In the wake of a turbulent period for U.S. banks, the Pennsylvania Department of Banking and Securities has shut down Philadelphia-based Republic First Bank, also known as Republic Bank. The Federal Deposit Insurance Corporation (FDIC) has stepped in as receiver, with Fulton Bank assuming nearly all deposits and assets. Republic First Bank Shuttered as FDIC […]

In the wake of a turbulent period for U.S. banks, the Pennsylvania Department of Banking and Securities has shut down Philadelphia-based Republic First Bank, also known as Republic Bank. The Federal Deposit Insurance Corporation (FDIC) has stepped in as receiver, with Fulton Bank assuming nearly all deposits and assets. Republic First Bank Shuttered as FDIC […]

JPMorgan CEO says the Fed should be less focused on adding more rules and regulations for banks and more on fixing the banking crisis.

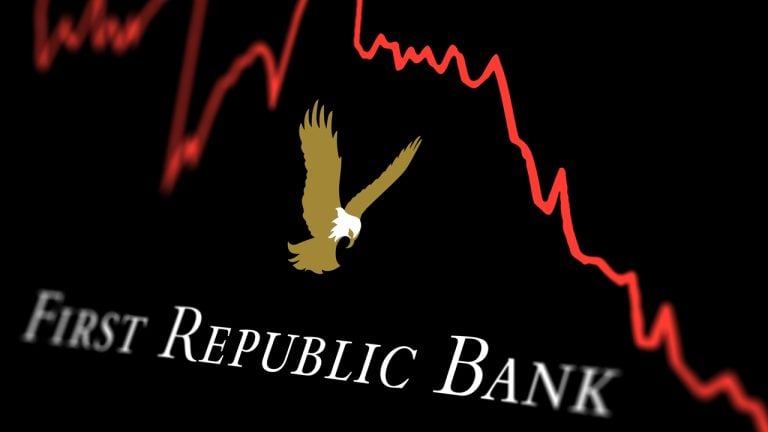

The CEO of JPMorgan Chase — which recently took over failed First Republic Bank — believes there could be more pain ahead for United States banks if the Federal Reserve goes into crisis mode with overregulation.

In a Bloomberg television interview on May 11, JPMorgan Chase Chair and CEO Jamie Dimon said he believes it's “going to get worse for banks” unless the Federal Reserve takes proactive measures beyond simply creating more regulations.

In just the first few months of the year, three major U.S. banks collapsed — Signature Bank, Silicon Valley Bank and First Republic Bank.

Dimon said that it’s “a supervision problem,” with the bank CEOs and board members the “people to blame,” as supervisors usually focus on if they are abiding by regulations.

However, Dimon believes adding more regulations to the Federal Reserve’s already 200,000-page long stress test is not the solution to the current banking crisis.

He argued that more regulations make it harder for banks to conduct business, noting that “some of these community banks now have more compliance people than loan officers.”

Instead, he proposed taking a holistic approach when modifying regulations, saying:

“At one point, it’s making it harder for them to do business. There are already hundreds of rules in place.”

He further questioned the effectiveness of stress tests, as companies that completely focus on “that one stress test” could be overlooking issues, such as historical events that “always happen” again.

He believes that focusing solely on one stress test gives a “false sense of security.”

Dimon suggested that that the Federal Reserve never saw issues emerging in the banking industry, noting that “not one Fed governor forecasted” the banking crisis.

Related: JPMorgan sees advantages in deposit tokens over stablecoins for commercial bank blockchains

This is not the first time a JPMorgan executive has expressed issues with banking regulations in recent times.

Bob Michele, the chief investment officer of J.P. Morgan Asset Management, stated in an April 27 Bloomberg television interview that First Republic Bank’s liquidity issues “should never have happened,” as banking is the “most heavily regulated capitalized industry on the planet.”

More recently, it was reported on May 1 that JPMorgan was set to acquire First Republic Bank’s (FRB) assets, after its previous efforts to rescue it failed.

