Economist Peter Schiff has warned that restoring a real economy requires letting the “phony economy” collapse, which would result in significant financial losses for many. However, he emphasized that the alternative is worse, as it would lead to the devaluation of money itself. Schiff criticized the government and Federal Reserve policies, particularly following the 2008 […]

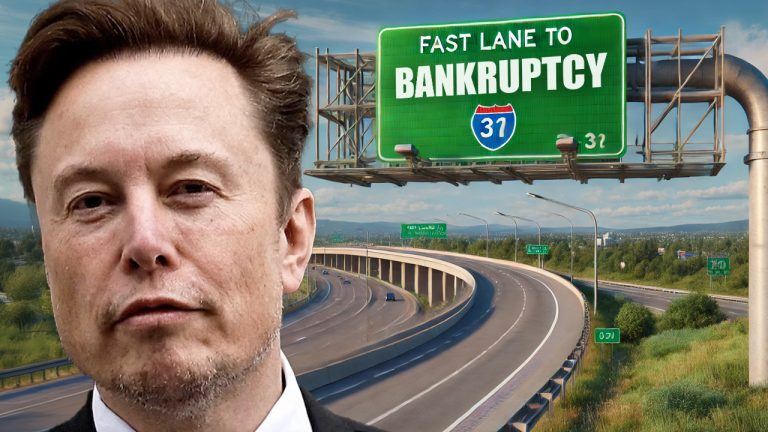

Economist Peter Schiff has warned that restoring a real economy requires letting the “phony economy” collapse, which would result in significant financial losses for many. However, he emphasized that the alternative is worse, as it would lead to the devaluation of money itself. Schiff criticized the government and Federal Reserve policies, particularly following the 2008 […] In recent times, Elon Musk, the owner of X and the CEO and product architect at Tesla, Inc., has been voicing his concerns about inflation. This discussion became especially prominent after he interviewed former U.S. President Donald Trump. Just two days ago, Musk took to X, declaring that the United States is “in the fast […]

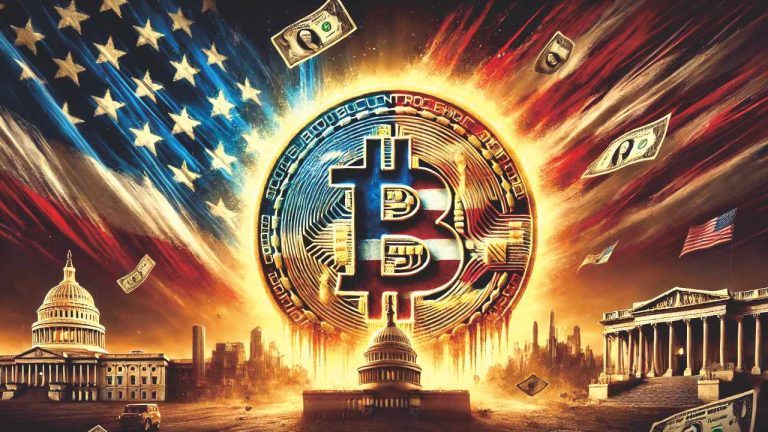

In recent times, Elon Musk, the owner of X and the CEO and product architect at Tesla, Inc., has been voicing his concerns about inflation. This discussion became especially prominent after he interviewed former U.S. President Donald Trump. Just two days ago, Musk took to X, declaring that the United States is “in the fast […] Robert Kiyosaki, the author of Rich Dad Poor Dad, has warned that the U.S. is adding a trillion dollars to its debt every 100 days. He advises investing in gold, silver, and bitcoin to safeguard against economic instability. Kiyosaki also points out the dangers of relying on traditional banks, noting that banking panics are often […]

