The founders of the now-defunct cryptocurrency hedge fund Three Arrows Capital (3AC) have been served subpoenas by the fund’s liquidators via Twitter. While serving subpoenas on Twitter is rare, it has happened on various occasions in the past, including when Wikileaks was served on Twitter in 2018. Founders of Defunct Crypto Hedge Fund Contacted Electronically […]

The founders of the now-defunct cryptocurrency hedge fund Three Arrows Capital (3AC) have been served subpoenas by the fund’s liquidators via Twitter. While serving subpoenas on Twitter is rare, it has happened on various occasions in the past, including when Wikileaks was served on Twitter in 2018. Founders of Defunct Crypto Hedge Fund Contacted Electronically […] According to court documents, Sam Bankman-Fried (SBF) is set to be arraigned by the federal court in the Southern District of New York (SDNY) on Jan. 3, 2023. The disgraced FTX co-founder plans to enter a plea in his fraud case in front of U.S. judge Lewis Kaplan in Manhattan, according to a report published […]

According to court documents, Sam Bankman-Fried (SBF) is set to be arraigned by the federal court in the Southern District of New York (SDNY) on Jan. 3, 2023. The disgraced FTX co-founder plans to enter a plea in his fraud case in front of U.S. judge Lewis Kaplan in Manhattan, according to a report published […] On Dec. 23, 2022, Matthew Russell Lee from the Inner City Press published the recently unsealed guilty plea transcript of Caroline Ellison, Alameda Research’s former CEO. In her statements, Ellison describes that she was the co-CEO and CEO of Alameda, and under those roles, she reported directly to the former FTX CEO Sam Bankman-Fried (SBF). […]

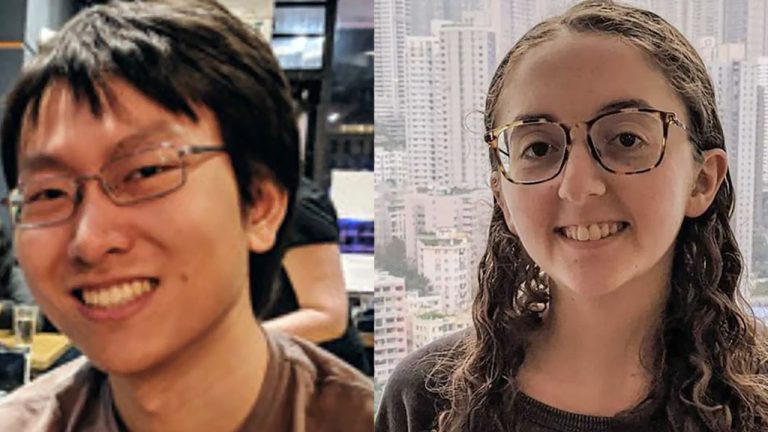

On Dec. 23, 2022, Matthew Russell Lee from the Inner City Press published the recently unsealed guilty plea transcript of Caroline Ellison, Alameda Research’s former CEO. In her statements, Ellison describes that she was the co-CEO and CEO of Alameda, and under those roles, she reported directly to the former FTX CEO Sam Bankman-Fried (SBF). […] On Dec. 21, 2022, members of U.S. law enforcement detailed that FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison have pleaded guilty to financial fraud charges. The recent charges against Wang and Ellison highlight some key findings and according to the U.S. Securities and Exchange Commission (SEC), FTX’s exchange token FTT is considered […]

On Dec. 21, 2022, members of U.S. law enforcement detailed that FTX co-founder Gary Wang and ex-Alameda Research CEO Caroline Ellison have pleaded guilty to financial fraud charges. The recent charges against Wang and Ellison highlight some key findings and according to the U.S. Securities and Exchange Commission (SEC), FTX’s exchange token FTT is considered […] On Dec. 21, 2022, U.S. attorney Damian Williams announced that the Southern District of New York (SDNY) Department of Justice (DOJ) filed charges against Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang. Williams declared that both Ellison and Wang have been cooperating with law enforcement officials. The U.S. Securities and Exchange Commission (SEC) […]

On Dec. 21, 2022, U.S. attorney Damian Williams announced that the Southern District of New York (SDNY) Department of Justice (DOJ) filed charges against Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang. Williams declared that both Ellison and Wang have been cooperating with law enforcement officials. The U.S. Securities and Exchange Commission (SEC) […]

The Australian securities regulator is pursuing BPS Financial Pty Ltd for allegedly making false and misleading representations and engaging in unlicensed conduct.