1/ On Monday, JPMorgan Chase acquired a substantial majority of assets and assumed certain liabilities of First Republic Bank from the FDIC. https://t.co/2a3bnTJJJW

— First Republic (@firstrepublic) May 5, 2023

Louisiana Republican senator John Kennedy recently stated in an interview published on Wednesday that the U.S. Federal Reserve may need to increase the federal funds rate to 8-10% to address the country’s inflationary pressures. Kennedy’s remarks come after he criticized the Biden administration in mid-March for bailing out Silicon Valley Bank and Signature Bank, emphasizing […]

Louisiana Republican senator John Kennedy recently stated in an interview published on Wednesday that the U.S. Federal Reserve may need to increase the federal funds rate to 8-10% to address the country’s inflationary pressures. Kennedy’s remarks come after he criticized the Biden administration in mid-March for bailing out Silicon Valley Bank and Signature Bank, emphasizing […] After the second largest bank failure in history, the U.S. Securities and Exchange Commission (SEC) is reportedly investigating First Republic Bank executives for allegedly engaging in insider trading. Two sources have claimed that the securities regulator is scrutinizing the bank’s executives for making trades using confidential information. Although the sources have not named any specific […]

After the second largest bank failure in history, the U.S. Securities and Exchange Commission (SEC) is reportedly investigating First Republic Bank executives for allegedly engaging in insider trading. Two sources have claimed that the securities regulator is scrutinizing the bank’s executives for making trades using confidential information. Although the sources have not named any specific […]

JPMorgan Chase chief executive Jamie Dimon thinks the US banking crisis is “pretty much” resolved after his company acquired the majority of collapsed First Republic Bank. Dimon told analysts in a call after JPMorgan’s acquisition that “there are only so many banks that were offsides this way,” CNBC reports. Says Dimon, “There may be another […]

The post JPMorgan Chase CEO Jamie Dimon Says Purchase of First Republic ‘Pretty Much’ Resolves US Banking Crisis: Report appeared first on The Daily Hodl.

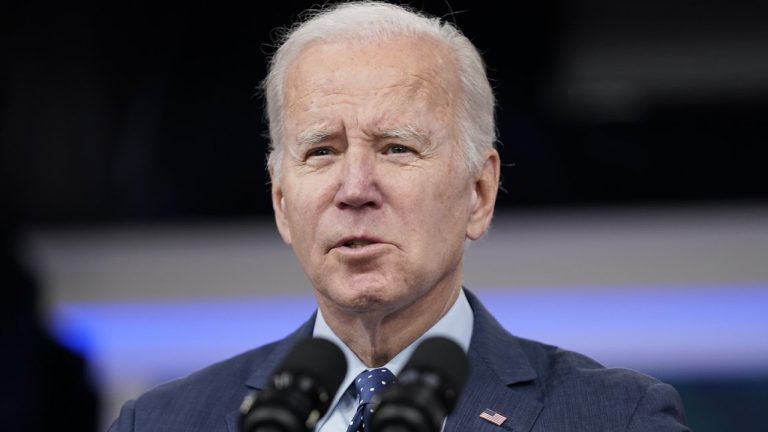

The recent takeover of First Republic Bank, the fourth U.S. bank to fail this year, has awakened concerns about the possible repercussions this new failure might have on U.S. and international economies. While United States President Joe Biden has assured the public that the banking system remains safe, analysts are warning that this might not […]

The recent takeover of First Republic Bank, the fourth U.S. bank to fail this year, has awakened concerns about the possible repercussions this new failure might have on U.S. and international economies. While United States President Joe Biden has assured the public that the banking system remains safe, analysts are warning that this might not […] Following the acquisition of First Republic Bank by JPMorgan Chase, several regional banks such as Pacwest and Western Alliance experienced a significant drop in their stock prices. On Tuesday afternoon, all four major U.S. benchmark stock indexes are in decline as regional bank stocks hit new lows. Banking Industry on Edge as Pacwest Shares Sink […]

Following the acquisition of First Republic Bank by JPMorgan Chase, several regional banks such as Pacwest and Western Alliance experienced a significant drop in their stock prices. On Tuesday afternoon, all four major U.S. benchmark stock indexes are in decline as regional bank stocks hit new lows. Banking Industry on Edge as Pacwest Shares Sink […] Amid the collapse of the second, third, and fourth largest banks in American history, U.S. president Joe Biden reassured the public that the country’s banking system remains sturdy. However, the president also acknowledged the “threat by the speaker of the House to default on the national debt.” Biden Expresses Confidence in American Banking System Despite […]

Amid the collapse of the second, third, and fourth largest banks in American history, U.S. president Joe Biden reassured the public that the country’s banking system remains sturdy. However, the president also acknowledged the “threat by the speaker of the House to default on the national debt.” Biden Expresses Confidence in American Banking System Despite […]

Bitcoin bulls fail to get a grip despite worries over U.S. banking sector stability, with BTC price near four-day lows.