Robert Kiyosaki, the author of Rich Dad Poor Dad, has warned that the U.S. is adding a trillion dollars to its debt every 100 days. He advises investing in gold, silver, and bitcoin to safeguard against economic instability. Kiyosaki also points out the dangers of relying on traditional banks, noting that banking panics are often […] A U.S. recession in 2024 appears to be on the horizon, according to a recent editorial piece by the Economist. The article surfaces as warnings of an economic downturn grow louder, with the author asserting that “there is no escaping the squeeze ahead for America’s economy.” Economist Article Predicts 2024 Recession as Media Hypes Economic […]

A U.S. recession in 2024 appears to be on the horizon, according to a recent editorial piece by the Economist. The article surfaces as warnings of an economic downturn grow louder, with the author asserting that “there is no escaping the squeeze ahead for America’s economy.” Economist Article Predicts 2024 Recession as Media Hypes Economic […] Egon von Greyerz, a former banker and gold analyst, claims that gold and silver are set for a price rally amidst an upcoming collapse of the U.S. financial system. Von Greyerz states that interest rates will exceed 10% in a hyperinflationary environment, fueled by the issuance of unlimited debt and the loss of trust in […]

Egon von Greyerz, a former banker and gold analyst, claims that gold and silver are set for a price rally amidst an upcoming collapse of the U.S. financial system. Von Greyerz states that interest rates will exceed 10% in a hyperinflationary environment, fueled by the issuance of unlimited debt and the loss of trust in […]

Rich Dad Poor Dad author Robert Kiyosaki is again predicting that the real estate sector will crash and cause a severe global financial crisis. The former best-selling author says that 2023 will see a worse economic downturn than the global financial crisis (GFC) of 2008, caused by an imploding commercial real estate market. Kiyosaki cites […]

The post Rich Dad Poor Dad Author Says Biggest Ever Real Estate Crash Coming, Calls BTC and Precious Metals the Answer appeared first on The Daily Hodl.

House of Representatives Speaker Kevin McCarthy says President Joe Biden is failing to adequately negotiate the raising of the US debt limit, and it should people nervous. In a new interview with CNBC, McCarthy says that he repeatedly criticized the President for not negotiating, and now a dangerously tight deadline to reach an agreement awaits. […]

The post ‘We Should Be Nervous’ – Speaker McCarthy Says Biden Not Negotiating US Debt Ceiling As Default Looms appeared first on The Daily Hodl.

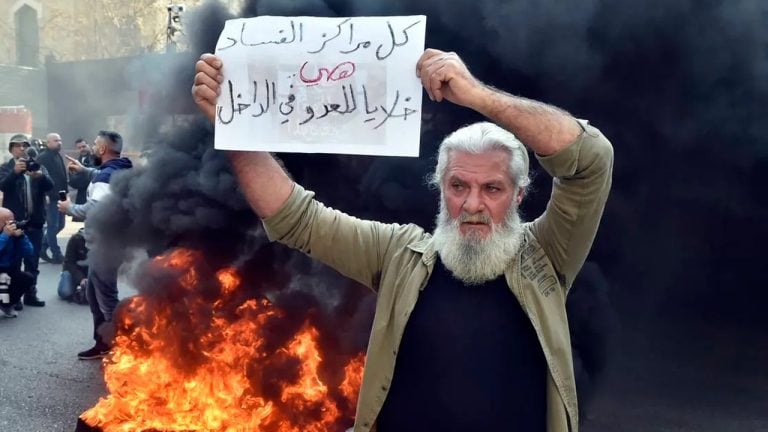

Amid Lebanon’s financial crisis, significant demonstrations have erupted in Beirut targeting financial institutions. Outraged Lebanese depositors, witnessing their savings vanish, have resorted to smashing bank windows, setting fires, and engaging in riots. Simultaneously, leaders of Lebanon’s central bank face grave allegations of fraud, embezzlement, and political corruption. Lebanese Citizens Left Penniless as Financial Institutions Crumble […]