Australia’s financial regulator has issued a stark warning to Australian crypto asset providers amid launching civil proceedings against Australian firm BPS Financial Pty Ltd (BPS) over “misleading” representations concerning its Qoin token.

In an Oct. 25 announcement, the Australian Securities and Investments Commission (ASIC) said it has commenced civil penalty proceedings against BPS Financial for making “false, misleading or deceptive representations” to its 79,000 users about its token Qoin.

It alleges the company engaged in “unlicensed conduct” relating to Qoin, a digital currency launched in Oct. 2019 which allows participating merchants to accept as payment for goods and services.

ASIC Deputy Chair Sarah Court said this case should serve as a warning to all crypto issuers that ASIC is monitoring the crypto market for misconduct.

“Where it falls within our remit, ASIC will take targeted action against unlicensed conduct and misleading promotion of crypto-asset financial products that could harm consumers — this is a key priority for ASIC.”

She further explained its crucially important that consumers and investors are “provided with honest and accurate information” because, “Crypto-assets are highly volatile, inherently risky, and complex. Every crypto-asset is different, often making it difficult to compare with each other - or anything else.”

The court said they were particularly concerned over BPS Financial’s alleged misrepresentation that the Qoin Facility is regulated in Australia, and that the token can be used to purchase goods and services from an increasing number of merchants registered with BPS.

“We believe the more than 79,000 individuals and entities who have been issued with the Qoin Facility may have believed that it was compliant with financial services laws, when ASIC considers it was not.”

BPS has denied all wrongdoing in an Oct. 25 statement on the Qoin website, saying they disagree with “ASIC’s position” and “will be defending the matter.”

“Before it started, BPS consulted with ASIC in late 2019 regarding the structure of the Qoi project and did so again in early 2021. BPS will keep the community updated as it is able to.”

ASIC is seeking declarations, pecuniary penalties, injunctions and adverse publicity orders from the Court, but the date for the first case management hearing has not been scheduled.

Related: 1M Aussies will enter crypto over the next 12 months — Swyftx survey

The Australian regulator has ramped up scrutiny over the crypto sector over the last few months. In August, ASIC chief Joe Longo raised the alarm over the number of people that invested in “unregulated, volatile” crypto assets during the COVID-19 crisis.

At the time, he said considering there are “limited protections” for investors, the lack of understanding among retail investors makes “a strong case for regulating crypto-assets to better protect investors.”

The corporate regulator isn’t the first to pursue legal action against BPS.

In late 2021, Queensland-based law firm Salerno Law accused BPS of engaging in misleading and deceptive conduct and sought $100 million in damages on behalf of merchants, investors and holders who suffered losses after acquiring the Qoin utility token.

Cointelegraph reached out to BPS for further comment about the case, but did not receive a reply before publication.

A Brazilian federal court ordered the sale of a bitcoin stash worth $1.1 million. The sale was conducted by the largest regulated exchange in the country, Mercado Bitcoin. The Federal Police seized the bitcoin sold from Tradergroup, a company that allegedly was operating as a Ponzi scheme, under the facade of being a cryptocurrency investment […]

A Brazilian federal court ordered the sale of a bitcoin stash worth $1.1 million. The sale was conducted by the largest regulated exchange in the country, Mercado Bitcoin. The Federal Police seized the bitcoin sold from Tradergroup, a company that allegedly was operating as a Ponzi scheme, under the facade of being a cryptocurrency investment […]