Bitcoin (BTC) headed toward $28,000 support after the May 1 Wall Street open as markets digested fresh United States banking jitters.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dropping to multi-day lows at the time of writing.

The pair continued a comedown that began after the weekly and monthly candle close, shedding over $1,000 since that time.

The start of the week saw a potential volatility catalyst during Asia trading as First Republic Bank was sold to JPMorgan Chase by the U.S. government.

Amid suspicions over the legitimacy of the move, First Republic became the second-largest bank failure in U.S. history.

Bitcoin showed little interest in mimicking its reaction to the start of the banking crisis in March, instead tracking lower despite warning signs that another lender might already be in trouble.

This came in the form of PacWest Bancorp, the stock of which, PACW, saw a 7% drop on the day to return to its lowest levels in a month.

For Marty Bent, founder of crypto media company TFTC, the behavior was “eerily similar” to First Republic. PACW was down nearly 60% year-to-date on the day, while FRC, now suspended indefinitely, had dived 97%.

Eerily similar to the First Republic chart before it went under. pic.twitter.com/TPHl7VYJEf

— Marty Bent (@MartyBent) May 1, 2023

Despite the turmoil and potential looming continuation, U.S. equities were calm at the open, leaving crypto markets on the more volatile end of the risk asset spectrum.

Reacting, traders considered the possibility of a comedown in advance of the Federal Reserve’s decision on interest rates due on May 3.

Well, well, well #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) May 1, 2023

Again we're getting a correction going into FOMC? pic.twitter.com/dg2tRL6Tlm

This was nonetheless already heavily priced in by markets, which anticipated a 0.25% hike as a near certainty despite the banking fragility. Data from CME Group’s FedWatch Tool measured the probability at 94% on the day.

One asset, meanwhile, showing keen strength to start the week was the U.S. dollar, with the U.S. Dollar Index (DXY) challenging its highest levels since mid-April.

Related: Second-biggest US bank failure — 5 things to know in Bitcoin this week

“Huge week coming up, particularly for the US dollar. Expect defensive positioning leading into Wednesday,” financial commentator Tedtalksmacro wrote in part of ananalysis.

He argued that markets should not “expect” the Fed to hint at a pivot or freeze of rate hikes at this week’s meeting, this in itself boosting the dollar and risk-off sentiment.

A prior thread flagged key correlations for observers, these including DXY versus BTC.

12/ To finish off the thread, here's a few correlations to pay attention to:

— tedtalksmacro (@tedtalksmacro) May 1, 2023

- DXY + #Bitcoin (risk-on or off)

- DXY + US02y/DE02y (leads DXY)

- DXY + equities (risk-on or off)

Typically DXY higher --> risk-off, but context matters (is it driven by a move in another currency?) pic.twitter.com/5nZn2BxcfJ

Magazine: Whatever happened to EOS? Community shoots for unlikely comeback

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

On May 1, 2023, the California Department of Financial Protection and Innovation (DFPI) seized First Republic Bank, placing it into Federal Deposit Insurance Corporation (FDIC) receivership. According to reports, this move came after the bank’s financial troubles made it insolvent and unable to meet its obligations. Following the seizure, JPMorgan Chase submitted the winning bid […]

On May 1, 2023, the California Department of Financial Protection and Innovation (DFPI) seized First Republic Bank, placing it into Federal Deposit Insurance Corporation (FDIC) receivership. According to reports, this move came after the bank’s financial troubles made it insolvent and unable to meet its obligations. Following the seizure, JPMorgan Chase submitted the winning bid […]