Law recently told Cointelegraph that regulators should be looking to implement “common sense regulation:”

“[Regulators] are reacting to an industry that is evolving constantly but overregulation could stifle that innovation [...] poorly thought-out regulation could create a two-fold issue: first it could limit US consumers’ ability to participate in the cryptocurrency ecosystem and it could also drive these businesses to less regulated jurisdictions.”

“This actually creates more risk for customers as it puts them in a position of dealing with less regulated institutions to participate in the ecosystem,” he added.

His comments, however, were made before the collapse of the FTX crypto exchange. Cointelegraph has reached out to Hook to understand if his position has changed in light of the new events.

Related: US senators commit to advancing crypto bill despite FTX collapse

Meanwhile, Shark Tank host and millionaire venture capitalist Kevin O’Leary stated in a Nov. 11 interview with CNBC that U.S. regulators “need to start with one thing” rather than regulating everything at once — with the investor recommending Congress start with the Stablecoin Transparency Act.

O’Leary said that given the recent events at FTX, he believes institutional investors will likely put a pause on deploying “serious capital” into new investments until a legitimate regulatory framework is set in place:

“That would signal to everybody around the world that regulators in the United States are taking crypto on, starting to put rules in place, putting the guard rails on, no one is going to play ball in this space on an institutional level with serious capital until we get it done.”

Among the most notable cryptocurrency bills to have been introduced into U.S. Congress include the Central Bank Digital Currency Study Act of 2021, the Digital Commodities Consumer Protection Act of 2022 (DCCPA), the Stablecoin Transparency Act and the Cryptocurrency Tax Clarity Act.

Future bills will center around President Joe Biden’s executive order in March 2022 — which will include bills aimed at improving consumer and investor protection, promoting financial stability, countering illicit finance and improving the United States’ standing in the global financial system, financial inclusion and responsible innovation.

The Biden administration is concerned about digital currency mining operations affecting climate change, after the U.S. Office of Science and Technology Policy published a report that says politicians should take action against crypto mining. The federal government’s entity recommends the Biden administration should encourage more research about mining’s electricity consumption and codify public policy for […]

The Biden administration is concerned about digital currency mining operations affecting climate change, after the U.S. Office of Science and Technology Policy published a report that says politicians should take action against crypto mining. The federal government’s entity recommends the Biden administration should encourage more research about mining’s electricity consumption and codify public policy for […]

The governor of the largest US state by population is signing an executive order to boost and regulate blockchain technology within the state. Governor Gavin Newsom of California signed an executive order on Wednesday, April 5, to create a regulatory framework that encourages blockchain innovation while protecting consumers. “Under this executive order, and pursuant to […]

The post California Governor Gavin Newsom Signs Executive Order for Crypto Regulatory Framework in Golden State appeared first on The Daily Hodl.

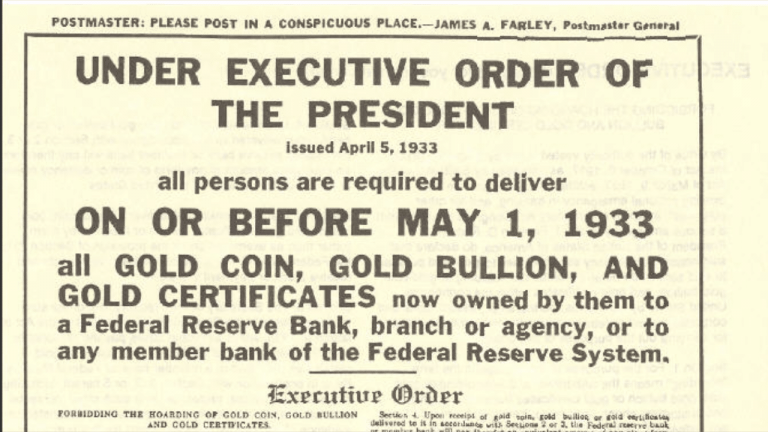

This past Tuesday, April 5, was the 89th anniversary of Executive Order 6102 when the U.S. government would strictly “forbid the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” While the global economy seems to be heading toward disaster and the U.S. dollar’s strength is being examined, many have […]

This past Tuesday, April 5, was the 89th anniversary of Executive Order 6102 when the U.S. government would strictly “forbid the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” While the global economy seems to be heading toward disaster and the U.S. dollar’s strength is being examined, many have […] Florida governor, Ron DeSantis explained at a press conference on Tuesday that he’s spoken with state agencies and told them to figure out ways for businesses to pay tax with cryptocurrencies. During the signing ceremony for a bill focused on financial literacy, DeSantis said that the government is working on accepting bitcoin “for payments in […]

Florida governor, Ron DeSantis explained at a press conference on Tuesday that he’s spoken with state agencies and told them to figure out ways for businesses to pay tax with cryptocurrencies. During the signing ceremony for a bill focused on financial literacy, DeSantis said that the government is working on accepting bitcoin “for payments in […]

The head of the Office of Science and Technology Policy (OSTP) is providing clarity about the intentions behind President Biden’s recent executive order on cryptocurrencies. In a new press release, Dr. Alondra Nelson discusses a trifecta of policy initiatives for blockchain technology ranging from expansive access, consumer safety, and reducing environmental impact. Calling the plan […]

The post White House Official Explains How Biden Administration’s Latest Executive Order Will Change Crypto Industry appeared first on The Daily Hodl.

The bank will work alongside the MIT Media Labs’ Digital Currency Initiative (DCI) team to examine how “advanced technologies could affect the potential design of a CBDC.”

The Bank of Canada has partnered with the Massachusetts Institute of Technology (MIT) to work on a 12 month research project focused on the design of a Central Bank Digital Currency.

According to a March 16 announcement, the bank will work alongside the MIT Media Labs’ Digital Currency Initiative (DCI) team to examine how “advanced technologies could affect the potential design of a CBDC.”

The Bank of Canada stated that the project is part of a broader development agenda on digital currencies, fintech and how CBDCs could work in a Canadian context.

It cautions that “no decision has been made on whether to introduce a CBDC in Canada,” but said it would provide an update once the research project has been completed.

This is not the MIT DCI’s first partnership with a bank for CBDC research, with Cointelegraph reporting earlier at the start of February that it had published research on the topic in collaboration with The Federal Reserve Bank of Boston.

Dubbed “Project Hamilton,” it tested a “hypothetical general purpose CBDC” using two potential models, including distributed ledger technology (DLT) and processing transactions in parallel on multiple computers, rather than relying on a single ordering server to prevent double-spending.

CBDCs — memorably described by Asset Strategies International president Rich Checkan as being “concocted in hell by Satan himself” andwith Edward Snowden warning about the implications for privacy and freedom — have been grabbing the headlines of late.

In terms of the U.S. President Joe Biden’s Executive Order on Ensuring Responsible Development of Digital Assets outlines that his administration will place “the highest urgency on research and development efforts into the potential design and deployment options” of U.S.-based CBDC.

Related: Blockchain Association policy head: US shouldn't compete with China's CBDC using surveillance tools

The Executive Order also directs the Secretary of the Treasury and other relevant officials to produce a research report on a local CBDC, while the attorney general has also been tasked with leading an effort to “to assess any necessary legislative changes” required for a CBDC and to promptly develop a legislative proposal afterward.