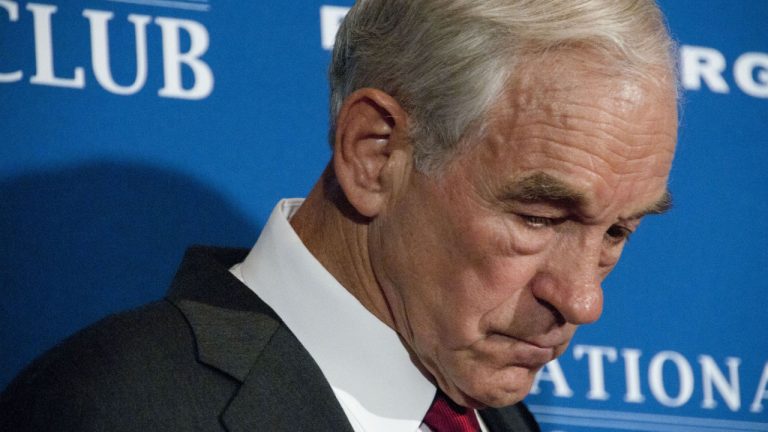

Amid Lebanon’s financial crisis, significant demonstrations have erupted in Beirut targeting financial institutions. Outraged Lebanese depositors, witnessing their savings vanish, have resorted to smashing bank windows, setting fires, and engaging in riots. Simultaneously, leaders of Lebanon’s central bank face grave allegations of fraud, embezzlement, and political corruption. Lebanese Citizens Left Penniless as Financial Institutions Crumble […] Former House Representative Ron Paul has presented his stance when it comes to the financial crisis that the U.S. is currently facing. Paul stated that the continued application of quantitative easing (QE), a policy used to increase the money supply, and the decades of almost null interest rates, are what nurtured the current financial crisis […]

Former House Representative Ron Paul has presented his stance when it comes to the financial crisis that the U.S. is currently facing. Paul stated that the continued application of quantitative easing (QE), a policy used to increase the money supply, and the decades of almost null interest rates, are what nurtured the current financial crisis […]

According to a recent poll from Gallup, nearly half of Americans polled expressed concern about the safety of their money deposited with banks.

Public opinion of banks appears to be dwindling according to an April survey, as the industry struggles to contain the collapse of several high-profile financial institutions in recent months.

A Gallup poll conducted across the United States in April with at least a thousand respondents revealed that 48% of them said that they were concerned about their money in the bank, with almost 20% who indicated they were “very concerned.”

It should be noted however that the poll was conducted after the collapse of Silicon Valley Bank and Signature Bank, but before First Republic Bank failed in late April.

Republicans, lower-income adults and those without a college degree are more worried than their counterparts about the safety of their money in banks or other financial institutions. https://t.co/qhaQqu3mW6

— GallupNews (@GallupNews) May 7, 2023

Gallup concluded that the level of worry was on a par with that measured during the last bank-induced financial crisis in 2008 “when financial institutions previously believed to be “too big to fail” collapsed.”

“The latest readings are similar to those in 2008. In September of that year, shortly after the collapse of Lehman Brothers, which remains the largest bankruptcy filing in U.S. history.”

Meanwhile, experts at the Hoover Institution think-tank postulate that if half of uninsured savers withdrew all of their cash, 186 American banks would be at “potential risk of impairment.”

These banks have total assets of $300 billion but represent less than 5% of the estimated 4,135 FDIC (Federal Deposit Insurance Corporation) insured commercial banks in the United States.

Furthermore, according to reports, California-based PacWest, Arizona’s Western Alliance, and Memphis-based First Horizon Banks hang in the balance following a share price slump last week.

Related: Banking crisis: What does it mean for crypto?

A more damning report emerged from the UK’s Telegraph earlier this month suggesting that half of the banks in America could be insolvent.

It cited research published in April by Stanford University banking expert, Professor Amit Seru, who estimated that more than 2,315 U.S. banks are currently sitting on assets worth less than their liabilities.

“The U.S. banking system’s market value of assets is $2.2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity,” he said.

Magazine: Crypto winter can take a toll on hodlers’ mental health