The bills aim to create a regulatory framework for payment stablecoins and enshrine rights for crypto users to self-custody digital assets.

The House Financial Services Committee has advanced another two landmark crypto bills previously under consideration — with one aiming to better regulate stablecoin issuers and another seen as positive for crypto self-custody in the United States.

On July 28 the Committee said the Clarity for Payment Stablecoins Act and the Keep Your Coins Act were passed alongside five other finance-related bills.

Respectively the bills aim to provide regulations on the issuance of payment stablecoins and ensure crypto users are permitted to maintain custody of their assets in self-custodial wallets.

Coinbase chief policy officer Faryar Shirzad said in response to the bills passing that it's a "historic week" for crypto regulation.

Yet more congratulations to @PatrickMcHenry for getting the Clarity for Payment Stablecoins Act across the line with bipartisan support. It’s been a historic week, and a big step forward for consumer protection. https://t.co/7bRgAotAD6

— Faryar Shirzad (@faryarshirzad) July 28, 2023

On July 26, the Committee passed the Financial Innovation and Technology (FIT) for the 21st Century Act and the Blockchain Regulatory Certainty Act.

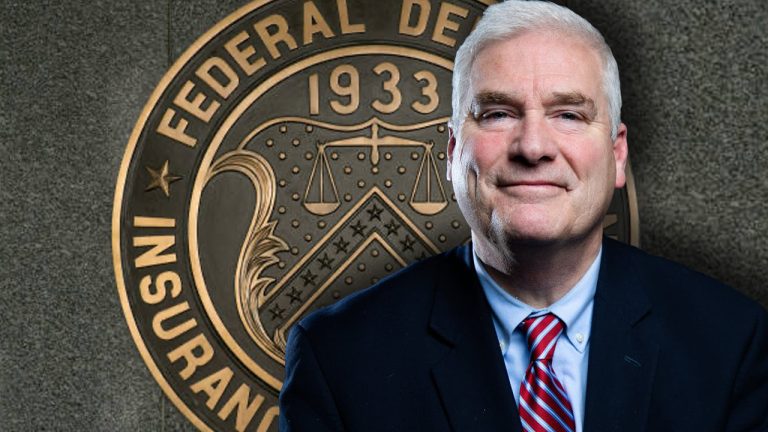

Related: Rep. Patrick McHenry blames White House for lack of urgency on stablecoin bill negotiations

The bills respectively establish when crypto firms have to register with regulators and set guidelines for projects such as miners and decentralized finance (DeFi) platforms.

On July 27, the FIT for the 21st Century Act also passed the House Agriculture Committee.

Magazine: Crypto regulation — Does SEC Chair Gary Gensler have the final say?